Give Your Child a Cell Phone?

Kids may try to sell you on a cell on grounds of safety and convenience. Don't fall for it unless your child is ready for the responsibility -- both in maturity and finances.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

When should a child get an expensive electronic device, such as a cell phone?

When the child is prepared to pay part of the cost and mature enough to handle the phone responsibly (which often go hand in hand).

Kids often try to sell their parents on cell phones on grounds of safety and convenience. But face it, Mom and Dad. What kids really want to do is text-message their friends, download music or play games.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Besides, cell phones aren't foolproof when it comes to safety. If your child doesn't want to be reached, she can always turn off the phone and plead the "no service" defense.

And just because your son calls to tell you he's at Johnny's house doesn't mean he's actually there. Unless you have a GPS feature (and the idea of using GPS to keep tabs on your child strikes me as extreme), you're better off calling Johnny's parents on a land line.

In addition, experts on Internet safety worry that new generations of cell phones will provide Internet access with fewer parental controls and less privacy protection for younger children.

But the most common cause of cell-phone tension is cost -- witness those TV commercials featuring parents who dread to open their cell-phone bills or freak out when they do.

Think of all the household arguments and parental palpitations that would be avoided (and commercials that wouldn't have to be made) if it was agreed in advance that parents would pay for basic service while kids pony up for overage charges, text messaging or ring tones.

Of course, this requires that kids have a measure of self-control plus the wherewithal to pay the bill. You can help by breaking down the plan into limits kids can understand. For example, 1,000 minutes per month sounds generous, but it averages out to only about 30 minutes per day. And make sure that kids know their free nights may not start until 9 p.m.

Or go with a prepaid service, provided by Cingular, TracFone, Virgin Mobile and others, that lets you control costs by paying a set fee or buying a set number of minutes. And you don't have to bother with service contracts (go to www.letstalk.com or www.cnet.com to compare plans).

With a financial stake in the outcome, your kids will be more likely to listen to you -- and less inclined to talk.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Janet Bodnar is editor-at-large of Kiplinger's Personal Finance, a position she assumed after retiring as editor of the magazine after eight years at the helm. She is a nationally recognized expert on the subjects of women and money, children's and family finances, and financial literacy. She is the author of two books, Money Smart Women and Raising Money Smart Kids. As editor-at-large, she writes two popular columns for Kiplinger, "Money Smart Women" and "Living in Retirement." Bodnar is a graduate of St. Bonaventure University and is a member of its Board of Trustees. She received her master's degree from Columbia University, where she was also a Knight-Bagehot Fellow in Business and Economics Journalism.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Smart Strategies for Paying Your Child an Allowance

Smart Strategies for Paying Your Child an AllowanceBy giving your kids money to spend and save, you’ll help them sharpen their financial skills at an early age.

-

When Tech is Too Much

When Tech is Too MuchOur Kiplinger Retirement Report editor, David Crook, sounds off on the everyday annoyances of technology.

-

I Let AI Read Privacy Policies for Me. Here's What I Learned

I Let AI Read Privacy Policies for Me. Here's What I LearnedA reporter uses AI to review privacy policies, in an effort to better protect herself from fraud and scams.

-

What Is AI? Artificial Intelligence 101

What Is AI? Artificial Intelligence 101Artificial intelligence has sparked huge excitement among investors and businesses, but what exactly does the term mean?

