Is Etsy Stock Finally a Buy?

Etsy stock might be the bargain investors have been waiting for now that it's 70% off its all-time high.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Few stocks benefited more from the darkest days of the pandemic than Etsy (ETSY). Consumers and creators hunkering down at home flocked to the online crafts marketplace. Revenue, and ETSY stock, soared.

But now, like so many other pandemic-era darlings, ETSY stock has come back down to Earth. The lockdowns are over; brick-and-mortar retail traffic is back.

Even more daunting is the fact that Etsy has to contend with tough year-over-year comparisons at a time when retail spending is softening. Inflation peaked nearly a year ago, but it remains at a multi-decade high. That creates an especially difficult environment for any company selling mostly consumer discretionary goods.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

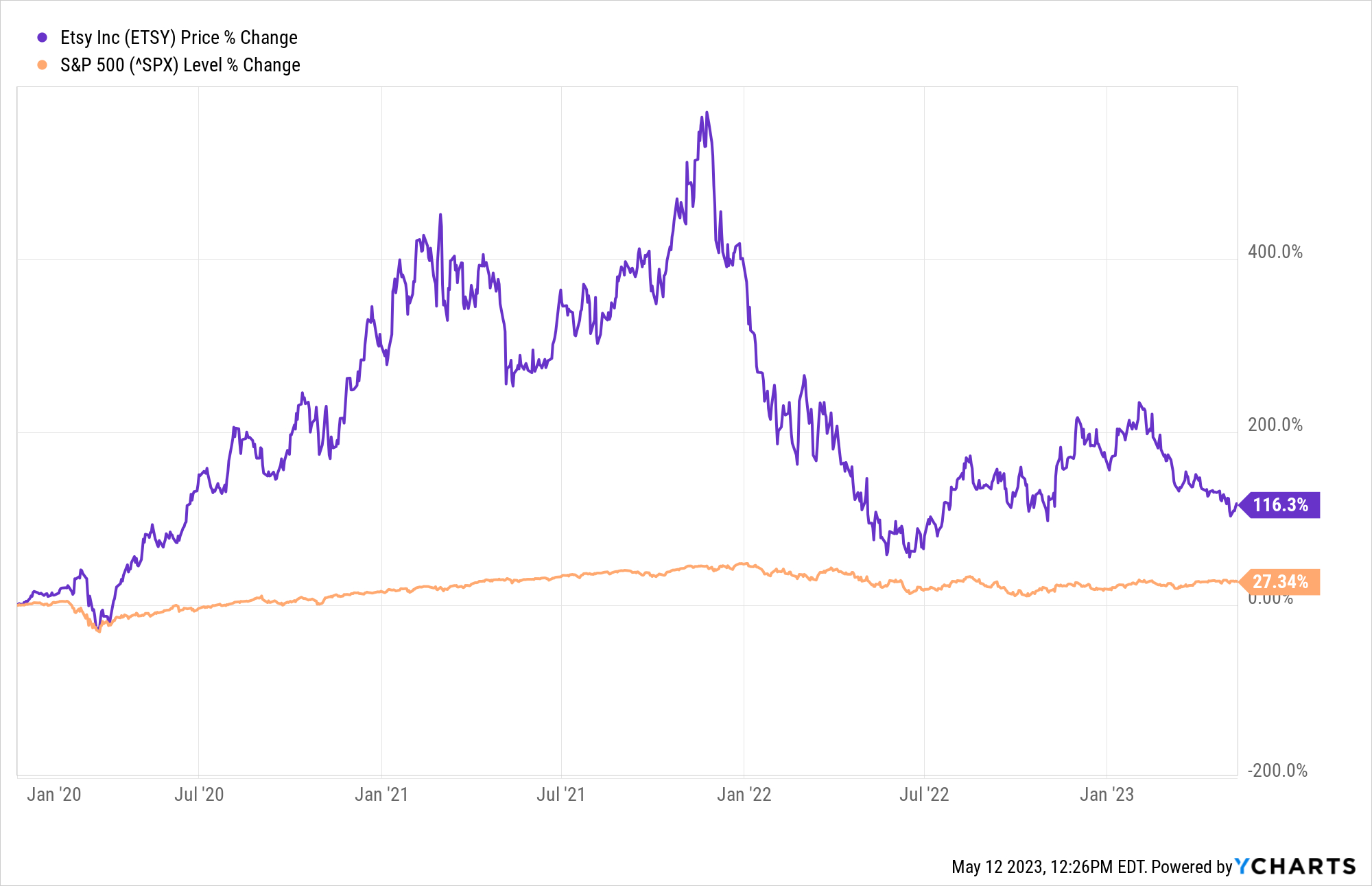

To recap: the first year of the pandemic was outstanding for ETSY stock, with shares more than quadrupling in 2020. The S&P 500, by comparison, gained 16% on a price basis that year.

And Etsy stock was just getting started, powering ever higher through the first 11 months of 2021. Indeed, between Dec. 31, 2019 and its all-time closing high set in late November 2021, ETSY rose 570%. The broader market added 46% on a price basis over the same span.

We all know what happened next. ETSY remains almost 70% below its record high of late 2021. Heck, shares have lost a fifth of their value in 2023 alone.

So where does ETSY go from here? Some analysts argue that the painful selloff in Etsy stock is overdone. Others contend that rising prices and looming recession make ETSY a bad idea at this moment in the cycle.

