Seven Reasons Your House Is Still on the Market

You stuck a for-sale sign in the front yard but the offers aren’t rolling in. Here’s why.

Donna LeValley

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Your house has been on the market for quite some time and you're beginning to wonder. Will it ever sell?

So let’s back up a bit: Did you and the real estate agent representing your property have a good heart-to-heart about the asking price? Did you look at recent sales and comparable listings in your neighbor (“comps,” in Realtor-speak)? Or did you balk at the figure the agent calculated for your home and wanted it higher?

An unrealistic asking price is the obvious reason a home will linger on the market. Here are seven more reasons that might be less obvious, but they nonetheless could be keeping your house from attracting bids.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

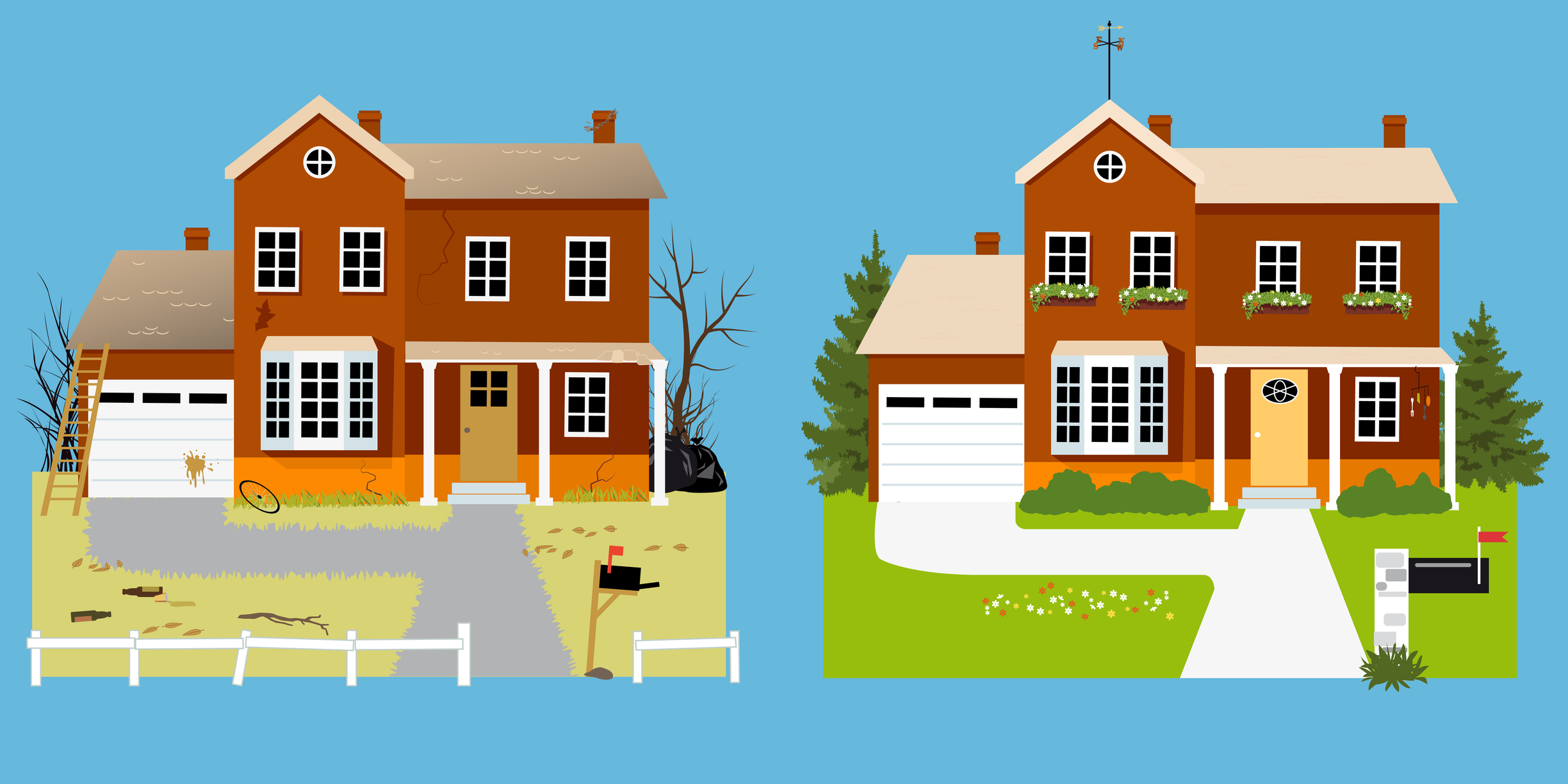

1. It lacks curb appeal

As most agents will tell you, if you can’t get potential buyers past the front yard, you’re not going to get them in the front door.