-

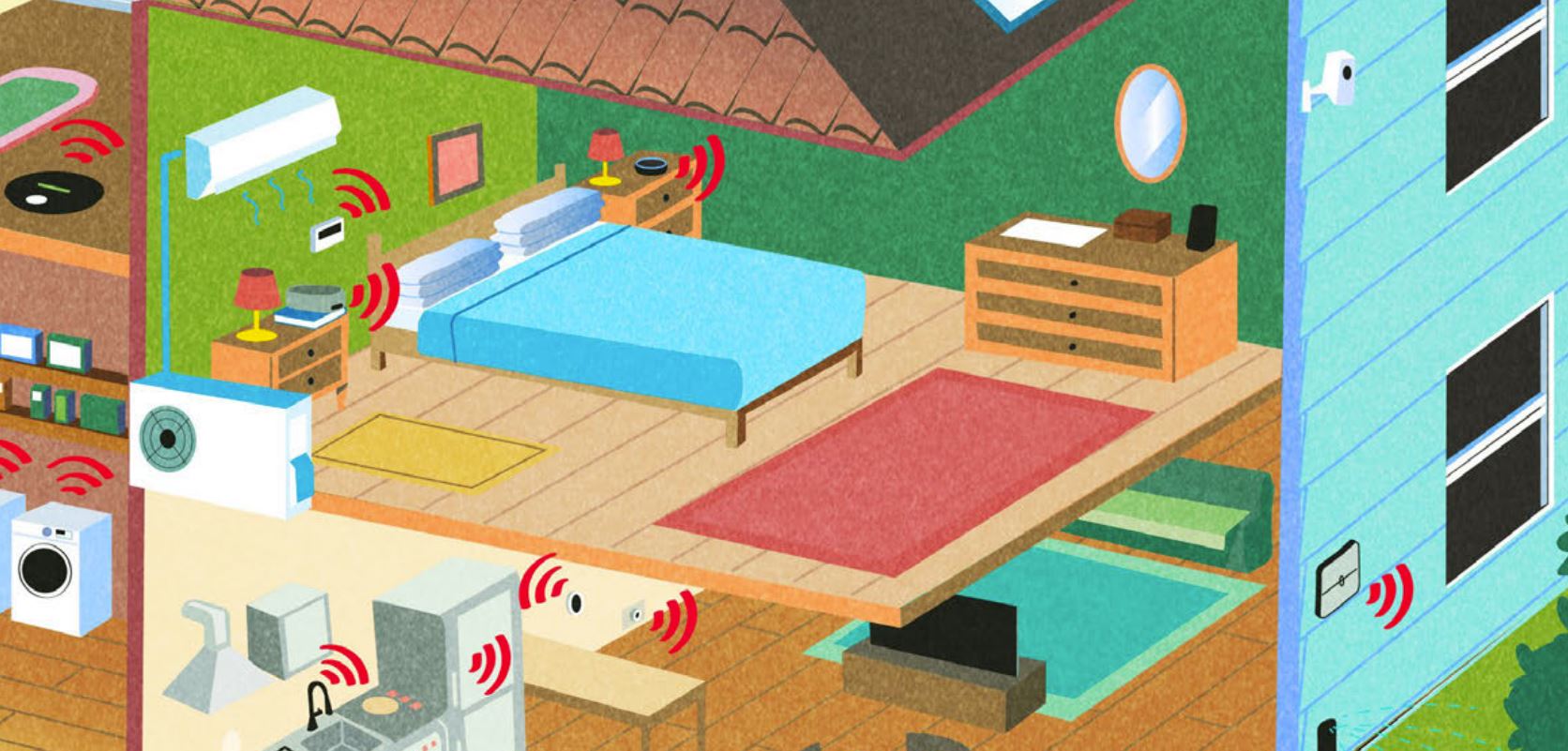

The 27 Best Smart Home Devices

The 27 Best Smart Home Devicesgadgets Innovations ranging from voice-activated faucets to robotic lawn mowers can easily boost your home’s IQ—and create more free time for you.

-

How to Motivate Kids to Save

How to Motivate Kids to Savepersonal finance It's not easy teaching your child to save. Here are some ways readers have incentivized their kids to keep track of their finances.

-

How to Choose the Right Payment App

How to Choose the Right Payment Appbanking Using PayPal, Venmo, Zelle and other apps is convenient, but there are pros and cons to each.

-

Shop for a New Wireless Plan and Save Big

Shop for a New Wireless Plan and Save BigSmart Buying Competition is fierce, and carriers are dangling free phones and streaming subscriptions.