Wealth: The Ultimate Magnifying Glass

Having substantial wealth certainly makes your finances more complicated, but it can also magnify already complex family relationships and dynamics.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

I recently interviewed a wonderful family. The family members were very eager to share with me some of the work that their family had already undertaken in their journey to become “enterprising.” And, indeed, I would say that they had done some really great things, specifically around creating transparent and open communication, while working to prepare heirs.

Still, I was curious. I wanted to know why. Why was this so important to them? Why had they gone to great lengths to embark on an intentional process for their family? The response was quite simple: “Money can be toxic.”

You see, this family of nine was worried about one thing: how their wealth would impact the members of their family. And, they wanted to take proactive steps to avoid entitlement and instead create an environment of empowerment. Is this sounding familiar yet? I know that many of you may feel the same way when it comes to your own families.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Why is wealth a magnifier?

While having more money can certainly make your life easier in some ways, it can also take already complex family relationships and magnify them, especially for families of significant wealth. For many families, members or branches own and control their assets outright; however, in families of substantial wealth, a characteristic that distinguishes them is that their assets are often intertwined. For example, most assets are in a family-owned or closely held business, family trusts, family limited partnerships, investment accounts or other vehicles that require joint decision-making. This combination of a family’s “financial lives” with their “family lives” gives rise to a heightened degree of complexity.

Decisions, decisions…

This complexity translates to myriad decisions financially wealthy families must make. There are the financial decisions about how to protect and grow the family’s assets, and then there are decisions about the maintenance and use of assets such as homes, automobiles and perhaps boats and airplanes.

The wealth provides a host of options that aren’t available to others — options around education, travel and lifestyle, each of which involve a discrete range of decisions.

Some of the decisions and questions my clients faced regarding their children included (and there are many!):

- How do we define family?

- Who is included and for what purpose?

- What do we tell family members about the extent of our wealth?

- When and how do we tell them?

- How much do we give our children and other family members, when do we give it to them, and how do we prepare them to know what to do with it once they get it?

- How much is enough?

- How do we empower our families to take advantage of all that our wealth allows, without it defining who they are and creating a sense of entitlement?

- Do we treat are children equally or equitably?

- How do we use our wealth to help others and support philanthropic causes we care about?

- How do we ensure that our financial wealth serves the family today, as well as for generations to come?

These examples of the non-financial decisions that need to be made are all common questions for families of substantial wealth.

Everyone has needs

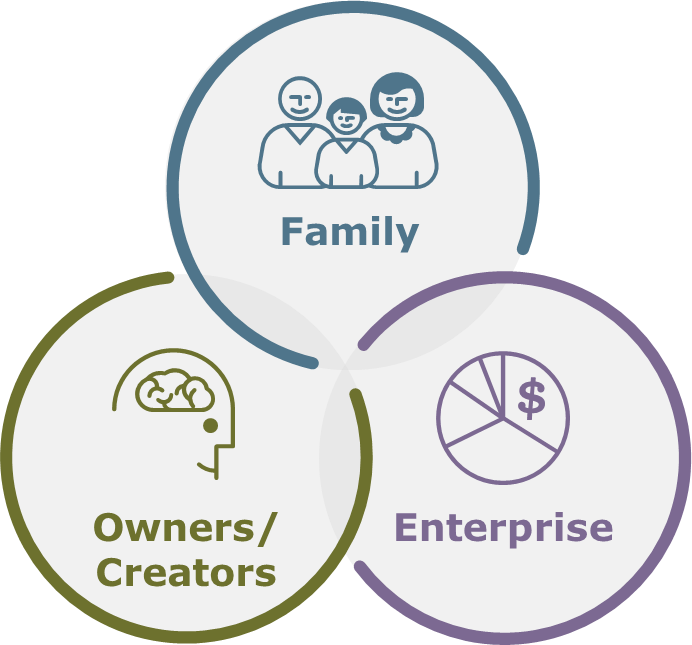

One strategy Enterprising Families use to help them navigate decisions concerning the knowledge, use, management, investment and stewardship of their assets — and the impact of their wealth on their family — is “systems thinking.”

Enterprising Families recognize that the combining of their financial and their family lives results in a set of at least three interlocking systems.

- The family system — of which all family members are a part.

- The Owners’ or Creators’ system — which is made up of those family members who actually own the assets from which all family members benefit.

- The Enterprise system — which refers to a business, other jointly owned assets or even wealth just being used as a tool to accomplish shared goals.

Adapted from the Three-Circle Model of the Family Business System, Tagiuri and Davis, 1982.

The complexities of the Family Enterprise System arise from the fact that:

- People in each of the constituent systems have different priorities, interests and needs. These differences in perspective give rise to a range of questions that require a series of essential family conversations.

- These constituent systems of differing priorities overlap.

- Family members play different roles with respect to each of the systems.

- The roles played by each family member will likely change over time.

Let’s look at a couple of examples that illustrate these complexities.

If the key asset within the Family Enterprise System is a business the family operates, what do you think the primary interests and priorities of the owner position might be (those who own a share of the business, but are not employed within the business)? How might their interests and priorities be different from those in the enterprise position (those who work in the business, but are not owners)? This is a classic scenario that can present challenges for a family that hasn’t invested time and energy in grappling with family dynamics.

