Start Saving Now

Get in the habit early, even if it’s only a small amount with each paycheck.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

If you don’t pay your rent or cell-phone bill, the consequences are immediate. If you fail to stash money in savings as soon as you start earning a paycheck, you probably won’t notice the damage right away. But the long-term fallout can be devastating if it limits your choices—whether that’s buying the house you want, sending your kids to a top college, or deciding when (or even if) you can retire.

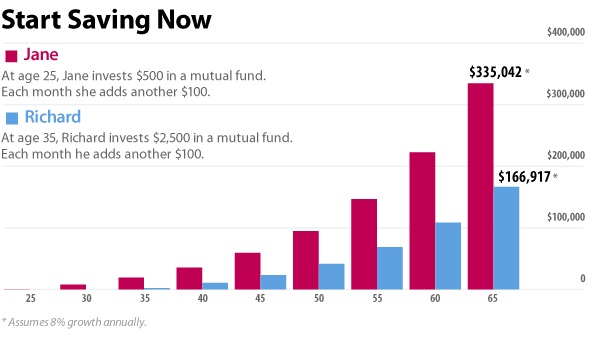

As illustrated below for example, say Jane is 25 years old and puts $500 into a mutual fund that earns 8% a year, adding $100 each month. She’ll wind up with more than $335,000 by the time she's 65, excluding taxes. Richard, on the other hand, waits until he's 35, invests $2,500 and then adds that $100 a month. All else being equal he’ll have only about $167,000 by age 65.

Pay Yourself First

If you skim savings off the top of each paycheck, the cash will disappear before you have a chance to miss it. With a 401(k) retirement plan at work, for example, your employer pulls the amount you designate from each paycheck. For other savings, you can schedule automatic transfers from your checking account. You may want to set up multiple savings accounts if that helps you track progress toward each goal more easily.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Saving for retirement is usually priority number one, but you should also create an emergency fund that holds enough cash to cover at least six months’ worth of living expenses (see Smart Money Moves for Young Adults). Then, assuming you have a plan to pay off any debts, you can move on to saving for your other goals.

Choose a Bank

Any savings that you may need to access in a pinch (and that includes your emergency fund) should reside in a bank, where your money is insured. Savings accounts and money market deposit accounts, which often pay more than regular savings accounts, are generally easy to access. At www.depositaccounts.com, look for accounts available in your area that pay top interest rates. Watch out for minimum-balance requirements and monthly maintenance or transfer charges.

You don’t have to have a checking account and savings account in the same place. Banks are increasingly offering convenient features such as mobile check deposit, which allows you to submit a check by snapping a picture of it with your smart phone. Online banks, such as Ally Bank and Evantage Bank, let you perform many of the same transactions as a traditional bank.

Wherever you put your money, watch for fees. If you regularly get cash from other banks’ ATMs, you could pay hundreds of dollars a year in extra charges. Some banks will reimburse you for fees that other banks charge you for using their ATMs; the State Farm Bank Free Checking Account, for one, will refund all ATM charges if you have direct deposit. Other institutions are members of large, surcharge-free ATM networks, such as the Allpoint network. Most banks waive monthly maintenance fees on checking accounts if you have a monthly direct deposit or maintain a minimum balance.

This story was originally published in the June 2014 issue of Kiplinger's Personal Finance.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Lisa has been the editor of Kiplinger Personal Finance since June 2023. Previously, she spent more than a decade reporting and writing for the magazine on a variety of topics, including credit, banking and retirement. She has shared her expertise as a guest on the Today Show, CNN, Fox, NPR, Cheddar and many other media outlets around the nation. Lisa graduated from Ball State University and received the school’s “Graduate of the Last Decade” award in 2014. A military spouse, she has moved around the U.S. and currently lives in the Philadelphia area with her husband and two sons.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Debit Cards vs Charge Cards

Debit Cards vs Charge Cardscredit & debt Whether sticking to a budget or reaping big rewards, understand whether debit cards vs charge cards are right for you.

-

Four Smart Steps To Take Before Buying Your First Home

Four Smart Steps To Take Before Buying Your First Homehome Buying your first home can be daunting. Here are four things you need to do years before you start house-hunting to prepare financially for the biggest purchase of your life.

-

The 15 Cheapest Places to Live: US Cities Edition

The 15 Cheapest Places to Live: US Cities Editionplaces to live Have a look at the cheapest places to live in America for city dwellers. Is one of the cheapest places to live in the U.S. right for you?

-

Sharing His Path to Success

Sharing His Path to SuccessStarting Out: New Grads and Young Professionals This Native American studied tech in the Air Force and landed his dream job. Now he’s giving back.

-

PODCAST: How to Find a Job After Graduation, with Beth Hendler-Grunt

PODCAST: How to Find a Job After Graduation, with Beth Hendler-GruntStarting Out: New Grads and Young Professionals Today’s successful job applicants need to know how to ace the virtual interview and be prepared to do good old-fashioned research and networking. Also, gas prices are high, but try a little global perspective.

-

Preparing for a New Life

Preparing for a New LifeStarting Out: New Grads and Young Professionals While this Afghan refugee waits for resettlement, she is working to bring her family to the U.S.

-

When It’s Time to Drop Your Parents’ Health Insurance

When It’s Time to Drop Your Parents’ Health InsuranceStarting Out: New Grads and Young Professionals Thanks to the Affordable Care Act, the uninsured rate for twenty-somethings has plummeted.

-

Financial Planning We Can Afford

Financial Planning We Can AffordFinancial Planning You don't have to be a wealthy baby boomer to hire a financial adviser.