Estate Taxes Could Hit the Not-So-Wealthy

Democratic candidates are talking about raising the death tax to fund their proposed initiatives.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Democratic presidential candidates Elizabeth Warren and Bernie Sanders have unveiled ambitious plans to fund universal health care and other programs by hiking taxes on the wealthiest Americans. But lurking beneath proposed tax hikes on the super rich are measures that could affect a broader swath of taxpayers.

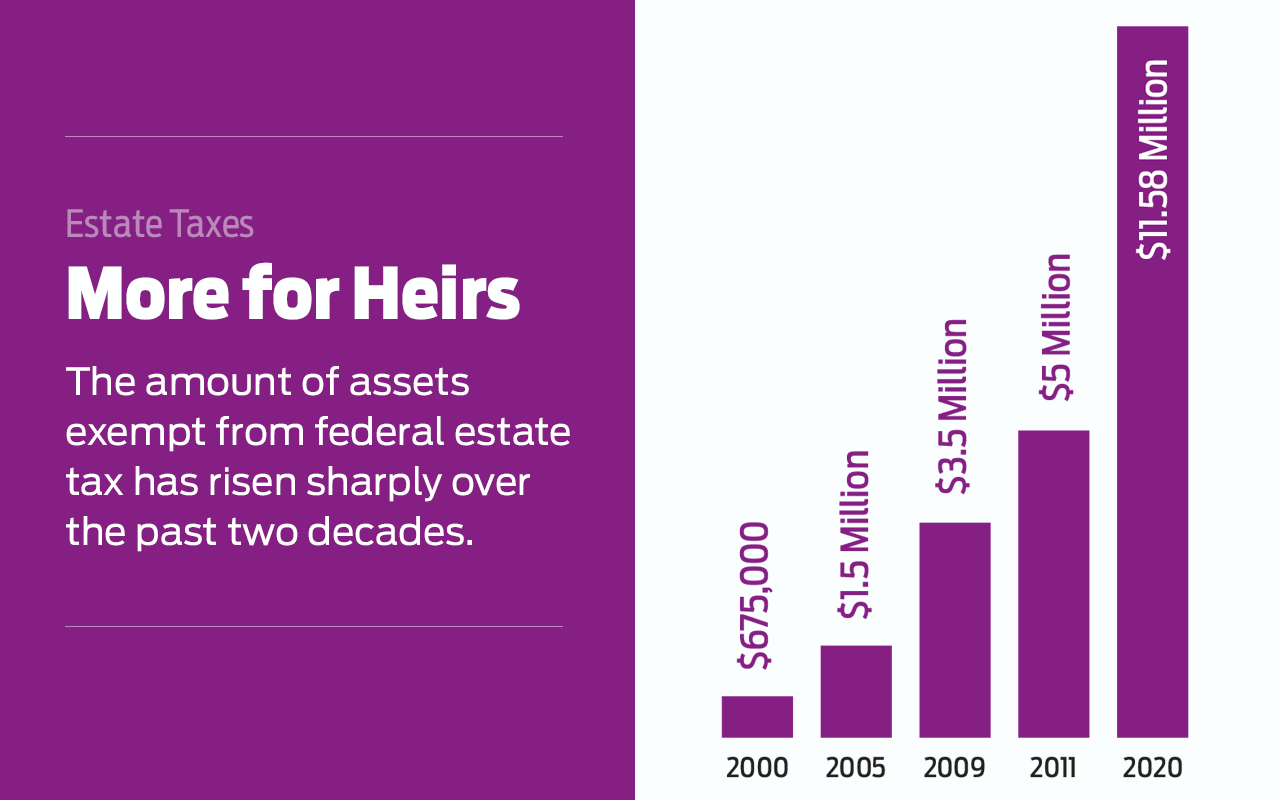

Both Warren and Sanders want to lower the amount of assets exempt from federal estate taxes—$11.58 million per person in 2020—to $3.5 million. Sanders has also proposed increasing the estate tax rate, which now tops out at 40%, to 45% to 77%, depending on the size of the estate.

If either candidate is elected president, “there will be a pretty strong push to increase estate taxes by raising rates or lowering exemptions or both,” says Howard Gleckman, senior fellow at the Urban-Brookings Tax Policy Center.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Democratic presidential candidates have also expressed an interest in narrowing or eliminating a provision in the tax code that benefits heirs who inherit assets that have appreciated in value. Now, when you inherit securities or other assets, the cost basis of those assets is “stepped up” to their value on the date of the original owner’s death. If you turn around and sell the securities, you won’t owe any capital gains, even if they’ve increased significantly in value since they were purchased. Former vice president Joe Biden has proposed eliminating the step-up to help pay his higher-education initiatives.

Presidential candidates—and future presidents—who want to increase revenue from estate taxes face some strong headwinds. While the idea of a wealth tax on plutocrats has a lot of support, estate taxes are widely unpopular, even among people who will never have to pay them, says Joseph Thorndike, director of the Tax History Project at Tax Analysts, which publishes information for tax professionals. Many people believe it’s fundamentally unfair to tax inherited wealth, he says. “Lowering the exemption might exacerbate the problem of the tax’s unpopularity.”

