Housing Recovery Firmly Under Way

Gains among states will be uneven, but progress will continue through 2014

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

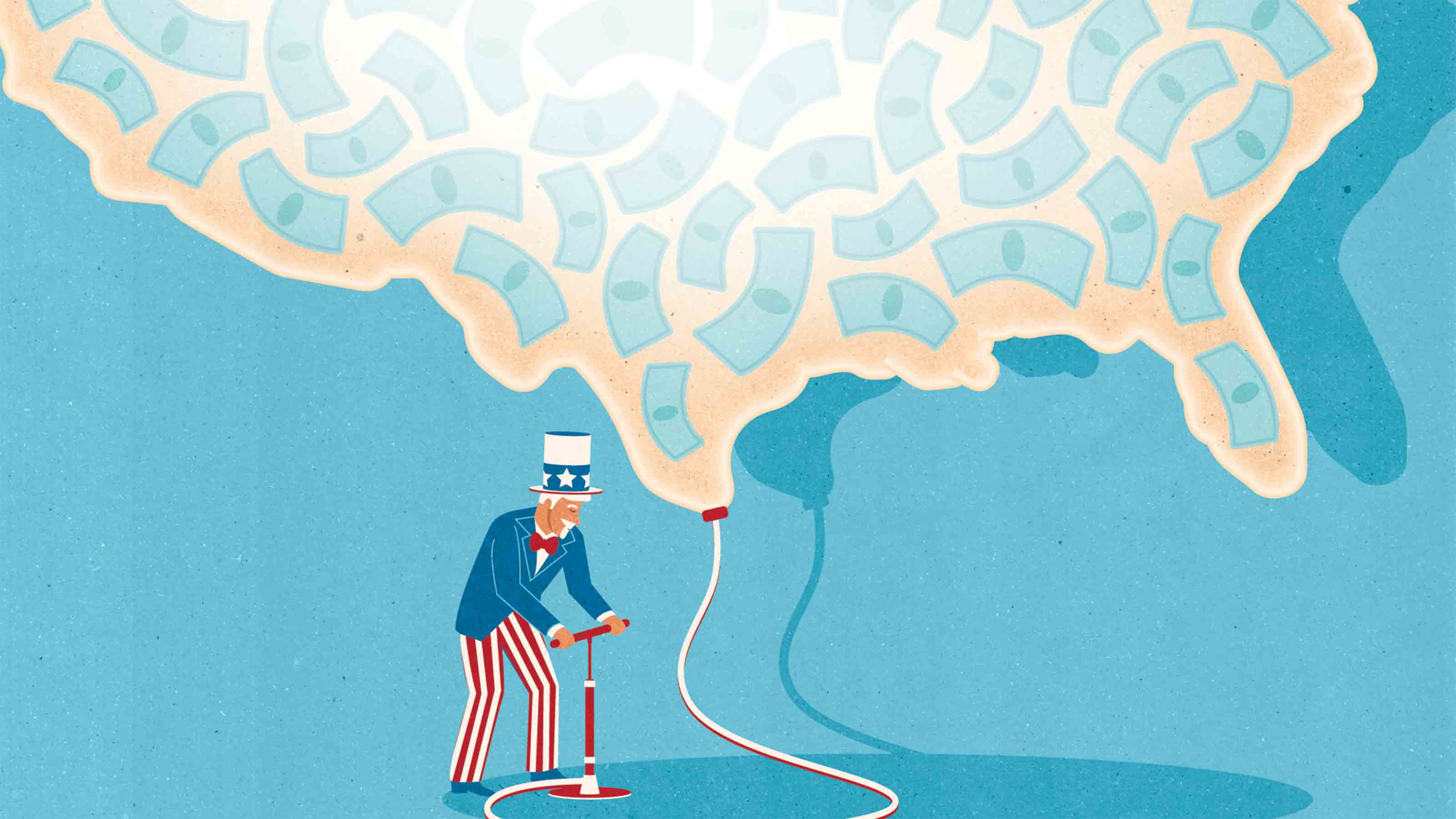

The housing industry finds itself on much better footing this year: Prices are up, inventories are down, and signs abound that a recovery is firmly under way. This is good news for the economy as a whole at a time when other stalwarts of the recovery, such as exports and government spending, have started to tail off. Increased home sales put more people to work and feed an upward spiral of income, spending and employment in the real estate and home building industries. Makers and sellers of appliances, furniture and carpets, plus nurseries, landscapers and others also benefit.

Look for housing to add 0.6% to GDP this year and as much as 1% in 2014. All of the major national indicators -- building permits and starts, sales of new and existing homes and overall home prices -- are likely to rise in 2013, for just the second time since 2005. Overall, sales of existing homes will climb to almost 5 million this year, up 7.5% from last year's 4.65 million. The annualized pace of January sales -- 4.92 million -- was strong, particularly considering that the cold winter months are typically slow. The spring and summer seasons will bring an even faster sales pace. Growth of new-home sales will also accelerate in 2013, climbing by 36%, to about 500,000 this year.

