Match Bond Income With Yearly Costs

Using a liability-driven investing strategy can help retirees account for projected spikes in spending.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

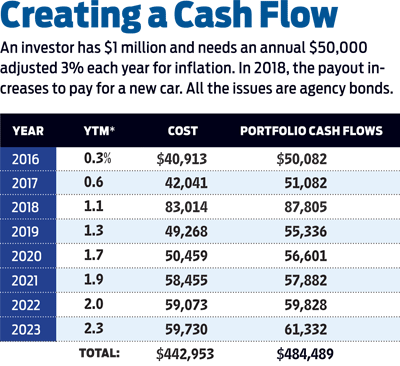

It's a new retiree's financial dream: an annual income stream that will closely match estimated expenses for years into the future. Planning a blowout trip to Asia three years after you retire? You can set up your finances now so the spigot will open up then to deliver the needed cash -- without jeopardizing your overall portfolio.

Sure, you can get predictable income from a bond ladder or an immediate annuity. But those techniques don't take into account projected spikes in retirement spending -- such as a big trip or increased tax bills when you start withdrawing from your IRA. To meet such expenses, a growing number of financial planners are turning to "liability-driven investing," which creates a stream of individual-bond income that equals an investor's projected cash-flow needs. "With individual bonds, we know what the coupon will be and how much money you get back when they mature," says Brent Burns, president of Asset Dedication, a San Francisco asset management firm.

Asset Dedication (www.assetdedication.com) is a leader in liability-driven investing, a strategy that pension funds use to figure out how much to invest to pay retirees years down the road. The firm works with about 50 financial planners, who look to the firm's technology to build personalized portfolios of individual bonds for their clients who are retired or approaching retirement.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

A financial adviser and client first create a spending plan, which considers the retiree's sources of guaranteed income as well as the size of the total stock and bond portfolio. "We figure out what they will be getting from pensions and Social Security, and then figure out the gaps," says Jason Branning, a certified financial planner in Ridgeland, Miss., who uses Asset Dedication to buy bonds to fill those income gaps.

Branning says that expenses could differ from year to year -- and so will the bond interest and redemption proceeds that will be needed to match those spending variations. Perhaps, he says, the client will need more bond income until Social Security kicks in. "The spending can be lumpy," he says. "We need different amounts of income for different cycles."

After Branning sends the client’s plan to Asset Dedication, the firm's software scours the bond market for the precise amounts of coupons and maturities to cover a client's projected expenses for eight to ten years. Bond proceeds are not reinvested. Instead, each year the firm sends the client a cash payment that is derived from a combination of the principal from bonds maturing that year and of interest from all of the bonds bought for those eight to ten years. For those years when income needs are expected to spike, the firm will buy bonds that will throw off enough interest and principal to meet those expenses. (See table.)

By using individual bonds to cover spending for the first eight or so years of retirement, retirees can allow their stocks to grow over the long term. "You don't have to sell stocks when the market is terrible," Burns says. And buying eight years of income will carry investors through most bear markets without locking in lower interest rates for too long, he says.

As each bond matures, the firm will buy bonds to cover another year by using proceeds from the sales of appreciated stocks. For example, if you have a bond portfolio that covers eight years, you'll buy a bond for the ninth year when the first year's bond matures -- and so on. And the amount of bond income you buy for that year will depend on your projected expenses.

Better Than a Typical Bond Ladder

Supporters say the liability-driven investing approach does a better job than a typical bond ladder in meeting estimated expenses and boosting growth in the stock portfolio. With a bond ladder, your investment is divided, usually equally, among maturity-date "rungs" that are evenly spaced over a number of years.

But because payouts from a traditional bond ladder don't account for annual variations in spending, you may find yourself short on bond income in, say, year five when a big IRA tax bill comes due -- and you might be forced to sell stocks when the market is down. "Rather than getting $50,000 every year from a straight bond ladder, clients get what they actually need, and that really allows people to go into retirement with a sense of confidence," says Frank Thomas Corrado, a certified financial planner with Blue Blaze Financial Advisors, in Red Bank, N.J., an Asset Dedication client. The income-matching strategy, he says, enables him to invest the client's stock portfolio more aggressively because he's already bought eight or so years of cash flow.

With interest rates poised to rise, supporters of liability matching say they are not concerned about locking in relatively low rates for years out. While on paper the bond's value may decline when rates rise, Corrado says, "at the end of the day, clients are getting their principal back. They are achieving their goals." And as rates rise, Corrado says, he'll be able to buy bonds with higher yields at a lower price as each bond matures.

Asset Dedication's Burns tends to stick with certificates of deposit, high-grade municipal bonds and bonds issued by government agencies, such as the Federal Home Loan Bank and the Federal Farm Credit Bank. He steers clear of corporate bonds. "We are buying very safe bonds," he says. The firm charges investors from 0.2% to 0.35% of assets it manages.

Advisers will make tweaks if they decide that changes in market returns, portfolio size, inflation and expenses have diverted the plan from its "critical path" toward a financially secure retirement. For example, if there's a market downturn, perhaps the firm will hold off on buying bonds for a year or two.

One disadvantage of liability-driven investing is that do-it-yourself investors don't have the expertise and the technology to comb the bond market as Burns's sophisticated computer models do. But Burns says investors can create their own income-matching portfolio by buying Treasury STRIPS, which are fixed-income securities that offer no interest payments but can be bought for much less than the face value at maturity. "That makes it easier for DIY investors because they don't have to do the complex math," he says. You can buy STRIPS only through a financial institution or broker.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

What Does Medicare Not Cover? Eight Things You Should Know

What Does Medicare Not Cover? Eight Things You Should KnowMedicare Part A and Part B leave gaps in your healthcare coverage. But Medicare Advantage has problems, too.

-

15 Reasons You'll Regret an RV in Retirement

15 Reasons You'll Regret an RV in RetirementMaking Your Money Last Here's why you might regret an RV in retirement. RV-savvy retirees talk about the downsides of spending retirement in a motorhome, travel trailer, fifth wheel, or other recreational vehicle.

-

457 Plan Contribution Limits for 2026

457 Plan Contribution Limits for 2026Retirement plans There are higher 457 plan contribution limits in 2026. That's good news for state and local government employees.

-

Estate Planning Checklist: 13 Smart Moves

Estate Planning Checklist: 13 Smart Movesretirement Follow this estate planning checklist for you (and your heirs) to hold on to more of your hard-earned money.

-

Medicare Basics: 12 Things You Need to Know

Medicare Basics: 12 Things You Need to KnowMedicare There's Medicare Part A, Part B, Part D, Medigap plans, Medicare Advantage plans and so on. We sort out the confusion about signing up for Medicare — and much more.

-

The Seven Worst Assets to Leave Your Kids or Grandkids

The Seven Worst Assets to Leave Your Kids or Grandkidsinheritance Leaving these assets to your loved ones may be more trouble than it’s worth. Here's how to avoid adding to their grief after you're gone.

-

SEP IRA Contribution Limits for 2026

SEP IRA Contribution Limits for 2026SEP IRA A good option for small business owners, SEP IRAs allow individual annual contributions of as much as $70,000 in 2025, and up to $72,000 in 2026.

-

Roth IRA Contribution Limits for 2026

Roth IRA Contribution Limits for 2026Roth IRAs Roth IRAs allow you to save for retirement with after-tax dollars while you're working, and then withdraw those contributions and earnings tax-free when you retire. Here's a look at 2026 limits and income-based phaseouts.