Time to Switch to Electronic Social Security Payments

Beneficiaries will no longer receive paper checks after March 1.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Is Social Security still requiring everyone to get their monthly benefit by automatic deposit by March 1, 2013? I think my aunt still gets Social Security checks, and I’m wondering what she needs to do to make the change.

SEE ALSO:

How Well Do You Know Social Security?

p>

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Yes. She has until March 1, 2013, to switch to electronic payments -- by direct deposit either to a bank account or to a prepaid debit card.

The government started to phase out paper checks for federal benefits two years ago. Everyone who applied for Social Security, Veterans Affairs, Railroad Retirement or other federal benefits after May 1, 2011, could receive benefits only through direct deposit to a bank account or a debit card. People who were already in the system and receiving their benefits by paper checks were given until the upcoming deadline to switch to electronic payments. Most people have already made the change -- the government sent out 11 million paper checks in January 2011 and is now sending only 5 million paper checks a month, says Walt Henderson, of the U.S. Treasury Department. The government estimates that switching to electronic payments will save more than $1 billion in the next ten years. /p>

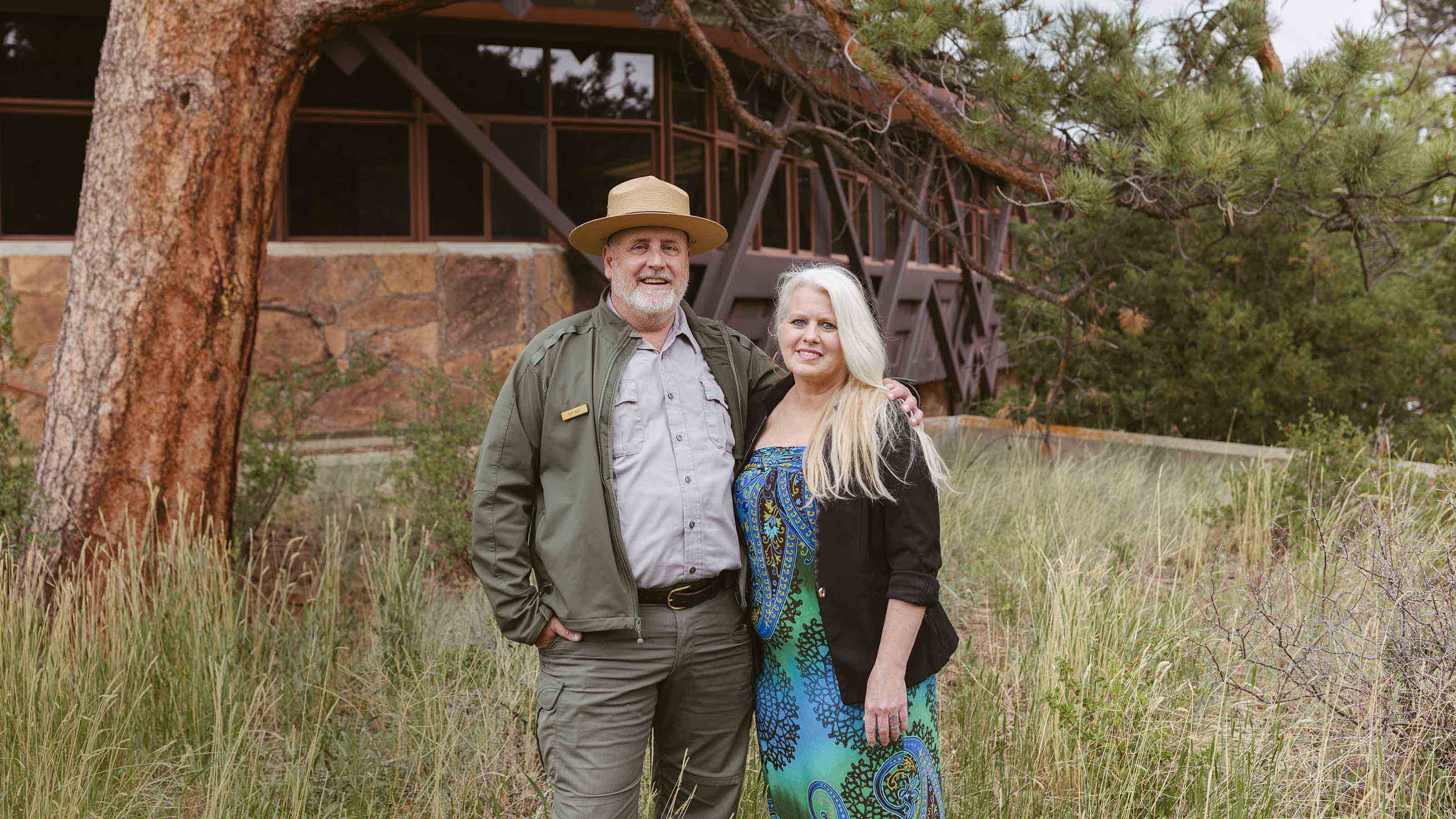

It’s easy to switch to direct deposit. You’ll need your account number and your bank’s routing number. Look for these numbers on your personal checks – the routing number is usually the first set of numbers in the bottom left-hand corner, and the account number is usually on the bottom in the middle; go to the Treasury’s GoDirect.org site for an illustration. You can then plug in the information at the GoDirect.org Web site or call Treasury’s electronic-payment helpline at 800-333-1795. Your bank should be able to help you make the change, too. “We’ve been working with banks and credit unions to help people switch over,” says Henderson, who estimates that it should only take most people about five minutes to make the change.

Another option is to have the money deposited to the Direct Express debit card, but you’re better off going with the direct deposit. The debit card can be used wherever MasterCard debit cards are accepted and charges no fee for purchases, but you’ll pay a 90-cent fee for ATM withdrawals after one free withdrawal per month, plus a $1.50 fee for each transfer made from the debit card to a checking or savings account. See the Direct Express fee schedule for details.

