10 Ways to Turn Yourself Into a Millionaire

Our smart strategies will help you reach (or surpass) the seven-figure milestone.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

1. Start a Business

Maggie Cook, 37, had no business experience when she founded Maggie’s Salsa in 2004. Born in Mexico to American parents who ran an orphanage, she had developed a knack for making salsa. “The only thing I knew how to do was chop salsa ingredients into a bowl,” says Cook. But friends at the University of Charleston, in Charleston, W.Va., raved about her recipe, so she decided to enter it in a contest at Charleston’s Capitol Market, a year-round farmer’s market. She won.

See All 10 Ways to Make $1 Million

- Start a Business

- Save Early and Often

- Let Your Boss Help

- Don't Overspend

- Own a Home

- Buy When Stocks Are Cheap

- Look for Stocks on Steroids

- Earn Income on the Side

- Capitalize on a Windfall

- Protect Your Wealth

At the time, Cook was working full-time at an interior-design firm. With an $800 investment, she started making salsa in her kitchen. Her first two customers were stores in the Capitol Market; as her business grew, she rented commercial kitchens in Charleston and nearby Huntington, W.Va. Her big break came in 2007, when she cold-called Whole Foods. After a store representative expressed interest in her product, she loaded up her Honda Civic with salsa and drove 360 miles to Hyattsville, Md. The meeting led to a contract for 10,000 pounds of salsa a week, which enabled Cook to quit her interior-design job and focus on her business. She expanded her product line to include several kinds of dips and salsas and landed contracts with Kroger and Walmart. In 2014, Cook sold her business to Garden Fresh Gourmet, a national salsa manufacturer. (Cook declined to disclose the terms of the deal, but at the time, she was bringing in revenues of more than $1 million a year.) In 2015, Campbell Soup bought Garden Fresh for $231 million.

Starting a successful business can make you a millionaire (or even a billionaire, if you create the next Facebook), but the risks are high. About half of all new businesses fail within the first five years. Your chances of success are greater if you start with a well-thought-out business plan that outlines your competitive strategies and your goals. You should also have a plan in place to scale up—which usually means being bought out by a larger company, selling franchises or licensing your product. Keep good records, create an operations manual and develop a diverse group of customers. Not only will your business be more likely to succeed, you’ll also make your business more attractive to deep-pocketed buyers. You can get free advice from more than 11,000 small-business volunteers through Score, a nonprofit organization supported by the Small Business Administration.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Cook, who briefly lived in her car because she couldn’t afford rent, credits her success to her willingness to ride out the difficult times. “The biggest thing I’ve had is perseverance,” she says.

Self-starters who want a template for their business can purchase a franchise. A franchisee typically acquires the right to use a franchise’s name and business system for a specified period of time. Franchisors may also provide training, advertising and help finding a location. Start-up costs typically range from $50,000 to $200,000, depending on the franchise; fees are much higher for well-known chains.

For example, the minimum start-up fee for a Visiting Angels franchise, which provides home care for seniors, is about $69,000; franchisees must also have between $40,950 and $48,950 in cash and a net worth of at least $100,000. In addition, you’ll probably have to fork over a percentage of your monthly gross revenue. Successful franchisees often have more than one store. Several websites rate franchises, including Franchise Business Review.

See All 10 Ways to Make $1 Million

- Start a Business

- Save Early and Often

- Let Your Boss Help

- Don't Overspend

- Own a Home

- Buy When Stocks Are Cheap

- Look for Stocks on Steroids

- Earn Income on the Side

- Capitalize on a Windfall

- Protect Your Wealth

2. Save Early and Often

A portfolio worth $1 million is the gold standard for many new retirees. Depending on where you live and how much you can count on from guaranteed sources of income, it’s often enough for a secure retirement.

Employer-provided retirement plans offer the best route to success. Contributions to a 401(k) are pretax, which lowers your taxable income. Money inside the account grows unfettered by taxes, which boosts your annual return.

