Still Time to Undo a Roth Conversion

You have until October 15 to recharacterize your account back to a traditional IRA. Here's why you might want to do so.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Is it true that I can still undo a Roth conversion that I made last year and get back the money I paid in taxes?

Yes, it is. You have until October 15, 2009, to undo a Roth conversion you made anytime in 2008. So if you converted a traditional IRA to a Roth last year -- and, because of market losses, the account is now worth less than the amount you paid taxes on -- you can undo the conversion, file an amended tax return (Form 1040X), and get back the taxes you paid on the conversion. Wait 30 days, and you can reconvert to a Roth, paying tax next April on the reduced amount in the account at the time of the second conversion.

For example, say you converted a $100,000 traditional IRA to a Roth in 2008. If none of your contributions to the IRA were nondeductible, then you had to pay taxes on the full $100,000 conversion.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

But say that your Roth took such a beating in the meltdown that it now holds just $75,000, even after the market recovery in recent months. You can undo the conversion and reclaim the taxes you paid on that $100,000. If you later reconvert the $75,000, the tax bill will be based on the lower amount. If you are in the 25% bracket, the conversion do-over would save you $6,250.

Undoing the Roth conversion might make sense even if your account has not fallen in value. Say you’re in a different financial situation than you were when you made the switch, and you could really use the money you paid in taxes -- for example, you’ve lost your job since then and are struggling with mounting debt. You could undo the conversion, get back the money you paid in taxes, and then reconvert the traditional IRA to a Roth later, when it’s easier to afford the tax bill. If you wait until 2010 to reconvert the traditional IRA to a Roth, you’ll be able to spread the tax bill over your 2011 and 2012 tax returns. See The New Roth Rollover Rules Explained for more information.

To undo a Roth conversion, contact the IRA administrator and ask to recharacterize the Roth back to a traditional IRA. The administrator must make a direct transfer from the Roth to the traditional IRA, without sending the money to you. Many administrators have recharacterization request forms available on their Web sites. You’ll also need to file an amended return on Form 1040X for 2008 to get back the money you paid in taxes on the original conversion, and file Form 8606 to report the recharacterization. See the Instructions for Form 8606 and IRS Publication 590 for details.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

