12 Strategies to Generate Income in Retirement

Here's how to ensure that your retirement savings last as long as you do.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

When it comes to saving for retirement, maybe you've done everything right. You started early, maxed out your 401(k) plan, invested in a diversified portfolio and avoided costly mistakes, such as cashing out your retirement plan. Fantastic. But now comes the hard part: making sure you don't outlive your money.

That's a tall order for today's retirees. Taxes, unpredictable investment returns, rising health care costs and inflation down the road can significantly erode the value of your nest egg. And perhaps the biggest challenge is that you'll probably need the money for a long time. A 65-year-old man has a life expectancy of 19.3 years; it's 21.6 years for a 65-year-old woman. If you're married, there's a 45% chance that one of you will live to age 90 and a nearly 20% chance that you or your spouse will live to 95.

Fortunately, there are steps you can take to generate extra income and extend the life of your portfolio.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

1. Put Your Money in Buckets

A bear market just as you enter retirement couldn't come at a worse time if you're forced to sell securities after prices have plunged. Certainly, many investors today worry about how long the bull market can keep running (see When Will the Bull Market End?). That's where the "bucket system" can help. Basically, you divide your money among different kinds of investments based on when you'll need it. Jason L. Smith, a financial adviser in West Lake, Ohio, and author of The Bucket Plan (Greenleaf Book Group Press), uses the system with clients, splitting their assets among three buckets: "Now," "Soon" and "Later."

The Now bucket holds what you'll need in the short term. Smith recommends setting aside enough so that, when added to Social Security or a pension, it will cover your basic expenses for up to a year. It should also have enough for major expenses that are likely to crop up over the next couple of years, such as paying for a new roof or that once-in-a-lifetime trip around the world, plus cash for unexpected emergencies.

Money in the Soon bucket will be your source of income for the next 10 years. Smith recommends investing in a fixed annuity (not an immediate annuity, which locks you into monthly payments) or high-quality short-term bonds or bond funds. As the Now bucket is depleted, you withdraw money from the annuity or sell some of the fixed-income investments in the Soon bucket to replenish it.

The assets in the Later bucket aren't meant to be tapped for more than a decade into your retirement, so they may be invested more aggressively in stock funds, which provide greater growth potential, and alternative investments such as REITs. This bucket can also include life insurance or a deferred-income annuity, which pays income later in life. Consider selling securities in the Later bucket to replenish the Soon bucket starting about five years before it runs out of money. If the market is in a downward spiral, you can wait, knowing you still have a few years before the Soon bucket will be empty.

KIP TIP: Money you’ll need in the near term should be parked in a savings account. Yields on deposit accounts have been abysmal, and even though the Fed has been nudging rates higher, most banks haven’t passed on the increases to savers. Still, some are boosting rates. Yields on saving accounts requiring little or no minimum balance were recently 1.4% at Dollar Savings Direct, 1.35% at Live Oak Bank, and 1.3% at BankPurley and CIT Bank.

2. Manage Your Spending

To avoid running out of money during retirement, the standard rule has been to withdraw 4% from your nest egg in the first year of retirement and use the inflation rate as a guide to adjust withdrawals in subsequent years. For example, if you have $1 million, you can withdraw $40,000 in year one. If the inflation rate clocks in at 2% in year two, your withdrawal grows by 2%, to $40,800.

The 4% rule is based on historical market returns for a portfolio evenly split between stocks and bonds. But as the saying goes, past performance is no guarantee of future returns. Plus, the rule assumes you will live 30 years in retirement, so you might want to adjust the withdrawal rate up or down based on your life expectancy, says Judith Ward, a senior financial planner at T. Rowe Price.

Still, you should do just fine if you use the rule as a starting point for withdrawals. In fact, T. Rowe Price tested the 4% rule for a worker who retired in 2000 with a $500,000 portfolio (60% stocks, 40% bonds) and experienced two bear markets—the 47% drop in Standard & Poor’s 500-stock index in 2000–02 and the 55% drop in 2007–09. Though the retiree’s balance shrunk to about $300,000 by 2009—a 40% decline—the subsequent bull market helped restore the balance to $414,000 by the end of 2016.

