Medicare Part B Premiums Climb for 2020

High-income retirees will experience the biggest changes.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Medicare beneficiaries, expect to pay more for coverage next year. The Medicare Part B premium is rising, and high-income retirees will see a spike in income-related charges for 2020. But for the first time in a decade, inflation adjustments have changed the income thresholds for those charges, mitigating the pain for some high-income beneficiaries.

The standard monthly premium for Part B, which covers doctor visits and other outpatient services, jumps nearly 7% for 2020, to $144.60. New Medicare enrollees, those who don’t get Social Security benefits and those who are directly billed for Part B premiums are automatically subject to the standard premium.

Other Medicare beneficiaries may not get the full wallop of that premium increase. Given the 1.6% cost-of-living adjustment for Social Security benefits in 2020, some Medicare beneficiaries will be protected by the “hold harmless” provision. That provision keeps many beneficiaries’ Part B premium increase from exceeding the increase in their Social Security benefits if premiums are automatically deducted from benefits.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

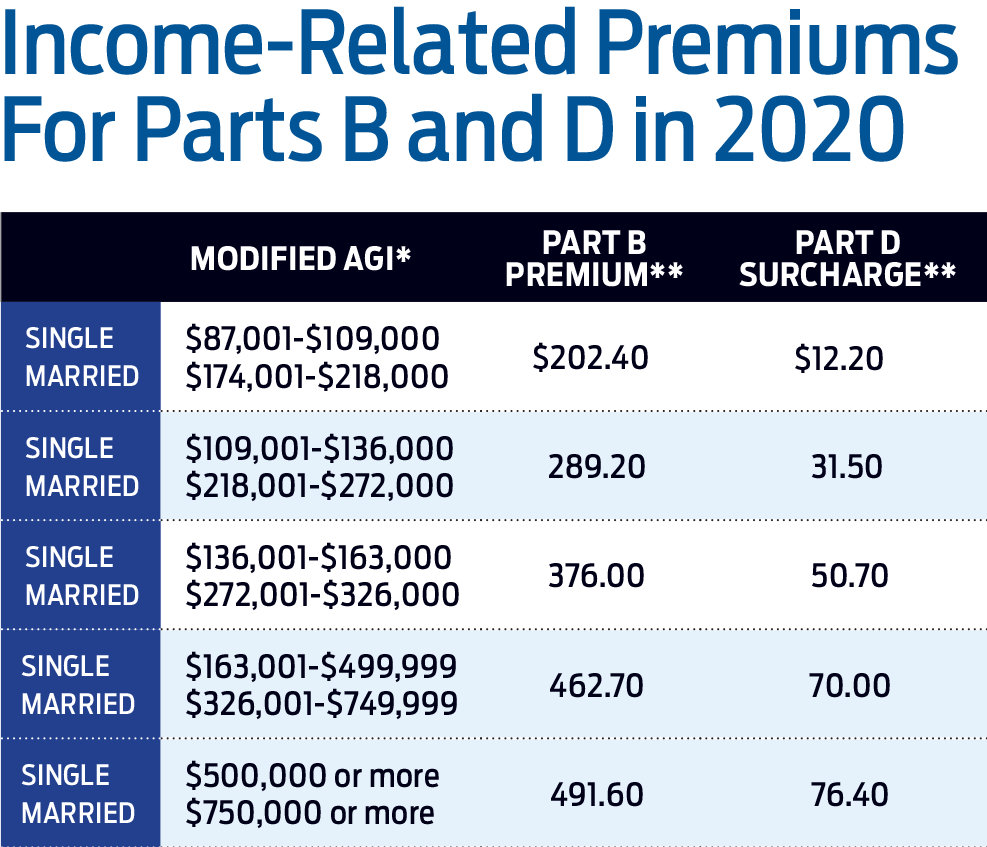

But about 7% of beneficiaries will pay more than the standard premium: High-income beneficiaries don’t benefit from the hold-harmless provision and instead pay a monthly income-related adjustment on top of the standard Part B premium. These beneficiaries also pay a surcharge on their Part D prescription-drug plan premiums.

