No Biz Like Home Biz

The ABCs on deductions when you're running a business from your home.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Like many stay-at-home moms, Michelle Alpern wanted to earn extra cash. She found that she had some time while her 4-year-old son attended preschool and her husband, an L.A. County firefighter, was at work. So she became a consultant for MemoryWorks, a company that sells supplies to scrapbooking hobbyists, primarily through home-demonstration parties. Alpern earned $8,000 in 2006 -- but she'll pay taxes on a lot less than that.

Self-employed people like Alpern are taxed only on their profits. She can deduct the $2,500 she spent to set up her home office and buy inventory, and she can write off other direct business expenses, such as advertising, accounting software and half of her business-entertainment costs. And because she uses her home office exclusively for business, she can also write off the business portion of her overhead expenses, such as utilities and homeowners insurance.

In addition to the 44.5 cents per mile Alpern can deduct for business use of her car in 2006, she can write off personal-property taxes, parking fees and tolls, and the business portion of interest on a car loan. And every $100 worth of deductible expenses trims the Alperns' joint tax bill by nearly $50, which represents their combined federal and state income-tax brackets plus the 15.3% self-employment tax.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

How to file. If you have any self-employment income -- even if it's just from freelance work on the side -- you'll need to file Schedule C reporting your business income and expenses. (People without inventory can file the simpler Schedule C-EZ as long as they have less than $5,000 in business expenses and don't show a net loss.) If your net earnings are more than $400 for the year, you'll also need to file Schedule SE to calculate your self-employment tax, which funds Social Security and Medicare. You'll have to pay the employer and employee portions of the tax for a total of 15.3% of your net earnings, but half of that is deductible.

A major perk of being self-employed is the ability to stash lots of tax-deductible money in a retirement plan, such as a solo 401(k) or Simplified Employee Pension, also known as a SEP. Contributions to your retirement plan -- up to $45,000 in 2007 -- will reduce your current taxable income and grow tax-deferred until withdrawn in retirement. If you are 50 or older, you can contribute an additional $5,000 in "catch-up" contributions to a solo 401(k) plan but not to a SEP.

Good records are essential to prove to the IRS that you're running a legitimate business, says Paul Gada, senior tax analyst with the CCH Business Owner's Toolkit. And if you lose money in three out of five years, the IRS generally considers your pursuit a hobby rather than a business and makes it more difficult to deduct expenses.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

As the "Ask Kim" columnist for Kiplinger's Personal Finance, Lankford receives hundreds of personal finance questions from readers every month. She is the author of Rescue Your Financial Life (McGraw-Hill, 2003), The Insurance Maze: How You Can Save Money on Insurance -- and Still Get the Coverage You Need (Kaplan, 2006), Kiplinger's Ask Kim for Money Smart Solutions (Kaplan, 2007) and The Kiplinger/BBB Personal Finance Guide for Military Families. She is frequently featured as a financial expert on television and radio, including NBC's Today Show, CNN, CNBC and National Public Radio.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

How to Search For Foreclosures Near You: Best Websites for Listings

How to Search For Foreclosures Near You: Best Websites for ListingsMaking Your Money Last Searching for a foreclosed home? These top-rated foreclosure websites — including free, paid and government options — can help you find listings near you.

-

Four Tips for Renting Out Your Home on Airbnb

Four Tips for Renting Out Your Home on Airbnbreal estate Here's what you should know before listing your home on Airbnb.

-

Kiplinger's Tax Map for Middle-Class Families: About Our Methodology

Kiplinger's Tax Map for Middle-Class Families: About Our Methodologystate tax The research behind our judgments.

-

Is Relief from Shipping Woes Finally in Sight?

Is Relief from Shipping Woes Finally in Sight?business After years of supply chain snags, freight shipping is finally returning to something more like normal.

-

Retirees, Make These Midyear Moves to Cut Next Year's Tax Bill

Retirees, Make These Midyear Moves to Cut Next Year's Tax BillTax Breaks Save money next April by making these six hot-as-July tax moves.

-

Economic Pain at a Food Pantry

Economic Pain at a Food Pantrypersonal finance The manager of this Boston-area nonprofit has had to scramble to find affordable food.

