A Case for Tech: Q4 Sector Outlook

October 2014By FIDELITY VIEWPOINTS

The fourth quarter got off to a rocky start with volatility in October. The reemergence of risks may be a good reminder to take stock of your strategy and holdings. If you are reconsidering your sector investment strategy, it may make sense to consider your technology holdings.

Each quarter, Fidelity SelectCo, Fidelity Management & Research Company Equity Division, and the Asset Allocation Research Team assess a range of factors to determine which areas of the market offer the best combination of strong fundamentals, reasonable valuations, and positive technical factors over a range of time horizons.

The sector that appears to be best positioned for the current phase of the business cycle is a familiar one: Technology.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

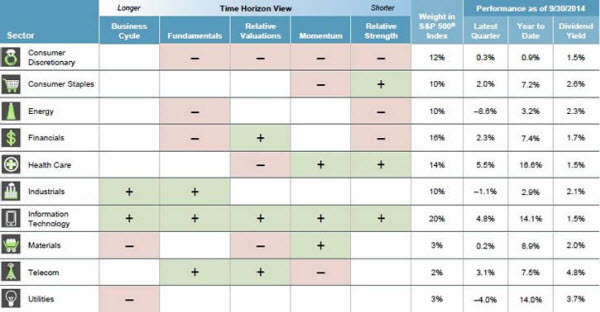

Scorecard: Information Technology Strong across the Board

Information Technology is showing positive signals on all five factors, benefiting from the current phase of the U.S. business cycle, relatively strong fundamentals, reasonable valuations, and positive technical factors. Meanwhile, the Consumer Discretionary sector appears weak on factors ranging from fundamentals to relative strength.

Past performance is no guarantee of future results. Sectors are defined by the Global Industry Classification Standard (GICS®); Factors are based on historical analysis and are not a qualitative assessment by any individual investment professional. Green portions suggest outperformance, red suggests underperformance, and unshaded portions indicate no clear pattern vs. the broader market, as represented by the S&P 500® Index. Quarter-end and year-to-date performance reflects performance of the S&P 500 Sector Indices. It is not possible to invest directly in an index. All indexes are unmanaged. Percentages may not total 100% due to rounding. Source: Fidelity Investments, as of Sep. 30, 2014.

Business Cycle: Mid-Cycle Supports Technology, Industrials

The U.S. economy remains in a mid-cycle expansion, benefitting from widespread progress across the majority of economic sectors. Corporate fundamentals remain strong and forward-looking indicators for manufacturing and capital spending have continued to improve, which should bode well for the Information Technology and Industrials sectors.

Fundamentals: Strong for Technology, Telecom, Industrials

Technology and Industrials continue to appear strong on fundamental factors, including earnings growth and free cash flow. Telecom earnings, while strong, have been boosted by an industry accounting change. Energy is a relative laggard, as global integrated oil and gas companies have faced challenges. Financials and Consumer Discretionary also have lagged.

Relative Valuations: Tech, Financials below Historical Averages

At quarter-end, sectors were trading around historical valuation levels based on forward earnings, and most were at a premium based on free-cash-flow yield. Technology, and to a lesser extent Financials and Industrials, appear undervalued based on forward earnings. Telecom also has strong forward earnings, but accounting changes have affected projections.

Momentum: Technology, Health Care Among the Leadership

Health Care has moved into the leadership, while the Technology and Materials sectors have remained strong. Consumer Discretionary, previously a strong performer, has weakened during the past year. Consumer Staples lags over the 12-month period, but has turned upward recently, possibly signaling a market turn toward more defensive sectors.

Rising U.S. Dollar May Support Domestic, Defensive Sectors

The U.S. dollar has been boosted by an improving economy and market expectations for higher interest rates. Historically, a strong dollar has been positive, on a relative basis, for domestically oriented or defensive sectors like Health Care, Financials, and Utilities. Consumer Staples often experiences multiple expansion that outweighs its foreign exposure.

Learn more

To see the underlying research behind these findings, read the full Quarterly Sector Update.

Research Fidelity sector funds.

Views expressed are as of the date indicated, based on the information available at that time, and may change based on market or other conditions. Unless otherwise noted, the opinions provided are those of the author and not necessarily those of Fidelity Investments or its affiliates. Fidelity does not assume any duty to update any of the information.

References to specific investment themes are for illustrative purposes only and should not be construed as recommendations or investment advice. Investment decisions should be based on an individual’s own goals, time horizon, and tolerance for risk. This piece may contain assumptions that are “forward-looking statements,” which are based on certain assumptions of future events. Actual events are difficult to predict and may differ from those assumed. There can be no assurance that forward-looking statements will materialize or that actual returns or results will not be materially different from those described here.