The sooner you start saving, the more likely you’ll reach your goal, but you must be willing to increase your contributions. Nearly 60% of companies with 401(k) plans automatically enroll new employees, usually at a 3% contribution rate. But that will leave you short of your goal. For example, if a 30-year-old makes $60,000 a year and contributes 3% a year, he’ll have about $367,000 by the time he’s 65 (that assumes a 3% annual raise and a 7% rate of return). But if he bumps up his contributions to 10%, he’ll end up with $1.2 million.

If your employer matches contributions (and the vast majority of large companies do), you’ll have an even better shot at reaching the million-dollar milestone. If the same 30-year-old earns $60,000 and contributes 10% of his salary to a 401(k) plan with a 50% company match of up to 6% of pay, by age 65 he will have nearly $1.6 million.

See All 10 Ways to Make $1 Million

- Start a Business

- Save Early and Often

- Let Your Boss Help

- Don't Overspend

- Own a Home

- Buy When Stocks Are Cheap

- Look for Stocks on Steroids

- Earn Income on the Side

- Capitalize on a Windfall

- Protect Your Wealth

3. Let Your Boss Help

Some employers provide valuable benefits that can help you reach your $1 million goal. For example, about 18% of private workers and more than 80% of public workers are eligible for a traditional pension. And restricted stock units—shares given to employees after a vesting date—can be lucrative if your company’s stock performs well, as any number of Silicon Valley millionaires can attest. For example, a Google employee with 1,400 restricted stock units would have a nest egg valued at more than $1 million.

Another benefit that could be worth a lot more than you think: a health savings account. To qualify for an HSA, you must sign up for a high-deductible health insurance plan. In 2016, you can contribute up to $3,350 to an individual HSA or $6,750 to a family plan. Over time, contributions to an HSA can add up because HSAs offer a triple tax advantage: Contributions are sheltered from income taxes, the money grows tax-deferred, and funds can be withdrawn tax-free in any year for medical expenses. About half of large companies match contributions to an HSA; the average employer match is about $900.

To truly tap the power of an HSA, use money outside of the account to pay medical bills and let the money in the account grow. After you sign up for Medicare (when contributions to an HSA are no longer allowed), you can reimburse yourself for any eligible expenses you incurred after you first opened the HSA, plus pay for retirement health expenses—including long-term care.

4. Don’t Overspend

See All 10 Ways to Make $1 Million

- Start a Business

- Save Early and Often

- Let Your Boss Help

- Don't Overspend

- Own a Home

- Buy When Stocks Are Cheap

- Look for Stocks on Steroids

- Earn Income on the Side

- Capitalize on a Windfall

- Protect Your Wealth

Even people who live in modest homes, drive used cars and go camping on their vacations can undermine their thriftiness by committing money missteps. Overspending on children, for example, can be a big temptation, and it’s particularly strong when it’s time to send your kids to college. If you reduce or eliminate contributions to your savings plans to pay for college, you’ll be hard-pressed to make up for those lost years of compounding. A better strategy:

Select a college your family can afford without racking up debt—or encourage your children to take out federal student loans (as long as you keep a lid on the amount).

Paying more than you owe to the IRS is another mistake that could leave you short of your goal. About two-thirds of taxpayers claim the standard deduction, but millions would pay a lower tax bill if they itemized deductions, according to H&R Block’s Tax Institute. Homeowners typically benefit most from itemizing, but renters who pay high state income taxes and make large charitable contributions could also save money if they itemized. And those savings could help to grow your million-dollar kitty.

Taxes may also hobble your investment returns, particularly in your taxable accounts. Tax-free municipal bonds are a good choice for these accounts, as are stock index funds and other investments that qualify for lower long-term capital-gains rates.

