Is Relief from Shipping Woes Finally in Sight?

After years of supply chain snags, freight shipping is finally returning to something more like normal.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

After two years of shipping delays and rising delivery costs, relief is in sight. By the end of the year, a marked improvement will be seen compared with a year ago.

The numbers of new drivers and trucks have picked up, easing constraints, though chassis shortages will likely continue into 2023. Spot market rates for trucks, excluding fuel surcharges, have dropped 30% from their peak earlier this year. They should decline a bit more, ending 2023 about 5% above their prepandemic level, according to Avery Vise, Vice President of Trucking at FTR Transportation Intelligence. Contract rates are typically slower to respond, and should ease to 17% above their prepandemic level by the end of 2023. Also, diesel prices are still 65% above prepandemic, so fuel surcharges will continue to be higher than normal. However, if a recession happens next year, then both volumes and rates will tumble.

Congestion at East Coast ports should ease in the next few months as a new labor contract is likely to be signed for West Coast dockworkers, allowing more vessels to return to using West Coast ports. Ship traffic from Asia is easing as 70% of retailers shipped early this year ahead of the holiday season, after getting burned last year, according to Ken Hoexter, a managing director at Bank of America. Ocean freight rates from China to the West Coast have fallen to $3,900 per 40-foot container, though that is still $2,500 more than the prepandemic average.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Rail freight is the problem child, according to Todd Tranausky, vice president of rail & intermodal at FTR. Freight has been moving at slower than normal speeds this year because of crew staffing shortages. Prior to the pandemic, the railroads embarked on a cost-cutting and labor-saving spree, reducing the workforce from 60,000 to 52,000. During the pandemic, that number dropped further and has only partially rebounded to 48,000 currently. This staffing level was inadequate for the greater demands of the past two years, and intermodal loadings have been stuck at a fixed level of capacity. Reduced demand may help the railroads return to an average speed level, but the system is still fragile and subject to shocks. Intermodal rates rose 15% last year, and should rise a further 2% to 3% on a year/year basis, according to Tranausky. Carload rates should rise 4% to 6%.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

David is both staff economist and reporter for The Kiplinger Letter, overseeing Kiplinger forecasts for the U.S. and world economies. Previously, he was senior principal economist in the Center for Forecasting and Modeling at IHS/GlobalInsight, and an economist in the Chief Economist's Office of the U.S. Department of Commerce. David has co-written weekly reports on economic conditions since 1992, and has forecasted GDP and its components since 1995, beating the Blue Chip Indicators forecasts two-thirds of the time. David is a Certified Business Economist as recognized by the National Association for Business Economics. He has two master's degrees and is ABD in economics from the University of North Carolina at Chapel Hill.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

How to Search For Foreclosures Near You: Best Websites for Listings

How to Search For Foreclosures Near You: Best Websites for ListingsMaking Your Money Last Searching for a foreclosed home? These top-rated foreclosure websites — including free, paid and government options — can help you find listings near you.

-

Four Tips for Renting Out Your Home on Airbnb

Four Tips for Renting Out Your Home on Airbnbreal estate Here's what you should know before listing your home on Airbnb.

-

Economic Pain at a Food Pantry

Economic Pain at a Food Pantrypersonal finance The manager of this Boston-area nonprofit has had to scramble to find affordable food.

-

The Golden Age of Cinema Endures

The Golden Age of Cinema Enduressmall business About as old as talkies, the Music Box Theater has had to find new ways to attract movie lovers.

