Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stephen Moore began to realize he had hearing problems more than a decade ago, when people seemed to mumble in conversations. He asked his wife to repeat lines at the movies. "It drove her crazy," he says. He turned the TV volume up so high that family members complained.

Finally, when he felt he was missing out on hearing important details during meetings at work, he got his hearing tested and was then fitted for hearing aids.

"Hearing loss is so gradual you don't really recognize it until your hearing is impaired, and it gets really bad," says Moore, 57, an economist for the Heritage Foundation, a conservative think tank, who also works as a TV analyst. "And there's still a little bit of a stigma about wearing hearing aids."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

As people age, they often don't immediately recognize hearing decline or seek treatment for it, says Barbara Kelley, executive director of the Hearing Loss Association of America. It takes an average of seven to 10 years from the time someone recognizes he or she has a hearing loss until getting help for it, she says. And about 80% of adults who could benefit from a hearing aid don't get one, according to a report by the National Academies of Sciences, Engineering and Medicine.

Does Medicare Cover Hearing Aids?

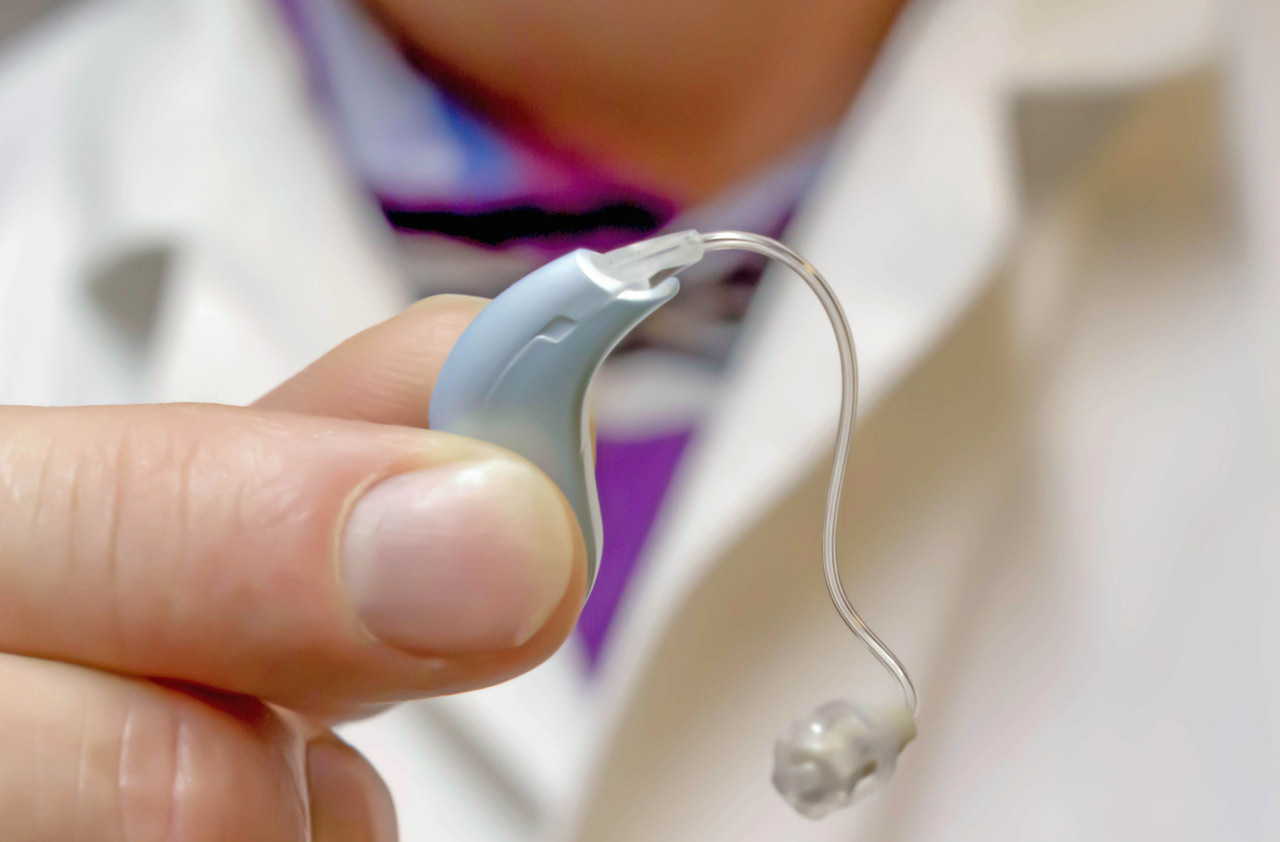

Baby boomers are sometimes reluctant to take even the first step of getting a hearing test, seeing it as a sign of aging and fearing having to wear "that brown plastic thing behind your ear," Kelley says. Not to mention that hearing aids can be expensive, as much as $3,000 per ear, and aren't covered by Medicare and only sometimes by other insurance.