KIP TIP: Like any rule of thumb, the 4% rule won’t work for everyone or in every situation. You might need to reduce the withdrawal rate if you retire early or have a major expense, or if a market downdraft wipes out a chunk of your nest egg. Or you might increase it if your investments have appreciated more than expected, or you’ve spent less than you anticipated and have built up a sizable balance.

3. Protect Against Inflation

The inflation rate has averaged 2.2% since 2000, and the Kiplinger forecast is for 1.3% inflation for 2017 and 1.9% for 2018. That seems tame, but don’t underestimate the power of even modest inflation, which can significantly erode purchasing power over time.

One way to make sure your nest egg keeps up with the cost of living is to remain invested in stocks. That can make for a bumpy ride over the short term, but over the long haul stocks’ steady upward trend makes them a go-to hedge against inflation. As measured by the S&P 500, stocks have returned an average annual rate of 10% for nine decades. Over the next decade, investors are more likely to see an average annual rate of 8% or even less—but even if inflation reverts to its long-term historical norm of a little over 3%, that return still provides a healthy cushion.

If you are near or just beginning retirement, advisers generally recommend a portfolio of up to 60% in stocks. But Michael Kitces, director of wealth management for Pinnacle Advisory Group in Columbia, Md., suggests that when stocks are highly valued (as they are now), investors should reduce their stock allocation to 30% at retirement. (If you’re using the bucket system, your 30% allocation to stocks goes in the Later bucket.) You can gradually increase your portfolio’s stock holdings to 60% or whatever amount meets your comfort level, he says.

Treasury inflation-protected securities, or TIPS, are another hedge against rising consumer prices. With these bonds, issued by Uncle Sam, your principal will be adjusted for inflation. In addition, you’re guaranteed a fixed rate of interest every six months, so as the principal rises, so does the amount of interest you’ll earn.

Ease the tax bite by holding securities in the right accounts. Income from bonds and bond funds are taxed at ordinary income tax rates and are best held in a tax-deferred account, such as an IRA. Stocks get favorable tax treatment in a taxable account; most dividends from stocks and stock funds,

as well as long-term capital gains, are taxed at only a 15% or 20% tax rate. But make sure you keep some stocks in tax-deferred accounts to fight the effects of inflation over the long term.

KIP TIP: You can buy TIPS straight from the federal government if you set up a TreasuryDirect account. That way, you won’t pay a commission to buy them, and you’ll avoid a management fee that comes with a TIPS fund. Plus, if you invest in TIPS directly, you’ll never get less than your original investment when the bonds reach maturity.

4. Get Income From Your Investments

If you need to boost your retirement paycheck to supplement Social Security and other sources of guaranteed income—or to generate cash while you wait for delayed benefits to supercharge your Social Security—dividend-paying stocks in a taxable portfolio should be high on your list. They can make up one-fourth to nearly one-half of your stock portfolio.

A number of blue-chip stocks have yields of 2.5% to 4%, including such stalwarts as Boeing (symbol BA), Caterpillar (CAT) and 3M (MMM). Look for companies with a record of regularly increasing dividends over time, which can serve as a hedge against inflation. But beware of chasing the highest yields. Outliers that boast yields of 7% or 8% may not generate enough profits to sustain those dividends.

As alternatives to individual stocks, consider exchange-traded funds and mutual funds that focus on investing in companies that pay dividends. T. Rowe Price Dividend Growth (PRDGX) and Vanguard Equity Income (VEIPX) are members of the Kiplinger 25, the list of our favorite mutual funds; Kiplinger’s 20 favorite ETFs include Schwab U.S. Dividend Equity (SCHD) and Vanguard High Dividend Yield (VYM).

Bonds are another key source of income. “You can make a huge difference in your income and your total return by properly managing the bond portion of your portfolio,” says Mari Adam, a certified financial planner with Adam Financial Associates, in Boca Raton, Fla.

