How to Election-Proof Your Retirement

Sponsored Content from Sensible Money

3 Steps to Secure Your Retirement Plans – No Matter Who Wins

By Dana Anspach, CFP®, RMA®, Kolbe Certified™ Consultant

The impact of election results on our country’s future weighs heavily on everyone’s minds. The stakes have rarely felt higher.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

But to what degree should you let politics affect your financial decisions? Should you adjust your retirement date? Rearrange your investment portfolio? Based on what you think will happen? Or just to be cautious?

The answer, of course, depends on your investment objectives and time frame. The problem is that most people set personal goals, and then, as human nature is so inclined to do, find themselves caught up by current events. The result? They lose focus on their long-term aims.

Here are three ways to stay focused on your goals, so you can keep your retirement on track.

- Watch this YouTube video on How to Make a Retirement Income Plan.

1. Shift Your Thinking About Elections

When it comes to the stock market, elections matter less than you might think. The reality is that no matter which political party is in charge, the overall trajectory of the market has been positive. Let’s look at some facts and analysis that illustrate this.

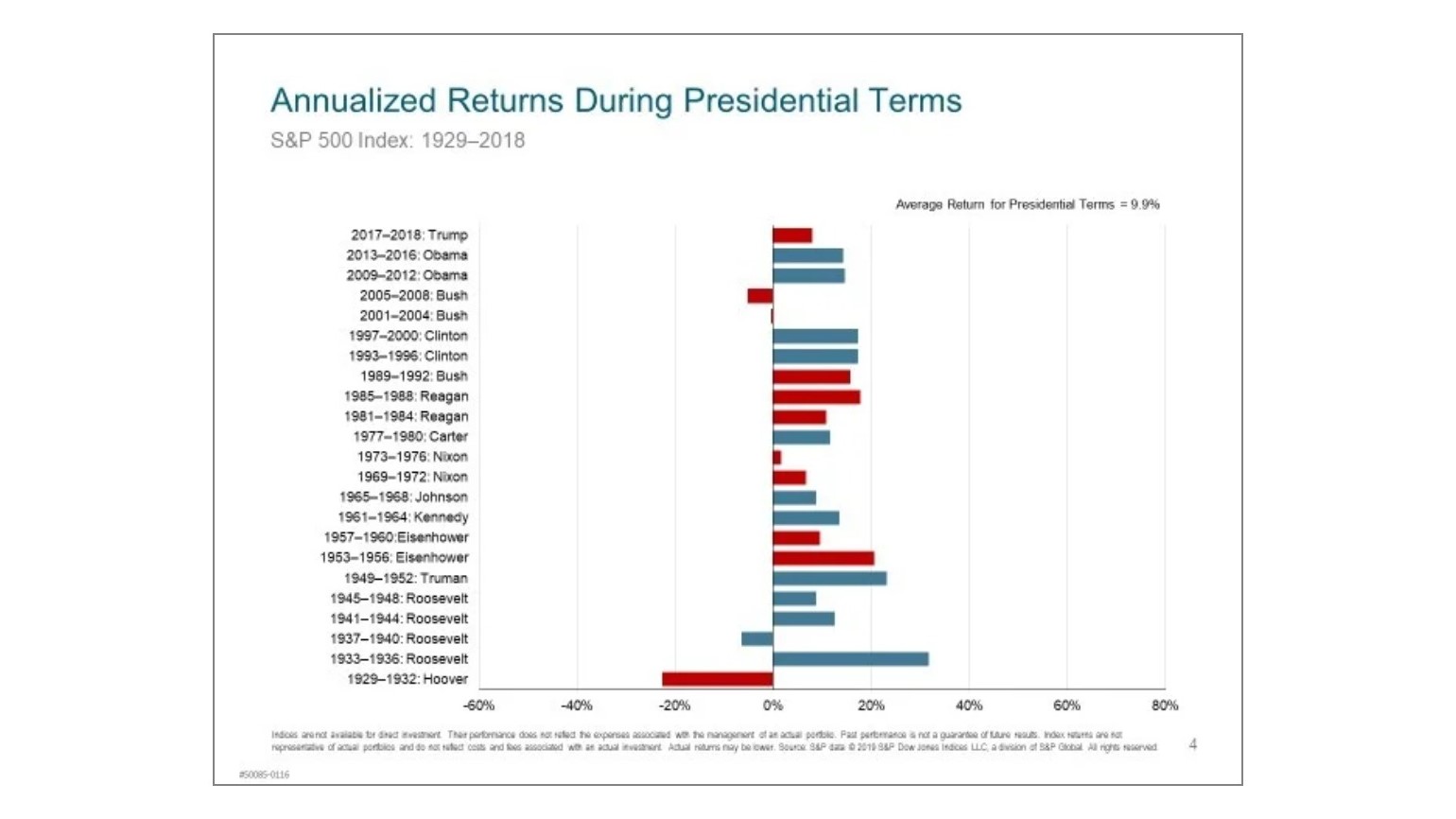

The chart below shows annualized returns during full presidential terms. With a few exceptions, average returns over the entire terms of most presidents have been positive, regardless of political party.

And an analysis from BTN Research looks at total S&P return over the past 50 years, according to which party held power in both the White House and the Congress. As you can see, the impact of various political configurations is less than you might assume.

