Prepare to Retire With a Gift Annuity

Donors can make a charitable gift now but defer annuity payments to start years later.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Charitable gift annuities have long been a popular way for older retirees with philanthropic intent to create a lifetime income stream while getting a nice tax deduction. Today, a new twist on the gift annuity is attracting younger people who have yet to retire.

Most charitable gift annuities provide monthly payouts that start immediately after a donor makes the contribution. About 75% of donors who set up immediate annuities are older than age 75 when they make the gift, according to a 2013 survey of charities by the American Council on Gift Annuities.

Meanwhile, the council notes a growing interest in "deferred payment" annuities. A donor, say age 55, makes a gift but defers payment until a specific later date, perhaps five or ten years away. Half of these donors are 65 or younger. Charities are also offering "flexible start date" annuities, which allow donors to turn on payments at any time down the road.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

With all three approaches, you get a charitable tax deduction in the year you make the donation. Your deduction is based on how much leftover cash is expected to go to the charity after your death (or the death of your survivor if you choose a joint annuity).

Do Well by Doing Good

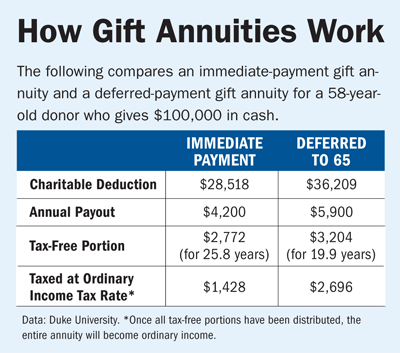

While older donors may be better off choosing a gift annuity that starts payments right away, workers who don't need the income now could consider the deferred or flexible options. "You may be still working, but you're thinking of retirement," says Jeremy Arkin, director of gift planning at Duke University. "You will know to the penny how much income you will get each year." (See the table.)

If you opt for the deferred or flexible annuity, you'll get a bigger payout the longer you postpone the income stream. That's partly because there will be fewer payments before you die.

Before you sign a contract, understand that you can't get the money back, says Bryan Clontz, president of consulting group Charitable Solutions. And if your only goal with an annuity is income and not philanthropy, you're better off buying a commercial annuity, which, Clontz says, offers payments that are about 50% higher than those offered by charities. (Most charities use payout rates set by the gift annuities council.)

The lower gift rates don't concern Steve Willey, 70, and his wife, Elizabeth, 67. They bought two commercial annuities soon after they sold their home solar-power business ten years ago. They started buying gift annuities as their bonds matured, and now they own nine of them. "The commercial annuities have a higher rate, but we realized that they were only benefiting the insurance company," Steve says.

The Willeys, who live in Sandpoint, Idaho, sank about $200,000 into the joint-life gift annuities and draw $16,000 in annual payouts—about 20% of their total income. They chose their favorite charities, including Greenpeace, the American Civil Liberties Union and a local animal shelter.

Steve Willey intends to buy more gift annuities, and he expects larger payouts. The older you are when you make the donation, the larger the annual payment and deduction. A 75-year-old who donates $100,000 would get a lifetime annual payment of $5,800 and a $45,772 deduction. That compares with a $28,518 deduction and $4,200 annual payment for a 58-year-old.

By using appreciated stock to fund your gift annuity, your deduction will be based on the current value of the shares. Part of each payment will be taxed as a long-term capital gain, part as ordinary income and part as a tax-free return of principal.

Time the charitable write-off "to minimize taxes in a big tax year," says Rick Rodgers, a financial planner in Lancaster, Pa. Also, because the annuity "becomes part of your fixed-income portfolio, you will need to adjust your asset allocation," he says.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

457 Plan Contribution Limits for 2026

457 Plan Contribution Limits for 2026Retirement plans There are higher 457 plan contribution limits in 2026. That's good news for state and local government employees.

-

Medicare Basics: 12 Things You Need to Know

Medicare Basics: 12 Things You Need to KnowMedicare There's Medicare Part A, Part B, Part D, Medigap plans, Medicare Advantage plans and so on. We sort out the confusion about signing up for Medicare — and much more.

-

The Seven Worst Assets to Leave Your Kids or Grandkids

The Seven Worst Assets to Leave Your Kids or Grandkidsinheritance Leaving these assets to your loved ones may be more trouble than it’s worth. Here's how to avoid adding to their grief after you're gone.

-

SEP IRA Contribution Limits for 2026

SEP IRA Contribution Limits for 2026SEP IRA A good option for small business owners, SEP IRAs allow individual annual contributions of as much as $70,000 in 2025, and up to $72,000 in 2026.

-

Roth IRA Contribution Limits for 2026

Roth IRA Contribution Limits for 2026Roth IRAs Roth IRAs allow you to save for retirement with after-tax dollars while you're working, and then withdraw those contributions and earnings tax-free when you retire. Here's a look at 2026 limits and income-based phaseouts.

-

SIMPLE IRA Contribution Limits for 2026

SIMPLE IRA Contribution Limits for 2026simple IRA For 2026, the SIMPLE IRA contribution limit rises to $17,000, with a $4,000 catch-up for those 50 and over, totaling $21,000.

-

457 Contribution Limits for 2024

457 Contribution Limits for 2024retirement plans State and local government workers can contribute more to their 457 plans in 2024 than in 2023.

-

Roth 401(k) Contribution Limits for 2026

Roth 401(k) Contribution Limits for 2026retirement plans The Roth 401(k) contribution limit for 2026 has increased, and workers who are 50 and older can save even more.