Past performance is no guarantee of future results.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time and you may gain or lose money.

All indexes are unmanaged. You cannot invest directly in an index. Stock markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments.

Because of its narrow focus, sector investing tends to be more volatile than investments that diversify across many sectors and companies. Sector investing is also subject to the additional risks associated with its particular industry.

Market Indexes

The S&P 500® Index is a market capitalization–weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation to represent U.S. equity performance. S&P 500® is a registered service mark of Standard & Poor’s Financial Services LLC. Sectors and industries are defined by the Global Industry Classification Standard (GICS®).

The S&P 500® Sector Indices include the 10 standard GICS® sectors that make up the S&P 500® Index. The market capitalization of all 10 S&P 500® Sector Indices together composes the market capitalization of the parent S&P 500® Index; all members of the S&P 500® Index are assigned to one (and only one) sector.

S&P 500® sectors are defined as follows: Consumer Discretionary: companies that provide goods and services that people want but don’t necessarily need, such as televisions, cars, and sporting goods; these businesses tend to be the most sensitive to economic cycles. Consumer Staples: companies that provide goods and services that people use on a daily basis, like food, household products, and personal-care products; these businesses tend to be less sensitive to economic cycles. Energy: companies whose businesses are dominated by either of the following activities: the construction or provision of oil rigs, drilling equipment, or other energy-related services and equipment, including seismic data collection; or the exploration, production, marketing, refining, and/or transportation of oil and gas products, coal, and consumable fuels. Financials: companies involved in activities such as banking, consumer finance, investment banking and brokerage, asset management, insurance and investments, and real estate, including REITs. Health Care: companies in two main industry groups: health care equipment suppliers and manufacturers, and providers of health care services; and companies involved in the research, development, production, and marketing of pharmaceuticals and biotechnology products. Industrials: companies whose businesses manufacture and distribute capital goods, provide commercial services and supplies, or provide transportation services. Information Technology: companies in technology software and services and technology hardware and equipment. Materials: companies that are engaged in a wide range of commodity-related manufacturing. Telecommunication Services: companies that provide communications services primarily through fixed-line, cellular, wireless, high bandwidth, and/or fiber-optic cable networks. Utilities: companies considered to be electric, gas, or water utilities, or companies that operate as independent producers and/or distributors of power.

The Russell 1000® Index is a stock market index that represents the highest-ranking 1,000 stocks in the Russell 3000® Index, which represents about 90% of the total market capitalization of that index.

Third-party marks are the property of their respective owners; all other marks are the property of FMR LLC.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

701213.5.0

This content was provided by Fidelity Investments and did not involve the Kiplinger editorial staff.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Best Banks for High-Net-Worth Clients

Best Banks for High-Net-Worth Clientswealth management These banks welcome customers who keep high balances in deposit and investment accounts, showering them with fee breaks and access to financial-planning services.

-

Stock Market Holidays in 2026: NYSE, NASDAQ and Wall Street Holidays

Stock Market Holidays in 2026: NYSE, NASDAQ and Wall Street HolidaysMarkets When are the stock market holidays? Here, we look at which days the NYSE, Nasdaq and bond markets are off in 2026.

-

Stock Market Trading Hours: What Time Is the Stock Market Open Today?

Stock Market Trading Hours: What Time Is the Stock Market Open Today?Markets When does the market open? While the stock market has regular hours, trading doesn't necessarily stop when the major exchanges close.

-

Bogleheads Stay the Course

Bogleheads Stay the CourseBears and market volatility don’t scare these die-hard Vanguard investors.

-

The Current I-Bond Rate Is Mildly Attractive. Here's Why.

The Current I-Bond Rate Is Mildly Attractive. Here's Why.Investing for Income The current I-bond rate is active until April 2026 and presents an attractive value, if not as attractive as in the recent past.

-

What Are I-Bonds? Inflation Made Them Popular. What Now?

What Are I-Bonds? Inflation Made Them Popular. What Now?savings bonds Inflation has made Series I savings bonds, known as I-bonds, enormously popular with risk-averse investors. How do they work?

-

This New Sustainable ETF’s Pitch? Give Back Profits.

This New Sustainable ETF’s Pitch? Give Back Profits.investing Newday’s ETF partners with UNICEF and other groups.

-

As the Market Falls, New Retirees Need a Plan

As the Market Falls, New Retirees Need a Planretirement If you’re in the early stages of your retirement, you’re likely in a rough spot watching your portfolio shrink. We have some strategies to make the best of things.