Let's have a look at what Wall Street and the data make of Etsy stock at current levels.

Etsy stock: Buy, Sell or Hold?

Etsy's days of extraordinary top-line growth are long gone, that's for sure. Annual revenue more than doubled during the first year of the pandemic, soaring to $1.7 billion in 2020 from $818.4 million the prior year. Revenue increased by another 35% in 2021.

Etsy's top line expanded by just 10% last year, however, and analysts forecast revenue to increase by just 7.6% in 2023.

Earnings per share (EPS) followed a similar trend, and they too have stalled out. The Street forecasts Etsy to generate adjusted EPS of $4.33 in 2023, or a decline of more than 6% from the $4.61 a share it earned last year.

On the bulls' side of the debate stands Truist Securities analyst Youssef Squali. He rates Etsy stock at Buy, citing data that suggests the company is adjusting well to the post-pandemic marketplace.

"User metrics show that Etsy is retaining most of the gains achieved during COVID-19, positioning it well for a more normalized setting," Squali writes in a note to clients. The analyst adds that the guidance Etsy offered when it reported earnings in early May was "appropriately conservative given potential risks to consumer spending from high inflation, rising rates, a weak macroeconomic environment and [unfavorable] foreign exchange."

Other analysts aren't quite as comfortable about Etsy's prospects.

"Etsy is an innovative company with a compelling business model, and a huge addressable market, that saw a tremendous benefit from shopping at home and economic stimulus, as well as from its sellers' enterprising ability to fill an unprecedented demand for COVID masks," writes Argus Research analyst Chris Graja.

Nevertheless, Graja rates shares at Hold, saying he is "looking for a more favorable entry point." Although Etsy is a company with "tremendous growth potential and a great business plan," the traders who originally drove shares higher appear to have cashed out, he notes.

"The change in the macro environment has caused investors to become more conservative in their assumptions," Gaja says. "We have probably seen a shift in Etsy's investor base from aggressive growth investors to growth-at-a-reasonable-price investors, who may use lower assumptions for long-term growth."

Collectively, the Street gives Etsy stock a recommendation of Buy, but with less than stellar conviction. Of the 29 analysts covering the stock tracked by S&P Global Markets Intelligence, 10 rate it at Strong Buy, six say Buy, 11 have it at Hold and two call it a Strong Sell.

With an average target price of $124.90, analysts give Etsy stock implied upside of about 30% in the next 12 months or so. For context, the Street's highest target price of $186 implies that shares will gain more than 90% over the next year. Conversely, Etsy stock would fall by more than 50% if the Street's lowest price target were to come to pass.

And while Etsy's valuation has come down markedly from some previously eye-watering levels, it's not exactly a screaming bargain, either.

Shares change hands at 19.4 times analysts' average next-12-months EPS estimate. That's well below ETSY's five-year average of 26 times expected earnings. On the other hand, 19.4 times future earnings seems a bit pricey for a company forecast to generate average annual EPS growth of 13.4% over the next three to five years.

Keep in mind that this is not a market where investors can bank on multiple expansion. If anything, recessionary fears could cause multiples to contract.

Etsy stock is a tough call, to be sure. Analysts lean toward bullishness on the name, but without great conviction. Ultimately, there are probably more surefire places to allocate capital than a past pandemic hero.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

Stock Market Today: Trump Tariff Threats Keep Pressure on Stocks

Stock Market Today: Trump Tariff Threats Keep Pressure on StocksThe president warned of 25% tariffs being levied on automobiles, semiconductor chips and pharmaceutical imports.

-

Etsy Stock Sinks on Revenue Miss: What to Know

Etsy Stock Sinks on Revenue Miss: What to KnowEtsy stock is notably lower Wednesday after the online retailer fell short of revenue expectations for the key holiday quarter.

-

Buy eBay and Sell Etsy, Morgan Stanley Says

Buy eBay and Sell Etsy, Morgan Stanley SaysMorgan Stanley is bullish on eBay and bearish on Etsy. Here’s what you need to know.

-

Stock Market Today: Stocks Limp Out of the Starting Gate

Stock Market Today: Stocks Limp Out of the Starting GateStock Market Today Monday's session saw stocks give back a little territory from last week's rebound rally, but experts are seeing a few reasons to be optimistic.

-

25 Best S&P 500 Stocks of the Pandemic Bull Market

25 Best S&P 500 Stocks of the Pandemic Bull Marketstocks Work-from-home stocks and home-improvement retailers might have been the stars of the COVID bull's first half, but they didn't finish on top.

-

Stock Market Today: Stocks Suffer Worst Losses of 2022

Stock Market Today: Stocks Suffer Worst Losses of 2022Stock Market Today Investors snapped out of their brief post-Fed euphoria and rushed to the exits Thursday, with high-priced tech among the most punished stocks.

-

20 High-Volatility Stocks for the Market's Next Swing

20 High-Volatility Stocks for the Market's Next Swingstocks Active or tactical investors and traders might want to lean into the market's volatility via high-quality, high-vol stocks.

-

Stock Market Today: Dow Dashes to Best Gain Since November 2020

Stock Market Today: Dow Dashes to Best Gain Since November 2020Stock Market Today Russia reportedly is opening the door to negotiations, sparking a broad-based rally Friday that saw all 11 sectors finish well in the green.