6 Scams to Watch Out for This Holiday Season

When you're spending a lot, you become more vulnerable to identity theft and other threats.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

It's the most wonderful time of the year—for scam artists and other would-be thieves. Every time you swipe your credit card at the register or enter your personal information on a Web site, you risk having your sensitive data fall into the wrong hands. And as you count down the remaining shopping days in the season, you may let down your guard in a mad dash to check everything off your list. "The holiday season is a busy time for consumers, when we do the majority of our shopping for the year, and hackers are priming themselves for the wave of data coming in," says Yaron Samid, founder of personal finance app BillGuard (which was acquired by lending site Prosper in October 2015). "This is the Super Bowl of scam season."

To keep your holidays happy and your identity safe, be wary of these six common scams.

1. The Scam: Phishing

You get an e-mail luring you to a fake deal site promising unbelievable savings on your Christmas gifts—often popular electronics and gadgets. But it's really just a ruse to get your credit card information and other personal data.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The Fix

You can easily avoid this threat by not clicking on links in e-mails from unknown sources. Even if the e-mail seems to be from a legitimate retailer, you should type its Web address directly into your browser rather than clicking on an e-mail link, to be on the safe side.

Also, shop only at sites you are familiar with or that are recommended by a reliable source. You can check with the Better Business Bureau to verify that the merchant is legitimate. And make sure that wherever you shop online is secure: The url on any checkout page should begin with https:// and have a lock symbol next to it in the browser.

2. The Scam: Empty Gift Cards

The gift card you buy from a discount site might actually have no value. Criminals can spend the funds and replace the scratch-off material that covers the card's PIN, so the card seems unused when sold for a percentage of its face value.

The Fix

Buying discounted gift cards online is a great way to save money. You just have to be sure you use legitimate resellers. Consider trying Gift Card Granny, CardHub and Raise.

3. The Scam: Skimming

You innocently withdraw money from your checking account at the local drive-through ATM. Unfortunately, bad guys have attached a stealthy device to the machine's scanner that lifts your account information when you swipe.

The Fix

Samid recommends using only indoor ATMs because they offer additional security that is likely to deter scammers. Gas stations are also prime targets for this particular threat, so he suggests paying inside instead of at the pump. It may be less convenient, but it's not as troublesome as dealing with the repercussions of identity theft.

4. The Scam: A Fake Charity

You get an e-mail, a phone call or even an in-person request asking you to contribute to some seemingly worthy cause. But the solicitor turns out to be a fraudster who plans to take your credit card information and profit from the kindness of strangers like you. "Scammers are leveraging the fact that people are feeling particularly generous around the holidays and are more susceptible to charity requests and helping other people out," says Samid.

The Fix

Check on the legitimacy of any charity before you give. Sites such as Charity Navigator, Charity Watch and the Better Business Bureau's Wise Giving Alliance can help you verify the quality of a charity and decide whether it's worthy of your largesse. For more information, see How to Avoid Charity Scams.

5. The Scam: Nonstandard Payments

You go to make a purchase on Ebay or Craigslist, but the seller asks you to pay by money order or some other random way. "Any nonstandard forms of payment like these are almost always a scam," says Joe Siegrist, cofounder of password management site LastPass.

The Fix

Stick to the more usual ways to pay. Credit cards are a particularly safe method of payment because they come with fraud protection. You can easily dispute any unfamiliar charges.

6. The Scam: Fake Tech Support

You get an unsolicited call from someone saying he's providing assistance from the maker of your computer. Then he walks you through how to yield control over your machine. Once he has taken over, he's free to swipe any sensitive data you have stored there.

The Fix

Just say no. "Microsoft and Apple will never call you and ask you to take these types of steps, and they'll never e-mail you with these requests either," says Siegrist. "Be wary of anyone who contacts you with these requests."

Also make sure you use a unique password for each and every account you have. Apps such as Dashlane, Keeper and Siegrist's LastPass can help you create and keep track of all of them. See How to Manage Passwords for details.

Other ways you can protect yourself: Take advantage of your free annual credit report to make sure no fraudulent activity has been going on in your name. (Actually, you can get your report more than once a year.) And keep a close eye on all your account statements. If any charge, big or small, seems odd or unfamiliar, be vigilant and check whether you need to dispute it. "There is no substitute for your checking your own card statements during the holiday season," says Samid. "You are the frontline of defense."

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Rapacon joined Kiplinger in October 2007 as a reporter with Kiplinger's Personal Finance magazine and became an online editor for Kiplinger.com in June 2010. She previously served as editor of the "Starting Out" column, focusing on personal finance advice for people in their twenties and thirties.

Before joining Kiplinger, Rapacon worked as a senior research associate at b2b publishing house Judy Diamond Associates. She holds a B.A. degree in English from the George Washington University.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

When Tech is Too Much

When Tech is Too MuchOur Kiplinger Retirement Report editor, David Crook, sounds off on the everyday annoyances of technology.

-

I Let AI Read Privacy Policies for Me. Here's What I Learned

I Let AI Read Privacy Policies for Me. Here's What I LearnedA reporter uses AI to review privacy policies, in an effort to better protect herself from fraud and scams.