5. Own a Home

Derek and Lauren Ross didn’t buy their home in Oak Park, Calif., because they thought it would make them rich. They bought it because the community of 14,000, about 40 miles from Los Angeles, has some of the best schools in California, plus lots of parks and open space. Nonetheless, their investment has paid off. They bought their two-story home in 2002 for about $542,000. Today it’s worth more than $800,000, Derek estimates.

Home prices don’t always rise, of course, and the housing bust wiped out the equity of plenty of homeowners. But over the long term, you’re more likely to reach your $1 million goal if you own a home than if you rent. When you buy a home with a fixed-rate mortgage, you basically lock in your monthly housing payment. If your income rises, you’ll pay an increasingly smaller share of it on housing, which means you’ll have more to save and invest.

See All 10 Ways to Make $1 Million

- Start a Business

- Save Early and Often

- Let Your Boss Help

- Don't Overspend

- Own a Home

- Buy When Stocks Are Cheap

- Look for Stocks on Steroids

- Earn Income on the Side

- Capitalize on a Windfall

- Protect Your Wealth

Low interest rates have also made homeownership more affordable. The average rate for a 30-year, fixed-rate mortgage has been less than 5% since 2009. The National Association of Realtors’ housing affordability index estimates that at the end of 2015, mortgage payments consumed only about 15.3% of household income, based on median family income and median home prices.

Derek says they refinanced several times to lower their interest rate and made some changes to the yard that reduced their water bills—an increasingly significant expense in California. “The value of our home has increased dramatically, but our overall expenses have gone down,” he says.

Homeowners can deduct interest on up to $1.1 million of mortgage debt. This deduction is particularly valuable during the first half of your mortgage term, when most of your monthly payment will consist of interest. But the most lucrative tax break comes when it’s time to sell. As long as the home is your primary residence and you’ve lived in it for two of the past five years, you can reap up to $250,000 in tax-free profit, or $500,000 if you’re married.

The equity you’ve accumulated gives you options that can increase your wealth. You can use payments from a reverse mortgage—or money from selling your home, if you plan to downsize—to supplement retirement income. Then you can let other investments grow or delay taking Social Security benefits. If you wait to claim benefits until after your full retirement age (between 66 and 67, depending on when you were born), you’ll earn a delayed-retirement credit worth 8% a year for each year you delay until age 70.

See All 10 Ways to Make $1 Million

- Start a Business

- Save Early and Often

- Let Your Boss Help

- Don't Overspend

- Own a Home

- Buy When Stocks Are Cheap

- Look for Stocks on Steroids

- Earn Income on the Side

- Capitalize on a Windfall

- Protect Your Wealth

6. Buy When Stocks Are Cheap

A stock market slide like the one that occurred earlier this year may be nerve-racking if you need to cash out your investments. But stocks still offer the best choice if your long-term goal is to hit the million-dollar mark.

How long it takes you to reach seven figures depends on how much you start with, how much you add to your kitty and how often, and how much you earn on your investments. Over the long haul, U.S. stocks have returned an annualized 10%, including dividends. Building at that rate, it would take a bit less than 32 years to turn $50,000 into $1 million. If you invest $10,000 per year, it would take 24 years to reach the milestone. (The calculations assume that you invest in a tax-deferred account.)

But now, seven years into a bull market that has seen share prices more than triple from the 2009 bottom, many pros expect less-generous returns in the future. For example, Jim Paulsen, chief strategist at Wells Capital Management, estimates that stocks will return an average of 6.5% a year for the next decade. If his projection is right, it will take 31 years to reach $1 million if you invest $10,000 per year.

As the market’s performance since the financial crisis underscores, taking advantage of big declines to buy stocks can pay off handsomely. Few of us will be lucky enough to time the next big upward move perfectly. What’s key is that the more share prices drop, the greater the future opportunity. So one way to boost your gains is to set thresholds for buying on the dips. You could do so after a decline of 10%, for example. And if stock prices fall another 10%, buy more.

