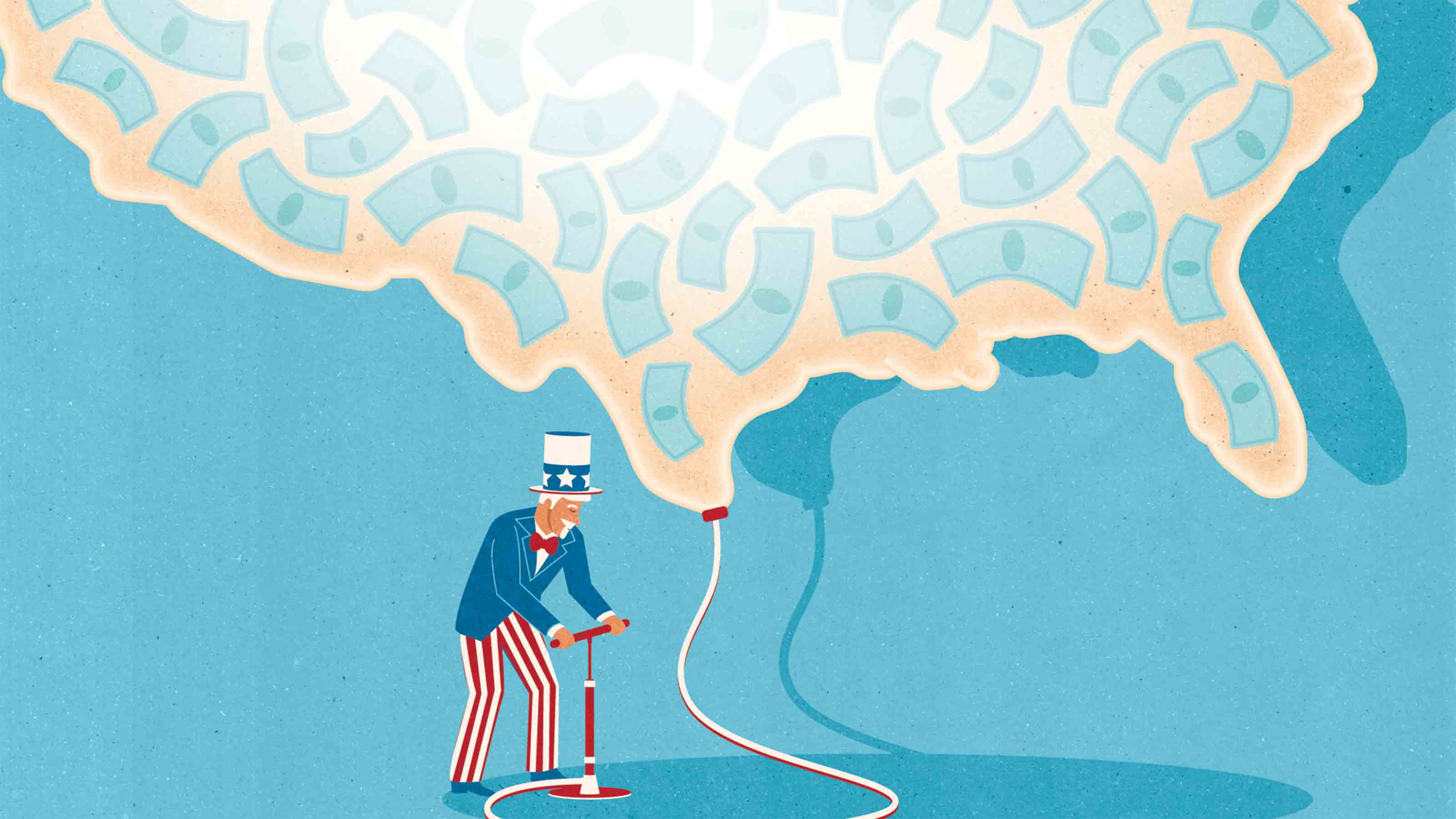

The Good News on Social Security

All that’s needed are some nips and tucks to get the supplemental retirement program on a sounder financial path. The tougher problems are with Medicare and Medicaid.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

“Social Security won’t be there when I retire.” How many times have you heard or read a variation on that? In conversations about retirement, it has turned from a wry throwaway line into a dire mantra.

Endism is all the rage, four troubled years after the Great Recession hit. The end of the American empire. The end of Europe. Even the box office hit “Rise of the Planet of the Apes” deals with the apocalyptic end of humanity. (At least we don’t have to worry about the world’s implosion, prophesized for May 21, 2011, by Christian broadcaster Harold Camping.)