The bond allocation for conservative investors near or at retirement is roughly 40% or more. Adam recommends that up to half of that be invested in a core bond or bond index fund consisting of U.S. government and high-quality corporate securities. Or, if you’re in the 28% or higher tax bracket, make municipal bonds your core holding, she says. The yields on munis issued by state and local governments tend to be lower than those of some other bonds, but you won’t owe federal taxes on the income.

Among mutual funds that focus on munis, Fidelity Intermediate Municipal Income (FLTMX) is in the Kip 25. The rest of the bond money can be spread among TIPS, high-yield bonds (also called junk bonds), international bonds, strategic bond funds, floating-rate bond funds and preferred stocks. (Preferreds behave like bonds, paying out regular fixed payments.)

KIP TIP: Real estate investment trusts, which own and manage properties such as offices, apartments and shopping malls, must distribute at least 90% of their taxable income to shareholders. Plus, REITs are a hedge against inflation. You can invest in REITs through ETFs and mutual funds. Among our favorites is Schwab U.S. REIT (SCHH).

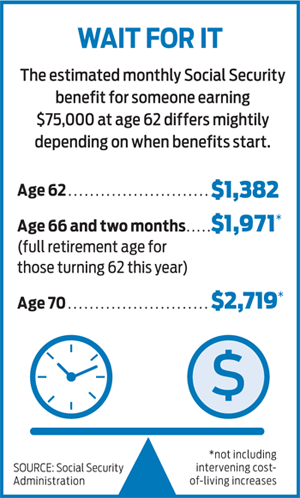

5. Delay Social Security Benefits

You might not think of Social Security as an inflation fighter, but for many people it will be their only stream of income with an automatic cost-of-living adjustment. The COLA was only 0.3% for 2017, but it’s projected to be 2.2% in 2018. (When inflation was soaring in 1981, the COLA hit a record high of 14.3%.)

More than 45% of people take Social Security retirement benefits as early as they can, at age 62. For those who have taken early retirement, perhaps because of poor health, this often makes sense. But grabbing benefits early comes at a steep cost. If you claim Social Security at 62, your benefit will be reduced by as much as 30% compared with delaying until full retirement age (currently 66 but gradually rising to age 67). And if you’re patient and have other sources of income, you get a generous bonus for waiting until age 70 to claim benefits: For every year you wait to take Social Security beyond full retirement age until age 70, your benefit increases by 8%. Even better, future COLAs will be based on that bigger benefit.

KIP TIP: Spouses should coordinate their claiming strategies to maximize the survivor benefit. A married couple is likely to maximize lifetime income from Social Security if the higher earner delays taking Social Security until age 70, so no matter who dies first, the survivor gets the largest possible benefit (see How Misinformation From Social Security Can Cost You Tens of Thousands of Dollars).

6. Earn Extra Income

When Steve Cornelius retired in 2011 from his job as an executive for an industrial supply company in Atlanta, he moved to Minneapolis—no doubt passing other retirees who were headed in the opposite direction. “I can’t stand hot weather,” he says. Cornelius loves spending time outdoors and playing golf, but after a couple of years he realized he needed something else to do during Minnesota’s long, cold winters. His solution: a part-time job with tax-preparation giant H&R Block.

Cornelius, 67, started working for Block in 2013 and has a growing roster of return clients. His hours are flexible, but he usually works 32 hours a week from January through April. During the rest of the year, he works about 10 hours a week providing clients with general tax-planning advice.

Cornelius says the income from his job will allow him to postpone claiming Social Security benefits until he’s 70. He’ll get a bump up of 8% for every year he delays taking benefits after his full retirement age of 66. “That’s going to give me security against inflation, which will rear its ugly head at some point,” Cornelius says.

The income has also enabled Cornelius to take trips he might not otherwise be able to afford. This fall, he and his partner, Robin, are taking a cruise through Southeast Asia, with stops in Hanoi, Ho Chi Minh City, Bangkok and Singapore. “I’ve got a great retirement plan, but unless you’re Warren Buffett, you’re on a budget,” he says.

