Fair Deals in a Tough Market

When you live and work in a small town, it’s not all about profit.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

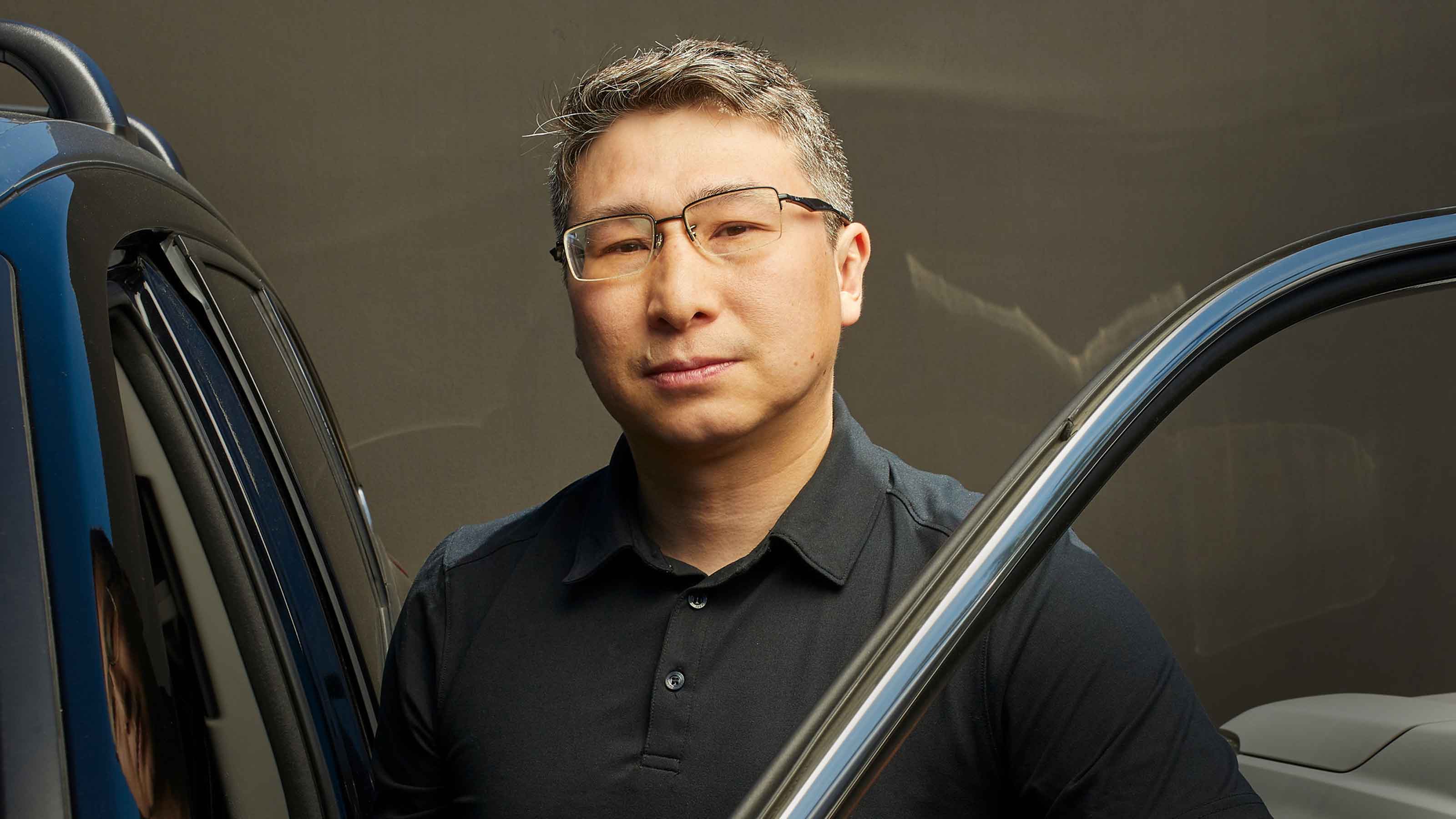

Who: Leo Karl III, 61

What: President of Karl Chevrolet

Where: New Canaan, Conn.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Who are your customers? We sell new Chevrolets and a variety of preowned vehicles, predominantly trucks and SUVs. We cater to small businesses with work trucks, but the core of our business is families that drive various sizes of SUVs for hauling kids and gear around and living life in New England. Leasing is around half of our business.

