A Brief History of the Federal Gasoline Tax

The government has been taxing our fuel for over 80 years—and right from the get-go, the money was going to things other than roads and bridges.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

As Congress considers raising the federal tax on gasoline for the first time since 1993, consider highlights from a history of the tax prepared by the Congressional Research Service (CRS). In 1911, just three years after the Model T was introduced, Oregon became the first state to tax motor fuels. By 1932, every state and the District of Columbia had followed suit. And in 1932, the feds got in on the act.

1932

A temporary 1-cent-a-gallon federal tax is imposed. It is not dedicated to building roads but rather to deficit reduction in the midst of the Great Depression. It is scheduled to expire in 1934.

1933

Congress votes to extend the tax and increase the rate to 1.5 cents a gallon.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

1934

When Prohibition ends (so the feds can again tax booze), the gas tax falls back to 1 cent a gallon, where it stays until 1940.

1940

In anticipation of World War II, the tax rate is hiked to 1.5 cents a gallon through June 1945. Later, it is made permanent at that level.

1951

To help pay for the Korean War, Congress boosts the gas tax to 2 cents a gallon.

1956

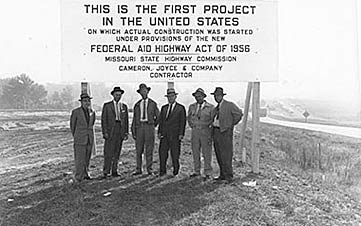

Congress creates the Highway Trust Fund, increases the federal gas tax to 3 cents a gallon and dedicates 100% of the revenue to the Trust Fund to help pay for the interstate highway system.

1959

Congress pushes the tax to 4 cents a gallon.

1983

Lawmakers add a nickel a gallon, setting the rate at 9 cents a gallon, with 1 cent dedicated to mass transit projects.

1990

An additional 5 cents a gallon is added, bringing the tax to 14 cents a gallon. Half of the increase is dedicated to highways, the other 2.5 cents aimed at deficit reduction (the same goal as the original tax in 1932).

1993

Congress adds 4.3 cents a gallon to the gasoline tax, with the added revenue dedicated to deficit reduction. With the addition of the 0.1-cent-a-gallon levy to fund the leaking underground storage tank trust fund the federal tax rose to 18.4 cents a gallon. That’s where it stands today. Since 1997, the full federal gasoline tax has gone to the Highway Trust Fund.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)Struggling with picking a date? Experts explain how to get out of your head and retire on your own terms.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

The Best Precious Metals ETFs to Buy in 2026

The Best Precious Metals ETFs to Buy in 2026Precious metals ETFs provide a hedge against monetary debasement and exposure to industrial-related tailwinds from emerging markets.

-

9 Types of Insurance You Probably Don't Need

9 Types of Insurance You Probably Don't NeedFinancial Planning If you're paying for these types of insurance, you may be wasting your money. Here's what you need to know.

-

Banks Are Sounding the Alarm About Stablecoins

Banks Are Sounding the Alarm About StablecoinsThe Kiplinger Letter The banking industry says stablecoins could have a negative impact on lending.

-

Amazon Resale: Where Amazon Prime Returns Become Your Online Bargains

Amazon Resale: Where Amazon Prime Returns Become Your Online BargainsFeature Amazon Resale products may have some imperfections, but that often leads to wildly discounted prices.

-

Tax Rule Change Could See Millions Lose Health Insurance

Tax Rule Change Could See Millions Lose Health InsuranceThe Kiplinger Tax Letter If current rules for the health premium tax credit (PTC), a popular Obamacare subsidy, aren't extended, 3.7 million people could lose their health insurance.

-

Roth IRA Contribution Limits for 2026

Roth IRA Contribution Limits for 2026Roth IRAs Roth IRAs allow you to save for retirement with after-tax dollars while you're working, and then withdraw those contributions and earnings tax-free when you retire. Here's a look at 2026 limits and income-based phaseouts.

-

Four Tips for Renting Out Your Home on Airbnb

Four Tips for Renting Out Your Home on Airbnbreal estate Here's what you should know before listing your home on Airbnb.

-

Five Ways to a Cheap Last-Minute Vacation

Five Ways to a Cheap Last-Minute VacationTravel It is possible to pull off a cheap last-minute vacation. Here are some tips to make it happen.

-

How Much Life Insurance Do You Need?

How Much Life Insurance Do You Need?insurance When assessing how much life insurance you need, take a systematic approach instead of relying on rules of thumb.