Of course, there are reasons doomsayers have a ready audience. The economy is close to stalling, and the unemployment rate is uncomfortably near double-digit levels. Meanwhile, Washington oversaw a debt-limit fiasco that brought the U.S. government to the edge of default and a historic downgrade of U.S. Treasuries.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

An even more critical force feeding all the foreboding: Americans feel anxious about an aging population that is living longer than before. The leading edge of the Woodstock generation -- the roughly 76 million baby-boomers born from 1946 to 1964 -- are either eligible or close to eligible for Social Security and Medicare benefits. Average life expectancy has risen from nearly 62 years in 1935, when Social Security became law, to 78 years today. The potent combination of longer lives and more elderly people -- along with the federal government’s massive debts and yawning deficit -- are stoking fearful predictions of a fiscal catastrophe. The core of the country’s long-term fiscal challenge are the three main entitlement programs: Social Security, Medicare and Medicaid. (The other big spending items are defense and interest on the debt.)

Economist Joseph Schumpeter once noted that “pessimistic visions about almost anything always strike the public as more erudite than optimistic ones.” Well, here’s a realistic -- and optimistic -- perspective on Social Security. It isn’t in fiscal crisis. Bankruptcy isn’t even a remote risk. The genuine long-term federal fiscal problem is health care. For example, Social Security payments are running about 5% of gross domestic product, and the Congressional Budget Office forecasts they will rise to 6% of GDP by the 2030s.

In sharp contrast, federal spending on health care, including Medicare and Medicaid, could jump from 5.6% of GDP to the 9%-to-10% range in 20 years. Put somewhat differently, unlike Medicare, Medicaid and the overall health care system, Social Security only needs some nips and tucks to get on a sounder financial path.

Better yet, there’s an opportunity to quickly shore up the retirement system. The so-called super committee of 12 congressional leaders is charged with coming up with a debt- and deficit-reduction package. The widespread expectation is that the committee will fail at its task, a reasonable forecast considering the dispiriting rush to blame after Standard & Poor’s stripped the government of its AAA credit rating. Nevertheless, there have been countless blue-chip commissions and think-tank panels that offer the super committee an off-the-shelf Social Security compromise, a quick way to demonstrate to a weary, disgusted electorate that fiscal progress is possible. (The same common ground doesn’t exist with Medicare and Medicaid, let alone Obama/Romneycare.)

Among the key elements informing most Social Security reform packages are: boosting benefits for low-income workers; raising the full retirement age and, at the same time, pushing up initial eligibility for filing for benefits above 62; hiking the cap on annual wages subject to the payroll tax; and embracing a more conservative calculation of the consumer price index. There is even the opportunity for negotiators to improve America’s retirement savings system by approving a proposal inserted into most studies of Social Security reform: adding to the Social Security system a program of voluntary additional contributions for long-term savings.

I think the common menu of choices is a mixed bag. Nevertheless, Social Security reform would send a powerful signal to young and old alike that the third pillar of America’s retirement system -- the other two are personal savings and pensions -- is safe and sound. Social Security will be there for current and future retirees.

Here’s the thing: Social Security and all other retirement savings schemes, including 401(k)s and defined-benefit plans, are claims on the future health of the U.S. economy. If workers are productive and entrepreneurship is flourishing, the elder care tab is easy to pay. For example, the 75-year projection on Social Security’s funding shortfall is based on an average annual productivity growth rate of 1.7% after 2018. Push that number up to 2% and the shortfall is pushed out into the mists of the future.

The advantage of dealing with Social Security now is that it frees up time and effort for what really counts: strategies for boosting the productivity and incomes of young and aging workers alike.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

Federal Debt: A Heavy Load

Federal Debt: A Heavy LoadEconomic Forecasts The debt continues to grow, but record-low interest rates could ease the long-term damage.

-

How the Fed's Moves Affect You

How the Fed's Moves Affect YouEconomic Forecasts It’s pumping trillions of dollars into the economy and keeping rates near zero. Savers are sunk, but borrowers get a boost.

-

Consumers Will Feel Impact of Rapidly Falling Interest Rates

Consumers Will Feel Impact of Rapidly Falling Interest RatesEconomic Forecasts Mortgage and car loans will experience the most significant dips, while some holders of Treasuries may get a slight boost.

-

Will You Have to Pay More Sales Taxes on Your Online Purchases?

Will You Have to Pay More Sales Taxes on Your Online Purchases?business One thing’s for sure: Consumers who live in one of the five states without a sales tax won’t be affected by the Supreme Court’s ruling.

-

Is Credit-Card Debt Out of Control?

Is Credit-Card Debt Out of Control?credit & debt Balances are on the rise, but defaults are still low.

-

Help Wanted in America: Skilled Workers

Help Wanted in America: Skilled WorkersTechnology In an ever-more-competitive job market, technology increases the need for skilled workers.

-

The Unintended Consequences of a Boost in Overtime Pay

The Unintended Consequences of a Boost in Overtime PayBusiness Costs & Regulation New rules mean millions more employees will be overtime-eligible. But will employers find workarounds?

-

America's Perilous National Debt

America's Perilous National Debtdebt At $14 trillion and climbing, it's like "termites in the basement."