The government won’t discontinue payments for people who miss the March 1 deadline, but it will contact those last people by mail with an offer to help them make the switch, and then may eventually make the payments through the debit card if they don’t make the change themselves. (The Treasury Department will not contact anyone by e-mail or phone, which is a common ploy of scam artists.)

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

As the "Ask Kim" columnist for Kiplinger's Personal Finance, Lankford receives hundreds of personal finance questions from readers every month. She is the author of Rescue Your Financial Life (McGraw-Hill, 2003), The Insurance Maze: How You Can Save Money on Insurance -- and Still Get the Coverage You Need (Kaplan, 2006), Kiplinger's Ask Kim for Money Smart Solutions (Kaplan, 2007) and The Kiplinger/BBB Personal Finance Guide for Military Families. She is frequently featured as a financial expert on television and radio, including NBC's Today Show, CNN, CNBC and National Public Radio.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

What Does Medicare Not Cover? Eight Things You Should Know

What Does Medicare Not Cover? Eight Things You Should KnowMedicare Part A and Part B leave gaps in your healthcare coverage. But Medicare Advantage has problems, too.

-

15 Reasons You'll Regret an RV in Retirement

15 Reasons You'll Regret an RV in RetirementMaking Your Money Last Here's why you might regret an RV in retirement. RV-savvy retirees talk about the downsides of spending retirement in a motorhome, travel trailer, fifth wheel, or other recreational vehicle.

-

Estate Planning Checklist: 13 Smart Moves

Estate Planning Checklist: 13 Smart Movesretirement Follow this estate planning checklist for you (and your heirs) to hold on to more of your hard-earned money.

-

Should You Rent in Retirement?

Should You Rent in Retirement?Making Your Money Last Renting isn't right for all retirees, but it does offer flexibility, and it frees up cash.

-

6 RMD Changes We Could See This Year

6 RMD Changes We Could See This YearMaking Your Money Last Congress is considering two bills that would make major changes to required minimum distributions. Could your RMDs be affected?

-

A Kiplinger-ATHENE Poll: Retirees Are Worried About Money

A Kiplinger-ATHENE Poll: Retirees Are Worried About MoneyMaking Your Money Last Concerns about recession, inflation and health care costs weigh on retirees and near retirees.

-

The Retiree's Guide to Going Back to Work

The Retiree's Guide to Going Back to WorkMaking Your Money Last Inflation and a bear market have prompted some retirees to change course.

-

Does an Annuity Belong in a 401(k)?

Does an Annuity Belong in a 401(k)?Making Your Money Last Unlike pensions, 401(k)s place the risk of outliving savings squarely on the retiree's shoulders. Find out what's right for you.