So it was good news for people with hearing loss when Congress last August authorized the Food and Drug Administration to create a new class of hearing devices, which will be available over the counter and expected to cost far less than what you pay for a device from the audiologist's office. The over-the-counter hearing aids are for adults with mild to moderate hearing loss and will be FDA-regulated. The only way now to purchase a hearing aid is through an audiologist or hearing instrument specialist. In the future, certain hearing aids and other hearing wearable devices will be available in pharmacies and electronics retailers.

What's often confusing, though, is that some over-the-counter alternatives, sometimes called personal sound amplification products, are available in stores now. Moore, for example, once grabbed a cheap pair when he lost his regular hearing aids on a trip. Quality and prices for the devices vary widely; some disposables sell for $20 to $30 per pair while high-tech sound amplifiers cost several hundred dollars.

But these devices aren't considered medical devices or regulated by the FDA, and they can't be marketed as hearing aids or as a product to improve hearing loss, even with the new law. The FDA has up to three years to write regulations and set safety and labeling standards for the authorized OTC devices. An FDA spokesperson said the agency won't speculate on a time frame for the process. Once regulations are in place, expect lower prices for FDA-approved aids and more choices.

Getting Your Hearing Tested

Don't wait to address your hearing health as the guidance is sorted out. Get tested by an audiologist, take an online screening test, or visit a hearing center that has licensed hearing health providers. Find a hearing aids guide at hearingloss.org.

Take advantage of hearing aid discounts. Costco offers its own brand of hearing aids and other hearing services. Drugstore chain CVS has opened 32 hearing centers in seven states, with plans to expand this year, a company spokesperson says. Single device costs range from about $400 to $2,500. Try a high-tech device that's not a hearing aid. Hearing technology company Nuheara sells wireless earbuds that work with a smartphone app for about $300 a pair. Wearers can tune out background noise at restaurants, offices or outside and "control how they hear the world around them,' says company co-founder David Cannington.

Do You Need a Hearing Aid?

The following are some signs of when to consider having your hearing tested, according to the Food & Drug Administration:

- You hear better out of one ear than the other.

- People say you are shouting when you talk.

- You often ask people to repeat themselves.

- You can’t hear a dripping faucet or high-pitched musical notes.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

9 Types of Insurance You Probably Don't Need

9 Types of Insurance You Probably Don't NeedFinancial Planning If you're paying for these types of insurance, you may be wasting your money. Here's what you need to know.

-

Trump Calls for Cane Sugar Coke: Will You Pay Higher Prices and Soda Tax?

Trump Calls for Cane Sugar Coke: Will You Pay Higher Prices and Soda Tax?Food Taxes The debate over cane sugar vs. corn syrup is heating up, raising questions about cost, policy, and, in some cases, soda taxes.

-

Amazon Resale: Where Amazon Prime Returns Become Your Online Bargains

Amazon Resale: Where Amazon Prime Returns Become Your Online BargainsFeature Amazon Resale products may have some imperfections, but that often leads to wildly discounted prices.

-

457 Plan Contribution Limits for 2026

457 Plan Contribution Limits for 2026Retirement plans There are higher 457 plan contribution limits in 2026. That's good news for state and local government employees.

-

Costco Raises Membership Fees For First Time Since 2017

Costco Raises Membership Fees For First Time Since 2017Costco raised its membership prices for the first time in nearly seven years. Here’s what you need to know.

-

Medicare Basics: 12 Things You Need to Know

Medicare Basics: 12 Things You Need to KnowMedicare There's Medicare Part A, Part B, Part D, Medigap plans, Medicare Advantage plans and so on. We sort out the confusion about signing up for Medicare — and much more.

-

The Seven Worst Assets to Leave Your Kids or Grandkids

The Seven Worst Assets to Leave Your Kids or Grandkidsinheritance Leaving these assets to your loved ones may be more trouble than it’s worth. Here's how to avoid adding to their grief after you're gone.

-

SEP IRA Contribution Limits for 2026

SEP IRA Contribution Limits for 2026SEP IRA A good option for small business owners, SEP IRAs allow individual annual contributions of as much as $70,000 in 2025, and up to $72,000 in 2026.