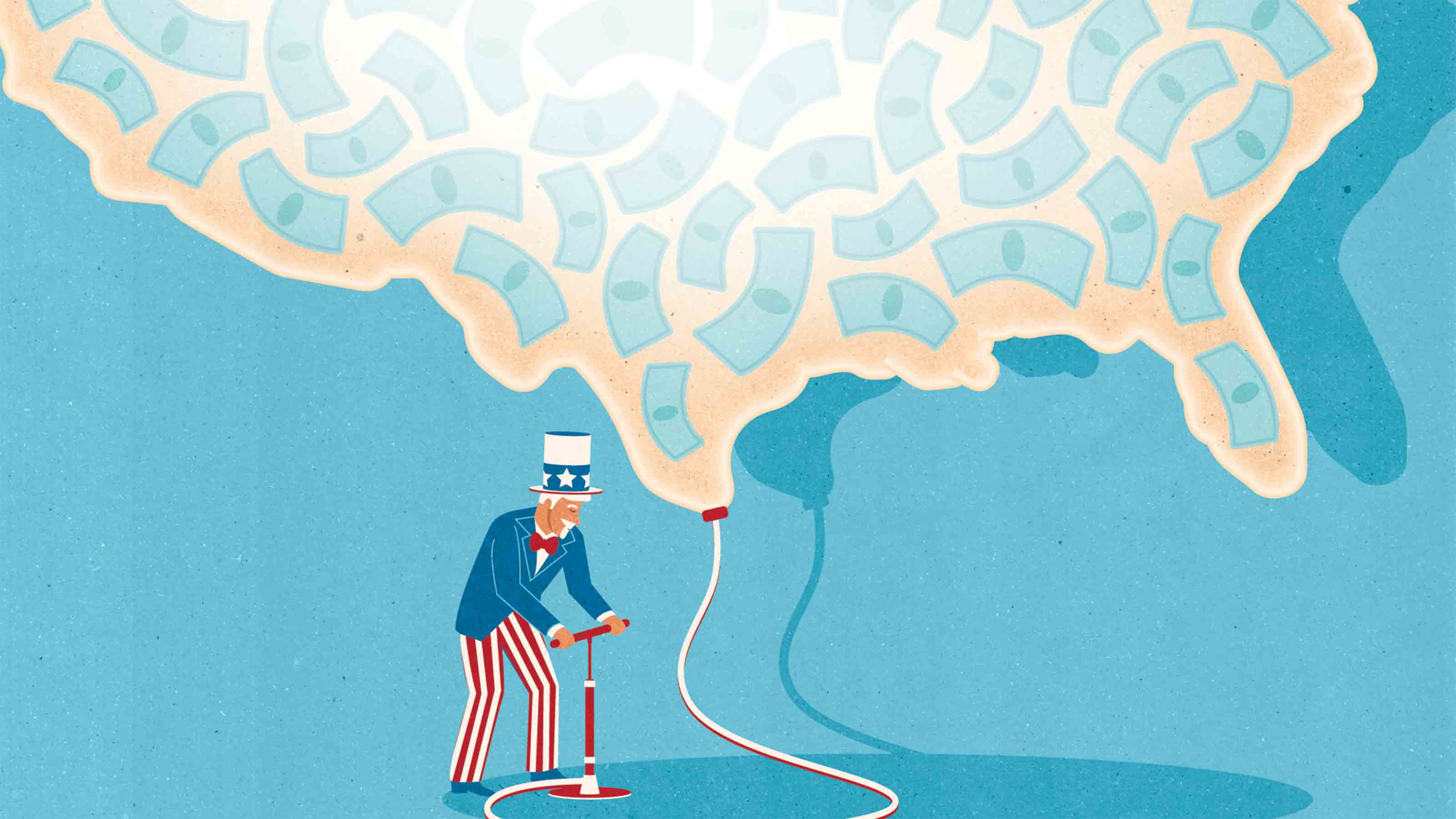

Why Health Care Reform Is No Cure-all

Its fiscal impact will be slight. But it improves the prognosis for modest efficiency gains in health care delivery.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The country’s new health care law is no more and no less than a modest, credible start at reconfiguring the vast inefficiency known as our health care system. A decade from now the share of our national income dedicated to health care will still be far greater than any other country’s, while health care outcomes will merely be average among developed countries, at best.

To judge the legislation, take a peek at what our future would look like under the status quo. According to projections from the Department of Health and Human Services, health care’s share of GDP would continue its ascent from 12% in 1990, to 16% in 2008, to 19% by 2019. According to the Social Security and Medicare Boards of Trustees, the Hospital Insurance Trust Fund would be exhausted by 2017. I agree with both assessments. And according to virtually all labor market economists, real wage gains would be slowed as employers continue shifting inexorably rising health care costs onto workers.