In addition to allowing you to delay taking Social Security, income from a part-time job can help cover your expenses during a market downturn, which means you won’t have to sell investments at a loss to pay the bills. Part-time and seasonal job opportunities run the gamut, from working as a park ranger to teaching English as a foreign language in another country. Freelancing is another way to earn extra cash (see www.freelancersunion.org for advice on everything from contracts to taxes). Freelance gigs range from online tutoring to consulting in your former profession. If you have a garage apartment or second home, you can earn income through home-sharing services, such as Airbnb.

KIP TIP: If you’re receiving Social Security benefits and haven’t reached full retirement age—66 for most retirees—be mindful of the earnings test. In 2017, if you make more than $16,920, you’ll lose $1 in benefits for every $2 you earn over that amount. In the year you reach full retirement age, you’ll give up $1 for every $3 you earn over $44,880 before your birthday. Starting in the month you reach full retirement age, you can earn as much as you want without worrying about the earnings test. But the benefits aren’t lost forever. Once you reach full retirement age, your benefits will be adjusted to recover what was withheld. Still, if you’re planning on working after you retire, it makes sense either to keep your earnings below the limit or delay claiming benefits until you reach full retirement age.

7. Buy an Annuity

Unless you’re a retired public service employee or you worked for one of the handful of companies that still offer a traditional pension (see below), you’re not going to receive a monthly paycheck from your employer for the rest of your life. But that doesn’t mean that a guaranteed source of lifetime income is an impossible dream. You can create your own pension by buying an immediate fixed annuity.

When you buy an immediate annuity, you give an insurance company a lump sum in exchange for a monthly check, usually for life. You can buy an annuity that has survivor benefits so that it will continue to pay your spouse after you die. But you pay for that protection by accepting smaller monthly payouts. Another option is a deferred-income annuity; you purchase the annuity when you’re in your fifties or sixties, but the payments don’t start for at least 10 years. The longer you wait, the bigger the payouts. Of course, if you die before payments start, you get nothing—unless you opt for return of premium or survivor benefits. (These products are often referred to as longevity insurance, because they protect you from the risk of outliving your savings.)

A relatively new type of deferred-income annuity, a qualified longevity annuity contract (QLAC), offers a tax benefit for retirees who have a lot of money in tax-deferred retirement accounts. You can invest up to 25% of your traditional IRA or 401(k) plan (or $125,000, whichever is less) in a QLAC without taking required minimum distributions on that money when you turn 70½. To qualify for this special tax treatment, your payments must begin no later than age 85.

An analysis by New York Life illustrates how this strategy could lower your tax bill. A 70-year-old retiree in the 28% tax bracket with $500,000 in an IRA would pay about $117,000 in taxes on RMDs between age 70 and 85, assuming 5% annual net returns. If the retiree opted instead to put 25% of the IRA balance into a QLAC at age 70, he would pay roughly $87,000 in taxes over the same period—a $30,000 reduction. Taxes would increase, however, once the annuity payments began at 85. You can shop for QLACs at www.go2income.com.

KIP TIP: Don’t stash all of your nest egg in an annuity. Most experts recommend investing no more than 25% to 40% of your savings in an annuity. Alternatively, calculate your basic expenses, such as your mortgage, property taxes and utilities, and buy an annuity that, when added to Social Security benefits, will cover those costs.

8. Minimize Taxes

To get the most out of your retirement savings, you need to shield as much as possible from Uncle Sam. Fortunately, there are plenty of legal ways to lower your tax bill, but they require careful planning and a thorough understanding of how your different retirement accounts are taxed.

Let’s start with your taxable brokerage accounts—money you haven’t invested in an IRA or other tax-deferred account. Because you’ve already paid taxes on that money, you’ll be taxed only on interest and dividends as they’re earned and capital gains when you sell an asset. The top long-term capital gains rate—which applies to assets held for more than a year—is 23.8%, but most taxpayers pay 15%. The rate is 0% for taxpayers in the 10% or 15% bracket. For 2017, a married couple with income of $75,900 or less can qualify for this sweet deal.

