5 Charitable Planning Options That Can Save You Money on Taxes

Due to recent changes in the tax law, charitable planning is becoming an intricate part of tax, estate and gift planning. It's important to plan now while opportunities still exist.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Since the 2017 Tax Cuts and Jobs Act, now more than ever there is a greater incentive for donors to contemplate whether charitable planning will provide an immediate or future benefit. Donors who will benefit from this range from business owners, executives, doctors, accountants, attorneys, professional athletes and even retirees due to the new deduction limits on state and local taxes (SALT), the elimination of several other deductions, as well as the increased standard deduction.

Here are five charitable planning options that can save you money on taxes in 2019 and beyond:

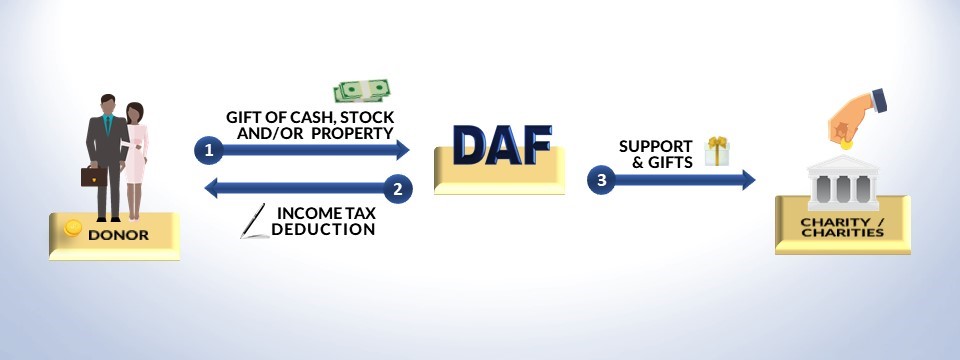

1. Donor-Advised Fund (DAF)

A donor-advised fund is a separately managed charitable investment account that is operated by a section 501(c)(3) organization, also known as a sponsor or sponsoring organization. You can contribute cash, appreciated securities, real estate and other property to receive an immediate tax deduction. Those assets grow tax-free, and in turn you can make recommendations to any charity, although the sponsoring organization makes the final decision (learn more by reading Choosing Between a Private Foundation vs. Donor-Advised Fund).

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The main advantage of a donor-advised fund is an upfront tax deduction. The disadvantages are loss of control with contributions, investment fees charged, and the sponsoring organization having the final choice on the charity that receives the funds.

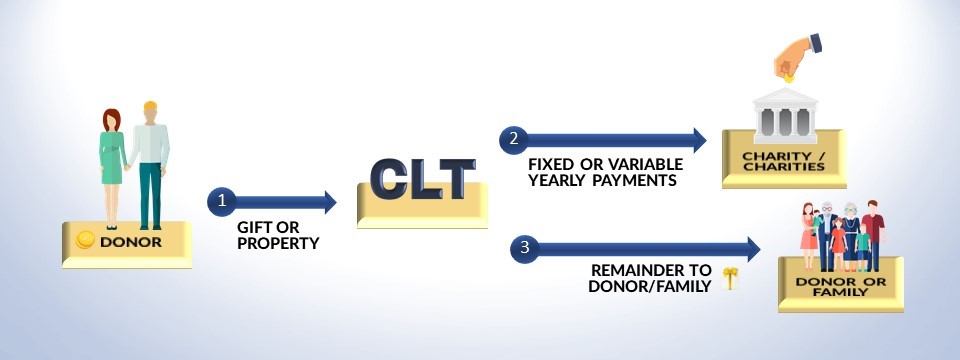

2. Charitable Lead Trust (CLT)

A charitable lead trust is a type of irrevocable trust that provides income payments to a charity for a period of time — typically through a fixed term of years — with the remainder either going to the donor or donor’s family members. Gifts can be cash, appreciated securities, real estate and other types of property. Depending on the type of charitable lead trust — grantor or non-grantor — the purpose for establishing either can be for estate or gift tax reduction, as well as an income tax deduction.