Staying disciplined in the face of downturns should pay off. “One of the biggest mistakes people make is that they pull money out of stocks when things look cloudy,” says Princeton economist Burton Malkiel. You should be doing the opposite. Before you know it, you may be sitting on a million bucks.

See All 10 Ways to Make $1 Million

- Start a Business

- Save Early and Often

- Let Your Boss Help

- Don't Overspend

- Own a Home

- Buy When Stocks Are Cheap

- Look for Stocks on Steroids

- Earn Income on the Side

- Capitalize on a Windfall

- Protect Your Wealth

7. Look for Stocks on Steroids

The surest way to make a million bucks in stocks is to go for growth and not worry so much about the price. Your chances of earning spectacular returns improve if you hop aboard companies that are generating equally spectacular sales and profit growth. And you don’t need to take a flier on small technology firms.

Consider the 30 best-performing stocks over the past 15 years. Not surprisingly, the roster includes such familiar tech firms as Apple (symbol AAPL) and Amazon.com (AMZN). But their returns pale beside that of retailer Tractor Supply (TSCO), which we recommended in our October 2001 issue. If you had invested in Tractor back then, you’d have earned 9,222%, an average of 36% per year. And if you hit the jackpot with the top 15-year stock, Monster Beverage (MNST), you’d be up by more than 48,000%, turning a $10,000 investment into $4.9 million today.

Finding the next monster stock isn’t easy; if it were, we’d all be multimillionaires. But dynamic, innovative companies that have long runways for growth offer the best chances of supersized returns. Consider Acuity Brands (AYI, $200), one of North America’s top makers of lighting products, such as LED bulbs and fixtures, sensors and control systems. Sales for commercial buildings are growing steadily. Acuity is also developing digital lighting products for the “Internet of things” (the expanding web connecting everything from buildings to appliances). Analysts see sales rising 20%, to $3.3 billion, in the fiscal year that ends in August, and profits soaring 39%, to $7.50 per share.

Also compelling is Icon PLC (ICLR, $71), an Ireland-based company that helps drugmakers test their products in laboratories and conduct late-stage clinical trials. Pharmaceutical firms are contracting out more of their research to try to bring products to market more quickly and less expensively. That creates long-term “growth tailwinds” for Icon, says Morningstar analyst Stefan Quenneville. Wall Street expects sales of $1.8 billion this year (an increase of 8% from 2015) and forecasts that profits will jump 19%, to $5.25 per share.

Finally, you may be able to cash in on big tech firms that still have excellent long-term prospects. Both online travel giant Priceline (PCLN, $1,296) and cloud software company Salesforce.com (CRM, $70) are boosting sales at a rate of more than 15% a year.

8. Earn Income on the Side

A part-time job or side gig courtesy of the sharing economy could be the ticket to generating some extra cash. If you invest the money or use it to, say, help you buy a house, you’ll get closer to your $1 million goal.

Danielle and Joe Haymes of Houston found a side gig they love two years ago after searching for a place to board their two dachshunds. Danielle is a technology instructor for a local school district and Joe is a sales manager, but they decided to become dog sitters on the side after learning about DogVacay, which matches pet sitters with dog owners. The Haymeses usually take in three to four dogs at a time, depending on their schedules. In 2015, they earned about $13,000; the year before, they earned about $12,000. (Sitters set their own rates and pay 20% to DogVacay.) That income alone might not make them millionaires, but they’re planning to use it as leverage to reach a larger goal: They have saved most of the money as a down payment on their dream house in a neighborhood with a great school district.

See All 10 Ways to Make $1 Million

- Start a Business

- Save Early and Often

- Let Your Boss Help

- Don't Overspend

- Own a Home

- Buy When Stocks Are Cheap

- Look for Stocks on Steroids

- Earn Income on the Side

- Capitalize on a Windfall

- Protect Your Wealth

Danielle says business is so good that they’ve had to turn away some customers. She and her husband don’t mind receiving late-night texts from worried dog owners because they love caring for their pets. “I’ve gotten thank-you cards and presents because dog parents feel so much better leaving their dogs with us rather than a kennel,” she says.

