Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

I can’t take any further losses.

I’m just not comfortable with losing 8% of my money in one year.

I’ll thinking about more aggressive investments when the dust settles.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The stock market is pretty rough right now. If that continues, I don’t want any part of it.

I know I shouldn’t time the market, but it’s now up 3x and I can just see it reversing course soon!

These are just a few paraphrased notes from customers of the online financial advisor, Betterment, who reduced their stock allocation in January or February of 2016.

From November 1, 2015 to February 11, 2016, the global stock market (ACWI) fell about 15%.

And, of course, markets then rallied 31% to September 2017. Looking back from February 2017, a stay-the-course investor tracking the index would be up about 20% cumulatively.

A reactive investor who sold in February then re-bought when markets recovered in July, would be up only 4%. Read more about those findings from Betterment here.

Betterment published research showing that the more a customer changes their allocations, the worse their performance is. On average, investor returns dropped about 0.20% per year for each allocation change the customer made. This means if you change your allocation three times per year, you could underperform by about 0.60%.

That’s more than twice the annual cost of Betterment’s advice and portfolio management.

One study of 58,000 IRA account holders from 2008 to 2012 found that those who reacted to the crisis had significantly worse performance than those who stayed the course, giving up about 1% a year. When you consider that a reasonable rate of return for global stock markets is about 6%, that could mean giving up about 17% of your expected return.

How can you ensure that you won’t succumb to the same fears and anxieties the next time a market drop hits?

Betterment’s recommendation involves three simple steps:

- Arrange your finances.

- Write out a downturn plan.

- Stick to it.

Arrange your Finances

Properly arranged finances make it much easier to glide through a rough market by buffering and hedging your overall downside exposure. Here are four major steps to getting your finances in order.

1. Have an emergency fund.

An emergency fund is usually one of the highest priority goals we recommend customers have, and we believe it should be invested conservatively. A bond-heavy portfolio does a better job than cash at preserving the real value of your wealth.

One reason it’s important to have an emergency fund is because it gives you peace of mind when longer-term, higher risk portfolios are more affected by a market drop. If you need to make a withdrawal from your emergency fund, you’ll be able to access it since it’s invested conservatively and is less likely to experience an extreme loss than a fund invested in a more aggressive allocation.

2. Earmark your money to future expenditure.

It’s also smart to earmark your money for future spending. Often, financial advisors call this setting a goal.

Setting up goals helps to make sure you have money when you need it—aligning our investing advice to your life needs.

3. Don’t take more risk than necessary given your time horizon.

It’s easy to get excited when markets have gone up, and increase your stock allocation to try and benefit from it. While it’s okay to deviate within a range, we generally don’t recommend deviating too far in one direction.

Good stock allocation advice is based on how long you’re investing for. It takes into account the total cumulative returns over that period, and figures out an optimal amount of risk to take.

4. Don’t invest in a portfolio that might keep you up at night.

Your emotional time horizon is likely much shorter than the goal term. Have a honest chat with yourself about how much of a loss would be too much.

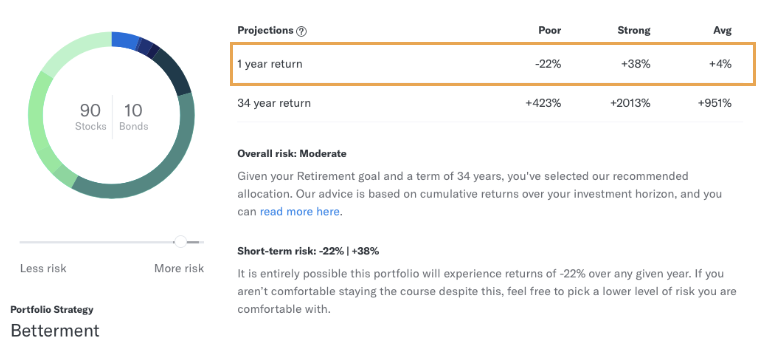

When setting your allocation, Betterment shows you a range of one-year performance you can expect from that portfolio.