- +17.5% Democratic President and a Republican-led Congress

- +5.4% Republican President and a Democratic-led Congress

- +12.3% White House and Congress controlled by the same political party

- +10.8% House and Senate controlled by different parties, regardless of which party is in the White House

- Check out this free online class on How to Election-Proof Your Retirement.

Now, all this doesn’t mean there won’t be short-term volatility. There will always be volatility. But when you expect volatility, you develop a plan on how to handle it. And that plan should be based on your personal financial circumstances, not outside events.

While it can be tempting to try to read the statistical tea leaves and formulate a plan to “beat the market,” for those nearing retirement, that could backfire.

Yes, during your younger years, it often does make sense to take risks that give you the potential for higher returns. But as you near retirement, your primary goal becomes generating a reliable outcome because you’ll need a retirement paycheck that lasts.

Often, that requires a new way of thinking about investing. What you need is an investment plan that gives you confidence, knowing your retirement cash flows are secure – no matter who wins, now or in the future.

- Build a retirement plan customized for your unique financial situation.

2. Build a Portfolio That Can Withstand Volatility

If you’re asking what will happen to the markets as a result of the election, and what you should do about it now, perhaps you aren’t posing the right questions.

Instead, ask yourself what portion of your investment portfolio you need to withdraw in retirement, and when? After all, isn’t that what matters?

Let’s say you’ve run your numbers, and you estimate that you will need to withdraw $25,000 each year in retirement from your investments. If you’re five years away from retirement, you could put about $125,000 ($25,000 x 5) of your retirement savings in accessible, safe investments. Not stocks. If you’re 10 years away, reserve about $250,000 and so on.

What kind of investments? Consider less-volatile holdings like these:

- Money market funds

- Short-term municipal bond funds

- No-commission fixed annuities

- US government agency bonds

For higher yields, though, you could check out some new ultra, short-term municipal bond funds or build a ladder of fixed annuities. Sensible Money is able to offer its clients slightly higher yields on fixed annuities through an exclusive partnership with DPL Financial Partners.

The idea is to invest this money in something liquid and safe, so you don’t have to worry about short-term market shifts. You can keep the remainder of your portfolio invested in long-term assets such as stocks, but your pool of safer investments will give you breathing room to put volatile events like elections in perspective.

After all, more so than buying a house or a car, retirement is the biggest financial decision you’ll make. Getting the right plan in motion, and sticking to it, will determine the level of financial security you have for thirty or forty years, or even more.

- Stress-test your retirement income plan with these 3 steps.

3. Create a Retirement Plan Focused on Income

No matter who sits in the White House, the top financial priorities in retirement are to maximize income, while also minimizing risk. That’s why it’s important to build a plan for retirement income now – a plan that identifies your future spending, sources of cash flow, taxes, and risks.

For spending, you’ll want to model out your daily living expenses. But you’ll also want to consider how spending on items like health care, home repairs, autos, mortgages, and travel will evolve as you move through your retirement years.

For example, while you may spend more in early retirement, that spending is likely to slow down when you hit your mid-70s. And if you have a mortgage now, it may be paid off later, but property taxes and insurance expenses will continue.

Remember, you must also incorporate income taxes, which will vary depending on whether you’re drawing income from taxable brokerage accounts, retirement accounts like 401(k)s and IRAs, or Social Security. For example, preferential tax rates apply to dividends and capital gains from a taxable brokerage account.

In contrast, regular income tax rates, which are typically higher, apply to withdrawals from traditional IRA and 401(k) retirement accounts. Social Security income is run through its own complex formula that determines how much of it is taxed.

You’ve also got to project your cash flow over time, so you make sure you have enough to meet your lifestyle needs throughout retirement.

For sources of cash, first, list fixed sources such as Social Security, pensions, annuity payments, and rental income – and the expected timing of such income. Then, estimate how much additional cash you’ll need to supplement these fixed sources.

This number becomes your estimate of withdrawals, and it provides the projected cash needs that will help define objectives for your investment portfolio.

- Get a free guide on 4 Things Near-Retirees Must Know About the 4% Rule.

Don’t React, Make a Plan

Once you have an investing plan that accounts for volatility, the only reason to change your portfolio’s asset allocation is if your financial situation or long-term goals have changed.

For retirees, an income plan will also help you squeeze the most you can out of your savings. And that will give you added confidence in the face of any market swings (due to elections or otherwise).

The bottom line is that for most of us, the upcoming election should not trigger personal financial changes that warrant portfolio adjustments. So, if you’re itching to alter your portfolio now, make sure the changes are for the right reasons.

- Discover how to squeeze every penny out of your retirement savings. Download the Don’t Cheat Yourself guide today.

Dana Anspach is the founder and CEO of Sensible Money, LLC. Practicing as a financial planner since 1995, when Dana began working with people in their 50s and 60s, she realized that a different type of planning was needed to align one’s finances for a transition out of the workforce.

As Dana says, “The retirement income planning process is alive with choices and variables. To make the best decisions you need a way to understand the interactions of the choices you make and the corresponding impact on your future. You need an independent voice. You need information free of the influence of politics, financial products, or advertising incentivized media articles. Thus, was born the vision for Sensible Money.”

You can also read the first chapter of Dana Anspach’s book, Control Your Retirement Destiny. And listen to this podcast.

This content was provided by Sensible Money. Kiplinger is not affiliated with and does not endorse the company or products mentioned above.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.