Debt Ceiling Crisis: What Did Stocks Do the Last Time the U.S. Nearly Defaulted?

Playing chicken with the debt ceiling has been bad for stocks in the past.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The halting pace of negotiations over the debt ceiling crisis is quite understandably making market participants increasingly nervous. After all, the last time the U.S. government came this close to defaulting on its debt obligations, equity markets absolutely hated it.

History doesn't repeat itself and past performance is not a guarantee of future results. The usual caveats always apply. But a look at what stocks did when debt ceiling negotiations came down to the wire in 2011 is not encouraging at all.

Before we get into the past, however, it is important to emphasize that the vast majority of experts believe that Washington will come to its senses before it's too late in 2023 too.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

True, lawmakers are getting perilously close to running out of time to raise the debt ceiling. Treasury Secretary Janet Yellen has warned that the federal government could hit the "X-date" – or the day on which it runs out of cash to pay its bills – as early as June 1.

Other calculations suggest the government has more time than Yellen thinks – but not by much. Alec Phillips, Goldman Sachs' chief political economist, said in an interview that X-date is more likely to fall on June 8 or 9.

Either way, the odds of actually getting to X-date remain remote. The market for credit default swaps on U.S. debt is pricing in a 2% probability of a technical default. Most economists, strategists and portfolio managers also believe the government will get its act together on the debt ceiling in time.

"We see roughly a 60% probability of a short-term extension pushing X-date to September 30 or slightly beyond; a 30% probability of a resolution by early June; an 8% probability of no action by Congress resulting in Biden invoking the use of the 14th amendment; and a 2% probability of an outright Treasury default," notes Steven Zeng, U.S. rates strategist at Deutsche Bank.

The problem for equity investors is that the last time Washington cut it this close on raising the debt ceiling, markets sold off sharply and went on to deliver an essentially flat return for the calendar year.

Stocks in the debt ceiling crisis of 2011

The closest historical parallel to Washington's current game of debt-ceiling chicken came in the summer of 2011. Republicans agreed to raise the debt ceiling on July 31 – or just two days before the government expected to run out of cash. Catastrophe was avoided, but just barely. The brinkmanship even led Standard & Poor's to take the once unthinkable step of cutting the federal government's long-term credit rating.

It wasn't a fun time. As analysts at JPMorgan Chase recall: "Risk assets reacted negatively: the dollar sold off, stocks sank and credit spreads widened. But a strong rally in Treasuries (driven by other percolating market fears at the time like the European sovereign debt crisis) led bonds higher overall."

