Lower Your Future Income Risk by Taking Action Now

Your investment portfolio is doing great these days, but you can’t count on that forever. Before the next stock market correction, build a safer income plan with these six steps.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The news about the stock market has been wonderful for a lot of your retirement savings. The portion of your portfolio invested in the stock market has recovered from the thrashing the pandemic delivered and, if it followed the broad market, it has reached new highs.

However, other aspects of the economy aren’t necessarily the most favorable for individuals entering or in retirement:

- Interest rates are still low by historical standards.

- Expenses, such as travel, food and your car, have increased. Home prices have jumped too.

- Federal income tax rates may be going up.

- And, of course, there’s always the possibility of a stock market correction

Finally, some investors took their money out of the markets during the crash of 2020 and stayed on the sidelines during the historic upswing.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

All of that means the income from your savings may not cover current or future expenses. So, the decisions you make for your retirement income plan are more important than ever.

But don’t worry. A simple six-point point program that you can use any time — not just during times of uncertainty — will help you determine whether you need to take some action to keep your retirement plan on track.

Six ways to take control of your retirement

1. Create a plan for retirement income

Most importantly you should have a plan for retirement income. It doesn’t have to be elaborate, but it should be recorded and updated at least annually; it will help to guide your decisions going forward. The plan should be about income allocation — not asset allocation. An Income Allocation plan recommends that you allocate your income among interest, dividends, annuity payments and IRA withdrawals. And in some cases, drawing down or extracting equity from a primary residence.

For more on how an Income Allocation model works, please read Fill Your Income Gaps — And Then Some.

2. Generate more income from your retirement savings

A lot of retirees with savings in both IRA or 401(k) accounts, and personal (after-tax) savings follow this strategy: (1) Take required minimum distributions from your IRA or 401(k), and (2) Spend interest and dividends from personal savings. They cover any shortfall in income with capital withdrawals or hoped-for capital gains. These latter two sources, however, should not be considered “income,” because they are dependent on the market.

An Income Allocation Plan adds annuity payments to your monthly income, providing cash you can count on for life that also offers tax advantages. Annuity payments can start immediately and be a multiple of interest you’d earn on your savings. Or they can start in the future, enabling you, for example, to invest your rollover IRA savings more aggressively.

3. Build in more security

Investors understand the need for security in their retirement planning. For example, a large percentage of 401(k) participants invest their savings in target date funds, which automatically reduce risky holdings in their account as they near retirement.

Once investors retire, increasing income from annuity payments can provide similar security — guaranteed income for life no matter how long you live. Research shows that consumers generally do not reap all the rewards of stock market gains because they sell their holdings during bad times and are not invested when the market begins to climb again. A concentration on income, with a percentage of your retirement income coming from annuity payments, relieves that pressure and allows you to stay the course in volatile markets. In other words, the money you have invested in stocks can stay there, and you have time to let the market recover.

4. Minimize your stress level

Besides setting up a plan that is less dependent on market fluctuations, you can look for an adviser who will help manage your plan and make real-time adjustments to that plan to reflect changes in the market and your personal situation. The difference is this: You and your adviser are managing your plan, not just your investments.

Using an adviser to manage your plan and a low-cost robo-adviser to manage your investments could be the perfect combination. Look for your adviser to deliver holistic planning that considers your income goal and your employment-related guaranteed income, while pointing out the potential risk of withdrawing capital to manage any income gap.

5. Lower your fees

While you’ll want to keep a portion of your savings invested in the market, make sure you invest in diversified, low-cost index funds, ETFs or direct indexing portfolios. These investments can be managed within an automated, or “robo-adviser” platform, to cut your fees in half or more. Robo-platforms can even suggest investment models and allow you to adjust those models if you choose.

When your objective is a plan for retirement income, think about the fees you’re paying as coming directly out of your income rather than out of your savings. With a full-service advisory fee averaging 1% of assets under management, they can represent a large percentage of your income.

For more on how to cut your fees, please see How to Cut Your Investment Fees in Half.

6. Lower your tax rate

Conventional wisdom says that when you generate more income, your tax rate will be higher, too. But your taxes are very much dependent on the source and composition of the income, and by following an Income Allocation approach on your personal savings as well, you can lower your retirement tax rate. As suggested above, a portion of annuity payments made from your personal savings is free from tax during the first 15 or 20 years.

(For more on that, please see How to Lower Your Retirement Tax Rate to Less Than 10%.)

Putting the numbers together

The six principles listed above show the power and flexibility of an income allocation planning system and demonstrate how one simple move — adding annuity payments — can positively affect income, tax rate, fees and your peace of mind.