These trajectories wouldn’t be so disturbing if they simply reflected changing preferences, like consumers choosing to increase their spending on cable TV and cellular phones. But it’s not a choice. It is distorted incentives that are at the root of runaway health care costs. Service providers tend to overtreat, patients tend to overconsume, performance benchmarks are almost nonexistent and trade-offs are seldom entertained. (My brother-in-law, for example, has had three spinal surgeries in the past five years, courtesy of Medicare, and he hasn’t the foggiest idea what they cost. The alternative approach -- losing 50 pounds -- was considered only briefly.)

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

In this context of severe market failure and runaway costs, the health care legislation seems to pass the test, though clearly there are considerable uncertainties inherent in the projections. From the budget perspective, the plan is basically revenue neutral. An analysis by the Congressional Budget Office, an independent arm of the legislature, shows that increased benefits of $788 billion (mostly in subsidies to individuals and small businesses) are more than offset by revenues of $420 billion (mostly taxes on expensive health plans, hospitals, medical equipment and Medicare) and cost cuts of $511 billion (mostly on Medicare outlays). All told, that yields a 10-year deficit reduction of $143 billion. But since most of that deficit reduction comes from provisions having nothing to do with health care (i.e., student loans), let’s consider it a wash. Although critics say that this is only pulled off by front-loading revenues and back-loading costs -- a typical Washington ploy -- the very creditable CBO analysis indicates otherwise. It sees deficit reductions from the legislation continuing for the next decade.

But reigning in the deficit isn’t the real test. It is whether the new law will “bend the cost curve,” meeting existing health care obligations at a lower cost. And here, some modest achievements lie ahead. Myriad efficiencies are expected to trim combined Medicare and Medicaid spending by 0.7% by 2019. Critics will correctly point out that predicted savings in these programs have failed to materialize in the past, as Congress routinely reverses scheduled cost cuts. But this reform legislation takes Congress out of the picture altogether, replacing it with a more politically insulated advisory board that will focus on rewarding outcomes rather than simply slashing prices.

Efficiency-enhancing effects are also likely in the private sector, where most health spending still occurs. The tax on high-cost insurance plans, for example, will reduce the growth in private sector health care costs by 0.5% per year, according to the CBO and the congressional Joint Committee on Taxation. Increasingly transparent pricing through insurance exchanges and more diffuse usage of information technology also holds promise for greater efficiency.

Collectively, these improvements are modest, and our health care problem is far from solved. And execution will be critically important. Fortunately, there are still many containment options. This legislation does nothing, for example, to promote interstate competition among insurance carriers. Nor does it contain anything resembling tort reform. And though the health care reform bill gives employers more leeway to reward employees’ healthy lifestyle choices and discourage unhealthy ones, there’s still not enough effort nationally to encourage personal responsibility and better lifestyles. Perhaps next year?

Learn how the new health care legislation will affect your business. Join a special Kiplinger audio conference April 20. Order online now!

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

Federal Debt: A Heavy Load

Federal Debt: A Heavy LoadEconomic Forecasts The debt continues to grow, but record-low interest rates could ease the long-term damage.

-

How the Fed's Moves Affect You

How the Fed's Moves Affect YouEconomic Forecasts It’s pumping trillions of dollars into the economy and keeping rates near zero. Savers are sunk, but borrowers get a boost.

-

Consumers Will Feel Impact of Rapidly Falling Interest Rates

Consumers Will Feel Impact of Rapidly Falling Interest RatesEconomic Forecasts Mortgage and car loans will experience the most significant dips, while some holders of Treasuries may get a slight boost.

-

Will You Have to Pay More Sales Taxes on Your Online Purchases?

Will You Have to Pay More Sales Taxes on Your Online Purchases?business One thing’s for sure: Consumers who live in one of the five states without a sales tax won’t be affected by the Supreme Court’s ruling.

-

Is Credit-Card Debt Out of Control?

Is Credit-Card Debt Out of Control?credit & debt Balances are on the rise, but defaults are still low.

-

Help Wanted in America: Skilled Workers

Help Wanted in America: Skilled WorkersTechnology In an ever-more-competitive job market, technology increases the need for skilled workers.

-

The Unintended Consequences of a Boost in Overtime Pay

The Unintended Consequences of a Boost in Overtime PayBusiness Costs & Regulation New rules mean millions more employees will be overtime-eligible. But will employers find workarounds?

-

America's Perilous National Debt

America's Perilous National Debtdebt At $14 trillion and climbing, it's like "termites in the basement."