Stop Overpaying Property Taxes

These three Web sites can help you appeal your assessment.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

In 25 Ways to Waste Money, we show you several spending holes that may be in your budget and how to plug them. Here's one more waste of money to add to the list: paying too much in property taxes.

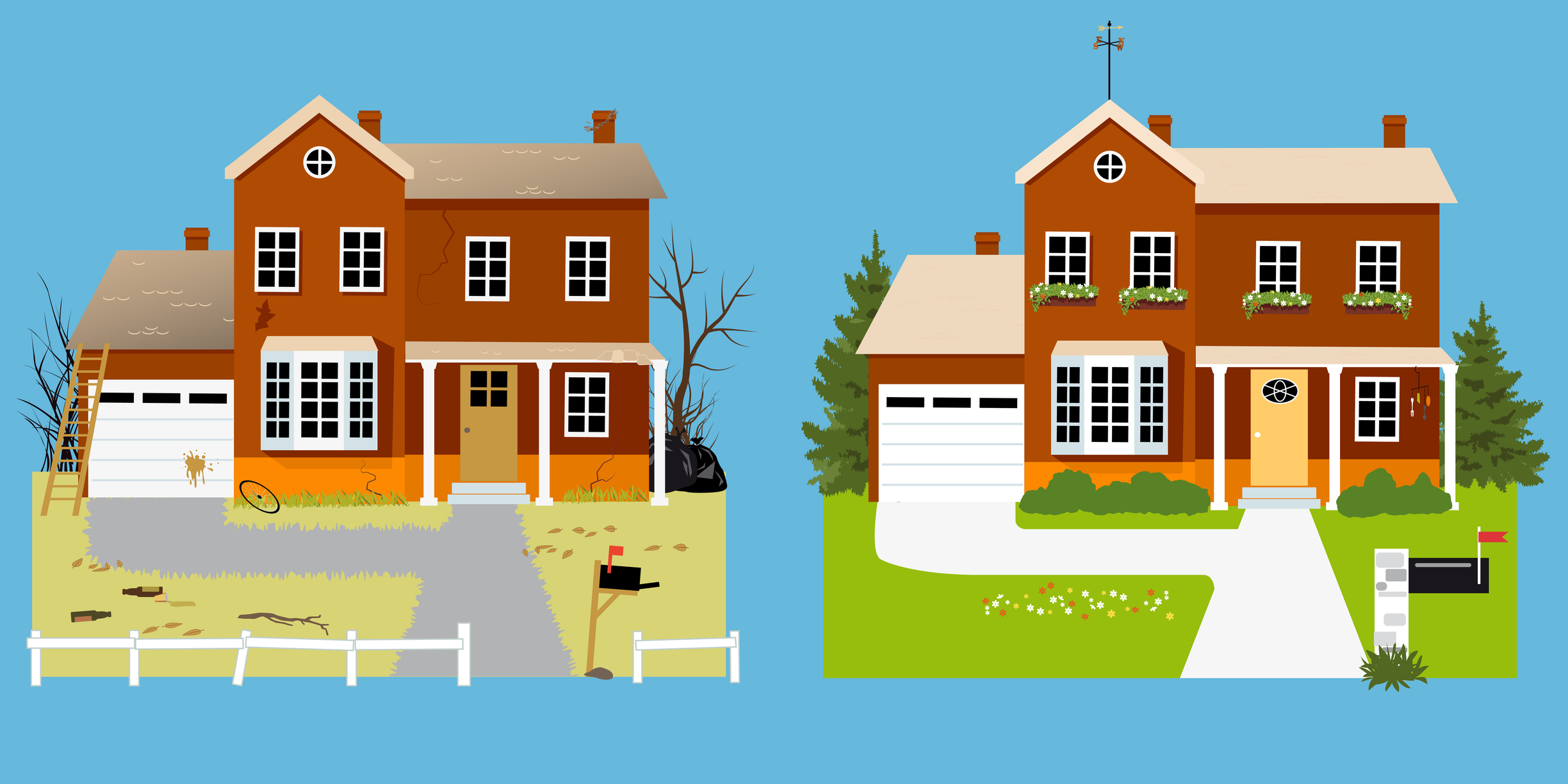

As many as 60% of properties in the U.S. are assessed higher than their current value, according to the National Taxpayers Union. That's because local governments assess properties, on average, once every two to three years. As we've seen, home values can fall a lot over that period of time. So if your property's value hasn't been assessed since it tumbled, you're probably paying too much in taxes.

