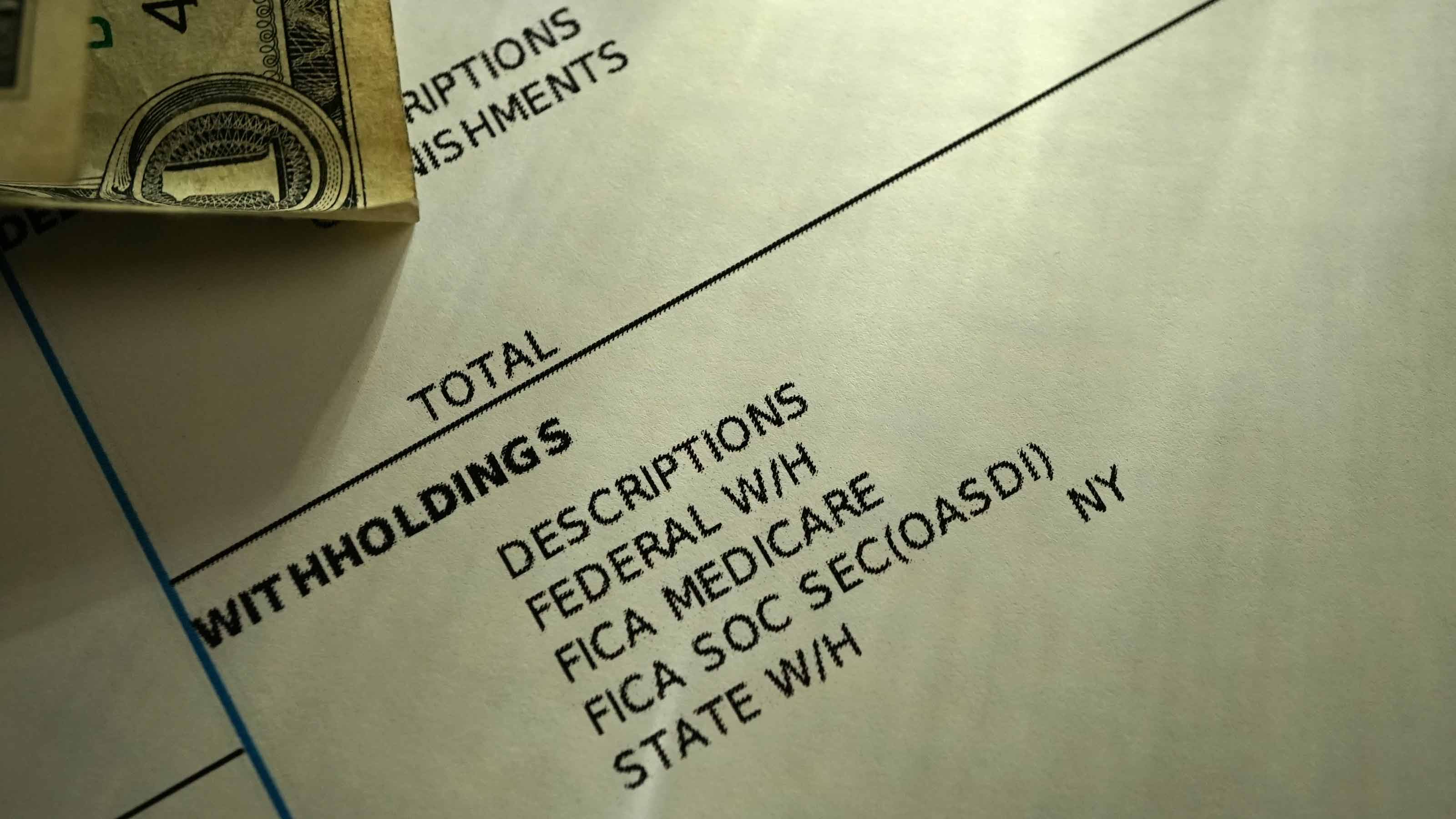

Babysitting and Taxes

Does your working child owe self-employment tax on his or her earnings? Plus, find out the rules for contributing to a kid's Roth IRA.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

My daughter will be able to open a Roth IRA this year with money she earns from babysitting over the summer. Does she need to pay the self-employment tax, which would eat up 15.3% of her income?

No, your daughter does not have to pay the self-employment tax. Ordinarily, individuals must pay the tax if their net earnings from self-employment are $400 or more. But there are special exceptions for kids.

