12 Best Freebies for Retirees

Many retiree-friendly goods and services are available at no cost — if you know where to look.

Cameron Huddleston

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Everything seems to be more expensive. Food, health care, housing and more. The numbers prove it.

For the past 12 months ending September 2025, overall inflation rose 3.0%, based on the latest U.S. Bureau of Labor Statistics (BLS) Consumer Price Index (CPI) data. Food is up 3.1%, housing is up 3.6%, health care is up 3.3% and used vehicles rose 5.1%.

While these individual single-digit increases might seem small, they add up significantly over a year, making a real impact on your budget — especially if you're retired and living on a fixed income.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Thankfully, some things in life are still free — senior discounts on everything from going to the movies to riding the bus, are ripe for the taking. But there are also plenty of freebies out there for those who have cast off the shackles of everyday work.

We gathered a collection of the 12 best freebies for retirees. Bear in mind, some are strictly for those of a certain age, retired or not. Others are fit for retirees and people of any age.

Check out our 12 favorite retirement-friendly freebies.

1. Free prescription drugs

Tap into the RxAssist database to find free or low-cost medications from the patient assistance programs of pharmaceutical manufacturers. Not all drugs are included here. Some that are included have eligibility requirements, such as income limits, and usually require that the applicant have no prescription insurance.

Some supermarket chains, including Meijer, Publix, Kroger, Family Fare, Sam’s Club and more, offer select medications for free. Blink Health offers more than 55 medications on its site that are well below standard pharmacy costs — and shipping is always free to all 50 states.

Keep in mind that some of these chains require a membership (Sam's Club and Kroger), and you'll need a prescription from your doctor.

