Kiplinger's Tax Map for Middle-Class Families: About Our Methodology

The research behind our judgments.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

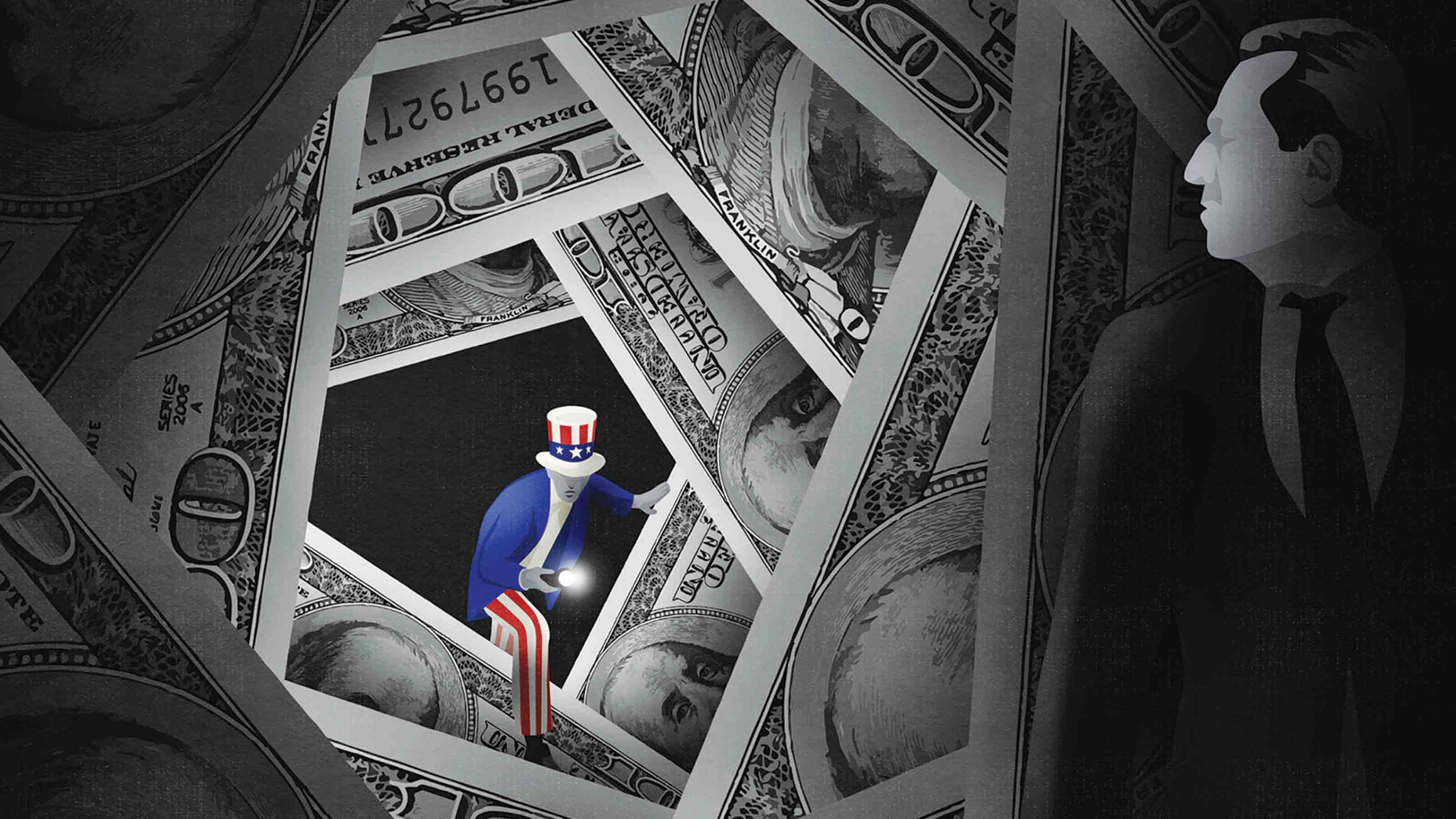

Our tax map for middle-class families and related tax content includes data from a wide range of sources. To generate our rankings, we created a metric to compare the tax burden for a hypothetical middle-class family in all 50 states and the District of Columbia.

Kiplinger Tax Map

- ARTICLE: 10 Most Tax-Friendly States for Middle-Class Families

- ARTICLE: 10 Least Tax-Friendly States for Middle-Class Families

- MAP: State-by-State Guide to Taxes on Middle-Class Families

- RELATED: The Retiree Tax Map

Data Sources:

Income Taxes – Our income tax information comes from each state's tax agency. Income tax forms and instructions were also used. See more about how we calculated the income tax for our hypothetical family below under "Ranking method."

Property Taxes – The median property tax rate is based on the median property taxes paid and the median home value in each state for 2021 (the most recent year available). The data comes from the U.S. Census Bureau. By using data on taxes actually paid and median home values, differences between the cost of housing from one state to another are factored into the equation (although the median property tax rate is still a statewide figure).

