A 50-Year Plan for Retirement Savings

Contributing to your grandchild's Roth IRA could be a do-it-yourself solution to the impending Social Security crisis.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

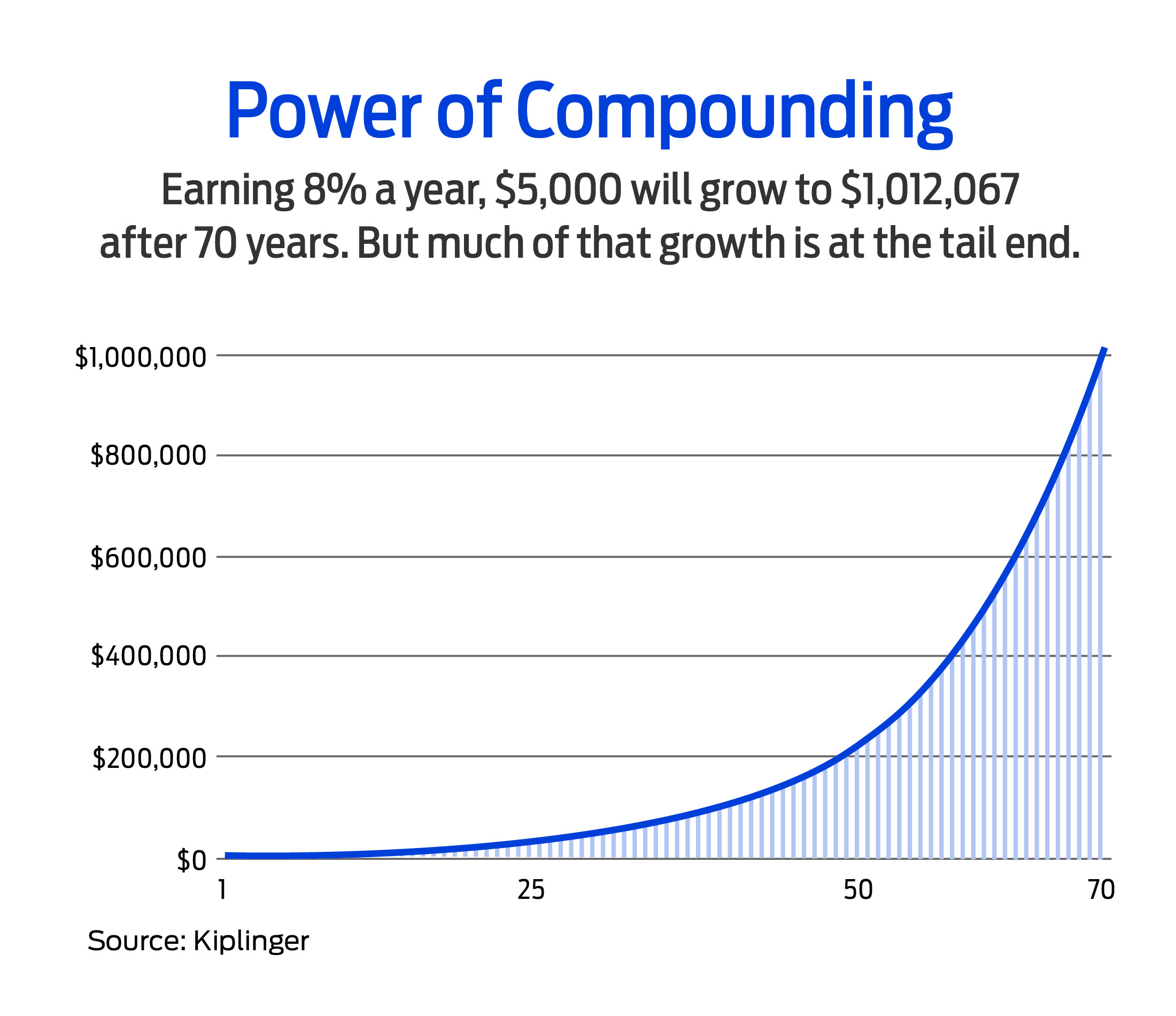

Ric Edelman likes to think big. He founded a nationwide financial-planning firm. He hosts a weekly radio show. He has written several best-selling books on managing money. He’s ubiquitous on PBS with shows such as The Truth About Retirement. And, in his spare time, he has crafted a plan to solve the impending Social Security crisis. It’s simple, he says, thanks to the powerful force of compound interest.