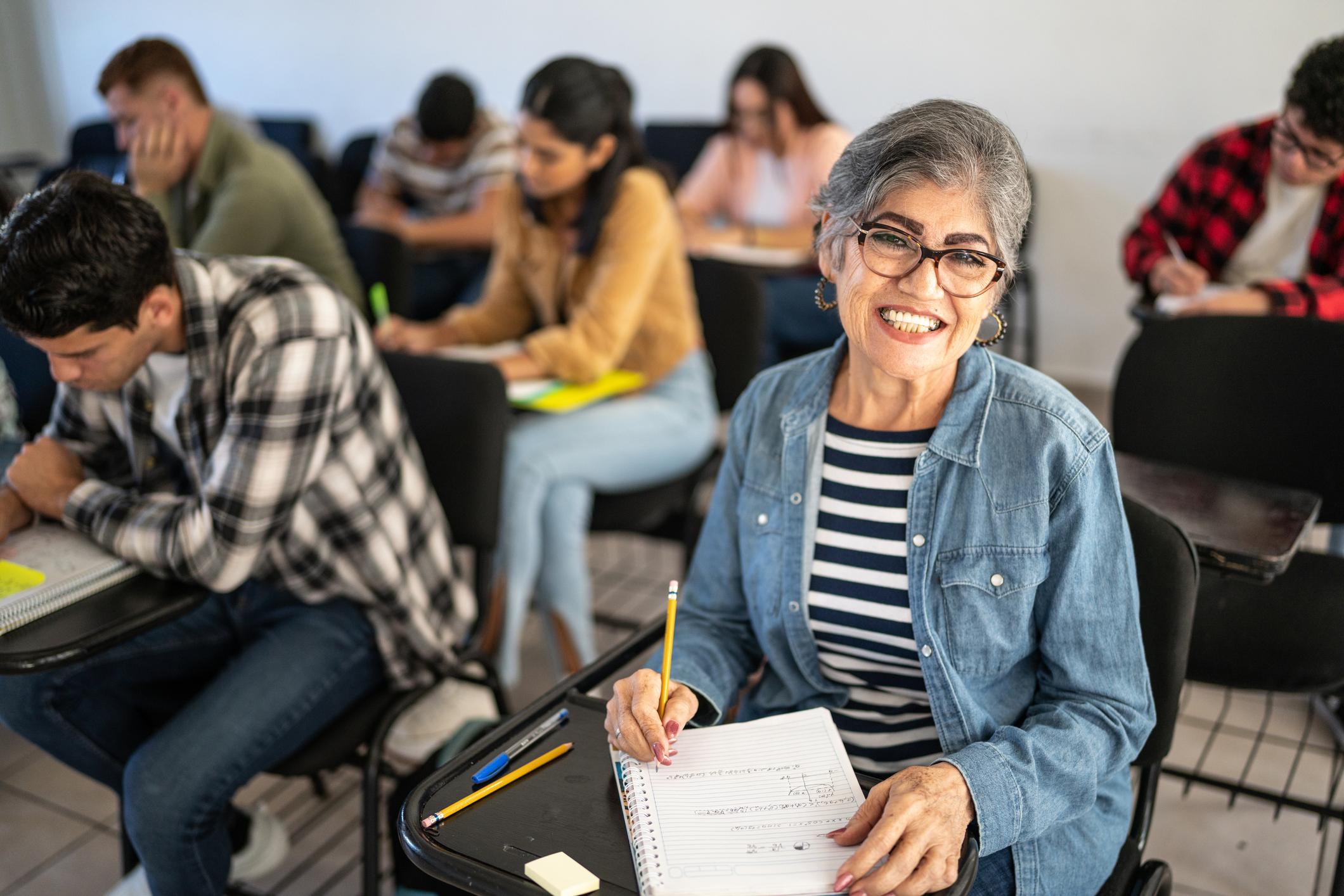

2. Free college tuition

If you're still dreaming about going back to school, it's never too late to make that happen. Some states require state-supported colleges and universities to waive tuition for older residents, as long as there’s space available in the class.

One example: Kentucky. The University of Kentucky and the University of Louisville are among 23 Kentucky colleges and universities that waive tuition for all residents 65 or older. Virginia does, too, for residents 60 and older.

Note: Some tuition-waiver programs allow credit to be earned for the course; others only allow the course to be audited.

Read: Free (or Cheap) College for Seniors and Retirees in All 50 States

3. Free services from Medicare

You pay a Medicare premium each month, an annual deductible, and possibly a co-pay for doctor visits and prescription drugs. However, Medicare also offers many services with no out-of-pocket costs. There are about 18 of them.

From free yearly wellness visits and seasonal vaccines to colorectal screenings and yearly mammograms, if you're on Medicare and not taking advantage of these free services, you're missing out.

Some freebies might not be available with Medicare Advantage, and there could be limitations on how often you can take advantage of a free service.

4. Free eye care

EyeCare America, a public service program of the American Academy of Ophthalmology, provides free eye exams and up to one year of care for any disease diagnosed during the exam.

This free service is available to anyone age 65 or older who doesn't have private insurance and hasn't visited an eye doctor in at least three years. You must fill out a short survey to see if you qualify for the program. Visit EyeCareAmerica for program guidelines.

5. Free entry to National Parks

Now you can take in the sights without paying a dime at some of our nation's most scenic National Parks, including the Great Smoky Mountains and Blue Ridge Parkway.

On several days throughout the year, seniors can get in free to all National Parks that usually charge admission.

Several state park systems — among them Maryland, New Hampshire, New York and Texas — also offer older adults free admission or free annual passes. (Some passes require a small processing fee.)

Don't forget about the Senior Pass, available for admission to all National Parks. It's not free, but well worth the cost. The Senior Lifetime Pass is valid for your lifetime and costs $80. The Senior Annual Pass is valid for one year and costs $20.

6. Free e-books, audiobooks and music

Project Gutenberg and the University of Pennsylvania’s Online Books Page let you legally download thousands of books that have expired copyrights, including War and Peace, Moby Dick and Little Women. You won't pay a dime.

If you'd rather listen than read, the Libby app lets you access thousands of audiobooks free from your local library. You can sign up even if you don't have a current library card. Or, check out titles from Digitalbook and Loyal Books.

More into music? Check out music streaming services, such as Pandora, iHeartRadio and Spotify. All three offer some variation of a free subscription.

7. Free credit reports

Nothing is worse than waking up to find out someone has charged something on your credit card, or worse yet, your identity has been stolen. More than half of all consumers feel they're more of a target of fraud than one year ago, according to the most recent report from Experian. Unfortunately, seniors are often the target for most types of fraud.

Fortunately, all three credit reporting agencies — Equifax, Experian and TransUnion — offer free credit reports to consumers each week at AnnualCreditReport.com.

Check for errors or signs of fraudulent activity, such as the presence of a credit card or loan that you never opened or a collection account for a debt that you don’t owe.

8. Free perks from credit cards

Speaking of credit cards, approximately 88% of Americans aged 65 and older own at least one credit card, and nearly half of Americans aged 50 and older carry over credit card debt from month to month. If that's you, take advantage of some free benefits for carrying around all that plastic.

For example, many of the best travel credit cards come with free rental-car insurance, and some will cover the cost of your vacation if you have to cancel your trip or reimburse you for luggage that's lost, stolen, or damaged during flights purchased with eligible cards.

Other credit card perks include free extended warranties, free cellphone replacement and free museum admission. Contact your card issuer to find out which perks you qualify for.

With the right credit card you can earn rewards, cashback, and savings. See Kiplinger's top credit card picks for online shoppers, powered by Bankrate. Advertising disclosure.

9. Free calls to the grandkids

In 2025, the average cellphone plan in the U.S. cost about $141 per month, based on factors such as the carrier, plan type and additional features. Why would you want to pay more when calling your grandkids, family or friends?

To limit your landline costs or avoid using precious minutes on your mobile phone plan, try using a free calling service such as Teams, Viber or FaceTime.