A grantor charitable lead trust makes payments to a charity for a fixed period of years, with the remainder going back to the donor (also known as the “grantor”). With this structure, the donor, or grantor, would receive an upfront income tax deduction for the present value of the charitable donation. However, the donor would not receive any additional tax deductions for future distributions made to a charity or charities through the rest of the term.

A non-grantor charitable lead trust makes payments to a charity for a fixed period of years, with the remainder going to family members or other persons who are not the donor. With this structure, the donor can substantially — or potentially entirely — avoid paying estate or gift taxes.

The advantages to the donor are either an upfront tax deduction or estate or gift tax reduction. In addition, the charity will also instantly benefit the most from this arrangement because of the immediate payments that will be made. The disadvantage is that once assets are transferred to the trust, they cannot be removed.

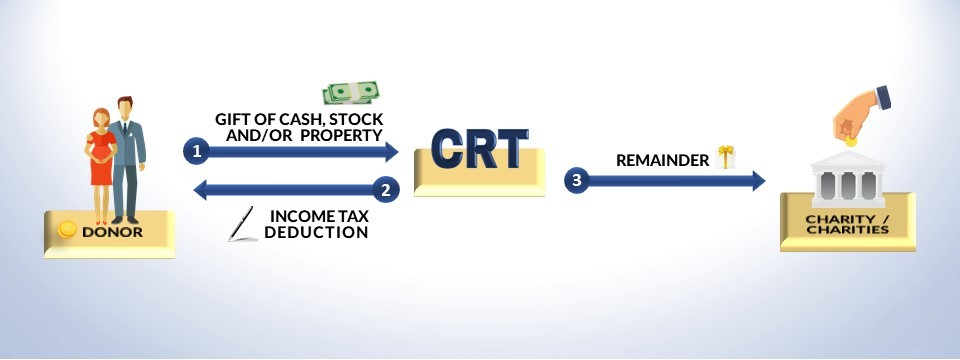

3. Charitable Remainder Trust (CRT)

A charitable remainder trust is another type of irrevocable trust, and the complete opposite of a charitable lead trust. Assets are transferred to the charitable remainder trust, which gives an immediate tax deduction, in addition to income for a period of time or the rest of your life. Gifts can be cash, appreciated securities, real estate and other types of property.

The income stream can be paid to you, a spouse, and any leftover will go to a beneficiary if you were to pass away prematurely and didn’t receive the predetermined income payments. At death, the remainder goes to the charity of your choice.

The advantages to the donor are the upfront tax deduction as well as the income payments made. Keep in mind that with this structure a charity will only benefit from this arrangement after you pass away. As with a charitable lead trust, the disadvantage is that once assets are transferred to the trust, they cannot be removed.

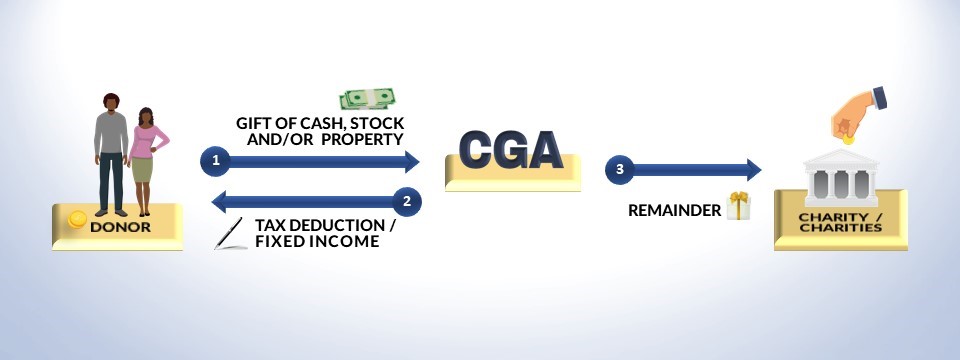

4. Charitable Gift Annuity (CGA)

A charitable gift annuity is an irrevocable contract between a donor and a charity that provides an upfront tax deduction as well as a lifetime stream of income payments. Gifts can be cash, appreciated securities, real estate and other types of property (learn more by reading Gift Annuity Offers Tax Break and Retirement Income).

