Why Housing Has a "Buy" Sign on It

With price declines and a bottom in sight, odds are improving that first-time home buyers will see positive returns over time.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

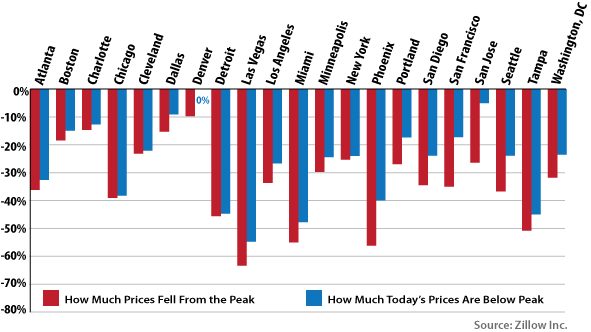

Will the nightmare on Main Street ever end? It sure doesn't seem like it, with home prices falling for 57 straight months, weighed down by everything from foreclosures to defaults to negative equity. Mortgage giants Fannie Mae and Freddie Mac are still troubled wards of the federal government. Recent headlines have trumpeted the housing market woes, such as the Wall Street Journal's May 9 story "Home Market Takes a Tumble" and CNN/Money's "Home Prices Crushed" the next day. Gary Shilling, a longtime Wall Street observer, recently panned homeownership in a lengthy report, "Still Home Sick."

The drumbeat of bad news is sinking in. A survey taken in April by Trulia and RealtyTrac has 54 percent of homeowners and renters saying housing won't recover until at least 2014. That's up from 34 percent in November.

"Real estate will be a bad investment this year and next year and possibly beyond that," says Jack Clark Francis, professor of finance and economics at Baruch College. "Prices are going to keep going down for a number of years at best."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Reading the signals

But I think housing has a "buy" sign on it. Am I delusional? Possibly. Yet it's striking how the pall enveloping the market is masking a number of important signals suggesting the bottom is near. This doesn't mean speculators will be rewarded and that prices are poised to come roaring back. There's no reason to rush. But the money maestro Warren Buffet once defined investing as laying out money now to get more money back in the future, after taking inflation into account. That's all. By that yardstick, the odds are good that first-time home buyers who decide it's time to make their move will get both a place of their own at a reasonable price, and earn a positive return on their investment over time.

Among the most intriguing signals that a home is attractive for first-time home buyers is the rent-to-price ratio. The rental and ownership markets compete for the household shelter dollar. The ratio is a quick way of capturing the relative value of each market, much like a price-to-earnings ratio with stocks. A simple back-of-the-envelope calculation for the ratio is average list price divided by average monthly rent multiplied by 12. The real estate website Trulia.com recently posted the price-to-rent ratios for 50 major metropolitan areas. A ratio below 15 suggests buying beats renting; from 15 to 20 it pays to be wary of buying and above 20 means renting reigns supreme. Buying came out on top in 39 metro markets; another eight were in the be-very-careful-before-making-an-offer category and renting was the clear favorite in the remaining cities. (The study compared renting a two-bedroom apartment vs. the cost of buying a two-bedroom condo or townhouse.)

It's getting more expensive to rent, too. According to the Joint Center on Housing Studies at Harvard University, rents in professionally managed apartments rose by 2.3 percent year-over-year in the fourth quarter of 2010. Vacancy rates in these complexes have come down from a peak of 13.5 percent in the third quarter of 2009 to nearly 10.5 percent at the end of 2010. The center's scholars believe rents will continue to strengthen. "The risk of renting is payment risk -- higher rents," says William Wheaton, economist at the Center for Real Estate at MIT. "If you buy a home with a fixed rate, mortgage payments are fixed."

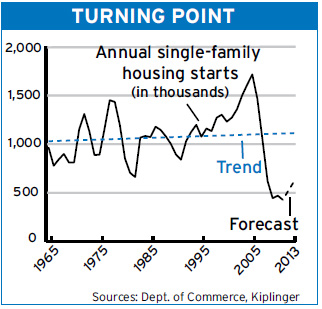

A major factor behind increased demand for apartments is young adults deciding it's safe to leave Mom and Dad's basement and get a place of their own. The job market is finally improving, with job creation in the three months ending in April averaging 233,000 a month compared to 78,000 a month last year. New household formation is expected to run in the 1.1 million-to-1.4 million range, which is about double the pace of recent years. Mortgage rates are at their lowest level in decades with the 30-year fixed rate mortgage at 4.35 percent and the 15-year fixed rate at 3.9 percent. The combination of low mortgage rates and low housing prices means that housing is more affordable than it's been in some 30 years.

The demand question

But will people want to buy? Clearly, the benefits of owning were oversold during the boom and more people have to come appreciate the flexibility of renting. Still, owning exerts a powerful pull in American culture. It's striking that the latest Fannie Mae National Housing Survey for the first quarter of 2011 shows 74 percent of renters still believe that owning makes more sense than renting. When the Pew Research Center surveyed renters earlier in the year, only 24 percent said they rented out of choice and 81 percent said they wanted to become owners. The lure of owning is that it's your place and you get to remake it the way you want. "For people who are going to stay put, owning is a better deal than renting," says Wheaton. "They can do what they want to the place, it has tax advantages and there's no rent payment risk."

The real lesson of the real estate boom and bust is that owners need stable jobs and solid finances. They also need a long-term horizon. Forget about owning if you think you might need to move within the next five years. But for the potential owner in for the long haul, market history suggest one of the best times to buy any asset -- a stock, a bond and, yes, a home -- is when prices have been beaten down for a long time and the popular consensus is the bad times will last. "We tend to talk about location, location, location with real estate," says Eric Belsky, managing director of the Joint Center for Housing Studies at Harvard. "It's really about timing, timing and timing." The economic fundamentals suggest the time is now.

Contributing Columnist Chris Farrell is economics editor for American Public Media's weekly "Marketplace Money" show and author of "The New Frugality."

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

A Housing Shortage Looms: Builders Can’t Keep Up

A Housing Shortage Looms: Builders Can’t Keep Upbusiness Starter homes especially are becoming scarce.

-

2016: A Second Good Year for Housing

2016: A Second Good Year for Housingbusiness The housing market picked up last year in many areas of the U.S. Look for it to grow as well or better this year.

-

Where the Housing Market Is Headed in Late 2015

Where the Housing Market Is Headed in Late 2015business First-time home buyers will be a big driver of this market's recovery.

-

Housing Market Will Improve in 2015

Housing Market Will Improve in 2015Economic Forecasts The lagging sector is new single family homes, where a shortage of skilled labor and buildable lots is holding back construction.

-

No Reason to Fear a Housing Bubble

No Reason to Fear a Housing Bubblebusiness Look for recent price spikes to ease as new construction picks up and more homes come on the market.

-

Housing Recovery Firmly Under Way

real estate Gains among states will be uneven, but progress will continue through 2014

-

Office, Other Commercial Property Rents to Rise in 2013

Business Costs & Regulation Like the economy as a whole, the commercial real estate market will strengthen over the coming year.

-

3 Signs the Housing Recovery Has Arrived

3 Signs the Housing Recovery Has ArrivedEconomic Forecasts Buyers are back, building is up -- and housing is poised to add to the economy instead of pulling it down.