-

What Is AI? Artificial Intelligence 101

What Is AI? Artificial Intelligence 101Artificial intelligence has sparked huge excitement among investors and businesses, but what exactly does the term mean?

-

Five Ways to Save on Vacation Rental Properties

Five Ways to Save on Vacation Rental PropertiesTravel Use these strategies to pay less for an apartment, condo or house when you travel.

-

How to Avoid Annoying Hotel Fees: Per Person, Parking and More

How to Avoid Annoying Hotel Fees: Per Person, Parking and MoreTravel Here's how to avoid extra charges and make sure you don't get stuck paying for amenities that you don't use.

-

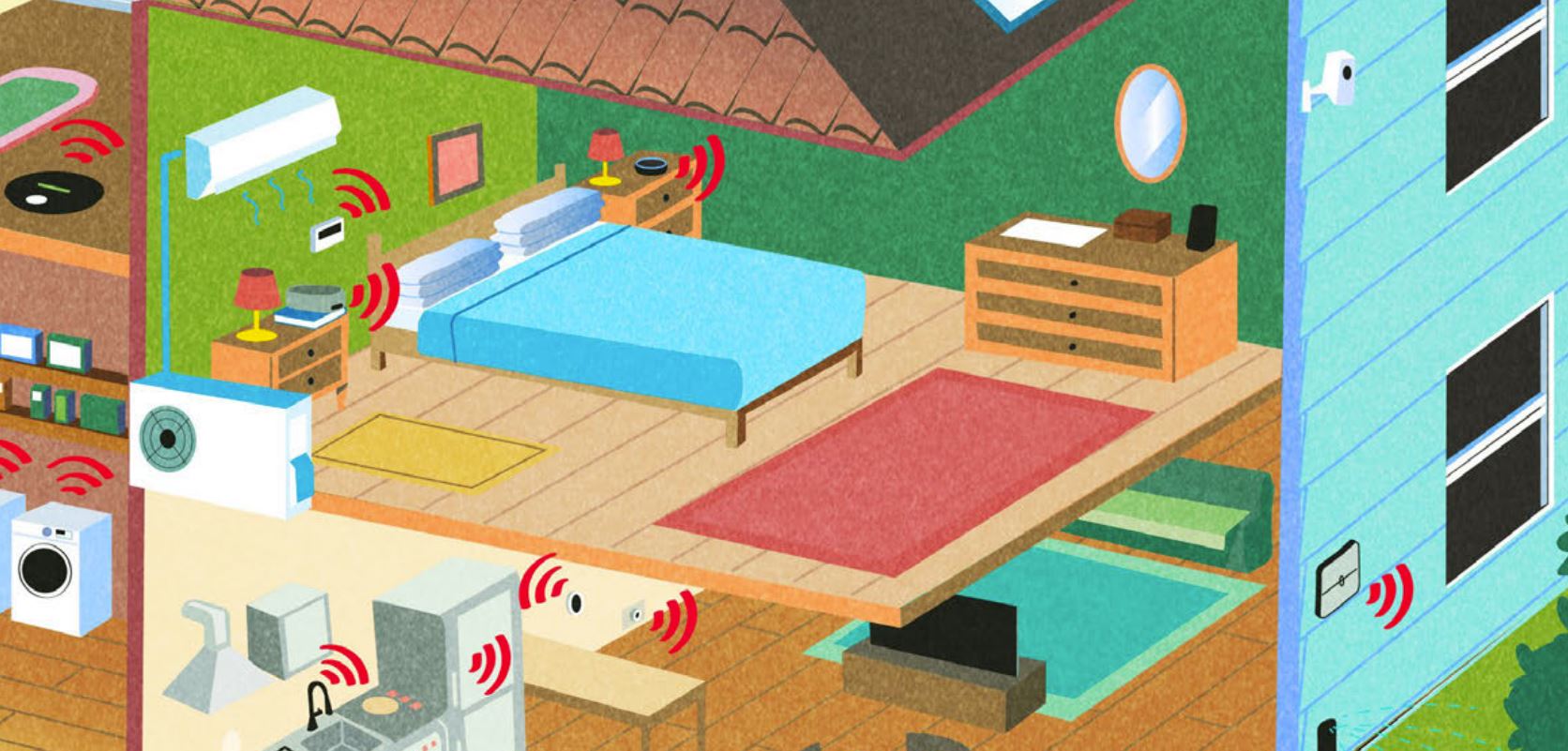

The 27 Best Smart Home Devices

The 27 Best Smart Home Devicesgadgets Innovations ranging from voice-activated faucets to robotic lawn mowers can easily boost your home’s IQ—and create more free time for you.

-

How to Appeal an Unexpected Medical Bill

How to Appeal an Unexpected Medical Billhealth insurance You may receive a bill because your insurance company denied a claim—but that doesn’t mean you have to pay it.

-

Amazon Prime Fees Are Rising. Here’s How to Cancel Your Amazon Prime Membership

Amazon Prime Fees Are Rising. Here’s How to Cancel Your Amazon Prime MembershipFeature Amazon Prime will soon cost $139 a year, $180 for those who pay monthly. If you’re a subscriber, maybe it’s time to rethink your relationship. Here’s a step-by-step guide to canceling Prime.