Next up: your tax-deferred accounts, such as your IRAs and 401(k) plans. Withdrawals from these accounts are taxed at ordinary income rates, which range from 10% to 39.6%. The accounts grow tax-deferred until you take withdrawals, but you can’t wait forever. Once you turn 70½, you’ll have to take required minimum distributions (RMDs) every year, based on the year-end balance of all of your tax-deferred accounts, divided by a life-expectancy factor provided by the IRS that’s based on your age. The only exception to this rule applies if you are still working at 70½ and have a 401(k) plan with your current employer; in that case, you don’t have to take RMDs from that account. You’ll still have to take withdrawals from your other 401(k) plans and traditional IRAs, unless your employer allows you to roll them into your 401(k).

Finally, there are Roth IRAs, and the rules for them are refreshingly straightforward: All withdrawals are tax-free, as long as you’ve owned the account for at least five years (you can withdraw contributions tax-free at any time). There are no required distributions, so if you don’t need the money, you can leave it in the account to grow for your heirs. This flexibility makes the Roth an invaluable apparatus in your retirement toolkit. If you need money for a major expense, you can take a large withdrawal without triggering a tax bill. And if you don’t need the money, the account will continue to grow, unencumbered by taxes.

Conventional wisdom holds that you should tap your taxable accounts first, particularly if your income is low enough to qualify for tax-free capital gains. Next, take withdrawals from your tax-deferred accounts, followed by your tax-free Roth accounts so you can take advantage of tax-deferred and tax-free growth.

There are some exceptions to this hierarchy. If you have a large amount of money in traditional IRAs and 401(k) plans, your RMDs could push you into a higher tax bracket. To avoid that scenario, consider taking withdrawals from your tax-deferred accounts before you turn 70½. Work with a financial planner or tax professional to ensure that the amount you withdraw won’t propel you into a higher tax bracket or trigger other taxes tied to your adjusted gross income, such as taxes on your Social Security benefits. The withdrawals will shrink the size of your tax-deferred accounts, thus reducing the amount you’ll be required to take out when you turn 70½.

Another strategy to reduce taxes on your IRAs and 401(k) plans is to convert some of that money to a Roth. One downside: The conversion will be taxed as ordinary income and could bump you into a higher tax bracket. To avoid bracket creep, roll a portion of your IRA into a Roth every year, with an eye toward how the transaction will affect your taxable income.

KIP TIP: If the stock market takes a dive, you may be able to reduce the cost of converting to a Roth. Your tax bill is based on the fair market value of the assets at the time of the conversion, so a depressed portfolio will leave you with a lower tax bill. If your investments rebound after the conversion, those gains, now protected inside a Roth, will be tax-free. Should the value of your assets continue to plummet after you convert, there’s a safety valve: You have until the following year’s tax- filing extension (typically October 15) to undo the conversion and eliminate the tax bill. If prospects for major tax reform and rate cuts come to fruition, it could open a golden era for Roth conversions. Keep an eye on Congress.

9. Manage Your Pension

At a time when defined-benefit plans are becoming as rare as typewriters, consider yourself fortunate if you have a traditional pension to manage. Even so, the decisions you make about how you take your pension payout could have a significant impact on the amount of income you receive.

One of the first decisions you’ll probably have to make is whether to take your pension as a lump sum or as a lifetime payout. A lump sum could make sense if you have other assets, such as life insurance or a sizable investment portfolio, and if you’re comfortable managing your money (or paying someone else to do it for you). You’ll also have more flexibility to take withdrawals, and your investments could grow faster than the rate of inflation. What you don’t spend will go to your heirs.

A lifetime payout, however, offers protection against market downturns, and you won’t have to worry about outliving your money. You’ll probably also get a higher payout from your former employer than you could get by taking a lump sum and buying an annuity from an insurer.

Consider longevity when deciding how to structure your lifetime payout. Married couples have a couple of basic options for their payments: single life or joint and survivor. Taking the single-life payment will deliver bigger monthly payments, but your pension will end when you die. By law, if you’re married, you must obtain your spouse’s consent before taking this option. With the joint-and-survivor alternative, payments will be smaller, but they’ll continue as long as you or your spouse is alive.

