Credit Unions Have Deposit Insurance, Too

Accounts are covered up to the same limits as deposits at banks.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

I have money in CDs at my credit union and would like to add some more -- the rates there are slightly higher than they are at the banks I’ve considered. Are credit unions covered by the FDIC in case anything happens?

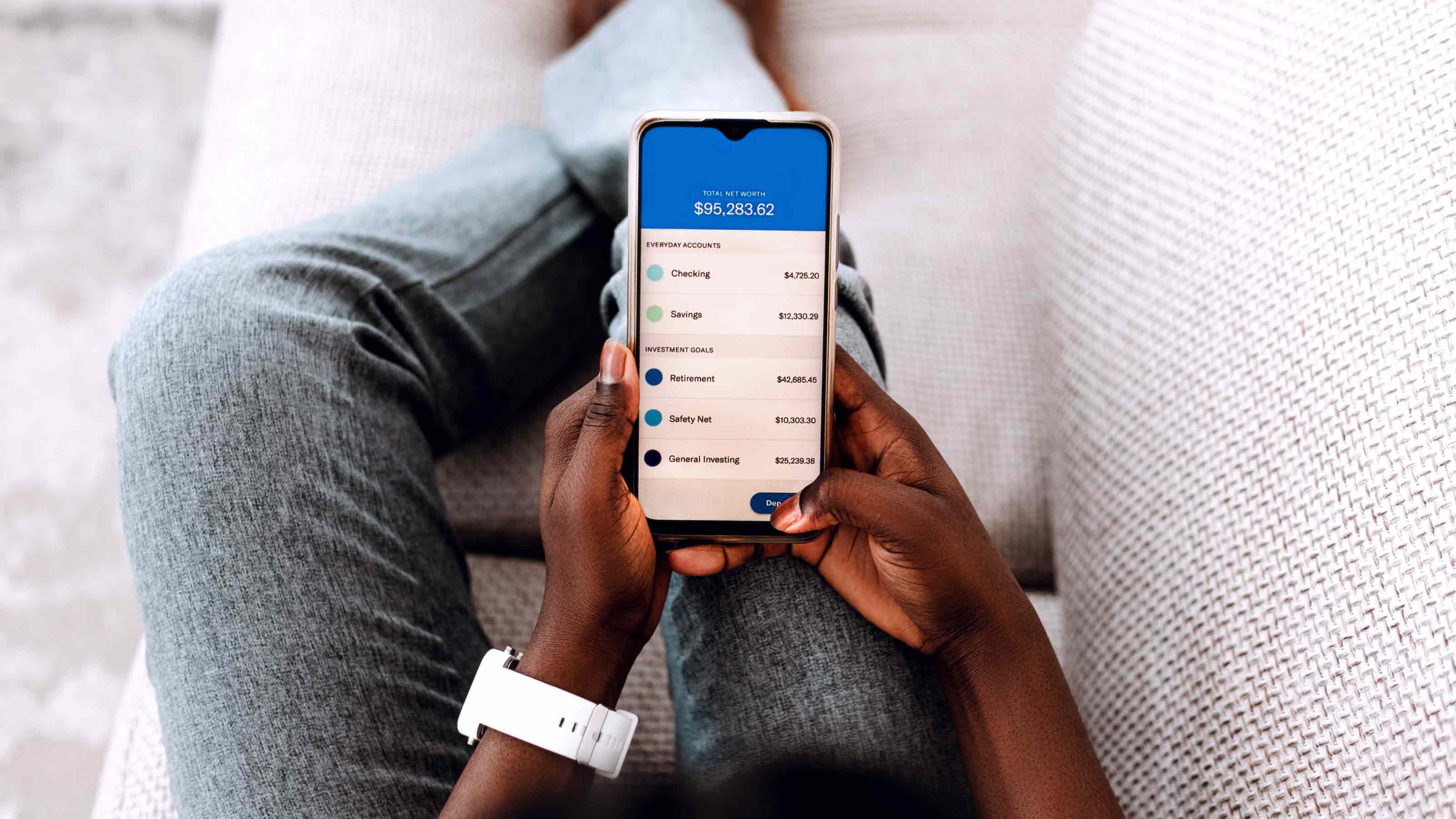

Deposits in most credit unions are covered by the National Credit Union Share Insurance Fund (NCUSIF), rather than by the FDIC. The coverage is similar, and the limits are the same as for the FDIC: The fund covers up to $250,000 for all of your individual accounts combined at each credit union, up to $250,000 for each person’s share of their joint accounts at each credit union, and up to $250,000 for all of their retirement accounts, such as IRAs, per credit union.