You don't have to keep throwing money away, though. You can appeal your property tax assessment, and there are Web sites that can help. These three sites find comparable properties in your area that have sold for less than the amount at which your property is valued and provide varying levels of help with the appeals process.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

ValueAppeal.com. For $99, you'll find out whether you're paying too much and how much you could save by appealing. You get a property valuation based on the same data your county uses for its assessments, a list of ten comparable properties, a customized appeal report to mail to your appeals board and access to a tool that analyzes the property assessor's comparable properties to demonstrate that they unfairly support a higher value for your home. You'll get your money back if your appeal is rejected. Although ValueAppeal.com recently expanded its service nationwide, there are some rural areas that are not covered.

EasyTaxFix.com. For $79.95, you get three comparable properties (with the option to select other ones if you think they better reflect your property's value), a completed appeal form, valuation document and instructions on how to proceed. You'll get your money back if you don't win your appeal. However, the site covers only New Jersey and select cities or counties in Florida, California and New York. But it will be expanding coverage in Florida, California and New York this year, says EasyTaxFix.com President Adam Berkson.

LowerMyAssessment.com. You can see your property's assessed value and market value for free. For $39.95, the basic package provides comparable sales data. This package is available to property owners in all 50 states (but data aren't available for some rural areas). For $79.95, the deluxe package includes completed appeals forms in addition to sales data (it's only available in 11 states). For $299.95, the premier package includes an appraisal by a licensed appraiser, along with appeals forms and comparable properties.

According to the April issue of Kiplinger's Personal Finance magazine, hiring a professional real estate appraiser who will take a thorough look at your property provides the strongest evidence of its worth. But check whether your community allows outside appraisals in an appeal before you get one. You can find certified appraisers through the Appraisal Institute or the National Association of Independent Fee Appraisers.

The April issue also cautions against using law firms or other services that offer to assist you with an appeal in return for a high percentage of any savings on your bill. Most often, residential homeowners can go through the process on their own. You can get more information about appealing your property tax bill in the April issue of Kiplinger's Personal Finance, which will be available on newsstands and online March 15. For $9.95, you can buy the National Taxpayers Union's guide How to Fight Property Taxes.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Award-winning journalist, speaker, family finance expert, and author of Mom and Dad, We Need to Talk.

Cameron Huddleston wrote the daily "Kip Tips" column for Kiplinger.com. She joined Kiplinger in 2001 after graduating from American University with an MA in economic journalism.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

3 Tips to Update Your Bathroom for Less

3 Tips to Update Your Bathroom for Lessreal estate The time of year, where you shop, and how you design can all affect your remodel costs.

-

Trim Your Mortgage Rate With a 'Nonbank'

Trim Your Mortgage Rate With a 'Nonbank'real estate Online lenders could help you cut your expenses.

-

Seven Reasons Your House Is Still on the Market

Seven Reasons Your House Is Still on the Marketreal estate You stuck a for-sale sign in the front yard but the offers aren’t rolling in. Here’s why.

-

5 Reasons You Hate Your Homeowners Association

5 Reasons You Hate Your Homeowners Associationreal estate You want the property, you sign on with an HOA and bear the consequences.

-

Scam Alerts: Beware Unattended ATMs, Down-Payment Fraud

Scam Alerts: Beware Unattended ATMs, Down-Payment FraudScams Fresh hustles and cons you need to avoid.

-

Worst Things to Buy at Memorial Day Sales

Worst Things to Buy at Memorial Day SalesSmart Buying Good deals can be found over the long holiday weekend – just not on what you’d expect.

-

3 Strategies to Remodel Your Kitchen for Less

3 Strategies to Remodel Your Kitchen for Lessreal estate What to do about everything from buying cabinets and appliances to scoring discounts.

-

How to Get a Refund on Your Water Bill If You Have a Leak

How to Get a Refund on Your Water Bill If You Have a Leakreal estate Refunds for water leaks are available from municipalities if you report and fix the problem.