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Sales Taxes – State sales tax rates are from each state's tax agency. We also cite the Tax Foundation's 2022 midyear average combined sales tax rate, which is a population-weighted average of state and local sales taxes. In states that let local governments add sales taxes, this gives an estimate of what most people in a given state actually pay, as those rates can vary widely.

Motor Fuel Taxes – The American Petroleum Institute prepares annual reports of state motor fuel tax rates. We used January 2022 data but made several updates to reflect new rates effective since then. Values include excise taxes, sales taxes (when applicable) and a variety of fees that states impose.

Sin Taxes – Information about "sin taxes" on tobacco products, alcoholic beverages, and marijuana comes from a variety of sources, including state tax agencies, Federation of Tax Administrators, Campaign for Tobacco-Free Kids, and Distilled Spirits Council of the United States.

Estate and Inheritance Taxes – Data from each state tax agency was used for estate and inheritance tax information.

Ranking Method:

The "tax-friendliness" of a state depends on the sum of income, sales and property taxes paid by our hypothetical middle-class family.

To determine the income tax component, we prepared tax returns for each state and the District of Columbia for a married couple with two dependent children, an earned income of $77,000, long-term capital gains of $1,500, qualified dividends of $1,000, and taxable interest of $500. They had $4,500 in state income taxes withheld from their wages. They also paid $3,000 in real estate taxes, paid $2,800 in mortgage interest, and donated $2,300 (cash and property) to charity. We calculated these 2021 returns using tax software from Cash App (adjustments were made to account for certain 2022 tax law changes).

How much they paid in sales taxes was calculated using the sales tax deduction tables in the instructions for federal Schedule A (Form 1040) and the Tax Foundation's 2022 midyear average combined sales tax rates.

How much the hypothetical family paid (and deducted on their income tax return) in property taxes was calculated by assuming a residence with $300,000 assessed value and then applying each state's median property tax rate to that amount.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

In his former role as Senior Online Editor, David edited and wrote a wide range of content for Kiplinger.com. With more than 20 years of experience with Kiplinger, David worked on numerous Kiplinger publications, including The Kiplinger Letter and Kiplinger’s Personal Finance magazine. He co-hosted Your Money's Worth, Kiplinger's podcast and helped develop the Economic Forecasts feature.

-

How to Turn Your 401(k) Into A Real Estate Empire

How to Turn Your 401(k) Into A Real Estate EmpireTapping your 401(k) to purchase investment properties is risky, but it could deliver valuable rental income in your golden years.

-

My First $1 Million: Retired Nuclear Plant Supervisor, 68

My First $1 Million: Retired Nuclear Plant Supervisor, 68Ever wonder how someone who's made a million dollars or more did it? Kiplinger's My First $1 Million series uncovers the answers.

-

How to Position Investments to Minimize Taxes for Your Heirs

How to Position Investments to Minimize Taxes for Your HeirsTo minimize your heirs' tax burden, focus on aligning your investment account types and assets with your estate plan, and pay attention to the impact of RMDs.

-

Retirees, Make These Midyear Moves to Cut Next Year's Tax Bill

Retirees, Make These Midyear Moves to Cut Next Year's Tax BillTax Breaks Save money next April by making these six hot-as-July tax moves.

-

Estimated Payments or Withholding in Retirement? Here's Some Guidance

Estimated Payments or Withholding in Retirement? Here's Some GuidanceBudgeting You generally must pay taxes throughout the year on your retirement income. But it isn't always clear whether withholding or estimated tax payments is the best way to pay.

-

How to Cut Your 2021 Tax Bill

How to Cut Your 2021 Tax BillTax Breaks Our guidance could help you claim a higher refund or reduce the amount you owe.

-

Why This Tax Filing Season Could Be Ugly

Why This Tax Filing Season Could Be UglyCoronavirus and Your Money National Taxpayer Advocate Erin M. Collins warns the agency will continue to struggle with tight budgets and backlogs. Her advice: File electronically!

-

Con Artists Target People Who Owe The IRS Money

Con Artists Target People Who Owe The IRS MoneyScams In one scheme, thieves will offer to "help" you pay back taxes, only to leave you on the hook for expensive fees in addition to the taxes.

-

Cash-Rich States Lower Taxes

Cash-Rich States Lower TaxesTax Breaks The economic turnaround sparked a wave of cuts in state tax rates. But some say the efforts could backfire.

-

The Financial Effects of Losing a Spouse

The Financial Effects of Losing a SpouseFinancial Planning Even amid grief, it's important to reassess your finances. With the loss of your spouse's income, you may find yourself in a lower tax bracket or that you qualify for new deductions or credits.

-

IRS Plans to Track Down Tax Cheats

IRS Plans to Track Down Tax Cheatstaxes The proposal targets high-income taxpayers, but enforcement wouldn’t be limited to the top 1%.