-

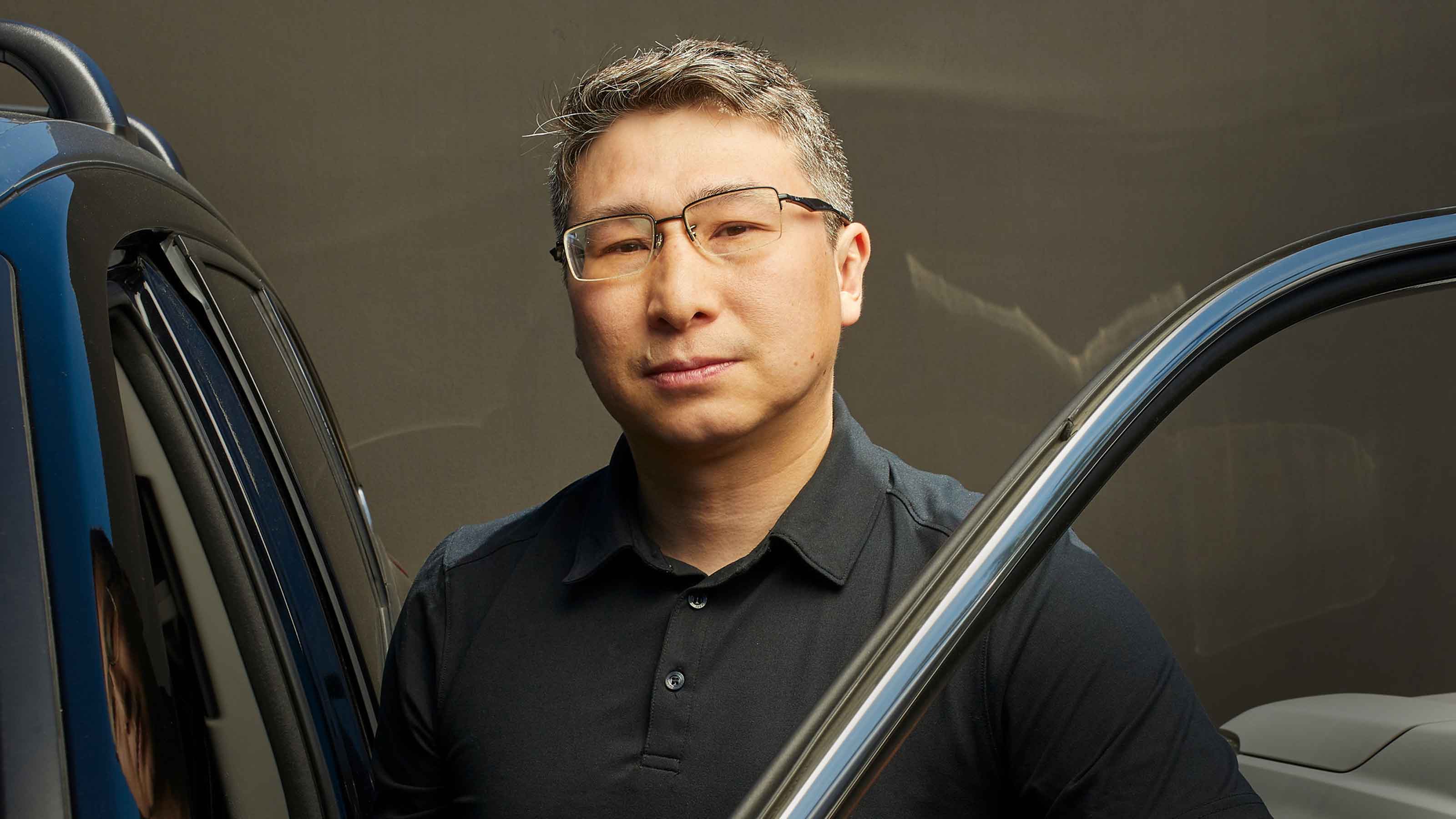

Pricey Gas Derails This Uber Driver

Pricey Gas Derails This Uber Driversmall business With rising gas prices, one Uber driver struggles to maintain his livelihood.

-

Smart Strategies for Couples Who Run a Business Together

Smart Strategies for Couples Who Run a Business TogetherFinancial Planning Starting an enterprise with a spouse requires balancing two partnerships: the marriage and the business. And the stakes are never higher.

-

Fair Deals in a Tough Market

Fair Deals in a Tough Marketsmall business When you live and work in a small town, it’s not all about profit.

-

Extending Financial Planning’s Reach

Extending Financial Planning’s ReachFinancial Advisers The challenge is to attract more women and minorities as professionals—and clients.