Can Sustainable Bonds Save the World?

Earn income in retirement without sacrificing your values with these ESG bond funds.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Bonds seem designed to make investors' eyes glaze over. Yields, maturities and credit ratings are not the stuff of cocktail-party conversation. But a fast-growing category of fixed-income investments promises to change that, transforming stodgy bonds into a vehicle for corporate governance, social and environmental change.

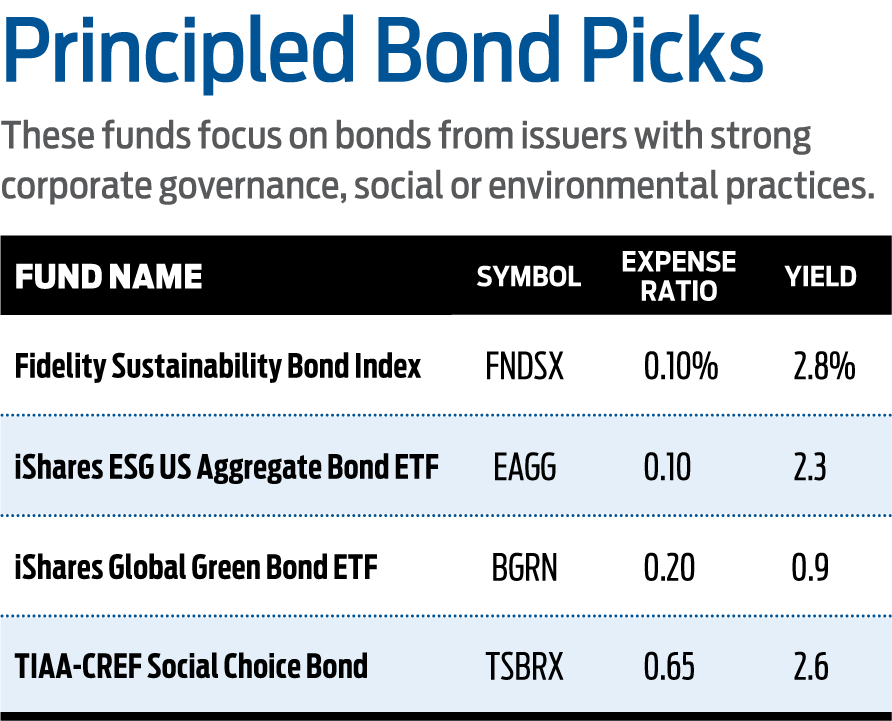

These “sustainable” bond funds include broadly diversified index funds that buy bonds from issuers with solid environmental, social and governance (ESG) practices; actively managed funds that engage with corporate and municipal issuers to fund ESG-related projects; and more specialized offerings, such as funds that buy environmentally focused “green” bonds.

The number of sustainable bond funds has grown quickly as investors recognize the potential credit implications of climate change, product safety and other ESG risks. There were 58 taxable sustainable bond funds at the end of 2018, up from 34 a year earlier, according to investment research firm Morningstar, and they cover the fixed-income waterfront from ultra-short-term to emerging markets bonds.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

These funds aren’t just feel-good investments. Tilting a fixed-income portfolio toward bonds that score well on ESG measures generally leads to higher returns, according to a 2018 report by Barclays.

Know the Risks

But these funds can also present challenges for investors Some invest in small issues that can be difficult to trade, so investors will want reassurance that the manager is adept at managing liquidity risks. What’s more, ESG scoring is complex, and methodologies vary from one research firm to the next.

Sizing up ESG risks can be particularly thorny for bond investors. Environmental risks that may be minimal for a one-year bond, for example, may be critical for a 30-year bond, says Henry Shilling, founder and research director at Sustainable Research and Analysis, in New York City.

These funds don’t have to be pricey or complex. Low-cost, broadly diversified bond funds that track indexes composed of ESG leaders include Fidelity Sustainability Bond Index fund and iShares ESG US Aggregate Bond exchange-traded fund, both launched last year.

Other funds take a more active approach and engage directly with issuers. In the TIAA-CREF Social Choice Bond fund, about two-thirds of assets are devoted to the bonds of ESG leaders, while roughly one-third is focused on impact investing—seeking measurable change alongside financial return. That approach allows the fund to work with some issuers who might not pass its standard ESG screens, says Stephen Liberatore, the fund’s manager. The fund wouldn’t buy the corporate debt of utility company Exelon, for example, because of its nuclear power operations, he says, but it has worked with Exelon’s renewable energy subsidiary to invest in bonds that fund wind farms.

Investors with an environmental focus might also consider green bond funds, which hold bonds that fund projects with environmental or climate benefits. The iShares Global Green Bond ETF, launched last year, holds U.S. and international investment-grade green bonds and hedges out currency fluctuations to give investors a smoother ride. Read a fund’s prospectus, annual reports and manager commentary to understand its sustainability strategy. Some funds fully integrate ESG criteria into every aspect of their investment process, while for others, ESG is just one among many factors considered. In many cases, “there’s very little disclosure around actual impact,” Shilling says. But some funds, including the iShares green bond ETF and TIAA-CREF Social Choice Bond, produce impact reports that translate their investments into energy saved, carbon emissions avoided and other measurable results.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

What Fed Rate Cuts Mean For Fixed-Income Investors

What Fed Rate Cuts Mean For Fixed-Income InvestorsThe Fed's rate-cutting campaign has the fixed-income market set for an encore of Q4 2024.

-

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)State Taxes Living in one of these places could lower your 2025 investment taxes — especially if you invest in real estate.

-

The Final Countdown for Retirees with Investment Income

The Final Countdown for Retirees with Investment IncomeRetirement Tax Don’t assume Social Security withholding is enough. Some retirement income may require a quarterly estimated tax payment by the September 15 deadline.

-

457 Plan Contribution Limits for 2026

457 Plan Contribution Limits for 2026Retirement plans There are higher 457 plan contribution limits in 2026. That's good news for state and local government employees.

-

Medicare Basics: 12 Things You Need to Know

Medicare Basics: 12 Things You Need to KnowMedicare There's Medicare Part A, Part B, Part D, Medigap plans, Medicare Advantage plans and so on. We sort out the confusion about signing up for Medicare — and much more.

-

The Seven Worst Assets to Leave Your Kids or Grandkids

The Seven Worst Assets to Leave Your Kids or Grandkidsinheritance Leaving these assets to your loved ones may be more trouble than it’s worth. Here's how to avoid adding to their grief after you're gone.

-

SEP IRA Contribution Limits for 2026

SEP IRA Contribution Limits for 2026SEP IRA A good option for small business owners, SEP IRAs allow individual annual contributions of as much as $70,000 in 2025, and up to $72,000 in 2026.

-

Roth IRA Contribution Limits for 2026

Roth IRA Contribution Limits for 2026Roth IRAs Roth IRAs allow you to save for retirement with after-tax dollars while you're working, and then withdraw those contributions and earnings tax-free when you retire. Here's a look at 2026 limits and income-based phaseouts.