Is There a Right Way to Make a Roth Conversion?

Converting some of your traditional IRA funds into a Roth can be a great strategy as you approach retirement. But be careful about how you incorporate such a move into your retirement withdrawal plan.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

A commonly recommended strategy for reducing your tax burden and the impact of required minimum distributions (RMDs) is a Roth conversion. You’ll have no trouble finding information on why you should consider converting pretax IRA money to a Roth IRA in a low-income year. Simply put, a Roth IRA lets people at least age 59½ withdraw money tax free and is not subject to RMDs. But, what may be harder to find is a demonstration of how to fully maximize a Roth conversion’s potential benefits.

Keep in mind though, each person’s financial situation is different, meaning a Roth conversion doesn’t make sense for everyone. Since you must pay income taxes on the amount you convert to a Roth, it’s ideal to do it in a low-tax year. Some retirees who live off of a steady annual income throughout retirement may never have a low-tax year. So, a series of Roth conversions would only add to their taxable income and potentially push them into a higher tax bracket.

An example would be traditional IRA owners who have no income other than Social Security. As it’s unlikely Social Security is enough to cover all of one’s retirement expenses, it’s safe to assume you would need to supplement it with a regular withdrawals from your IRA each year. Thus, a Roth conversion would only increase your annual income and, subsequently, your tax burden.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Nonetheless, there are many retirees who would be better off making a multiyear Roth conversion.

One couple’s story illustrates the Roth strategy

I find the best way to understand complex subjects such as this is through a story. Therefore, I would like to explore this strategy with a fictitious couple, but with actual dollar amounts. Everyone, meet John and Jane.

John and Jane are a retired, married couple who file their taxes jointly. They both turn 62 this November and will file for Social Security payments in January of next year. Together, they will receive $35,000 per year from Social Security. At the end of this year, they will have $750,000 in a traditional IRA and $250,000 in a trust.

John and Jane

Retirement date: Age 62

Combined Social Security benefit: $35,000/year

Assets:

- Traditional IRA: $750,000

- Trust: $250,000

Working with their financial adviser, John and Jane set a goal to keep the size of their retirement assets approximately the same as they approach age 90. They want to live a comfortable retirement but also leave some money to their children and grandchildren. They determine that given a 2.25% cost-of-living adjustment, they’ll have $70,000 in net income from savings and Social Security throughout their golden years. It’s also assumed that their accounts earn a pretax return of 5.9%. Now, let’s see how different strategies help them realize their goal.

Strategy 1: Drawing down assets proportionately

The first strategy they discuss is to take a proportionate withdrawal from both their IRA and trust money. Starting in January, they would take $28,000 in distributions from their IRA and $12,000 from their trust, which is about a 4% withdrawal rate. Adding in Social Security and subtracting taxes from their cash flow, they will have their annual target net income of $70,000. Throughout retirement, they will gradually increase both their trust and IRA withdrawals, keeping the IRA approximately three times the size of the trust.

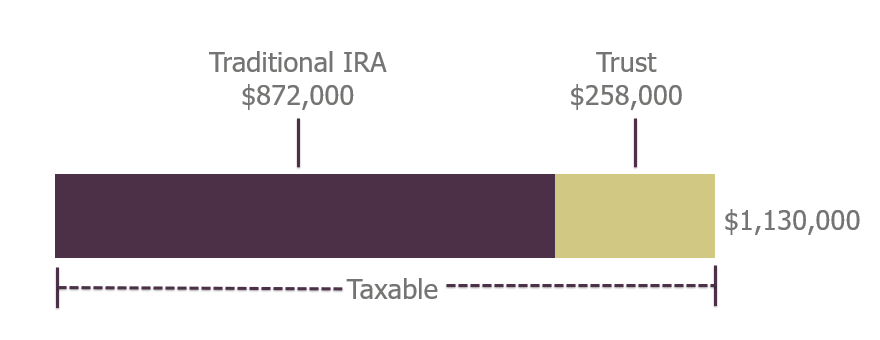

At age 70½ though, they must start taking RMDs from their IRA. Because RMDs increase as you grow older, by age 85, their RMDs will be large enough that they can gradually cut back on trust distributions. Since they’ve withdrawn less than they earned, by age 90, they can expect to have $872,000 in their IRA and $258,000 in their trust, for a total of $1,130,000. The trust will still generate taxable income, and the IRA will still have unrealized taxes built in.

