4 Ways to Avoid Running Out of Money in Retirement

August 2014

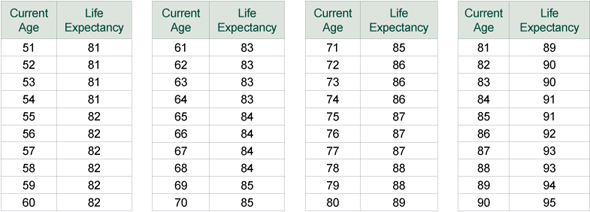

Average Life Expectancy*

*Source: 2006 US Total Population Life Table (revised as of 06/28/2010). National Vital Statistics Reports, volume 58, Number 21. Life expectancy rounded to nearest year.

Compared to the length of retirement, fifteen minutes is no time at all. But that's all you need to learn the basics of developing a plan to make your savings last as long as you need them. Still, many investors don't take this time—putting their retirement in jeopardy.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Investors' biggest errors often occur long before any buying or selling takes place. They tend to have poorly defined objectives, no real sense of their time horizon (how long they need the money to last) and don't quite understand that any investment has risks and returns to consider. To help get you started on a successful path, download this guide by Forbes columnist Ken Fisher's firm.

1. Don’t underestimate your life expectancy.

Ask yourself how long you'll need your retirement savings. Most investors need their savings to last as long as they do—sometimes longer if you'd like your portfolio to support a younger spouse, children or charity after you're gone. So exactly how long that could be isn't black and white. Average life expectancies are published every year, but they can only tell you so much. After all, an average is the middle, and you probably aren't exactly "average".

[NATIVE_AD_300x250]

To get a better idea, consider your heredity—your family's history of health and longevity. Be sure to consider advances in health care and technology! Merely because your father lived to be 70 doesn't mean you'll do the same. Most people outlive their ancestors, hence rising average life expectancies. Planning for a longer life early is smart.

2. Build a personalized spending plan -- and don’t forget inflation!

You could also be underestimating the amount of cash flow you’ll need in retirement. Maintaining your lifestyle becomes much more costly if your expenses are heavily tilted to categories of goods or services with fast-rising prices—like health care! Overall inflation has averaged 3% annually1—a retirement plan that doesn't account for inflation has a significant hole.

3. Don’t overlook your selfless goals for your nest egg.

Many investors have plans above and beyond purely funding retirement that can affect time horizon greatly. Here are two examples.

Bob aims to deplete his portfolio in full—he has no plans to pass funds to heirs or a charity at all. Bob may be able to afford to seek lower returns or take a higher rate of cash flow in retirement. Bob’s goal is cash flow, with an objective of effectively bouncing the last check he writes.

Bob’s time horizon would very likely be his life expectancy.

Jim is the opposite. He has a pension, and therefore, very low cash flow needs. However, it’s important to him to pass on a boodle to his favorite charity. And he has young grandkids he wants to leave an inheritance to. Bob wants each of those pots to be as big as he can make them, and with low cash flow needs, there is little chance of him running out of money.

Jim’s time horizon may have no relation to his age. It may in fact be considered nearly unlimited—the charity, after all, has no age.

These examples are the polar extremes, of course, and there are many shades of grey. But it’s worth considering the extremes to figure out the range of what’s possible.

4. Don’t assume your portfolio’s returns will repeat, year in and year out.

This may seem simple, but a common mistake many investors make is thinking average returns are normal. They aren’t. For example, stocks’ 10% long-term average returns are just the average of big up years and down years seen more frequently over time2. You must factor this variability into your plan, particularly if you have higher than average cash flows. Identify early expenses you might trim in a pinch. Identify those you absolutely cannot reduce. These are your areas for wiggle room in the event returns don’t shape up the way you might hope.

Our 15-Minute Retirement Plan can help get you get started on a successful path.

If you have a $500,000 portfolio, download the guide by Forbes columnist Ken Fisher's firm. Even if you have something else in place, this must-read guide includes research and analysis you can use right now. Don't miss it!

1Source: Global Financial Data, Inc., as of 01/18/2013. Based on US BLS Consumer Price Index from 1925-2012.

2Source: Global Financial Data, Inc., as of 02/25/2014. Annualized S&P 500 Total Returns for the period January 1926 – December 2013 calculated monthly. S&P 500 Total Returns between 0 and +20% occur in 35% of calendar years since 1926.

This content was provided by Fisher Investments and did not involve the Kiplinger editorial staff.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

457 Plan Contribution Limits for 2026

457 Plan Contribution Limits for 2026Retirement plans There are higher 457 plan contribution limits in 2026. That's good news for state and local government employees.

-

Medicare Basics: 12 Things You Need to Know

Medicare Basics: 12 Things You Need to KnowMedicare There's Medicare Part A, Part B, Part D, Medigap plans, Medicare Advantage plans and so on. We sort out the confusion about signing up for Medicare — and much more.

-

The Seven Worst Assets to Leave Your Kids or Grandkids

The Seven Worst Assets to Leave Your Kids or Grandkidsinheritance Leaving these assets to your loved ones may be more trouble than it’s worth. Here's how to avoid adding to their grief after you're gone.

-

SEP IRA Contribution Limits for 2026

SEP IRA Contribution Limits for 2026SEP IRA A good option for small business owners, SEP IRAs allow individual annual contributions of as much as $70,000 in 2025, and up to $72,000 in 2026.

-

Roth IRA Contribution Limits for 2026

Roth IRA Contribution Limits for 2026Roth IRAs Roth IRAs allow you to save for retirement with after-tax dollars while you're working, and then withdraw those contributions and earnings tax-free when you retire. Here's a look at 2026 limits and income-based phaseouts.

-

SIMPLE IRA Contribution Limits for 2026

SIMPLE IRA Contribution Limits for 2026simple IRA For 2026, the SIMPLE IRA contribution limit rises to $17,000, with a $4,000 catch-up for those 50 and over, totaling $21,000.

-

457 Contribution Limits for 2024

457 Contribution Limits for 2024retirement plans State and local government workers can contribute more to their 457 plans in 2024 than in 2023.

-

Roth 401(k) Contribution Limits for 2026

Roth 401(k) Contribution Limits for 2026retirement plans The Roth 401(k) contribution limit for 2026 has increased, and workers who are 50 and older can save even more.