The clock is ticking. No matter who is elected president, the generous federal estate tax threshold is living on borrowed time. Under sunset provisions in the 2017 tax overhaul, the current exemption is scheduled to revert to about $5.5 million in 2026 unless Congress moves to increase it.

Ryan Losi, a certified public accountant with Piascik in Glen Allen, Va., says he’s advising clients whose estates exceed that threshold to start planning now. “November will be an indicator of whether it drops down earlier than the sunset,” he says.

If you’re concerned that lower exemptions could reduce the amount you’ll leave to your heirs, there are numerous ways to avoid estate taxes. The easiest strategy is to give away assets while you’re still alive. In 2020, you can give $15,000 to as many people as you want without filing a federal gift tax return. As long as your gifts remain below the limit, they won’t eat into your exemption from federal estate taxes.

If you have a significant amount of appreciated stock or mutual funds in taxable accounts, you can reduce the size of your estate and lower your current tax bill by giving the securities to charity. If you’ve owned the securities for at least a year, you can deduct the fair market value of the securities when you donate them. You won’t have to pay taxes on the capital gains, and the charity won’t, either. If you’re not sure which charities you want to support, a donor-advised fund provides a tax-savvy way to make regular gifts to your favorite causes. These funds, offered by Schwab, Fidelity, Vanguard and other financial firms, allow you to make a large deductible contribution in one year and decide later how to dole out the money.

State estate taxes. These strategies could also help you avoid state estate taxes. Eighteen states have an estate or inheritance tax—which is paid by heirs, rather than by the estate—and in some of these states, the threshold is much lower than the federal exemption is.

Oregon and Massachusetts tax estates valued at $1 million or more, with a top tax rate of 16%. Rhode Island taxes estates valued at $1.56 million or more, at rates ranging from 0.8% to 16%. Washington taxes estates valued at $2.2 million or more at a top rate of 20%. (For more on estate and other state taxes that affect retirees, see Kiplinger’s Retiree Tax Map.)

President Donald Trump recently changed his residency from New York, which taxes estates valued at $5.74 million or more, to Florida, which has no estate tax (or income tax, either). Other well-off individuals have made a similar move. A recent study published by the National Bureau of Economic Research found that as wealthy individuals age, they’re less likely to live in a state with an estate tax.

Some states have sought to stem the migration by gradually increasing the amount of assets exempt from their estate taxes. But don’t look for states to abandon their estate taxes entirely. The NBER study also found that the loss of revenue from people who moved to other states was more than offset by estate tax revenue from wealthy residents who stayed put.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Block joined Kiplinger in June 2012 from USA Today, where she was a reporter and personal finance columnist for more than 15 years. Prior to that, she worked for the Akron Beacon-Journal and Dow Jones Newswires. In 1993, she was a Knight-Bagehot fellow in economics and business journalism at the Columbia University Graduate School of Journalism. She has a BA in communications from Bethany College in Bethany, W.Va.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

457 Plan Contribution Limits for 2026

457 Plan Contribution Limits for 2026Retirement plans There are higher 457 plan contribution limits in 2026. That's good news for state and local government employees.

-

Medicare Basics: 12 Things You Need to Know

Medicare Basics: 12 Things You Need to KnowMedicare There's Medicare Part A, Part B, Part D, Medigap plans, Medicare Advantage plans and so on. We sort out the confusion about signing up for Medicare — and much more.

-

The Seven Worst Assets to Leave Your Kids or Grandkids

The Seven Worst Assets to Leave Your Kids or Grandkidsinheritance Leaving these assets to your loved ones may be more trouble than it’s worth. Here's how to avoid adding to their grief after you're gone.

-

SEP IRA Contribution Limits for 2026

SEP IRA Contribution Limits for 2026SEP IRA A good option for small business owners, SEP IRAs allow individual annual contributions of as much as $70,000 in 2025, and up to $72,000 in 2026.

-

Roth IRA Contribution Limits for 2026

Roth IRA Contribution Limits for 2026Roth IRAs Roth IRAs allow you to save for retirement with after-tax dollars while you're working, and then withdraw those contributions and earnings tax-free when you retire. Here's a look at 2026 limits and income-based phaseouts.

-

SIMPLE IRA Contribution Limits for 2026

SIMPLE IRA Contribution Limits for 2026simple IRA For 2026, the SIMPLE IRA contribution limit rises to $17,000, with a $4,000 catch-up for those 50 and over, totaling $21,000.

-

457 Contribution Limits for 2024

457 Contribution Limits for 2024retirement plans State and local government workers can contribute more to their 457 plans in 2024 than in 2023.

-

Roth 401(k) Contribution Limits for 2026

Roth 401(k) Contribution Limits for 2026retirement plans The Roth 401(k) contribution limit for 2026 has increased, and workers who are 50 and older can save even more.