“If buyers don’t like the front [of the house] picture on the Internet or when driving by, they won’t look any further,” says Joel Hobson of Hobson Realtors in Memphis, Tenn. “Mulch the beds, paint the front door, clean the windows.” Look at your siding, too, and make sure all the gutters are attached and cleaned. And by all means maintain the lawn: No dandelions!

Jessica Riffle Edwards, a real estate agent with Coldwell Banker Sea Coast Advantage in Wilmington, N.C., has a curb appeal drill for her clients.

“I always tell my sellers to do an exercise called the ‘Front Door Check.’ Stand at your front door and imagine you are a prospective buyer. You might be waiting at the front door for a couple of minutes while the agent opens the door for a viewing. Look up and down, left and right and take notice of any cobwebs, paint chips or scuffs on the door or front porch that need attention,” she says.

2. You refuse to make upgrades

No home seller wants to replace appliances, flooring or countertops. Why spend the money on items you don’t plan to stick around and enjoy?

The big reasons you need to suck it up and do it is competition. If there are similar homes for sale in your area that have upgrades — stainless steel, granite, new windows and so on — and yours doesn’t, buyers will notice.

This is particularly noticeable if you haven’t upgraded in a decade or more. Cara Ameer, a broker associate with Coldwell Banker Vanguard Realty in Ponte Vedra, Fla., listed one house that came with baggage from the ‘80s. Entryway mirrors ran 20 feet from floor to ceiling and continued up the staircase to the second floor. Home buyers were stopped cold as soon as they entered.

“That house sat on the market that way for [two and a half] years,” says Ameer, until she persuaded the owners to take down the mirrors, a $3,000 job.

3. There’s too much clutter

Real estate agents and other professionals say a big part of selling your home is the staging. (Come on, you watch enough HGTV to know what I’m talking about).

Start by removing personal stuff: family photos, taste-specific artwork, notes attached to the fridge. Buyers want to see the potential, not so much your kid’s kindergarten project. Then, turn to large items that make rooms look small and cluttered such as oversized sofas and bulky exercise equipment. Next, clear out cabinets and closets to make them appear more spacious. And don’t forget the garage, a space that often becomes home to everything except the family car.

“A big word I use with clients is ‘editing’,” says Ameer. “Get rid of excess furniture and collections of things. Make sure the room is accessible and it flows.”

You might need to rent a storage unit to stash your stuff temporarily, but it’s a wise investment if your house sells faster.

4. The roof is old

This is a deal-breaker for many home buyers who can’t stomach the prospect of spending thousands — sometimes tens of thousands — of dollars on top of the sale price. But agents say sellers tend to revert to the “let’s see if we get an offer anyway” argument. Often, that doesn’t fly, especially if the seller wants top dollar for the home.

“An older roof scares buyers,’’ says Ameer.

Ameer and other agents say costs make it hard to talk sellers into replacing a roof before putting a house on the market. In Florida, where Ameer works, a new roof can range from approximately $15,000 for a 1,700-square-foot house to $35,000 for a 4,000-square-foot home. The figures are particularly daunting for first-time buyers, people selling inherited property and those selling homes on behalf of aging relatives who are no longer able to remain there.

One family initially balked, Ameer says, but relented when low offers kept coming in. The payoff was quick: The house sold within two weeks after the roof work was completed.

5. You still have renters

There’s this property you have that’s provided nice side income. You’re renting it out. But now you decide to sell the home. Think it through, agents say. You may want to send the renters packing with plenty of time to freshen up the place before you put it on the market.

Allowing the renters to stay while you attempt to sell that house is a tough go.

