Pushing the FDIC $250,000 Limit

If your bank or credit union balance exceeds the limit, you can still be covered by FDIC insurance with planning.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Question: I inherited more than $250,000 in cash. Do you recommend leaving funds for the short term in a regular bank account that only has the normal $250,000 of FDIC insurance?

Answer: Bank failures have been rare in the past few years. When the FDIC closed the Enloe State Bank of Cooper, Tex., in May, it marked the first bank failure since December 2017. If your money is in a large bank, it’s extremely unlikely that it will go under, and your risk is even lower if you don’t plan to leave the excess deposits in the bank for long. But if you want the peace of mind that this important federal protection provides, there are several steps you can take to make sure the amount of the estate that exceeds the limit is insured.

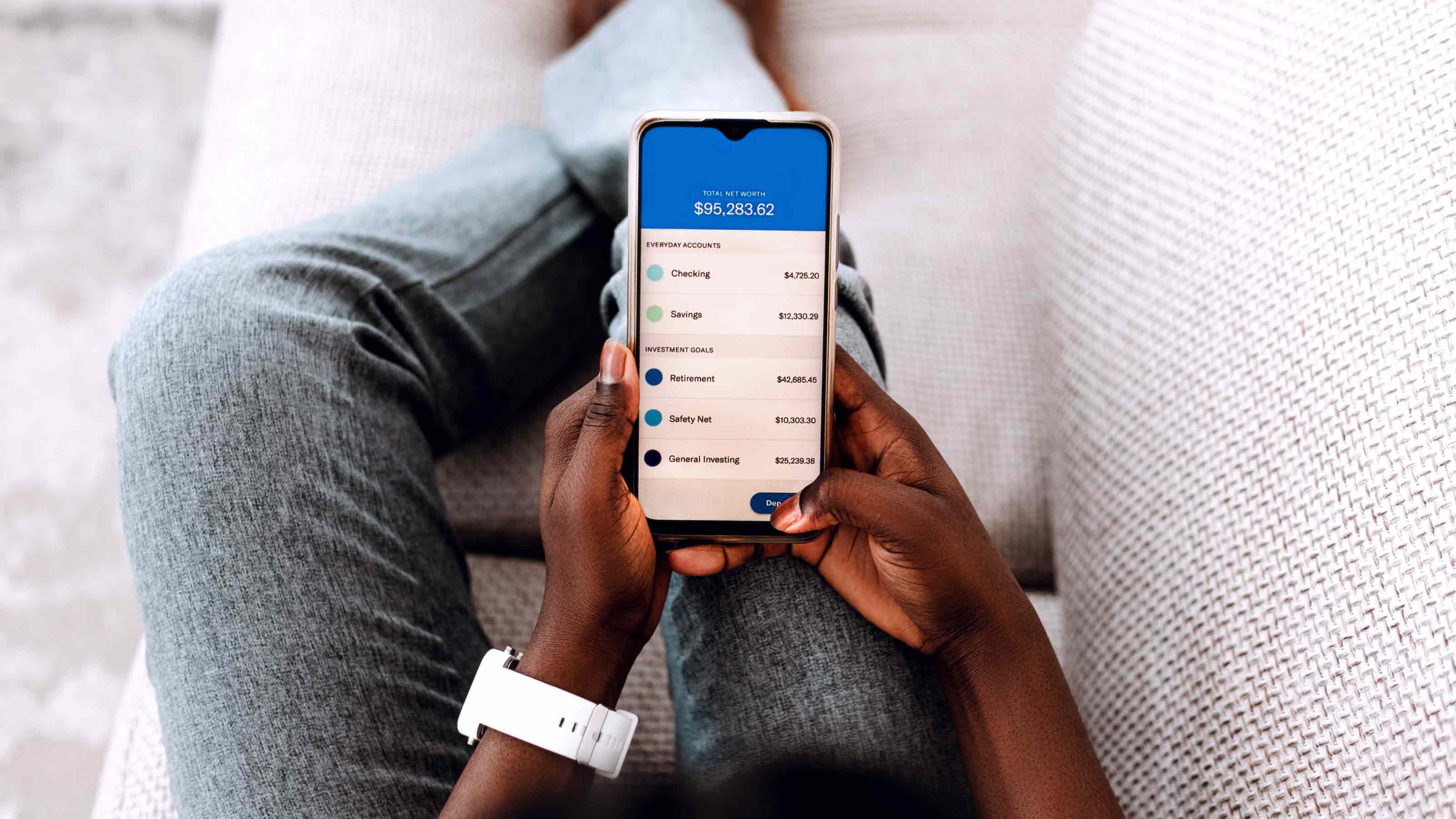

The FDIC insures up to $250,000 per person, per bank, per ownership category. (Credit union deposits are insured under the same terms by the National Credit Union Share Insurance Fund.) Coverage is automatic whenever you open an account at an FDIC-insured bank (you can check an institution’s eligibility at https://research.fdic.gov/bankfind). Checking accounts, savings accounts, money market deposit accounts and certificates of deposit are covered by insurance. Annuities, mutual funds, stocks and bonds aren’t covered, even if you buy them from a bank.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

If a bank closes, the FDIC usually pays insurance within two business days, either by providing depositors with a new account at another insured bank or by issuing a check for the insured balance of the account at the failed bank. Customers with uninsured deposits won’t be reimbursed until the bank is liquidated, and they may receive only a portion of their savings.

One of the easiest ways to increase the amount of insured deposits is to open accounts under different ownership categories. If you and your spouse or significant other have a joint account (or accounts) at an FDIC-insured institution, you’ll each receive $250,000 in coverage for your joint-account balances, plus $250,000 per person for any individual accounts you have, for a total of up to $1 million.

Another way to increase coverage is by spreading your money around to multiple FDIC-insured banks. If you’re looking for competitive rates, MaxMyInterest.com will spread your cash among high-yield savings accounts at insured banks for a quarterly fee of 0.02% of your cash balance. If you want to invest in CDs at multiple insured institutions, go to the Certificate of Deposit Registry Service (www.cdars.com).