The national average home price, meanwhile, will head about 5% higher this year, with a 7% gain likely next year. But not all areas will benefit equally: Those experiencing better-than-average job growth will see more-robust home sales and rising prices. Homeowners in North Dakota, Colorado and Texas, for example, are already seeing average prices that top 2007 levels, according to the Federal Housing Finance Agency.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Also likely to enjoy a price run-up in coming months: Areas where inventories of unsold homes are plunging. For example, a dozen California metropolitan areas, from Sacramento to San Diego, have seen inventories fall by as much as 65% in 12 months. For the Washington, D.C., and Boston metro areas, which weren't greatly overbuilt, inventories have fallen by 20% to 30%. Even in Phoenix, once buried under an avalanche of foreclosures, inventories have fallen by more than 15% from a year ago. Eventually, however, more home building spurred by rising prices will bolster supplies again, cooling off overheated prices.

Nationwide, inventory has slipped to a mere 4.2 months' worth of homes, which is the lowest since April 2005, before the overinflated housing market went bust. Others likely to fare well: Austin, Texas; Portland, Ore.; Seattle; Salt Lake City; Atlanta; Minneapolis; and Boise, Idaho. In the hottest spots, sellers are getting multiple bids and builders are scrambling to keep up with demand. "The typical home is selling nearly four weeks faster than it did a year ago," says Gary Thomas, president of the National Association of Realtors.

In other regions, inventory levels tell a much different story, and home values will remain depressed. Across much of Florida and in Nevada, for example, the supply overhang is still too big, and the plunge prices took, too steep to overcome quickly, despite good declines in inventories and decent price gains. That's particularly true in Florida, where foreclosures can take years. Similarly, the New York City-New Jersey-Connecticut corridor has a long way to climb back.

Nationwide, distressed sales will account for about one in five home sales in 2013, down from one in three a year ago but still way above the prerecession single digits. With foreclosed properties often selling at a discount of up to 40%, it's no surprise that Nevada home prices, for instance, started 2013 about 45% under Jan. 1, 2008, levels. Lagging economies and sluggish job growth are reining in growth for others. Among them: New Orleans, Chicago, Philadelphia and a wide swath of cities that cut from Charleston, W.Va., across Tennessee, Kentucky, Ohio, Indiana, Illinois and Missouri, into Michigan and Wisconsin.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Look Out for These Gold Bar Scams as Prices Surge

Look Out for These Gold Bar Scams as Prices SurgeFraudsters impersonating government agents are convincing victims to convert savings into gold — and handing it over in courier scams costing Americans millions.

-

How to Turn Your 401(k) Into A Real Estate Empire

How to Turn Your 401(k) Into A Real Estate EmpireTapping your 401(k) to purchase investment properties is risky, but it could deliver valuable rental income in your golden years.

-

My First $1 Million: Retired Nuclear Plant Supervisor, 68

My First $1 Million: Retired Nuclear Plant Supervisor, 68Ever wonder how someone who's made a million dollars or more did it? Kiplinger's My First $1 Million series uncovers the answers.

-

Federal Debt: A Heavy Load

Federal Debt: A Heavy LoadEconomic Forecasts The debt continues to grow, but record-low interest rates could ease the long-term damage.

-

How the Fed's Moves Affect You

How the Fed's Moves Affect YouEconomic Forecasts It’s pumping trillions of dollars into the economy and keeping rates near zero. Savers are sunk, but borrowers get a boost.

-

Consumers Will Feel Impact of Rapidly Falling Interest Rates

Consumers Will Feel Impact of Rapidly Falling Interest RatesEconomic Forecasts Mortgage and car loans will experience the most significant dips, while some holders of Treasuries may get a slight boost.

-

Will You Have to Pay More Sales Taxes on Your Online Purchases?

Will You Have to Pay More Sales Taxes on Your Online Purchases?business One thing’s for sure: Consumers who live in one of the five states without a sales tax won’t be affected by the Supreme Court’s ruling.

-

A Housing Shortage Looms: Builders Can’t Keep Up

A Housing Shortage Looms: Builders Can’t Keep Upbusiness Starter homes especially are becoming scarce.

-

Is Credit-Card Debt Out of Control?

Is Credit-Card Debt Out of Control?credit & debt Balances are on the rise, but defaults are still low.

-

Help Wanted in America: Skilled Workers

Help Wanted in America: Skilled WorkersTechnology In an ever-more-competitive job market, technology increases the need for skilled workers.

-

The Unintended Consequences of a Boost in Overtime Pay

The Unintended Consequences of a Boost in Overtime PayBusiness Costs & Regulation New rules mean millions more employees will be overtime-eligible. But will employers find workarounds?