“Renters are not going to have it show like you want it to show,” says Ameer, who deals with this “armchair landlord” situation a lot in Florida. “It’s a slippery slope: You want the rent but you also want to sell. It will lag on the market with tenants in there.”

6. You hate showings

Yes, it’s annoying to have to leave the house at a moment’s notice because an agent has a client eager to see your home. But deal with it. The real estate market is 24/7 now.

In your listing, you can have your agent outline rules for showings, including limited hours or “by appointment only,” as long as you’re willing to accept that you might be missing out on a potential sale. Not surprisingly, home buyers want to look at houses during off-hours including nights and weekends because that’s when it’s convenient for them.

“Make your house easy to show for selling agents. Never turn down a showing, and let them put a key box in for easy access,” says Hobson, who advises that when you know there is going to be a showing, “make your home as bright and light as possible. Open draperies, turn on lights, leave the temperature comfortable, so that buyers want to stay.”

Agents agree that it’s best if the homeowner isn’t present during showings, so resist the urge to hang around the house.

7. You didn’t sweat the small stuff

Paying attention to the little details — potential buyers surely will — is essential. Painting baseboards and trim, touching up scuffs on the walls, and replacing outdated lighting and switch plates can freshen up a house without breaking the bank.

Says Edwards: “Buyers today want the house to be move-in ready and you will be competing with nearby properties that are move-in ready. Painting and carpet cleaning are affordable improvements that you can make to allow your home to stand out.”

Then there’s this: “I love dogs, but make sure that your house does not smell bad,” says Hobson. “Cigarette smoke is the worst.”

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Bob was Senior Editor at Kiplinger.com for seven years and is now a contributor to the website. He has more than 40 years of experience in online, print and visual journalism. Bob has worked as an award-winning writer and editor in the Washington, D.C., market as well as at news organizations in New York, Michigan and California. Bob joined Kiplinger in 2016, bringing a wealth of expertise covering retail, entertainment, and money-saving trends and topics. He was one of the first journalists at a daily news organization to aggressively cover retail as a specialty and has been lauded in the retail industry for his expertise. Bob has also been an adjunct and associate professor of print, online and visual journalism at Syracuse University and Ithaca College. He has a master’s degree from Syracuse University’s S.I. Newhouse School of Public Communications and a bachelor’s degree in communications and theater from Hope College.

- Donna LeValleyRetirement Writer

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

Could Tax Savings Make a 50-Year Mortgage Worth It?

Could Tax Savings Make a 50-Year Mortgage Worth It?Buying a Home The 50-year mortgage proposal by Trump aims to address the housing affordability crisis with lower monthly mortgage payments. But what does that mean for your taxes?

-

15 Cheapest Small Towns to Live In

15 Cheapest Small Towns to Live InThe cheapest small towns might not be for everyone, but their charms can make them the best places to live for plenty of folks.

-

Before Buying Your First Home, Get These Three Ducks in a Row

Before Buying Your First Home, Get These Three Ducks in a RowWith mortgage rates higher than we're used to, making sure you can comfortably afford to buy your first home is more important than ever.

-

Is Home Insurance Required? Not Necessarily, But That Doesn't Mean You Should Drop It

Is Home Insurance Required? Not Necessarily, But That Doesn't Mean You Should Drop ItHome insurance is required by most mortgage lenders. But even if your home is paid off, does it make financial sense to drop coverage?

-

5 Ways to Shop for a Low Mortgage Rate

5 Ways to Shop for a Low Mortgage RateBecoming a Homeowner Mortgage rates are high this year, but you can still find an affordable loan with these tips.

-

Property Tax 101: What Homeowners Need to Know

Property Tax 101: What Homeowners Need to KnowProperty Tax No one likes to pay property tax, but knowing how these taxes work might make the situation more bearable.

-

5 Great Places to Buy a Vacation Home

5 Great Places to Buy a Vacation HomeWant a vacation home for remote work or a fun getaway? Here are locations with median prices under $500K.

-

How to Help Your Children Buy a Home

How to Help Your Children Buy a HomeFamily Finances If you want to help your children buy a home your options range from family loans to outright gifts.