These limits are separate for each credit union, similar to FDIC coverage. If you have individual accounts at two credit unions, for example, then you have $250,000 in NCUSIF coverage for each account. If your balance in one account is higher than the limits, then you can add protection by moving some money to another credit union or bank, where you will have a separate set of coverage limits.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Both the NCUSIF and FDIC cover deposit accounts, such as savings accounts, checking accounts, money-market accounts and CDs. They do not insure money invested in stocks, bonds or mutual funds.

The NCUSIF is administered by the National Credit Union Administration, which is an independent federal government agency that charters and supervises federal credit unions and most state-chartered credit unions. To see if your credit union is covered by the NCUSIF, use to the Credit Union Locator and the Research a Credit Union tool.

For more information about protection for credit union deposits, see MyCreditUnion.gov and the NCUA Share Insurance Fund information page. You can calculate how much coverage you have at the Electronic Share Insurance Calculator. To check on FDIC limits for bank deposits, see the FDIC’s deposit insurance consumer pages.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

As the "Ask Kim" columnist for Kiplinger's Personal Finance, Lankford receives hundreds of personal finance questions from readers every month. She is the author of Rescue Your Financial Life (McGraw-Hill, 2003), The Insurance Maze: How You Can Save Money on Insurance -- and Still Get the Coverage You Need (Kaplan, 2006), Kiplinger's Ask Kim for Money Smart Solutions (Kaplan, 2007) and The Kiplinger/BBB Personal Finance Guide for Military Families. She is frequently featured as a financial expert on television and radio, including NBC's Today Show, CNN, CNBC and National Public Radio.

-

4 Estate Planning Documents Every High-Net-Worth Family Needs

4 Estate Planning Documents Every High-Net-Worth Family NeedsThe key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares in This Situation

How to Get the Fair Value for Your Shares in This SituationWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

Best One-Year CD Rates

Best One-Year CD RatesSavings The best 1-year CD rates are a smart way to achieve short-term savings goals.

-

What Is a High-Yield Savings Account?

What Is a High-Yield Savings Account?A high-yield savings account is essentially the same as a traditional account with one key difference — it pays a higher-than-average APY on deposits.

-

Trusting Fintech: Four Critical Moves to Protect Yourself

Trusting Fintech: Four Critical Moves to Protect YourselfA few relatively easy steps can help you safeguard your money when using bank and budgeting apps and other financial technology.

-

Four Steps to Prepare Your Finances for Divorce

Four Steps to Prepare Your Finances for DivorceDivorce is rarely easy, but getting financial paperwork in order, working with professionals and making tough decisions now can take some of the stress out of it.

-

How to Open a Savings Account Online

How to Open a Savings Account OnlineYou may be wondering how to open a savings account online. The process is usually simple and straightforward — with just a few steps you’ll be able to start saving your hard-earned cash.

-

10 Easily Fixable, But Often Overlooked, Financial Planning Items

10 Easily Fixable, But Often Overlooked, Financial Planning Itemspersonal finance It’s easy to let important financial tasks slip your mind, so take a minute to check this list for any to-do items you may have forgotten. It could make a big difference in your bottom line.

-

How to Keep Your Savings Safe

How to Keep Your Savings Safesavings If you want to keep your savings safe but they exceed FDIC and NCUA limits, it's time to open multiple accounts, preferably ones with high yields.

-

Money Market Account or Money Market Fund? How to Choose

Money Market Account or Money Market Fund? How to Choosemoney market accounts Whether you choose a money market account or money market fund largely depends on the money's purpose.