Stock Fear? A Solid Income Plan Helps Keep Retirees Safe

If your retirement income relies on the stock market, a plunge isn't just "paper losses" to you. Here's the income plan my wife and I use that takes the worry out of market volatility.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The stock market recently gave us a reminder of what volatility feels like.

I’m writing this on the day following a two-day, 8% plummet in the Dow Jones industrial average. Everyone I talk to asked, “What happened?” “What do I do?” “Will it get worse?”

The most frantic questioners were those who had the largest amount of their savings in stocks, especially the ones who depend on equities to provide them with their retirement cash flow. (Even the Millennials got spooked when their robo-advisers jammed up.)

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The pundits immediately suggested that investors should “stay the course.” Some also opined, “This market correction probably was a good thing.”

But think about the investor whose cash flow depends on the value of the market, someone who takes required minimum distributions from her 401(k) or rollover IRA. She just experienced serious “Income Volatility” — a reduction in income from a fall in the market. It was the last thing she needed.

Income allocation over asset allocation

I believe we can create income allocation strategies that don’t collapse with our confidence when the market goes haywire — and that can reduce income volatility to near zero.

Here is a rough illustration of my own situation, which allowed my wife and me to stay calm during the drop. I concentrate on income allocation and the minimization of income volatility, not asset allocation and market volatility. And the plan is to provide income for the rest of our lives, however long it might be.

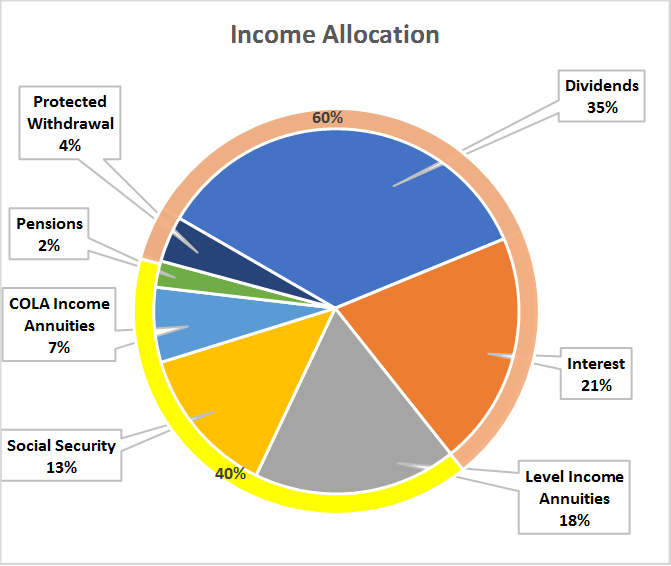

The pie chart below shows where my income comes from. Note that a high percentage of this income is likely to grow, addressing most of my concerns about inflation. If you add in my life insurance, long-term care insurance and longevity insurance in the form of a deferred income annuity called a QLAC, my plan is protected from life risks. Not everyone can get to a plan like this but it’s worth striving for.

How did I get to this position?

As an investment adviser, I understand the power of high-dividend stock portfolios and ways to manage income volatility.

As a retirement income planner, I understand the difference between income and withdrawals. (When your plan is set up correctly, it means that today’s cash flow doesn’t impact future income.)

As an actuary, I appreciate and understand the unique benefits that life insurance, long-term care insurance and income annuities can provide.

And as a fellow Baby Boomer and consumer of financial products, I understand the peace of mind I get from regular “paychecks” – along with the pleasure of seeing as little as possible go out in taxes.

While my background gives me a particular advantage, there’s one thing that all investors and their advisers can do for us Boomers: Think of the plans you’re building for retirement as being not about “asset allocation,” but about “income allocation.” The goal is to minimize income volatility.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jerry Golden is the founder and CEO of Golden Retirement Advisors Inc. He specializes in helping consumers create retirement plans that provide income that cannot be outlived. Find out more at Go2income.com, where consumers can explore all types of income annuity options, anonymously and at no cost.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Should You Do Your Own Taxes This Year or Hire a Pro?

Should You Do Your Own Taxes This Year or Hire a Pro?Taxes Doing your own taxes isn’t easy, and hiring a tax pro isn’t cheap. Here’s a guide to help you figure out whether to tackle the job on your own or hire a professional.

-

Trump $10B IRS Lawsuit Hits an Already Chaotic 2026 Tax Season

Trump $10B IRS Lawsuit Hits an Already Chaotic 2026 Tax SeasonTax Law A new Trump lawsuit and warnings from a tax-industry watchdog point to an IRS under strain, just as millions of taxpayers begin filing their 2025 returns.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AI

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AIFor financial advisers eager to embrace AI but unsure where to start, this road map will help you integrate the right tools and safeguards into your work.

-

The Referral Revolution: How to Grow Your Business With Trust

The Referral Revolution: How to Grow Your Business With TrustYou can attract ideal clients by focusing on value and leveraging your current relationships to create a referral-based practice.

-

This Is How You Can Land a Job You'll Love

This Is How You Can Land a Job You'll Love"Work How You Are Wired" leads job seekers on a journey of self-discovery that could help them snag the job of their dreams.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

65 or Older? Cut Your Tax Bill Before the Clock Runs Out

65 or Older? Cut Your Tax Bill Before the Clock Runs OutThanks to the OBBBA, you may be able to trim your tax bill by as much as $14,000. But you'll need to act soon, as not all of the provisions are permanent.

-

The Key to a Successful Transition When Selling Your Business: Start the Process Sooner Than You Think You Need To

The Key to a Successful Transition When Selling Your Business: Start the Process Sooner Than You Think You Need ToWay before selling your business, you can align tax strategy, estate planning, family priorities and investment decisions to create flexibility.

-

I'm a Financial Adviser: This Is the $300,000 Social Security Decision Many People Get Wrong

I'm a Financial Adviser: This Is the $300,000 Social Security Decision Many People Get WrongDeciding when to claim Social Security is a complex, high-stakes decision that shouldn't be based on fear or simple break-even math.