-

The Golden Age of Cinema Endures

The Golden Age of Cinema Enduressmall business About as old as talkies, the Music Box Theater has had to find new ways to attract movie lovers.

-

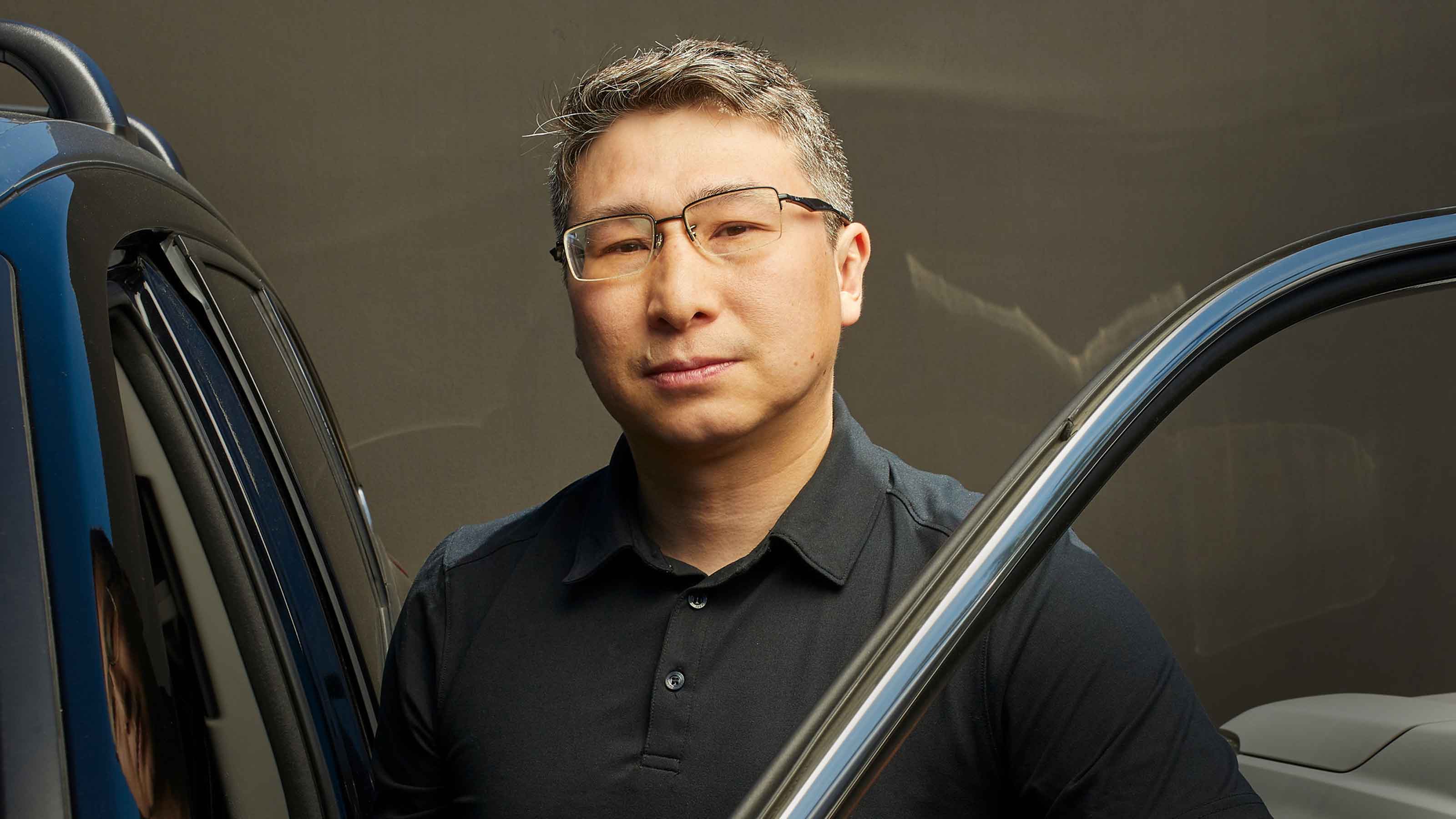

Pricey Gas Derails This Uber Driver

Pricey Gas Derails This Uber Driversmall business With rising gas prices, one Uber driver struggles to maintain his livelihood.