Here’s the plan. For every baby born in the U.S., the government sets up an account and seeds it with $7,000. A blue-ribbon panel invests the money in a diversified portfolio that earns an average annual return of 7.68% (the average projected return of the nation’s public pension plans). After 35 years, the original $7,000, adjusted for inflation, is returned to the government so that the program becomes self-sustaining, funding accounts for future newborns. The balance continues to grow until the account holder reaches age 70.

At that point, an individual’s account will hold almost $1 million, which will be enough to generate a retirement benefit of $73,000 a year (today’s average Social Security benefit adjusted for 70 years of inflation) for 23 years. Edelman believes enough beneficiaries would die before age 93 to fund additional benefits for those who live longer.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

At the current payroll-tax rate of 12.4%, Edelman figures a typical worker pays about $600,000 into Social Security between ages 22 and 70. He claims a single, $7,000 investment at birth could provide similar retirement income. The total cost to the government over the first 35 years would be just under $1 trillion (assuming about 4 million newborns a year). That’s a tiny fraction, he argues, of the cost of other plans that call for higher taxes or benefit cuts to make Social Security sustainable over the long term.

Edelman’s plan wouldn’t replace Social Security right away. And he readily admits that he hasn’t dotted all the i’s or crossed all the t’s. He’s trying to bring a new idea to the table by shining a bright light on the tremendous power of long-term compounding. He got the idea from a caller to his radio show who wanted to invest for an infant grandchild’s retirement.

As the graphic below shows, setting aside $5,000 for an infant and letting it grow for a couple of decades produces enough cash to pay for some college bills. Over a relatively short time period, compounding is okay, but it doesn’t blow you away. It’s in the way-out years that it really struts its stuff. That’s the key to Edelman’s Social Security solution.

Do-It-Yourself Plan

We won’t hold our breath for lawmakers to take up this plan to solve Social Security, but Edelman’s big thinking gives us another chance to remind grandparents of an existing opportunity to help provide for their grandkids’ retirement. We call it the kid IRA, and we wrote about it last month. It involves a parent or grandparent setting aside money in the child’s Roth IRA.

The fly in the ointment is that the child must have earned income to have an IRA, so unless the infant stars in diaper commercials, it’s tough to cash in on 70 years of compounding. But 50 years is possible, and you’d be surprised at how powerfully that can pay off.

Imagine that your granddaughter makes at least $4,000 a year from age 15 through 19 with after-school work and summer jobs and that you give her $4,000 for each of those five years to invest in a Roth IRA. (She can’t contribute more than she earns.) After age 19, no additional contributions are made.

If the money earns an average annual return of 8% and she doesn’t touch it for 50 years until she turns 70, the Roth will hold more than $1.1 million.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

457 Plan Contribution Limits for 2026

457 Plan Contribution Limits for 2026Retirement plans There are higher 457 plan contribution limits in 2026. That's good news for state and local government employees.

-

Medicare Basics: 12 Things You Need to Know

Medicare Basics: 12 Things You Need to KnowMedicare There's Medicare Part A, Part B, Part D, Medigap plans, Medicare Advantage plans and so on. We sort out the confusion about signing up for Medicare — and much more.

-

The Seven Worst Assets to Leave Your Kids or Grandkids

The Seven Worst Assets to Leave Your Kids or Grandkidsinheritance Leaving these assets to your loved ones may be more trouble than it’s worth. Here's how to avoid adding to their grief after you're gone.

-

SEP IRA Contribution Limits for 2026

SEP IRA Contribution Limits for 2026SEP IRA A good option for small business owners, SEP IRAs allow individual annual contributions of as much as $70,000 in 2025, and up to $72,000 in 2026.

-

Roth IRA Contribution Limits for 2026

Roth IRA Contribution Limits for 2026Roth IRAs Roth IRAs allow you to save for retirement with after-tax dollars while you're working, and then withdraw those contributions and earnings tax-free when you retire. Here's a look at 2026 limits and income-based phaseouts.

-

SIMPLE IRA Contribution Limits for 2026

SIMPLE IRA Contribution Limits for 2026simple IRA For 2026, the SIMPLE IRA contribution limit rises to $17,000, with a $4,000 catch-up for those 50 and over, totaling $21,000.

-

457 Contribution Limits for 2024

457 Contribution Limits for 2024retirement plans State and local government workers can contribute more to their 457 plans in 2024 than in 2023.

-

Roth 401(k) Contribution Limits for 2026

Roth 401(k) Contribution Limits for 2026retirement plans The Roth 401(k) contribution limit for 2026 has increased, and workers who are 50 and older can save even more.