New Canaan has a population of around 20,000 people. It’s in the heart of Fairfield County, Conn., best known as a bedroom community for New York commuters. We’re a third-generation family business, with about 40 employees now. There are several nearly 100-year-old family businesses that have been in the same family in New Canaan—there’s been a lot of camaraderie and competition over the years.

How did the pandemic impact your business? I made the decision early on that we were not going to lay anyone off, although I asked everyone to take a 20% pay cut temporarily. We had customers in the health care industry and local first responders who rely on their vehicles every day, so we wanted to be here for them. And because we weren’t spending time doing a lot of regular business, we rallied around some community needs. We helped Grace Farms Foundation, which is a local nonprofit, distribute masks, gowns, shields and gloves to local hospitals and first responder organizations. And we served as a drop-off point for water and food for some local health care organizations. So we kept busy during those times.

Many smaller-town dealers are involved in the community. One of the hallmarks of our business has always been community involvement. I’m currently on the board at Waveny Life Care Network, which is a senior living and care organization. It has been really interesting to have a retail auto business as my day job and then to be on the board of a health care facility through the pandemic. But I think those two things combined gave me access to a lot of information as it was evolving and to navigate the business side for my employees. Throughout the pandemic, we openly communicated with our team on the latest health and safety information from the CDC, the state and my local health care connections.

How have you grappled with supply shortages? When the pandemic first hit, there were a tremendous number of late model preowned vehicles on the market at very low prices. Hertz was going through a bankruptcy, and they were liquidating vehicles with very few miles on them. So we aggressively bought a lot of that kind of inventory, and that fueled our business for the following year. We went from selling about one used car for every three new to selling two or three used vehicles for every one new. But eventually, that supply shrank, and in March and April of last year, the prices had risen so much that a three-year-old vehicle was selling for almost the same price as a brand-new one. I couldn’t bring myself to ask our customers to pay that kind of a premium. We still did a fair amount of preowned sales, but not as brisk as the year before.

You don’t charge above sticker price? Integrity is one of our core values, and we have never charged a premium for any vehicle. On the new-car side of things, inventory is very tight. I normally have 150 new vehicles in stock, and now I might have 10. While other stores have been waiting to get vehicles in and tacking on market premiums, we have had customers order from the factory and pay in advance. The longer the pandemic has gone on, the harder it has been to continue this policy. But we’re delivering new vehicles every month and keeping the lights on and keeping our team engaged. And our customers, I think, are happy, even if they’re not jubilant about the wait. I believe in the long term that we will come out of this stronger because we’ve tried to do the right thing by our customers.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Emma Patch joined Kiplinger in 2020. She previously interned for Kiplinger's Retirement Report and before that, for a boutique investment firm in New York City. She served as editor-at-large and features editor for Middlebury College's student newspaper, The Campus. She specializes in travel, student debt and a number of other personal finance topics. Born in London, Emma grew up in Connecticut and now lives in Washington, D.C.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

How to Search For Foreclosures Near You: Best Websites for Listings

How to Search For Foreclosures Near You: Best Websites for ListingsMaking Your Money Last Searching for a foreclosed home? These top-rated foreclosure websites — including free, paid and government options — can help you find listings near you.

-

Four Tips for Renting Out Your Home on Airbnb

Four Tips for Renting Out Your Home on Airbnbreal estate Here's what you should know before listing your home on Airbnb.

-

Is Relief from Shipping Woes Finally in Sight?

Is Relief from Shipping Woes Finally in Sight?business After years of supply chain snags, freight shipping is finally returning to something more like normal.

-

Economic Pain at a Food Pantry

Economic Pain at a Food Pantrypersonal finance The manager of this Boston-area nonprofit has had to scramble to find affordable food.

-

The Golden Age of Cinema Endures

The Golden Age of Cinema Enduressmall business About as old as talkies, the Music Box Theater has had to find new ways to attract movie lovers.

-

Pricey Gas Derails This Uber Driver

Pricey Gas Derails This Uber Driversmall business With rising gas prices, one Uber driver struggles to maintain his livelihood.

-

Smart Strategies for Couples Who Run a Business Together

Smart Strategies for Couples Who Run a Business TogetherFinancial Planning Starting an enterprise with a spouse requires balancing two partnerships: the marriage and the business. And the stakes are never higher.

-

Extending Financial Planning’s Reach

Extending Financial Planning’s ReachFinancial Advisers The challenge is to attract more women and minorities as professionals—and clients.