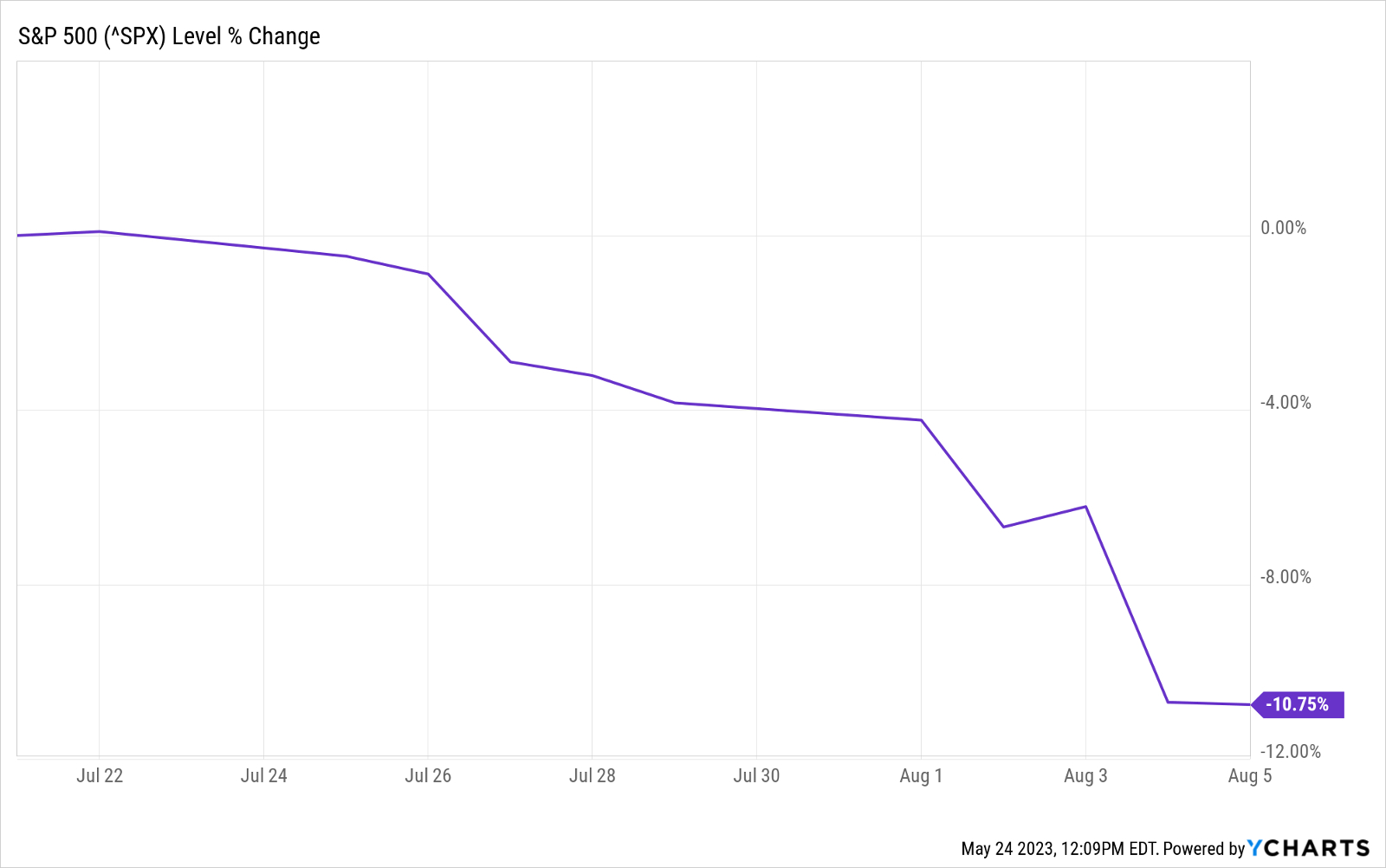

The immediate reaction from the stock market was swift and severe. As you can see in the chart below, the S&P 500 lost almost 11% on a price basis between July 21 – or 10 days before the debt ceiling agreement – and Aug. 5, the day of the S&P credit downgrade.

Of course, the above chart shows only a snapshot in time from right around the apex of the debt ceiling crisis. Pressure began building months before, and the market wasn't done fumbling for a bottom for many, many weeks. Ultimately, from the S&P 500's closing 2011 peak to its closing 2011 trough, the index lost more than 19% on a price basis. Have a glance at what that looked like in the chart below:

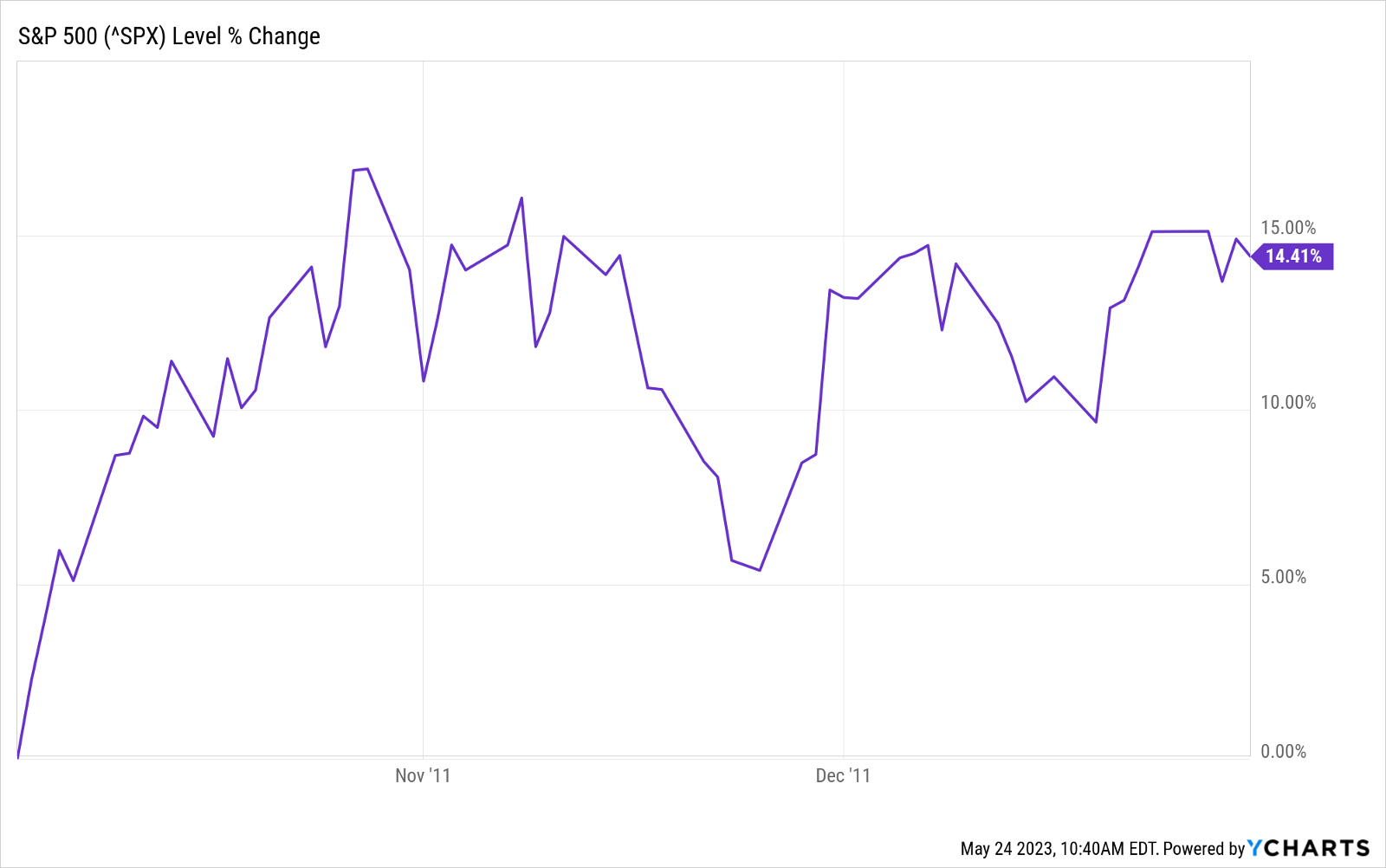

Markets did recover in the fourth quarter, however. Indeed, anyone who timed it perfectly that year grabbed hold of a rally of almost 15% through the end of 2011:

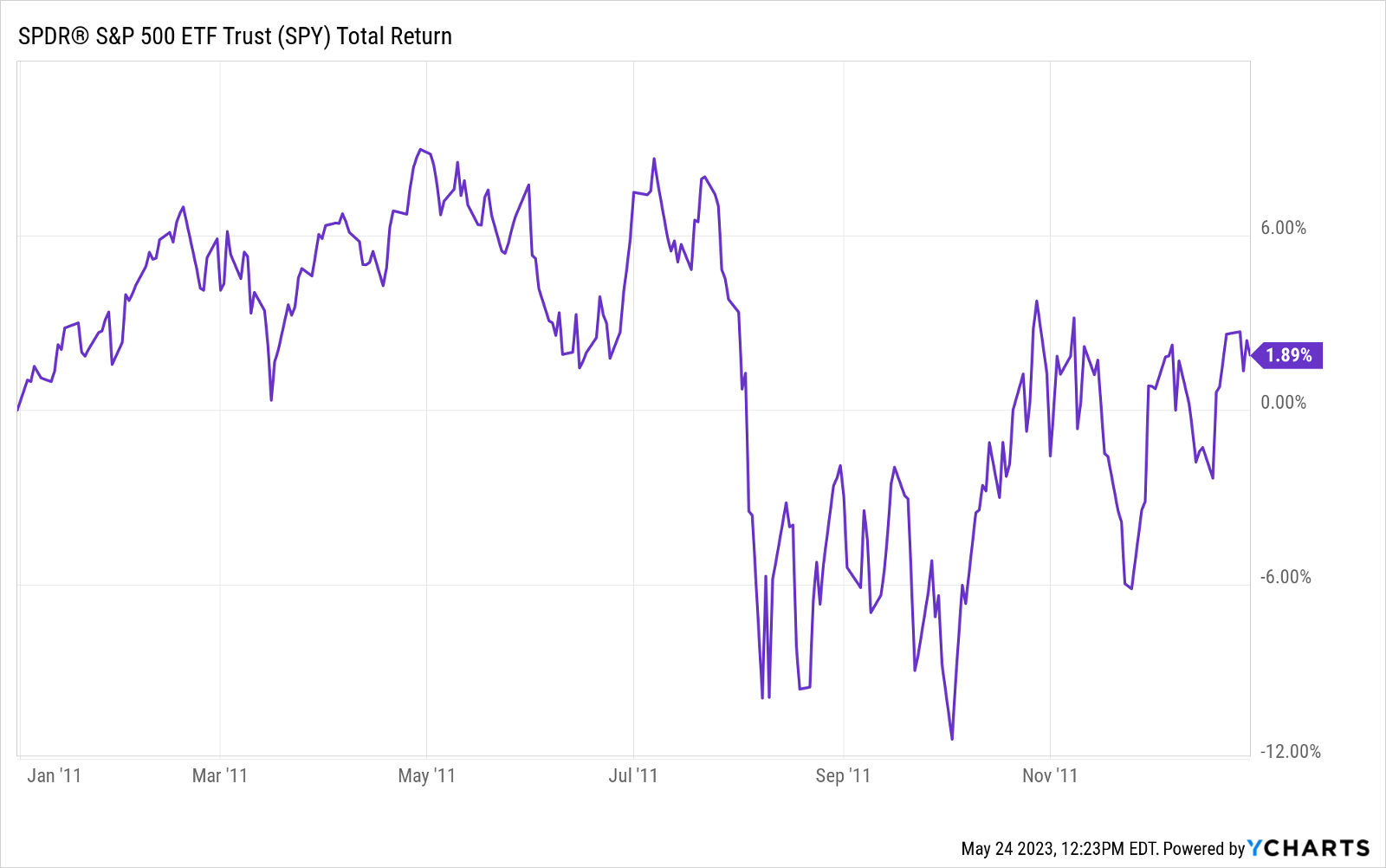

Nevertheless, taken as a whole, calendar 2011 was pretty much a lost year for equity investors. The market at one point had been on pace to deliver double-digit-percent returns. Instead, the debt ceiling crisis turned stocks into a dud. The S&P 500 was flat on a price basis in 2011.

Have a look at the chart below and you'll see that even on a total return basis (price change plus dividends), the SPDR S&P 500 Trust ETF (SPY) generated a gross return of not even 1.9%.

The broader market is on pace to deliver double-digit-percent returns this year – just as it was back in 2011 before the threat of default derailed everything. If nothing else, the events of 12 years ago suggest that Washington needs to reach a deal on the debt ceiling sooner rather than later. Leaving an agreement to the very last minute had dire consequences for equities the last time around. And no one wants to go through that again.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

How the Stock Market Performed in the First Year of Trump's Second Term

How the Stock Market Performed in the First Year of Trump's Second TermSix months after President Donald Trump's inauguration, take a look at how the stock market has performed.

-

What the Rich Know About Investing That You Don't

What the Rich Know About Investing That You Don'tPeople like Warren Buffett become people like Warren Buffett by following basic rules and being disciplined. Here's how to accumulate real wealth.

-

How to Invest for Rising Data Integrity Risk

How to Invest for Rising Data Integrity RiskAmid a broad assault on venerable institutions, President Trump has targeted agencies responsible for data critical to markets. How should investors respond?

-

What Tariffs Mean for Your Sector Exposure

What Tariffs Mean for Your Sector ExposureNew, higher and changing tariffs will ripple through the economy and into share prices for many quarters to come.

-

How to Invest for Fall Rate Cuts by the Fed

How to Invest for Fall Rate Cuts by the FedThe probability the Fed cuts interest rates by 25 basis points in October is now greater than 90%.

-

Are Buffett and Berkshire About to Bail on Kraft Heinz Stock?

Are Buffett and Berkshire About to Bail on Kraft Heinz Stock?Warren Buffett and Berkshire Hathaway own a lot of Kraft Heinz stock, so what happens when they decide to sell KHC?

-

How the Stock Market Performed in the First 6 Months of Trump's Second Term

How the Stock Market Performed in the First 6 Months of Trump's Second TermSix months after President Donald Trump's inauguration, take a look at how the stock market has performed.

-

Vanguard Is 50! Here's How It Has Made Investing Better

Vanguard Is 50! Here's How It Has Made Investing BetterVanguard was established by John C. Bogle in May 1975, and the fund manager's impact on investing has been revolutionary.