That kind of enthusiasm is critical to a successful side hustle. “You’re not going to stay up until 3 a.m. working at your side job and then get up at 6:00 and go to your day job if it’s not something you’re passionate about,” says Maria James, a career consultant based in Baltimore. James tells clients who are looking for work on the side to write down their interests and their skills, both at their day jobs and outside their regular jobs.

Side gigs can benefit retirees, too. The extra income will allow your savings to grow and help you postpone taking Social Security. Look for opportunities at www.retirementjobs.com, which lists jobs in fields such as tax preparation and caregiving; www.encore.org, which focuses on jobs in the nonprofit sector; and www.coolworks.com, which lists seasonal jobs in national parks and other outdoor settings.

9. Capitalize on a Windfall

See All 10 Ways to Make $1 Million

- Start a Business

- Save Early and Often

- Let Your Boss Help

- Don't Overspend

- Own a Home

- Buy When Stocks Are Cheap

- Look for Stocks on Steroids

- Earn Income on the Side

- Capitalize on a Windfall

- Protect Your Wealth

Unless you come from a super-rich family, you probably won’t inherit a million dollars when one of your family members dies. Still, there’s a good chance that a modest windfall will come your way. Two-thirds of boomers will receive an inheritance during their lifetime, according to the Center for Retirement Research at Boston College. The median amount is $64,000, but wealthier parents of boomers plan to leave much more, boosting the average amount to $292,000.

That may not be enough money to quit your day job, but with proper planning, it can help you reach your goal of $1 million. For example, after 20 years, a $292,000 investment would be worth more than $1.1 million, assuming a 7% average annual rate of return. But if you find yourself in that fortunate position, don’t make any decisions right away. Most financial planners recommend stashing your windfall in a bank account for six months to a year to educate yourself about the investment options.

Plus, putting money aside will help you resist the urge to splurge, says Tim Steffen, director of financial planning for Baird’s Private Wealth Management group. Otherwise, says Steffen, “you take a trip and buy a car and the next thing you know, $100,000 is gone.” Putting your windfall on ice will also help you avoid the temptation to start a business without a solid plan or invest in your brother-in-law’s llama farm.

Use the time to put together a financial team: a certified financial planner, an accountant and, depending on the circumstances, a lawyer and an insurance professional. A good team will help you figure out the best way to deploy your windfall, based on your age and goals. For example, the money could provide a down payment on a home for you (or your adult kids) or pay for college. Or it could help you pump up retirement savings. If you stash a windfall in taxable investments, when you take withdrawals in retirement, you’ll be taxed at long-term capital-gains rates. Those rates max out at 20% (most investors pay 15%) and will likely be lower than the ordinary income tax rate you’ll owe on withdrawals from tax-deferred retirement plans.

See All 10 Ways to Make $1 Million

- Start a Business

- Save Early and Often

- Let Your Boss Help

- Don't Overspend

- Own a Home

- Buy When Stocks Are Cheap

- Look for Stocks on Steroids

- Earn Income on the Side

- Capitalize on a Windfall

- Protect Your Wealth

10. Protect Your Wealth

Okay, arming yourself with insurance won’t make you rich, but it can prevent your fortune from being wiped out if, say, you’re found liable for a car accident or you need care in a nursing home.

Umbrella liability insurance will protect your assets and future income, as well as legal fees, if you’re sued and are required to pay damages. The policies typically pick up after you’ve exhausted liability coverage from your home and car insurance. Most insurers require you to have at least $300,000 in liability coverage on both your home and auto before you can buy umbrella insurance. Premiums generally cost $150 to $200 a year for $1 million in coverage. Increasing that amount to $2 million costs an additional $75 to $100.