John and Jane’s assets by age 90

Strategy 2: Making a multiyear Roth conversion

The second strategy they consider involves a few different steps. From the time they retire at age 62 until age 70, they will live entirely off the trust account, preserving more money in their tax-sheltered IRA. In their first year, they withdraw $37,200 to pay expenses, including a tax bill of less than $1,000 that results from their Roth conversion. They will convert $15,000 per year for eight years from their IRA to a Roth. This keeps their taxable Social Security at or near $0. With the standard deduction, they will owe almost no income tax in their 60s.

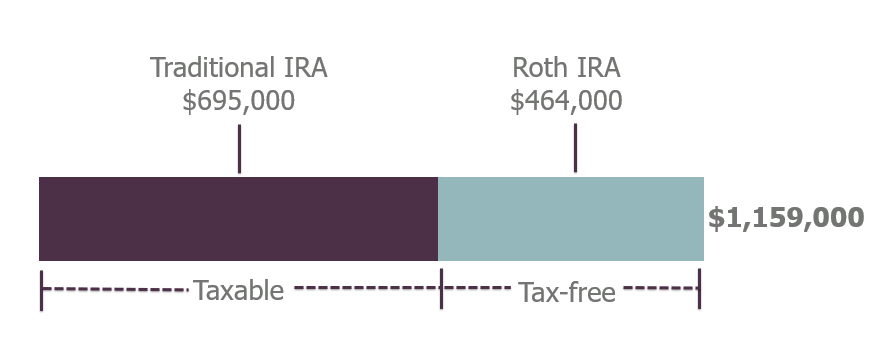

Once they’re age 70, they should have approximately $1,030,000 in their IRA, $148,000 in a Roth and nothing left in the trust. When RMDs kick in, they will have to take the required amount plus a bit extra to still net them $70,000 per year, including income from Social Security. But, because they kept their IRA from growing too quickly in their 60s, through age 90, their RMDs remain smaller than what they need to take out to maintain their standard of living. The IRA will begin to shrink as they continue to take increasing distributions, but since the Roth account has been left alone, it will grow. By age 90, they have $1,159,000 in savings, 40% of which is in the Roth — tax free and with no RMDs in their lifetime.

Under this strategy, they end up with an extra $29,000 for retirement. But, the real victory is that $464,000 of their total savings is free and clear in a Roth account.

John and Jane’s assets by age 90

If John and Jane chose to convert their entire IRA to a Roth in their lifetime, they would need to double their annual conversions over those eight years to $30,000. Then continued distributions would eliminate their IRA by age 90, leaving $1,014,000 in the Roth. This is obviously a smaller portfolio than either of the previous scenarios, but the money is entirely tax free. This might benefit them depending on the income tax structure at that time or what’s best for their heirs.

As you consider your own strategy, be mindful that there are many balls to keep in the air. You have to understand the rules governing each account you own — qualified vs. non-qualified — as well as the taxability of your assets. Also, be wary of how your income will affect the amount of your taxable Social Security benefit. A Roth conversion can help keep more of your money working for you throughout retirement. But, this is a complicated calculation that may be best performed with the guidance of a financial adviser.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Sean McDonnell, CFP®, is a financial adviser at Advance Capital Management, an independent registered investment adviser based in Southfield, Mich. He works closely with clients to create and implement customized financial plans, as well as provides a wide range of services, including: investment and 401(k) management, retirement planning and tax strategies.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AI

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AIFor financial advisers eager to embrace AI but unsure where to start, this road map will help you integrate the right tools and safeguards into your work.

-

The Referral Revolution: How to Grow Your Business With Trust

The Referral Revolution: How to Grow Your Business With TrustYou can attract ideal clients by focusing on value and leveraging your current relationships to create a referral-based practice.