The Rise of Robots and Automation

November 2014By FIDELITY VIEWPOINTS

If you call room service at the Starwood (HOT) Hotel in Palo Alto, California, a robot butler may arrive to bring you a fresh towel.

At the Children’s Hospital at Vanderbilt in Nashville, nurses rely on a robotic system to prepare IV solutions and shots for patients.

How about a robot who keeps your kids company while they go to sleep? Reminiscent of the Jetsons, a new family robot named Jibo promises to do just that.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Even the AP news service is going robotic. It plans to publish thousands of earnings articles this year, produced entirely by an automated service.

These are just a few examples of how declining costs and technological advances are bringing robotics and automation technology to smaller businesses, local shops, and perhaps most captivatingly, our homes.

“I think autonomous robots are going to be very common in households in the next 20 years,” says Gavin Baker, manager of Fidelity® OTC Fund (FOCPX). Indeed, some advanced, autonomous features are just over the horizon.

In the car space, for instance, driverless cars may be available at dealerships in 10 to 15 years. Google (GOOG) plans to roll out a few test cars this year. And BMW, Volvo, and Mercedes are gearing up to offer several autonomous features in the market this year (see table). “Thanks to cheaper, more flexible products, robotics and automation have reached an inflection point that should see use increase dramatically in the coming years,” says Charlie Chai, manager of Fidelity® Technology Portfolio (FSPTX). “It will have big implications for the kinds of jobs people do, and how we live.”

Innovations creating flexibility

Robotics and automation are expanding, thanks to a convergence of technological breakthroughs.

Sensors have evolved, allowing machines to become more aware of their environment. This enables them to handle new tasks and operate in new places. Smaller and more powerful controllers and processors—and the power of cloud computing—have helped machines become more flexible and cheaper.

"These technologies are opening doors to completely new applications for robots,” said Dr. Andreas Bauer, Chairman of the IFR Industrial Robot Suppliers Group. “Impressive for me are the opportunities that are provided in new fields for automation, especially in areas where no robots are currently used."

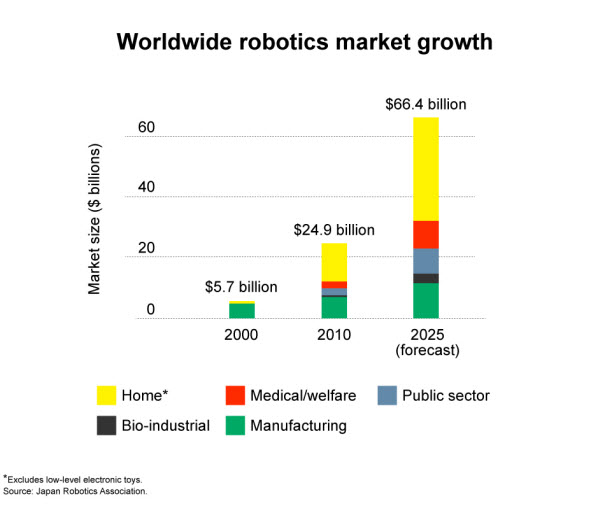

The result is a market that appears poised to grow rapidly for many years.

Potential investment opportunities

Investors may be able to tap into this breakthrough idea by investing directly in robotics manufacturers (see chart).

Plus, there are other less direct plays, including sensor manufacturers, processor companies, or hardware suppliers.

“Today, I think the most compelling opportunities lie with sensor manufacturers, and industrial automation manufacturers,” says Chai. “But I see this as a multiyear growth story.”

Digging deeper, Chai sees the best opportunities in component makers (e.g., sensors and motors), automation vendors (e.g., controllers and software platform companies), and system vendors that design and make the robots, among others.

In terms of value, a few of the pure-play robotics companies may be expensive. “However, growth is likely to be very significant over the next few decades, with current penetration still very low,” Chai notes.

Learn more

Charlie Chai manages Fidelity Select Information Technology Portfolio

Gavin Baker manages Fidelity OTC Fund

Find more investing ideas with Fidelity Viewpoints

Past performance is no guarantee of future results.

The information presented reflects the opinions of the speaker as of September 3, 2014. These opinions do not necessarily represent the views of Fidelity or any other person in the Fidelity organization and are subject to change at any time based on market or other conditions. Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Because of their narrow focus, sector investments tend to be more volatile than investments that diversify across many sectors and companies.

Gavin Baker manages Fidelity OTC Fund, which invests in some of the stocks mentioned in this article. As of July 31, the fund held 0.067% of assets in iRobot Corp.

As with all your investments through Fidelity, you must make your own determination as to whether an investment in any particular security or fund is consistent with your investment objectives, risk tolerance, financial situation, and your evaluation of the investment option. Fidelity is not recommending or endorsing any particular investment option by mentioning it in this article or by making it available to its customers. This information is provided for educational purposes only, and you should bear in mind that laws of a particular state and your particular situation may affect this information.

Indexes are unmanaged. It is not possible to invest directly in an index.

Stock markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. Investing in stock involves risks, including the possible loss of principal.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time and you may gain or lose money.

Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. A percentage value for helpfulness will display once a sufficient number of votes have been submitted.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

698304.4.0

This content was provided by Fidelity Investments and did not involve the Kiplinger editorial staff.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

What Is AI? Artificial Intelligence 101

What Is AI? Artificial Intelligence 101Artificial intelligence has sparked huge excitement among investors and businesses, but what exactly does the term mean?

-

The Best Tech Stocks to Buy

The Best Tech Stocks to BuyTech stocks are the market's engine of growth. But what defines a tech stock? How do you find the best ones to buy? We take a look here.

-

All AI Regulations Are Not Created Equal: Kiplinger Economic Forecasts

All AI Regulations Are Not Created Equal: Kiplinger Economic ForecastsEconomic Forecasts As Congress regulates artificial intelligence, tech advocates urge lawmakers to define different areas of AI, as some are more dangerous than others.

-

Best Banks for High-Net-Worth Clients

Best Banks for High-Net-Worth Clientswealth management These banks welcome customers who keep high balances in deposit and investment accounts, showering them with fee breaks and access to financial-planning services.

-

Text-Generating AI Faces Major Legal Risks: Kiplinger Economic Forecasts

Text-Generating AI Faces Major Legal Risks: Kiplinger Economic ForecastsEconomic Forecasts Major legal risks to text-generating artificial intelligence: Kiplinger Economic Forecasts

-

Stock Market Holidays in 2026: NYSE, NASDAQ and Wall Street Holidays

Stock Market Holidays in 2026: NYSE, NASDAQ and Wall Street HolidaysMarkets When are the stock market holidays? Here, we look at which days the NYSE, Nasdaq and bond markets are off in 2026.

-

Stock Market Trading Hours: What Time Is the Stock Market Open Today?

Stock Market Trading Hours: What Time Is the Stock Market Open Today?Markets When does the market open? While the stock market has regular hours, trading doesn't necessarily stop when the major exchanges close.

-

Bogleheads Stay the Course

Bogleheads Stay the CourseBears and market volatility don’t scare these die-hard Vanguard investors.