All three allow you to make free calls to other users of these same services, and all can be installed on mobile phones and computers.

10. Free coffee

Getting your coffee fix every morning is important to your overall well-being (at least for many of us), and there are plenty of places to enjoy it, besides your own home. In some cases, thanks to loyalty programs, your morning cup of coffee could be free.

Peet’s Coffee has a rewards program called Peetnik Rewards, which operates on a points system and allows you to exchange points for free beverages. Starbucks offers a similar program. Dunkin’ Rewards is another great option to get your caffeine (and food) fix.

While with each of these programs you'll have to pay to play, the points add up, equaling free coffee down the road. It's free to sign up.

11. Free gym memberships

Staying in shape is one way to live better and longer. Even if you’re 65 or older, staying active can add more than five years to your life, according to a 2025 study in the British Journal of Sports Medicine.

The study found that if everyone age 40 and older moved like the most active seniors — brisk walks, gardening, dancing or light strength training — average life expectancy could increase by 5.3 years.

That would mean more healthy, independent years to enjoy the grandkids, travel, go back to school or take up a new hobby. But some gym memberships are costly.

Thankfully many fitness centers offer discounted or free memberships through health insurers for people age 65 and older.

Many Medicare Advantage plans offer a membership called SilverSneakers (run by Tivity Health) that gives eligible seniors access to thousands of gym and fitness center locations nationwide — for free.

12. Free financial advice and retirement planning

We don't like to boast, but here at Kiplinger.com and on our social media platforms you can find actionable, straightforward financial and retirement guidance to keep more of your hard earned cash in your pocket.

Learn how to cut your tax bill, maximize returns on your investments, save more for retirement, stop insurance leaks, get the best banking and credit deals, and so much more.

Sign up for our free e-newsletters to get our best tips delivered straight to your email every week. You can also follow Kiplinger on Twitter (now X), TikTok and Facebook.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Bob was Senior Editor at Kiplinger.com for seven years and is now a contributor to the website. He has more than 40 years of experience in online, print and visual journalism. Bob has worked as an award-winning writer and editor in the Washington, D.C., market as well as at news organizations in New York, Michigan and California. Bob joined Kiplinger in 2016, bringing a wealth of expertise covering retail, entertainment, and money-saving trends and topics. He was one of the first journalists at a daily news organization to aggressively cover retail as a specialty and has been lauded in the retail industry for his expertise. Bob has also been an adjunct and associate professor of print, online and visual journalism at Syracuse University and Ithaca College. He has a master’s degree from Syracuse University’s S.I. Newhouse School of Public Communications and a bachelor’s degree in communications and theater from Hope College.

- Cameron HuddlestonFormer Online Editor, Kiplinger.com

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

5 Best Splurge Cruises for Retirees in 2026

5 Best Splurge Cruises for Retirees in 2026Embrace smaller, luxury ships for exceptional service, dining and amenities. You'll be glad you left the teeming hordes behind.

-

The 10 Most Valuable Vacation Destinations for Retirees in 2026

The 10 Most Valuable Vacation Destinations for Retirees in 2026From U.S. getaways to international escapes, these budget-friendly destinations offer retirees the perfect mix of rest, rejuvenation and just the right amount of excitement.

-

Noctourism: The New Travel Trend For Your Next Trip

Noctourism: The New Travel Trend For Your Next Trip"Noctourism" is a new trend of building travel and vacations around events and plans that take place at night. Take a look at some inspiring noctourism ideas.

-

30 Retirement Road Trip Destinations for Foodies

30 Retirement Road Trip Destinations for FoodiesWant to eat your way across America? Here's a look at foodie gems worth the drive, whether you’re craving the nostalgic taste of juicy BBQ or fresh-caught seafood straight from the ocean.

-

Sleep 'Outside' Without Back Pain: Five Glamping Resorts for Luxury and Nature

Sleep 'Outside' Without Back Pain: Five Glamping Resorts for Luxury and NatureGlamping, or glamorous camping, offers older travelers a chance to reconnect with nature in comfort. These glamping spots range from the simple to the decadent.

-

Seven Gorgeous Train Trips to Enjoy Fall Foliage

Seven Gorgeous Train Trips to Enjoy Fall FoliageSee fall's best colors from the rails. We've rounded up a range of short and longer train trips across the country that are ideal for older travelers.

-

How to Plan Your First Global Retirement Adventure in 2026

How to Plan Your First Global Retirement Adventure in 2026Retirement unlocks a thrilling (and slightly scary) new world of possibilities. Why not kick it off with an overseas journey — the ultimate way to step boldly into this exciting new chapter of your life?

-

11 Unforgettable Road Trips to Take in Retirement

11 Unforgettable Road Trips to Take in RetirementMore than a travel trend, the road trip is a quintessential American tradition, with millions of us taking them each year. Here's a guide to helping you choose your next adventure.