Over 50? Time to Get Wise About Long-Term Care

The Top 6 Myths About Long-Term Care and Planning for it.June 2013

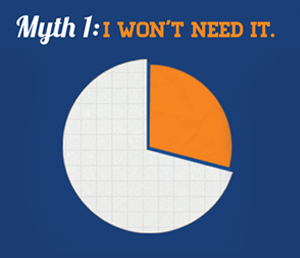

Myth 1: I won’t need it.

About 70% of Americans over 65 will need some kind of help with Activities of Daily Living (ADLs) that are non-medical, such as getting in and out of bed and walking, bathing and showering, dressing, eating, using the bathroom, as they age. It may be due to an illness, chronic disease or disability. But often, the care is required because of the natural decline due to aging of one’s eyesight, hearing, strength, balance or mobility. Help with ADLs comes in many forms and is generally known as long-term care, the need for which can last for a short time or for several years.

Myth 2: It means an insurance policy.

Many people confuse “long-term care planning” with “long-term care insurance plans,” but they are not the same. Insurance is just one of many options people consider for covering the costs of long-term care. But, long-term care planning means developing your personal strategy and making decisions now for how you want a range of things to be handled later when you or a loved one is in need of long-term care services.

Typically, your long-term care strategy should consider where you would live, how you would pay for care, getting legal documents in order, such as an advanced care directive, and discussing your decisions and preferences with family members.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

[page break]

Myth 3: Medicare, Medicaid or other government programs will pay for it.

Medicare does not cover any of the long-term care services people most often need—the Activities of Daily Living. It does cover a few rehabilitative sessions and home nursing visits, and in some cases, Medicare may cover durable medical equipment such as hospital beds and wheelchairs. However, this varies by state and the type of Medicare you have.

If your income is below a certain level, if you have very little in financial assets and you meet minimum state eligibility requirements, Medicaid may pay for long-term care services. However, the vast majority of middle-income people do not qualify. It is best not to assume that a government program will pay for long-term care services until you have fully researched the program rules and limitations in your area.

The Department of Veterans Affairs (VA) pays for long-term care services for service-related disabilities and for certain other eligible veterans. Visit www.va.gov to see available programs and services.

Myth 4: It’s too soon or too late for me to plan.

The best time to create your long-term care strategy is before you actually need long-term care. If you’re over 50, there’s no time like now to begin. But, even if you are in the midst of receiving services for yourself or a loved one, it’s still helpful to go through the planning steps. That way, you can be better informed, prepared and in control of decisions that lie ahead.

[page break]

Myth 5: No one knows how much it will cost.

Long-term care is more expensive than most people think, and you will likely be responsible for paying out of your own pocket for the care you need. Go to http://longtermcare.gov/costs-how-to-pay/costs-of-care/ to calculate an estimate of what your costs could be.

Because there are many kinds of long-term care services and supports, there is a wide range of costs depending on the type of care, where it is given and by whom. People are using a variety of ways to meet the costs, including long-term care insurance, personal income, annuities and reverse mortgages.

Myth 6: My family will take care of me.

Unpaid family members are the most common source of long-term care help. But, they may not be able to provide all the care you need, or be there every hour of the day. As part of your long-term care strategy, look into caregiving services in your area, including in-home care providers and elder daycare centers. Find out about elder shuttles, meals on wheels and other low-cost services offered in your community.

Also, be sure to involve close family members in your long-term care planning. Make sure they are willing and able to be caregivers for you. Go over your Advanced Care Directive (also known as a living will) so they will know who is designated to make health decisions for you if you are unable to do so, and what actions you do/do not wish to be taken.

Start now. Start here: www.Longtermcare.gov

This excellent government information resource takes you step-by-step through every aspect of creating your long-term care strategy. There are easy tools to help you focus on what to do now vs. later, and links to resources in your area for financial, legal and long-term care services and supports.

Take your first step to a better old age. Use the PathFinder tool now at longtermcare.gov

This content was provided by the Administration for Community Living of the U.S. Department of Health and Human Services, and did not involve the Kiplinger editorial staff.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

How to Turn Your 401(k) Into A Real Estate Empire

How to Turn Your 401(k) Into A Real Estate EmpireTapping your 401(k) to purchase investment properties is risky, but it could deliver valuable rental income in your golden years.

-

My First $1 Million: Retired Nuclear Plant Supervisor, 68

My First $1 Million: Retired Nuclear Plant Supervisor, 68Ever wonder how someone who's made a million dollars or more did it? Kiplinger's My First $1 Million series uncovers the answers.

-

How to Position Investments to Minimize Taxes for Your Heirs

How to Position Investments to Minimize Taxes for Your HeirsTo minimize your heirs' tax burden, focus on aligning your investment account types and assets with your estate plan, and pay attention to the impact of RMDs.

-

I Tried a New AI Tool to Answer One of the Hardest Retirement Questions We All Face

I Tried a New AI Tool to Answer One of the Hardest Retirement Questions We All FaceAs a veteran financial journalist, I tried the free AI-powered platform, Waterlily. Here's how it provided fresh insights into my retirement plan — and might help you.

-

457 Plan Contribution Limits for 2026

457 Plan Contribution Limits for 2026Retirement plans There are higher 457 plan contribution limits in 2026. That's good news for state and local government employees.

-

Medicare Basics: 12 Things You Need to Know

Medicare Basics: 12 Things You Need to KnowMedicare There's Medicare Part A, Part B, Part D, Medigap plans, Medicare Advantage plans and so on. We sort out the confusion about signing up for Medicare — and much more.

-

The Seven Worst Assets to Leave Your Kids or Grandkids

The Seven Worst Assets to Leave Your Kids or Grandkidsinheritance Leaving these assets to your loved ones may be more trouble than it’s worth. Here's how to avoid adding to their grief after you're gone.

-

SEP IRA Contribution Limits for 2026

SEP IRA Contribution Limits for 2026SEP IRA A good option for small business owners, SEP IRAs allow individual annual contributions of as much as $70,000 in 2025, and up to $72,000 in 2026.

-

Roth IRA Contribution Limits for 2026

Roth IRA Contribution Limits for 2026Roth IRAs Roth IRAs allow you to save for retirement with after-tax dollars while you're working, and then withdraw those contributions and earnings tax-free when you retire. Here's a look at 2026 limits and income-based phaseouts.

-

SIMPLE IRA Contribution Limits for 2026

SIMPLE IRA Contribution Limits for 2026simple IRA For 2026, the SIMPLE IRA contribution limit rises to $17,000, with a $4,000 catch-up for those 50 and over, totaling $21,000.

-

457 Contribution Limits for 2024

457 Contribution Limits for 2024retirement plans State and local government workers can contribute more to their 457 plans in 2024 than in 2023.