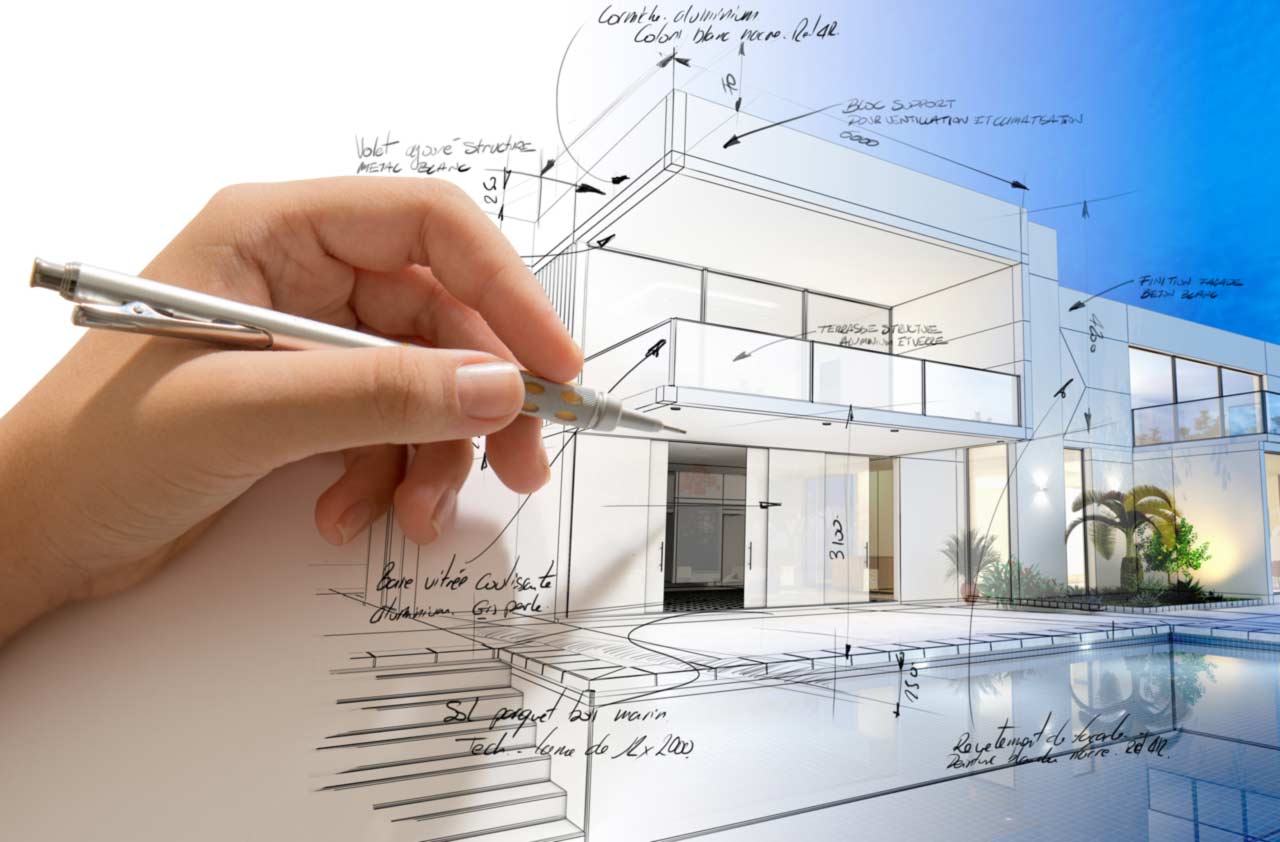

To Build a Sturdy Financial House, You’ll Need a Well-Designed Plan

You wouldn't build a house without a blueprint, but that's what too many people do with their finances, and it can easily turn out very wrong.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Is it possible, do you think, to accidentally build a house upside down?

It could happen, I guess. If you didn’t know what you were doing. If you got bad advice. Or if you didn’t have a set of blueprints to work from.

Obviously, at some point, though, you’d notice something was terribly wrong.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

When you’re building your financial house, the mistakes you make can be a lot harder to spot. But the idea is the same: It’s always best to work with a plan.

Lay the foundation

It’s important to start with a solid foundation built with “safe money,” such as Social Security and a pension, which can provide a steady and reliable source of income. And if those two income streams aren’t large enough when combined, you may decide to shore things up with an annuity. Think of the foundation as mostly — but not completely — replacing your salary, the income you’ve had all your life. It should be stable and dependable.

Build the walls and roof

Next are your walls, made up of conservative investments. They might be subject to some volatility, but they’ll stand up to most storms. Sometimes they’ll bend and sometimes they’ll break, but most of the time, they’ll help keep you protected.

And then, of course, comes the roof, which is made up of your more moderate- and high-risk investments. The more effort you put into care and maintenance, the better off your financial house can be. Still, this part of your financial portfolio may be the first to go when things get turbulent.

Unfortunately, I see upside-down financial houses all the time, and often the people who own them have no idea the precarious state they’re in. Because the marketplace puts a priority on equities and people are taught to chase returns, all the money goes there, instead of into a well-laid-out portfolio.

Go back to the blueprint

How can you fix an upside-down house?

Diversification is the key.

There are 13 asset classes, and an investment that does the best in one year typically won’t repeat that performance in the next. That’s why it’s important to own a mix of stocks, bonds and cash, diversified across different market caps and styles. This can help spread your risk, because you’ll own a variety of asset types that may perform differently from one another in any given time period.

If you’re looking at the periodic table of asset classes, which ranks asset returns as measured by global market indices, I recommend that clients stay in the middle range, with investments that have been ranked No. 5, 6 or 7 over the last 20 years. Not No. 1, but not 13, either.

Now, this isn’t to say that you won’t ever lose money — remember, your walls may bend or even break. But you may experience less loss of your investment if you go with this approach. And I have been telling my clients for years that when it comes to investing, you win by not losing big.

If you want to have a good, upstanding house with a strong foundation, sturdy walls and an adequate roof, you need financial advice and strategies that utilize a diversified portfolio. A financial professional who is held to the fiduciary standard can furnish you with a personalized detailed blueprint to get you started — or help you out if you’re standing in the middle of a leaky fixer-upper.

Kim Franke-Folstad contributed to this article.

Investment advisory services offered only by duly registered individuals through AE Wealth Management, LLC (AEWM). AEWM and Roberts Wealth Management are not affiliated companies. Investing involves risk, including the potential loss of principal. Insurance and annuity product guarantees are backed by the financial strength and claims-paying ability of the issuing insurance company.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Paul E. Roberts Jr. is the founder and chief investment officer of Roberts Wealth Management. He has passed the Series 65 exam and has insurance licenses in Texas, Louisiana, Mississippi and Alabama. He spent 22 years as a practicing CPA, then founded Roberts Wealth Management, a firm that focuses on estate preservation and retirement planning. His primary areas of focus are retirement income planning, investment management, 401(k)/individual retirement account (IRA) guidance and asset protection.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.