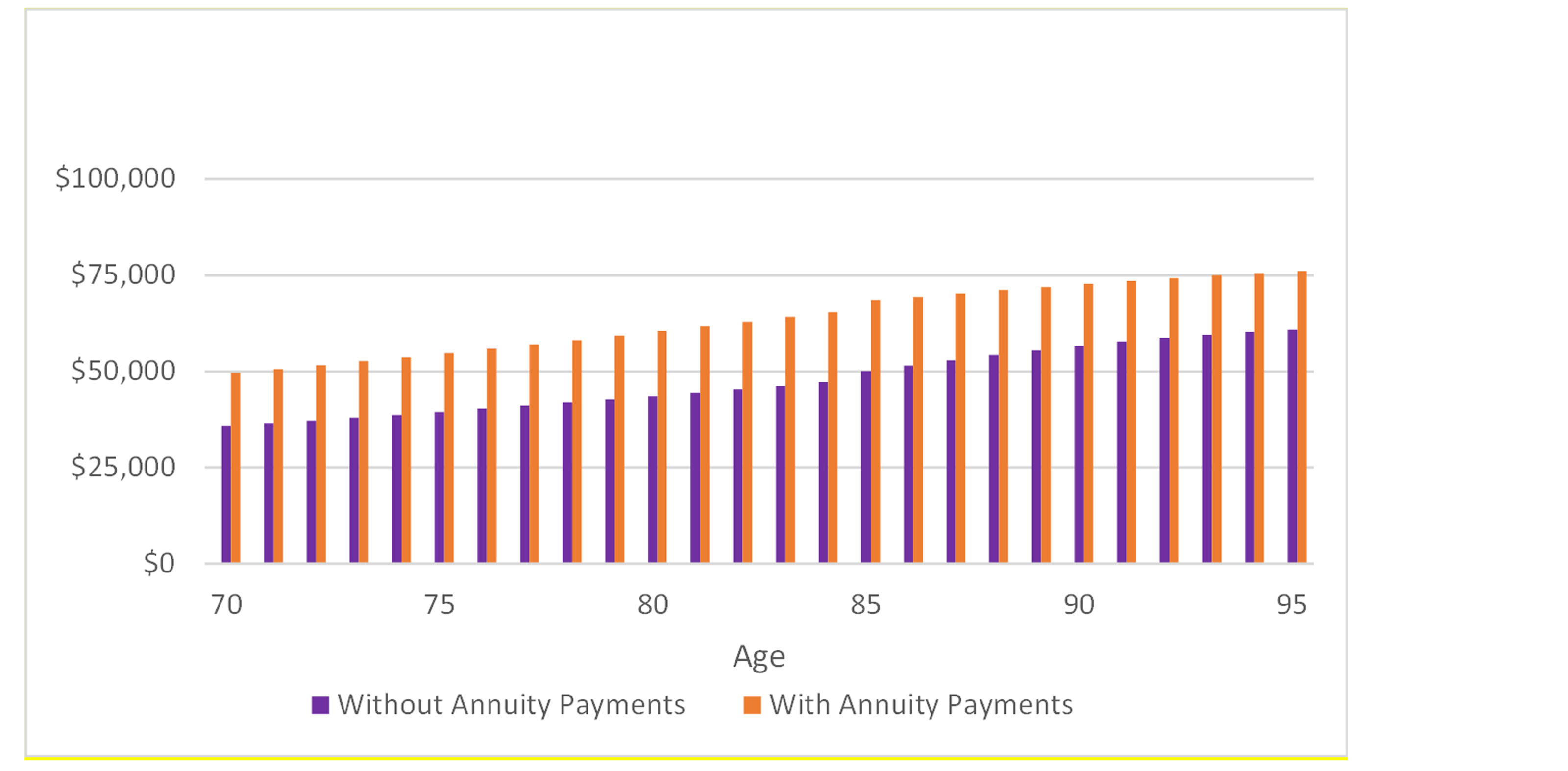

How much more income could you expect by developing an Income Allocation plan? The chart below shows how a 70-year-old man with $1 million in savings, and 50% in rollover IRA using a robo-adviser investment platform, enhances his retirement finances by switching some of his bond investments into income annuities generating lifetime annuity payments.

Comparison of Plan With and Without Annuity Payments

Here are some of the highlights:

- First year income from the plan with annuity payments is $14,000 per year higher than the plan without annuity payments.

- Cumulative income to age 95 is $420,000 higher.

- Assuming $36,000 from Social Security benefits, the first-year retirement tax rate is less than 4% on the plan with annuity payments vs. nearly 7% on the plan without annuity payments.

- And to reduce stress, a lower percentage of the income is subject to market risk.

Importantly, that higher income and lower taxes can be spent, gifted or reinvested for a future legacy.

An extra benefit: You can apply those principles to your retirement plan at any time, wherever the market is.

Are you a DIY investor who just wants some guidance to make sure you are on the right track with your retirement income plan? Income Allocation Planning at Go2Income enables you to design your own plan to address the retirement issues you are facing now and will continue to face in the future. For answers to other retirement questions, contact me at Ask Jerry.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jerry Golden is the founder and CEO of Golden Retirement Advisors Inc. He specializes in helping consumers create retirement plans that provide income that cannot be outlived. Find out more at Go2income.com, where consumers can explore all types of income annuity options, anonymously and at no cost.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.