The survivor benefit is based on the pension participant’s benefit. Plans must offer a 50% option, which pays the survivor 50% of the joint benefit. Other survivor-benefit options range from 66% to 100% of the joint benefit. In most cases, the benefit drops no matter who dies first, unless you choose the 100% option.

KIP TIP: In general, women who want lifetime income should take the pension’s monthly payout. Pension plans use gender-neutral calculations, which can further complicate the choice of monthly payments versus a lump sum. Because women tend to live longer than men, it’s highly likely that the pension plan will offer a higher payout than they could get on the open market. For example, a 65-year-old man who wants to buy an annuity that will provide $60,000 a year for life would need about $914,000, according to Immediateannuities.com. A 65-year-old woman would need about $955,000—roughly $40,000 more—to get the same amount of annual income. If you take the pension, however, your payment is based on your years of service and salary; your gender doesn’t play a role.

When it comes to converting the pension payment to a lump sum, however, gender neutrality can work against women. If their longer life expectancy could be taken into account, the lump sum would have to be larger to equate to the higher lifetime costs of the monthly payments.

10. Tap Permanent Life Insurance

Most of us buy life insurance to provide financial security for our loved ones after we’re gone, but a permanent life insurance policy could provide a valuable source of income while you’re still around to enjoy it.

A permanent life insurance policy has two components: the death benefit, which is the amount that will be paid to your beneficiaries when you die, and the cash value, a tax-advantaged savings account that’s funded by a portion of your premiums. With whole life and universal life, the insurance company usually promises that a minimal level of interest, after insurance costs and expenses are deducted, will be credited to your account every year. With variable life insurance policies, you choose the investments and may not get a guarantee.

You can withdraw your basis—the amount in the cash-value account you’ve paid in premiums—tax-free. That could provide a cash cushion in case, say, the stock market takes a 2008-style downturn and you want to give your portfolio a chance to recover. (Withdrawals that exceed what’s in the cash-value account will be taxed in your top tax bracket.) The death benefit will be reduced by the total amount you withdraw. You can also borrow against your policy, and you won’t have to undergo a credit check. Interest rates range from 5% to 8%, depending on market rates and whether the loan is fixed or variable. If you don’t repay the loan, or pay back only part of it, the balance will be deducted from your death benefit when you die.

When you borrow against your policy, you’re not taking withdrawals from your account that you’ll pay back later, as is the case with a 401(k) loan. Rather, the insurer is lending you money and using your policy as collateral. Unless you pay the interest out of pocket, it will be added to the loan balance. If the balance exceeds the policy’s cash value, the policy could lapse, and you’ll owe taxes on the amount of the cash value, including loans, that exceed the premiums you paid.

What if you need a regular source of income? One option is to convert your life insurance into an income annuity through what’s known as a 1035 exchange. The downside to this strategy is that you’ll give up the death benefit, but you’ll lock in income for the rest of your life, or for a specific number of years. The conversion is tax-free, but you’ll pay taxes on a portion of each payout, based on the proportion of your basis to your gains. Your insurance company may offer an income annuity, but you should look at payouts offered by other providers, too. Go to www.immediateannuities.com to comparison shop.

KIP TIP: If your insurance policy pays dividends, you can generate income without giving up the death benefit. Instead of reinvesting the dividends in the policy, which will increase its death benefit and cash value, you can take the dividends in cash. Dividends typically range from 5% to 6.7%, and any

dividends you receive up to the policy’s cost basis are tax-free. Dividends that exceed that amount are taxable.

11. Plan for Health Care Costs

Fidelity Investments estimates that the average 65-year-old couple retiring now will need about $260,000 to pay out-of-pocket health care costs, including deductibles and Medicare premiums, over the rest of their lives. That doesn’t include long-term care, which can be a major budget buster.

There are a variety of options to help pay these future medical bills. One tax-friendly way is a health savings account. As long as you have an eligible high-deductible health insurance policy, you can contribute to an HSA either through your employer or on your own (but you can no longer contribute after you’ve signed up for Medicare).