Imagine you’d invested $100,000 a few years ago, and today you logged in to see your portfolio was down to $90,000, a -10% loss. Would that be too much? How about $70,000, a -30% loss?

Betterment enables customers to adjust their allocation to fit their preferences. The above picture is an example of Betterment’s online platform and is for illustrative purposes only.

Write out your plan now

What kind of market drop plan would you recommend for your close friends and family? Should you make that clear not only for yourself, but also for them?

Prioritize your goals: In a market drop, most of your accounts will experience a loss. That might mean shifting balances between them, or waiting longer to achieve some. Know ahead of time what goals you’ll prioritize, and if you need to move money from lower priority goals to higher ones.

Have an anti-monitoring strategy: At some point, the stress of seeing losses increases the chance that you’ll do something impulsive. Rather than test your fortitude and willpower, give yourself a break from the stress.

For instance, try not logging into your account when bad news strikes.

What you can do during the drop

Liquidate legacy losers

The most common barrier to consolidating your taxable investments is capital gains tax. Take advantage of a short-term market drawdown and let go of a high cost mutual fund, or diversify away from a single stock position.

What can you do today? Prepare a short list of investments you would like to liquidate, and the price at which you will give them the pink-slip. Betterment’s tax-switch calculator can help you do that.

Do less than you want to

While the best investment strategy is typically to stay invested, some people could find the stress simply to be too much. If you think you might make an extreme decision—such as moving to 100% bonds—if the drawdown continues, then it’s ok to reduce your risk temporarily. Adjust from 90% stocks to 60% stocks, for example, for a 60-day period. Make sure you set a reminder to revisit your portfolio at that point. While we don’t believe it will improve your performance from a ‘cold’ view, it may mean you’ll be less likely to make an emotional decision, and have a higher return per night’s lost sleep.

Betterment optimizes its technology to help you make informed decisions in your investment strategy. Founded in 2008 the company manages $10 billion in assets. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Betterment’s charges and expenses. Betterment sponsored this article for Kiplinger.com. Visit Betterment.com for more information.

This content was provided by Betterment. Kiplinger is not affiliated with and does not endorse the company or products mentioned above.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

Best Banks for High-Net-Worth Clients

Best Banks for High-Net-Worth Clientswealth management These banks welcome customers who keep high balances in deposit and investment accounts, showering them with fee breaks and access to financial-planning services.

-

Stock Market Holidays in 2026: NYSE, NASDAQ and Wall Street Holidays

Stock Market Holidays in 2026: NYSE, NASDAQ and Wall Street HolidaysMarkets When are the stock market holidays? Here, we look at which days the NYSE, Nasdaq and bond markets are off in 2026.

-

Stock Market Trading Hours: What Time Is the Stock Market Open Today?

Stock Market Trading Hours: What Time Is the Stock Market Open Today?Markets When does the market open? While the stock market has regular hours, trading doesn't necessarily stop when the major exchanges close.

-

Bogleheads Stay the Course

Bogleheads Stay the CourseBears and market volatility don’t scare these die-hard Vanguard investors.

-

The Current I-Bond Rate Is Mildly Attractive. Here's Why.

The Current I-Bond Rate Is Mildly Attractive. Here's Why.Investing for Income The current I-bond rate is active until April 2026 and presents an attractive value, if not as attractive as in the recent past.

-

What Are I-Bonds? Inflation Made Them Popular. What Now?

What Are I-Bonds? Inflation Made Them Popular. What Now?savings bonds Inflation has made Series I savings bonds, known as I-bonds, enormously popular with risk-averse investors. How do they work?

-

This New Sustainable ETF’s Pitch? Give Back Profits.

This New Sustainable ETF’s Pitch? Give Back Profits.investing Newday’s ETF partners with UNICEF and other groups.

-

As the Market Falls, New Retirees Need a Plan

As the Market Falls, New Retirees Need a Planretirement If you’re in the early stages of your retirement, you’re likely in a rough spot watching your portfolio shrink. We have some strategies to make the best of things.