In your daughter's case, teenage babysitters are normally considered employees, so they are exempt from paying self-employment tax. There's also a specific exemption for newspaper carriers under age 18.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

If a child under 18 is working part-time as a household worker (this means babysitters, gardeners, people who do housecleaning or repair work, or anyone who is employed in or around someone else's home), he or she is also exempt from the Social Security tax.

Children under 18 who work in their parent's unincorporated business are also exempt from the Social Security tax.

For more on kids and work, see Tips for Landing a Summer Job and Young Kids Can Earn Money Too.

Funding a kid's Roth IRA

We'd like to open a Roth IRA for our 15-year-old, who will earn about $1,600 this year working for a tutoring company. Since the maximum IRA contribution is $4,000, can we kick in more money to bring her up to $4,000?

Nice idea, Mom and Dad, but the answer is no. In 2007 your child can make an IRA contribution up to $4,000 or 100% of her earned income, whichever is less. In your daughter's case, that would be $1,600.

You'll probably want her to use some of her earnings for spending money, or to save in a regular bank account. So you could kick in your own money to open the IRA -- as long as you don't exceed your daughter's actual earned income. See IRA Rules for Kids to learn more.

Where to open an IRA

I'd like to help my 16-year-old grandson start a Roth IRA with his summer earnings. But will investment companies open IRAs for minors? If so, will they accept just a few hundred dollars?

Policies vary, but in general you should have no trouble finding a company willing to take your grandson's money.

The list of financial firms willing to open IRAs for minors includes brokers Charles Schwab, E*Trade, Muriel Siebert, Scottrade and TD Ameritrade, plus mutual-fund families American Century, T. Rowe Price and Vanguard. Also on the list: Bank of America, Citibank and PNC.

Minimum investments vary. Schwab, for example, will open a kid's IRA with as little as $100; TD Ameritrade and Muriel Siebert have no minimums. At American Century and Vanguard, the minimum is the same as the fund's minimum investment.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Janet Bodnar is editor-at-large of Kiplinger's Personal Finance, a position she assumed after retiring as editor of the magazine after eight years at the helm. She is a nationally recognized expert on the subjects of women and money, children's and family finances, and financial literacy. She is the author of two books, Money Smart Women and Raising Money Smart Kids. As editor-at-large, she writes two popular columns for Kiplinger, "Money Smart Women" and "Living in Retirement." Bodnar is a graduate of St. Bonaventure University and is a member of its Board of Trustees. She received her master's degree from Columbia University, where she was also a Knight-Bagehot Fellow in Business and Economics Journalism.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

2023 Social Security Tax Wage Base

2023 Social Security Tax Wage BaseWealthier Americans will have more Social Security taxes taken from their paychecks next year because more of their income will be subject to the tax.

-

Five Big Tax Breaks at Work

Five Big Tax Breaks at Worktax planning Did the 2021 tax refund you expected turn into a surprise tax bill? Taking advantage of your employee benefits package could help you lower your taxable income.

-

5 Year-End Moves to Help Retirees Trim Their Tax Bill

5 Year-End Moves to Help Retirees Trim Their Tax Billtaxes The end of the year is a great time to start thinking about next year's tax bill. Here are some strategies on how to reduce what you will owe Uncle Sam.

-

Why Today’s Retirees Need to Pursue Tax-Minimization Strategies

Why Today’s Retirees Need to Pursue Tax-Minimization Strategiestax planning IRAs are the name of the game for today’s retirees. While they come with helpful tax breaks for savers, pulling money out in retirement comes with major tax consequences — which could get much more serious if taxes rise in the future. But there are things you can do about that.

-

4 Ways to Keep Your Taxes Down If You Are Self-Employed

4 Ways to Keep Your Taxes Down If You Are Self-Employedtax exemptions Whether you drive for a ride-hailing service on the side or work full-time as your own boss, these tips can help you save money when time comes to pay taxes.

-

Will Your Stimulus Check Increase Your Tax on Social Security Benefits?

Will Your Stimulus Check Increase Your Tax on Social Security Benefits?Coronavirus and Your Money The answer to this question comes down to whether your stimulus check increases your "provisional income."

-

Smart Ways to Save on Child Care Costs

Smart Ways to Save on Child Care CostsStarting a Family The expenses and tax complications that come with hiring a nanny were reason enough for me to take my son to day care instead.

-

5 Ways to Prepare for Higher Taxes Under President Biden

5 Ways to Prepare for Higher Taxes Under President Bidentax planning Will you be affected by tax changes in the future? Growing national debt, changes in Washington, and new policies on the horizon could impact you more than you might think. Here are five ways to prepare for higher taxes in the future.