An HSA offers a triple tax advantage. You contribute money on a pretax basis to the account. Money in the account grows tax-deferred. And withdrawals are tax-free if used to pay medical expenses, either today or when you’re retired. (You’ll owe income taxes and a 20% penalty on withdrawals used for other purposes, although the penalty disappears once you turn 65.)

To make the most of the HSA, contribute as much as you can to the account and pay current medical bills out of pocket. That way, the money in the account has time to grow. Years from now, you can use HSA funds to reimburse yourself for medical bills you’re paying today.

The maximum contribution for 2017 is $3,400 for single coverage and $6,750 for families, plus an extra $1,000 if you’re 55 or older. Your health insurance policy must have a deductible of at least $1,300 for singles and $2,600 for families.

Employers are increasingly offering workers this option to contain costs because premiums for high-deductible plans tend to be lower than for traditional insurance. Among Fidelity-run plans, nine out of 10 employers kick in money to workers’ accounts to encourage participation, says Eric Dowley, senior vice president of Fidelity’s HSA product management. The average employer contribution is $541 for singles and $991 for families.

If you’re looking for an HSA on your own, review fees and investment options. Morningstar recently looked at plans offered by the 10 most prominent providers and found that only one—offered by The HSA Authority—did a good job for both current spending and future investing.

You can use HSA funds to pay for long-term-care premiums—but that’s a small compensation given the steep price tag for a long-term-care policy. If you can’t afford a long-term-care policy that would cover at least three years of long-term care with inflation protection, another option is to buy enough coverage to pay the difference between the cost of care for three years and what you can afford to pay from savings and income.

Another solution: a hybrid policy that combines life insurance and long-term-care benefits. It’s basically a permanent life insurance policy that allows you to spend down the death benefit to pay for long-term care should you need it. You can also get a rider that will cover long-term care above and beyond the death benefit. If you don’t need long-term care or don’t entirely use up the death benefit, your heirs will collect what remains of it.

Lincoln National, for example, offers a hybrid policy called MoneyGuard that you purchase with an up-front lump sum or in installments over 10 years. A 60-year-old man paying $10,000 a year over a decade could get monthly long-term-care benefits at age 80 of $7,983 for up to six years, growing at 3% annually. The death benefit at that point would total $106,400, or he could cash in the policy and get 80% of his premiums returned. Under a similar scenario, a woman would get $7,076 per month for long-term care or a $113,600 death benefit.

The trade-off is that hybrid policies are doing double duty, so you’ll get a lower long-term-care benefit for your money than if you purchased a stand-alone long-term-care policy, says Bill Dyess, president of Dyess Insurance Services, in Boca Raton, Fla.

KIP TIP: If paying for long-term care is your chief goal and you don’t need more life insurance, buy a stand-alone policy rather than a hybrid policy. Today’s long-term-care policies are more accurately priced than those issued years ago, so it’s less likely that you’ll see steep premium jumps in the future, says Pinnacle’s Kitces. Plus, you may be able to deduct part of your premiums on your tax return, something you generally can’t do with a hybrid policy.

12. Move to a Cheaper Locale

Downsizing to a smaller place, particularly after the kids are launched, is a common way to lower housing costs and stay close to family. If you live in a highly appreciated home, selling can free up large sums that can be used to wipe out debt, add to a nest egg or pay future long-term-care costs. (Married couples can protect up to $500,000 in profit from the sale of a house from capital gains tax; singles can shelter half that amount.)

But for a move to become a financial game changer and significantly lower living costs, consider putting down roots in a state where housing and living expenses are cheaper.

“This can take a retirement situation that is nearly hopeless and turn it into one that is comfortable,” says Tim Maurer, director of personal finance for BAMAlliance in Charleston, S.C. For example, housing costs in San Diego are 173% higher than in Galveston, Texas, according to Bestplaces.net. Galveston made Kiplinger’s most recent list of great places to retire. Kiplinger also compiles a list of the most tax-friendly states for retirees. Moving to a state that gives retirees a big tax break can free up money for a higher standard of living in retirement. (If you want to stay in your home and tap the equity for income, see Use Your Home to Get More Income.)