The good news for some high-income beneficiaries: For the first time since 2011, the income thresholds determining the 2020 surcharges are adjusted for inflation. Surcharges don’t start to kick in until single taxpayers have more than $87,000 of modified adjusted gross income (AGI plus tax-exempt interest), which is $2,000 more than the threshold that applied for the past 10 years, or until married taxpayers filing jointly have more than $174,000 of MAGI, $4,000 more than in recent years. There’s one exception to the inflation adjustments: The top fifth tier, which was new for 2019, remains the same and applies to singles with MAGI of $500,000 or more and joint filers with MAGI of $750,000 or more.

The not-so-good news? The total Part B premium for those subject to surcharges is climbing by nearly 7% across all the tiers. The first tier’s total premium, for instance, rises from $189.60 in 2019 to $202.40 for 2020.

Part D surcharges, however, are dropping slightly. For example, those in the first tier will pay $12.20 on top of their plan premium in 2020, which is 20 cents less than 2019. Those in the fourth tier will pay an extra $70, a 90-cent drop from 2019.

Of course, the biggest savings will go to those who fall into a lower tier because of the inflation adjustments. For instance, let’s say your MAGI is $135,000 as a single. In 2019, you are in the third tier paying a Part D surcharge of $51.40, whereas in 2020, you fall into the second tier and owe a Part D surcharge of $31.50—a savings of nearly 39%. The total Part B premium would fall about 18% with that same switch in tiers, to $289.20 in 2020.

Check Eligibility for Surcharge Waiver

Medicare premium surcharges are based on information from your tax return two years prior. If your circumstances have changed since you filed that return, you might qualify for a surcharge waiver.

The federal government provides relief as a result of certain life-changing events, such as death of a spouse or retirement, which can qualify you to use your current, lower income and avoid the surcharge. You can learn more at www.socialsecurity.gov.

If you experienced one of those events since your 2018 tax return was filed, you can file Form SSA-44 with the Social Security Administration and provide the appropriate documentation, such as a letter from your former employer noting your retirement.

If you had a one-time spike in income, such as a large profit from the sale of a house, you’re out of luck on escaping the surcharges. But Medicare premiums are determined annually, and the surcharge will drop off in 2021 if your 2019 income falls below the surcharge income thresholds.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

457 Plan Contribution Limits for 2026

457 Plan Contribution Limits for 2026Retirement plans There are higher 457 plan contribution limits in 2026. That's good news for state and local government employees.

-

Medicare Basics: 12 Things You Need to Know

Medicare Basics: 12 Things You Need to KnowMedicare There's Medicare Part A, Part B, Part D, Medigap plans, Medicare Advantage plans and so on. We sort out the confusion about signing up for Medicare — and much more.

-

The Seven Worst Assets to Leave Your Kids or Grandkids

The Seven Worst Assets to Leave Your Kids or Grandkidsinheritance Leaving these assets to your loved ones may be more trouble than it’s worth. Here's how to avoid adding to their grief after you're gone.

-

SEP IRA Contribution Limits for 2026

SEP IRA Contribution Limits for 2026SEP IRA A good option for small business owners, SEP IRAs allow individual annual contributions of as much as $70,000 in 2025, and up to $72,000 in 2026.

-

Roth IRA Contribution Limits for 2026

Roth IRA Contribution Limits for 2026Roth IRAs Roth IRAs allow you to save for retirement with after-tax dollars while you're working, and then withdraw those contributions and earnings tax-free when you retire. Here's a look at 2026 limits and income-based phaseouts.

-

SIMPLE IRA Contribution Limits for 2026

SIMPLE IRA Contribution Limits for 2026simple IRA For 2026, the SIMPLE IRA contribution limit rises to $17,000, with a $4,000 catch-up for those 50 and over, totaling $21,000.

-

457 Contribution Limits for 2024

457 Contribution Limits for 2024retirement plans State and local government workers can contribute more to their 457 plans in 2024 than in 2023.

-

Roth 401(k) Contribution Limits for 2026

Roth 401(k) Contribution Limits for 2026retirement plans The Roth 401(k) contribution limit for 2026 has increased, and workers who are 50 and older can save even more.