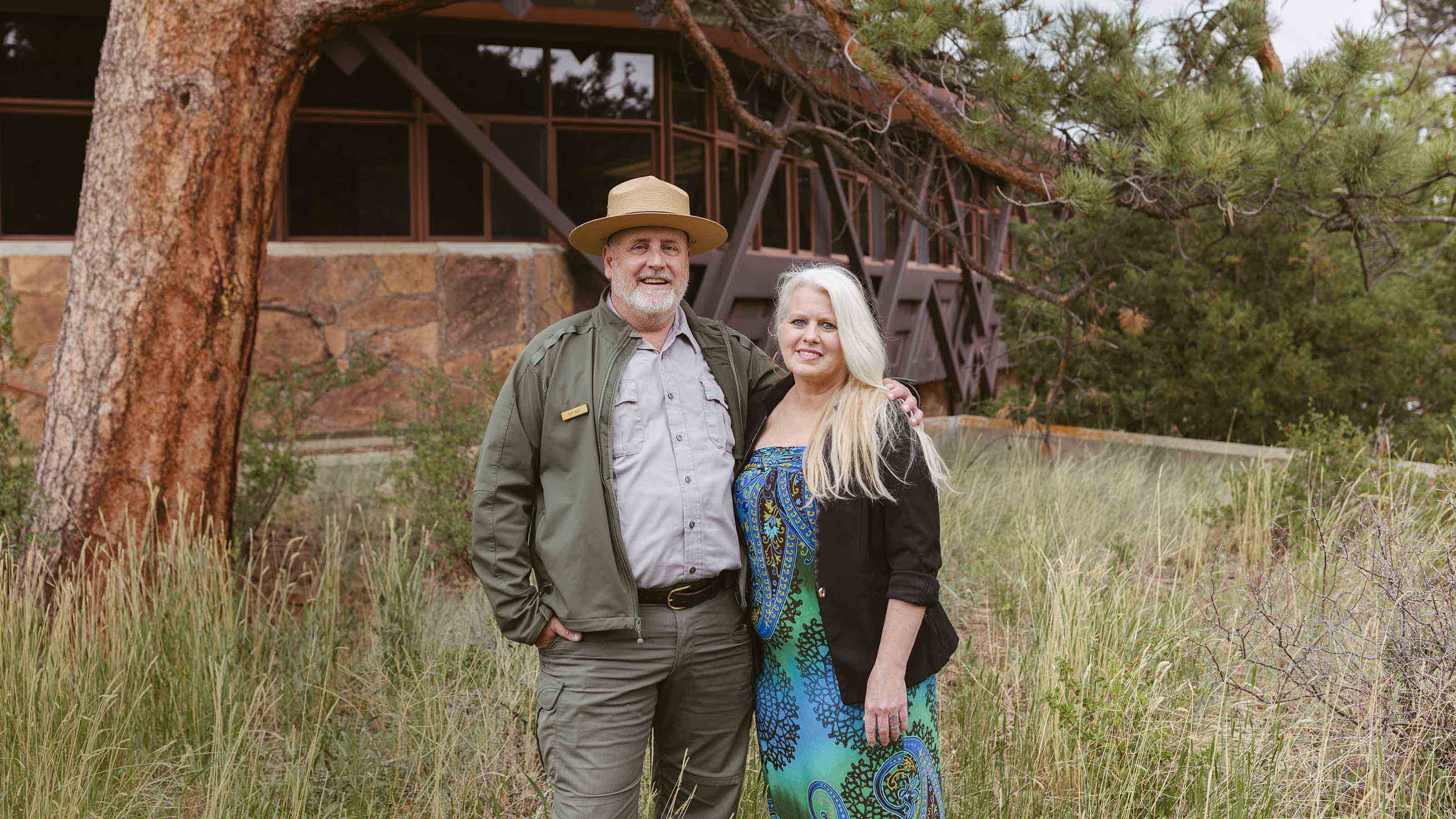

As the "Ask Kim" columnist for Kiplinger's Personal Finance, Lankford receives hundreds of personal finance questions from readers every month. She is the author of Rescue Your Financial Life (McGraw-Hill, 2003), The Insurance Maze: How You Can Save Money on Insurance -- and Still Get the Coverage You Need (Kaplan, 2006), Kiplinger's Ask Kim for Money Smart Solutions (Kaplan, 2007) and The Kiplinger/BBB Personal Finance Guide for Military Families. She is frequently featured as a financial expert on television and radio, including NBC's Today Show, CNN, CNBC and National Public Radio.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

What Does Medicare Not Cover? Eight Things You Should Know

What Does Medicare Not Cover? Eight Things You Should KnowMedicare Part A and Part B leave gaps in your healthcare coverage. But Medicare Advantage has problems, too.

-

15 Reasons You'll Regret an RV in Retirement

15 Reasons You'll Regret an RV in RetirementMaking Your Money Last Here's why you might regret an RV in retirement. RV-savvy retirees talk about the downsides of spending retirement in a motorhome, travel trailer, fifth wheel, or other recreational vehicle.

-

Estate Planning Checklist: 13 Smart Moves

Estate Planning Checklist: 13 Smart Movesretirement Follow this estate planning checklist for you (and your heirs) to hold on to more of your hard-earned money.

-

Should You Rent in Retirement?

Should You Rent in Retirement?Making Your Money Last Renting isn't right for all retirees, but it does offer flexibility, and it frees up cash.

-

6 RMD Changes We Could See This Year

6 RMD Changes We Could See This YearMaking Your Money Last Congress is considering two bills that would make major changes to required minimum distributions. Could your RMDs be affected?

-

A Kiplinger-ATHENE Poll: Retirees Are Worried About Money

A Kiplinger-ATHENE Poll: Retirees Are Worried About MoneyMaking Your Money Last Concerns about recession, inflation and health care costs weigh on retirees and near retirees.

-

The Retiree's Guide to Going Back to Work

The Retiree's Guide to Going Back to WorkMaking Your Money Last Inflation and a bear market have prompted some retirees to change course.

-

Does an Annuity Belong in a 401(k)?

Does an Annuity Belong in a 401(k)?Making Your Money Last Unlike pensions, 401(k)s place the risk of outliving savings squarely on the retiree's shoulders. Find out what's right for you.