Health care costs represent another threat to your wealth, particularly as you get older. A stay in a nursing home can run from $70,000 to $100,000 a year—and twice that much in higher-cost areas. You can protect your assets by purchasing long-term-care insurance, but these policies are pricey. One strategy to keep premiums in check is to estimate how much you could cover from savings and buy a lower-cost policy to fill the gap. Married couples can lower premiums by purchasing a shared-benefit policy that provides a pool of benefits both spouses can use.

If you get a policy, most financial advisers recommend buying it in your fifties or early sixties, before you develop medical conditions that will make you ineligible for preferred health discounts. Look for a policy that covers home care, an assisted-living facility and a nursing home. For a 60-year-old couple, annual premiums for a policy with a three-year benefit period and a 90-day deductible range from $2,985 to $4,190, according to the American Association for Long-Term Care Insurance (see Make Long-Term-Care Coverage Affordable).

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Block joined Kiplinger in June 2012 from USA Today, where she was a reporter and personal finance columnist for more than 15 years. Prior to that, she worked for the Akron Beacon-Journal and Dow Jones Newswires. In 1993, she was a Knight-Bagehot fellow in economics and business journalism at the Columbia University Graduate School of Journalism. She has a BA in communications from Bethany College in Bethany, W.Va.

-

Look Out for These Gold Bar Scams as Prices Surge

Look Out for These Gold Bar Scams as Prices SurgeFraudsters impersonating government agents are convincing victims to convert savings into gold — and handing it over in courier scams costing Americans millions.

-

How to Turn Your 401(k) Into A Real Estate Empire

How to Turn Your 401(k) Into A Real Estate EmpireTapping your 401(k) to purchase investment properties is risky, but it could deliver valuable rental income in your golden years.

-

My First $1 Million: Retired Nuclear Plant Supervisor, 68

My First $1 Million: Retired Nuclear Plant Supervisor, 68Ever wonder how someone who's made a million dollars or more did it? Kiplinger's My First $1 Million series uncovers the answers.

-

9 Types of Insurance You Probably Don't Need

9 Types of Insurance You Probably Don't NeedFinancial Planning If you're paying for these types of insurance, you may be wasting your money. Here's what you need to know.

-

10 Retirement Tax Plan Moves to Make Before December 31

10 Retirement Tax Plan Moves to Make Before December 31Retirement Taxes Proactively reviewing your health coverage, RMDs and IRAs can lower retirement taxes in 2025 and 2026. Here’s how.

-

Will AI Videos Disrupt Social Media?

Will AI Videos Disrupt Social Media?The Kiplinger Letter With the introduction of OpenAI’s new AI social media app, Sora, the internet is about to be flooded with startling AI-generated videos.

-

The Rubber Duck Rule of Retirement Tax Planning

The Rubber Duck Rule of Retirement Tax PlanningRetirement Taxes How can you identify gaps and hidden assumptions in your tax plan for retirement? The solution may be stranger than you think.