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Block joined Kiplinger in June 2012 from USA Today, where she was a reporter and personal finance columnist for more than 15 years. Prior to that, she worked for the Akron Beacon-Journal and Dow Jones Newswires. In 1993, she was a Knight-Bagehot fellow in economics and business journalism at the Columbia University Graduate School of Journalism. She has a BA in communications from Bethany College in Bethany, W.Va.

-

The Cost of Leaving Your Money in a Low-Rate Account

The Cost of Leaving Your Money in a Low-Rate AccountWhy parking your cash in low-yield accounts could be costing you, and smarter alternatives that preserve liquidity while boosting returns.

-

I want to sell our beach house to retire now, but my wife wants to keep it.

I want to sell our beach house to retire now, but my wife wants to keep it.I want to sell the $610K vacation home and retire now, but my wife envisions a beach retirement in 8 years. We asked financial advisers to weigh in.

-

How to Add a Pet Trust to Your Estate Plan

How to Add a Pet Trust to Your Estate PlanAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Best One-Year CD Rates

Best One-Year CD RatesSavings The best 1-year CD rates are a smart way to achieve short-term savings goals.

-

What Is a High-Yield Savings Account?

What Is a High-Yield Savings Account?A high-yield savings account is essentially the same as a traditional account with one key difference — it pays a higher-than-average APY on deposits.

-

Trusting Fintech: Four Critical Moves to Protect Yourself

Trusting Fintech: Four Critical Moves to Protect YourselfA few relatively easy steps can help you safeguard your money when using bank and budgeting apps and other financial technology.

-

Four Steps to Prepare Your Finances for Divorce

Four Steps to Prepare Your Finances for DivorceDivorce is rarely easy, but getting financial paperwork in order, working with professionals and making tough decisions now can take some of the stress out of it.

-

How to Open a Savings Account Online

How to Open a Savings Account OnlineYou may be wondering how to open a savings account online. The process is usually simple and straightforward — with just a few steps you’ll be able to start saving your hard-earned cash.

-

10 Easily Fixable, But Often Overlooked, Financial Planning Items

10 Easily Fixable, But Often Overlooked, Financial Planning Itemspersonal finance It’s easy to let important financial tasks slip your mind, so take a minute to check this list for any to-do items you may have forgotten. It could make a big difference in your bottom line.

-

How to Keep Your Savings Safe

How to Keep Your Savings Safesavings If you want to keep your savings safe but they exceed FDIC and NCUA limits, it's time to open multiple accounts, preferably ones with high yields.

-

Money Market Account or Money Market Fund? How to Choose

Money Market Account or Money Market Fund? How to Choosemoney market accounts Whether you choose a money market account or money market fund largely depends on the money's purpose.