As an owner, you may prioritize profits and dividend distributions. As a non-owner working in the business — and perhaps a manager of the business — you may prioritize profits too, but may want to reinvest those profits in growing the business, rather than distributing them.

This is not an unusual scenario as it relates to owners and employees, except that, when the people in question are family, they have a relationship independent of the business. They’ll see each other at family gatherings. They may even live in the same household. This leads to the potential for differences about the business to spill over into and negatively impact family affairs — and vice versa.

There may not even be any actual conflicts as it relates to the business; the conflicts may be with respect to purely family issues. The challenge then becomes how to ensure that their family differences don’t infect the business.

When you think systems, and map out the relationships in this way, the complexities become evident.

The challenges here are even greater when you consider that these relationships will likely change. A family member may not have an ownership interest in the business today, but that may change as they mature and inherit an ownership interest.

At any given moment, family members have to think about which role they are viewing a situation from and the various interests at play.

Have you identified where you fit into your Family Enterprise System and where everyone else within your family fits, too? What insights would you glean from looking at your Family Enterprise System?

When you pause to appreciate the extent of these complexities, it’s easier to understand how families can fall prey to miscommunication, misunderstandings and mistrust, as is the case with most families who lose their wealth by the end of the third generation — and why Enterprising Families spend the time thinking about and planning for these potential difficulties.

In my previous columns (“The Right Plan Can Bond Your Family Together Better Than Super Glue,” “My Family Drives Me (Financially) Nuts” and “Stop Pushing My Buttons! Family Tensions Can Prevent Forward Planning”), I shared research illustrating that the vast majority of reasons for the failure of generational wealth transfer are non-financial. Additionally, I pointed out there can be consequences if families do not exercise a high degree of purposefulness regarding the non-financial elements of their lives. We also explored what it takes to become an Enterprising Family and touched on how to thrive in an emotionally complex family system. Now, we looked at some of the unique complexities of families of financial wealth and how to navigate them.

What comes next

There are key concepts designed to help your family create a framework in approaching Family Dynamics. We will continue in the next few months by exploring:

- The multiple dimensions of wealth, or “family capital,” rather than seeing wealth as financially oriented only.

- Next steps: How to start your journey in becoming an Enterprising Family.

Wells Fargo Wealth Management provides products and services through Wells Fargo Bank, N.A. and its affiliates. Brokerage services are offered through Wells Fargo Advisors. Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC, Member SIPC, a registered broker-dealer and separate non-bank affiliate of Wells Fargo & Company. © 2017 Wells Fargo Bank, N.A. All rights reserved. Member FDIC. NMLSR ID 399801 Wells Fargo and Company and its affiliates do not provide legal advice. Please consult your legal advisers to determine how this information may apply to your own situation.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Katherine Dean is the Head of Family Dynamics for Wells Fargo Private Bank. Dean leads the ongoing evolution of the Family Dynamics program curriculum as well as the management of the Family Dynamics team that is distributed across the country. The Family Dynamics team helps families sustain their wealth across generations, by facilitating decision-making about the complex issues that arise as a result of substantial wealth.

-

Look Out for These Gold Bar Scams as Prices Surge

Look Out for These Gold Bar Scams as Prices SurgeFraudsters impersonating government agents are convincing victims to convert savings into gold — and handing it over in courier scams costing Americans millions.

-

How to Turn Your 401(k) Into A Real Estate Empire

How to Turn Your 401(k) Into A Real Estate EmpireTapping your 401(k) to purchase investment properties is risky, but it could deliver valuable rental income in your golden years.

-

My First $1 Million: Retired Nuclear Plant Supervisor, 68

My First $1 Million: Retired Nuclear Plant Supervisor, 68Ever wonder how someone who's made a million dollars or more did it? Kiplinger's My First $1 Million series uncovers the answers.

-

Don't Bury Your Kids in Taxes: How to Position Your Investments to Help Create More Wealth for Them

Don't Bury Your Kids in Taxes: How to Position Your Investments to Help Create More Wealth for ThemTo minimize your heirs' tax burden, focus on aligning your investment account types and assets with your estate plan, and pay attention to the impact of RMDs.

-

Are You 'Too Old' to Benefit From an Annuity?

Are You 'Too Old' to Benefit From an Annuity?Probably not, even if you're in your 70s or 80s, but it depends on your circumstances and the kind of annuity you're considering.

-

In Your 50s and Seeing Retirement in the Distance? What You Do Now Can Make a Significant Impact

In Your 50s and Seeing Retirement in the Distance? What You Do Now Can Make a Significant ImpactThis is the perfect time to assess whether your retirement planning is on track and determine what steps you need to take if it's not.

-

Your Retirement Isn't Set in Stone, But It Can Be a Work of Art

Your Retirement Isn't Set in Stone, But It Can Be a Work of ArtSetting and forgetting your retirement plan will make it hard to cope with life's challenges. Instead, consider redrawing and refining your plan as you go.

-

The Bear Market Protocol: 3 Strategies to Consider in a Down Market

The Bear Market Protocol: 3 Strategies to Consider in a Down MarketThe Bear Market Protocol: 3 Strategies for a Down Market From buying the dip to strategic Roth conversions, there are several ways to use a bear market to your advantage — once you get over the fear factor.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.