Kevin McGrain, 62, was able to retire last year as an executive of a catalog company after he moved from the Northeast to the Sun Belt. Two years ago, McGrain and his wife, Linda, traded in a $700,000 four-bedroom house on a small lot in Newburyport, Mass., for a $400,000 four-bedroom home in Inman, S.C., that sits on an acre of lakefront property with a view of the Blue Ridge Mountains. He says he doesn’t think he could have retired when he did if he hadn’t moved to South Carolina.

In Massachusetts, the McGrains’ property taxes were $15,000 a year, and monthly utility bills some winters reached $600. In South Carolina, the couple’s property taxes run $1,700 a year, and at age 65 they’ll be eligible for a special exemption that will reduce that bill even further. Their utility bills now average $150 a month.

Better yet, McGrain, who is an avid golfer, says his country-club fees are half of what they used to be, and he can play 11 months out of the year instead of seven.

KIP TIP: Before moving to a new zip code, do some field research. Take an extended vacation to experience day-to-day living in the new neighborhood you’re considering (you may be able to rent a place via Airbnb or VRBO). Visit in the off-season to see if the weather agrees with you. And meet up with a local real estate agent for a lowdown on the area.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Block joined Kiplinger in June 2012 from USA Today, where she was a reporter and personal finance columnist for more than 15 years. Prior to that, she worked for the Akron Beacon-Journal and Dow Jones Newswires. In 1993, she was a Knight-Bagehot fellow in economics and business journalism at the Columbia University Graduate School of Journalism. She has a BA in communications from Bethany College in Bethany, W.Va.

-

The Cost of Leaving Your Money in a Low-Rate Account

The Cost of Leaving Your Money in a Low-Rate AccountWhy parking your cash in low-yield accounts could be costing you, and smarter alternatives that preserve liquidity while boosting returns.

-

I want to sell our beach house to retire now, but my wife wants to keep it.

I want to sell our beach house to retire now, but my wife wants to keep it.I want to sell the $610K vacation home and retire now, but my wife envisions a beach retirement in 8 years. We asked financial advisers to weigh in.

-

How to Add a Pet Trust to Your Estate Plan

How to Add a Pet Trust to Your Estate PlanAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Stocks Struggle for Gains to Start 2026: Stock Market Today

Stocks Struggle for Gains to Start 2026: Stock Market TodayIt's not quite the end of the world as we know it, but Warren Buffett is no longer the CEO of Berkshire Hathaway.

-

9 Types of Insurance You Probably Don't Need

9 Types of Insurance You Probably Don't NeedFinancial Planning If you're paying for these types of insurance, you may be wasting your money. Here's what you need to know.

-

AI Stocks Lead Nasdaq's 398-Point Nosedive: Stock Market Today

AI Stocks Lead Nasdaq's 398-Point Nosedive: Stock Market TodayThe major stock market indexes do not yet reflect the bullish tendencies of sector rotation and broadening participation.

-

Stocks Bounce Back With Tech-Led Gains: Stock Market Today

Stocks Bounce Back With Tech-Led Gains: Stock Market TodayEarnings and guidance from tech stocks and an old-school industrial lifted all three main U.S. equity indexes back into positive territory.

-

10 Retirement Tax Plan Moves to Make Before December 31

10 Retirement Tax Plan Moves to Make Before December 31Retirement Taxes Proactively reviewing your health coverage, RMDs and IRAs can lower retirement taxes in 2025 and 2026. Here’s how.

-

The Rubber Duck Rule of Retirement Tax Planning

The Rubber Duck Rule of Retirement Tax PlanningRetirement Taxes How can you identify gaps and hidden assumptions in your tax plan for retirement? The solution may be stranger than you think.

-

Dow Adds 300 Points, Ends Losing Streak: Stock Market Today

Dow Adds 300 Points, Ends Losing Streak: Stock Market TodayThe Dow, the S&P 500 and the Nasdaq head into the weekend on high notes after posting gains for the first time since Monday.

-

President Trump Makes Markets Move Again: Stock Market Today

President Trump Makes Markets Move Again: Stock Market TodayThe White House is moving ahead with plans to reshape the Federal Reserve and to buy shares in more sectors and stocks.