A Scorecard for Your Financial Adviser

Assigning ratings to all the different parts of your plan could help you spot weaknesses and get more value from your financial professional.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Sometimes it can be difficult to fully grasp the value of a financial adviser. Do they mostly manage my money? Are they doing a good job for me? How would I even know? These are important questions that can often be difficult to answer.

There are many resources available that can help provide guidance when choosing a financial adviser. Perhaps the more challenging task arrives after you have selected one.

Nowadays, with technology as good as it is, the differences from one firm to another can be marginal. To help you in gauging the nature of your advisory relationship, let's establish some updated metrics you can use. To do this, we have divided the scope of planning into two distinct areas, Financial and Lifestyle. For ease of illustrating, we have mapped below some areas of importance relative to each.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

At first glance, the idea of quantifying the value delivered in each of these areas might seem daunting. No worries. We’ll simplify this process with an easy-to-use, objective way to continuously monitor the value of your adviser/client relationship.

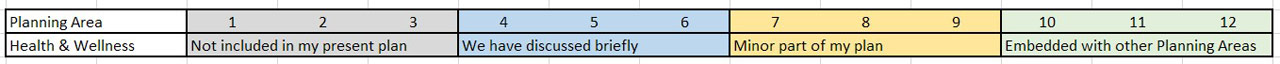

We suggest taking the areas above and creating a simple, one-page scorecard. The below template can serve as a basis for periodically scoring each planning area.

Adopting some version of this practice becomes a positive for both you and your adviser. Your scorecard can provide ongoing transparency as to the value you are receiving, while also yielding invaluable feedback for your adviser as to any areas requiring more time to explore together.

Evaluating the ‘Financial Planning’ Components of Your Plan

When looking at the planning areas, the financial components may not require a 50- to 100-page document, but more so a mutually agreed upon strategy for achieving success within each of them. Almost all of the financial planning areas — investment, cash flow and taxes, retirement and estate planning and risk management — are self-explanatory.

The “behavioral” component of financial planning is like getting adviser coaching. It represents timely, rational advice provided by your adviser during volatile times with high investor emotion.

Evaluating the ‘Lifestyle’ Components of Your Plan

To better understand each of the lifestyle areas, it’s first worth noting as to why they are included in a financial plan. To some, the financial services industry is evolving into more holistic planning or financial life management as its primary objective. It seems natural that financial and lifestyle planning might marry, because they have positive correlation in many respects.

Let’s drill down a bit further in defining each of the lifestyle areas as to provide you more clarity.

- Health & Wellness: How lifestyle habits can impact one’s ability to enjoy retirement with quality of life. Afterall, you save all of those years not to be sidelined when you have more freedom of time. What would you prefer your plan to include as metrics for improving or sustaining your quality of life?

- Energy & Excitement: Areas you are most passionate about. Your plan can account for consistent time spent in those areas most meaningful to you.

- Connectivity: Relationships are important to us as human beings. Staying in balance with our personal and professional lives is a metric worth including in your plan.

- Contribution: Any intentions you have for involvement in your community or philanthropy. This could be expressed financially or with your personal time.

- Challenge: Establishing some goals that will promote self-growth through courage and commitment. This could range from learning a new language to running a marathon as some examples.

Do some or all of these areas relate to your present plan? Do they sync up well with the financial components? In other words, is there collaboration between your intended lifestyle design and financial plan?

Designing a simple scorecard to encompass these areas will provide you and your adviser with a framework for quantifying value and satisfaction on a regular basis.

Branch address: 139 Genesee St., New Hartford, NY. Securities and advisory services offered through Commonwealth Financial Network, Member FINRA/SIPC, a Registered Investment Adviser.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Chris Giambrone is a co-founder of CG Capital™, a boutique wealth management firm based in New Hartford, N.Y. He is a CERTIFIED FINANCIAL PLANNER™ and Accredited Investment Fiduciary® (AIF®). Chris has also earned a Certificate in Retirement Planning from the Wharton School of Finance at the University of Pennsylvania.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AI

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AIFor financial advisers eager to embrace AI but unsure where to start, this road map will help you integrate the right tools and safeguards into your work.

-

The Referral Revolution: How to Grow Your Business With Trust

The Referral Revolution: How to Grow Your Business With TrustYou can attract ideal clients by focusing on value and leveraging your current relationships to create a referral-based practice.