Retirement Planning Reinvented

To help maximize your income and reduce your risk, try building your retirement on the allocation of income among dividends, interest, annuity payments and withdrawals.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

You might think I sound presumptuous when I say that a new era in retirement planning has begun.

But I plan to prove it to you.

An innovative difference

A new retirement planning method demonstrates that by properly allocating the smartest sources of income, you can create more income with less market risk — for the rest of your life. And you can do most of the research on your own.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Retirees and people planning for retirement can follow any number of paths. Most consider — or have been offered — only a fraction of them. Online tools, investment advisers and financial planners supply limited options.

Why? The biggest problem is that most retirement advice favors an allocation of assets — stocks, bonds and cash, paired with an algorithm for withdrawals — designed to make the money lasts as long as the retiree.

Most tools — such as the popular Monte Carlo Analysis — can handle only a few of these asset allocation strategies, thus ignoring major categories of financial vehicles and leaving retirees with market risks. Advisers often guide customers to products that they are already selling. And many are not educated on all the ways retirees can create income security.

When you instead build your retirement on the allocation of income among dividends, interest, annuity payments and withdrawals, you can achieve both higher and safer income. I call it the Income Allocation Planning (IAP) method, and it’s available as a free, no-obligation service at Go2Income.com.

How Is Income Allocation different from Asset Allocation?

The twin goals of the IAP method are to increase the amount of after-tax (spendable) income and to reduce income volatility (for more dependability). IAP differs from traditional retirement planning in three ways:

Step 1 uses annuity payments to provide guaranteed lifetime income. Advisers often ignore annuity payments as an option.

Step 2 treats rollover IRAs differently than personal (after-tax) savings accounts for optimal tax efficiency. Most calculators have a single investment allocation.

Step 3 manages withdrawals from rollover IRAs. Most advisers suggest retirees just withdraw IRS mandated required minimum distributions from IRAs.

How much more income will Income Allocation generate?

Go2Income’s Income Allocation tool enables the visitor to the site to create a customized plan on their own. (And makes available specially trained Go2Specialists to review the plan designed from the tool.)

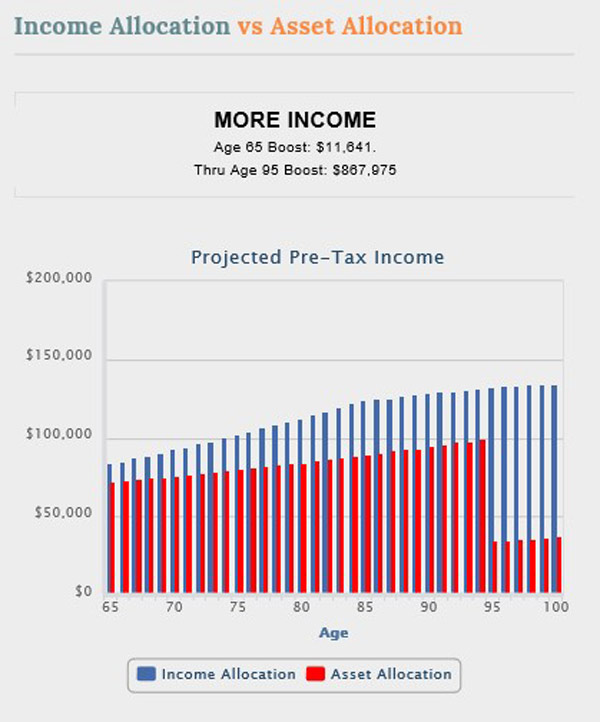

Set out below is a sample chart from the Go2Income site for a woman age 65 with a total of $2 million in savings (half of which is in a rollover IRA). Based on the assumptions listed underneath the chart and those provided in a detailed report the visitor can order, the income advantage vs. an Asset Allocation strategy is over $11,000 in the first year and over $850,000 cumulatively through age 95.

Here are the key underlying assumptions:

- Stock market return after fees: 6%

- Fixed income return after fees: 3%

- Annuity purchase rates: proprietary Go2Income methodology

- Asset allocation: 50% to equities; IRA withdrawals to 95

The right combination of DIY and specialists

Too many people feel they can’t make their own decisions about retirement. That’s partly because they don’t have all the information they need. It’s also because they haven’t educated themselves.

Now, instead of relying exclusively on your financial adviser to direct your retirement plans, the Income Allocation tool enables you to adjust inputs and create your own retirement income plan. It gives you solid information — and a range of potential solutions — that you can bring to your adviser for discussion.

Go2Income has specialists who can talk to you about the results you get from our tool, but they aren’t the only advisers you should consider. I urge you to examine all your options. Try out other tools and compare the results. Talk to a number of advisers before you choose one to guide you.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jerry Golden is the founder and CEO of Golden Retirement Advisors Inc. He specializes in helping consumers create retirement plans that provide income that cannot be outlived. Find out more at Go2income.com, where consumers can explore all types of income annuity options, anonymously and at no cost.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AI

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AIFor financial advisers eager to embrace AI but unsure where to start, this road map will help you integrate the right tools and safeguards into your work.

-

The Referral Revolution: How to Grow Your Business With Trust

The Referral Revolution: How to Grow Your Business With TrustYou can attract ideal clients by focusing on value and leveraging your current relationships to create a referral-based practice.