-

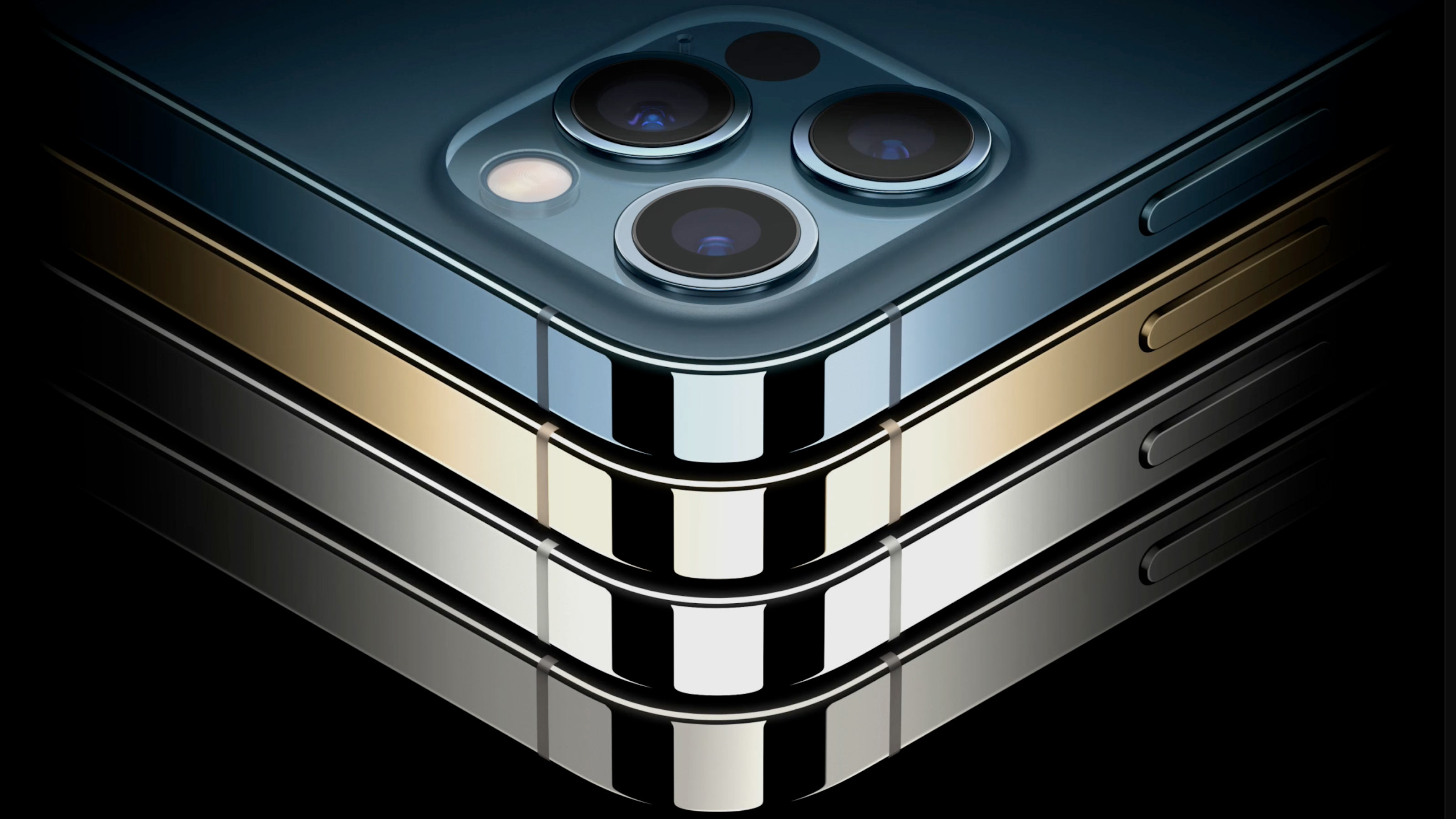

Apple Readies for AI Upgrade with New iPhones

Apple Readies for AI Upgrade with New iPhonesThe Kiplinger Letter The tech giant has stumbled when it comes to artificial intelligence, but a new batch of iPhones will help it make headway.

-

Money for Your Kids? Three Ways Trump's ‘Big Beautiful Bill’ Impacts Your Child's Finances

Money for Your Kids? Three Ways Trump's ‘Big Beautiful Bill’ Impacts Your Child's FinancesTax Tips The Trump tax bill could help your child with future education and homebuying costs. Here’s how.

-

Key 2025 Tax Changes for Parents in Trump's Megabill

Key 2025 Tax Changes for Parents in Trump's MegabillTax Changes Are you a parent? The so-called ‘One Big Beautiful Bill’ (OBBB) impacts several key tax incentives that can affect your family this year and beyond.

-

Amazon Resale: Where Amazon Prime Returns Become Your Online Bargains

Amazon Resale: Where Amazon Prime Returns Become Your Online BargainsFeature Amazon Resale products may have some imperfections, but that often leads to wildly discounted prices.