Many nonprofits and large universities offer charitable gift annuities. The advantages to the donor are the upfront tax deduction as well as the income payments. Similar to a charitable remainder trust, the charity (or multiple charities) will only benefit from this arrangement after you pass away. The disadvantages are that once assets are transferred to the trust, they cannot be removed and payments will cease if the charity goes insolvent.

As you can see, the charitable remainder trust and charitable gift annuity are very similar. The differences lie in their structure. Charitable gift annuities — like all annuities — are contracts and pay you (and your spouse if structured correctly) fixed payments for the rest of your lives, not adjusted for inflation. Payments are backed by the charity’s assets and are more regulated than a charitable remainder trust. With a charitable remainder trust, you can choose from either fixed or variable payments with both the tax deduction and payout potentially greater versus the charitable gift annuity. Also, the charitable remainder trust has more flexibility in case you want to contribute appreciated assets.

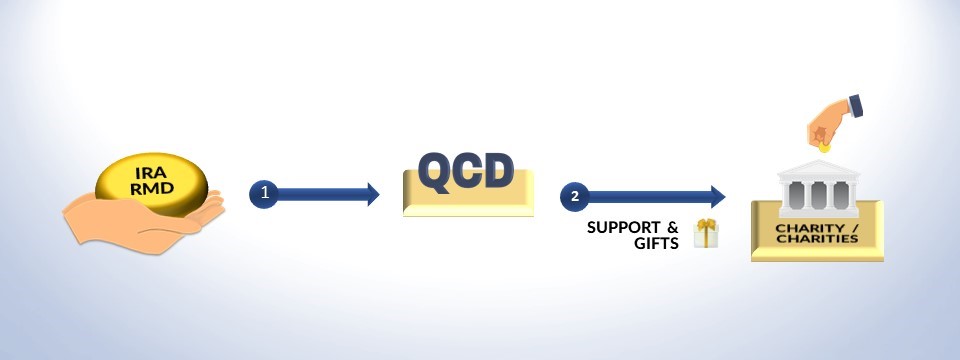

5. Qualified Charitable Distribution (QCD)

A qualified charitable distribution is for those age 70½ or more who don’t want (or need) the required minimum distribution (RMD) from their IRA. Although a QCD doesn’t provide an upfront tax deduction or lifetime income like a charitable gift annuity or trust would, it’s an overlooked tax loophole because retirees can exclude up to $100,000 per year from their RMDs without having to claim it on their tax return. The QCD is made directly from your IRA to a charity without having to be claimed as income. If you’re married, your spouse can also exclude up to $100,000 per year as well.

The advantage to the donor is the exclusion of up to $100,000 per year from their tax return (each spouse), which can help reduce Social Security taxation as well as Medicare premiums due to the lower adjusted gross income (AGI). The disadvantage is once the RMD is transferred to a charity, it is irrevocable and cannot be undone.

While it’s vital to have this conversation with a well-versed tax or financial professional, donors should explore certain charitable vehicles (or a combination) to maximize their tax deductions now while supporting a favorite charity at the same time. Otherwise, these opportunities may cease or substantially change in the next few years.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Carlos Dias Jr. is a financial adviser, public speaker and president of Dias Wealth, LLC, headquartered in the Orlando, Fla., area, but working with clients nationwide. His expertise spans a diverse clientele, including business owners, retirees, lottery winners and professional athletes with wealth management, tax planning, estate planning, long-term care, annuities and life insurance. Carlos has contributed to Kiplinger, Forbes and MarketWatch, and his work has been featured in CNN, CNBC, The Wall Street Journal, U.S. News & World Report, USA Today and other publications. He’s spoken at various CPA societies across the United States, and Carlos’ presentations often focus on innovative tax strategies, retirement planning and asset protection, providing valuable knowledge to accountants, attorneys and financial professionals.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.