If You'd Put $1,000 into Intel Stock 20 Years Ago, Here's What You'd Have Today

Intel stock has been a catastrophe for long-term investors.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Imagine a company that's enjoyed overwhelming success in its key markets for ages and also claims one of the most valuable and recognizable brands in the world.

This company was so important to both its sector and the broader economy that it was a component of the Dow Jones Industrial Average for nearly a quarter of a century.

One would expect this blue chip stock to have been an outstanding buy-and-hold bet. To be fair, for a good long while, it was.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

That was then. This is now.

Unfortunately, the former Dow Jones stock we're talking about is Intel (INTC).

Shares almost doubled in 2023, helped by a multibillion-dollar cost-cutting campaign and the generalized euphoria surrounding all things artificial intelligence (AI). Intel bulls harbored hopes that the year marked an inflection point for the long-time market laggard.

It hasn't worked out that way. INTC stock still trades almost 40% below its late 2023 peak. Heck, shares remain 60% below their all-time high.

It's hard to believe now, but once upon a time, INTC was one of the best stocks on the planet. Cut to the present, and it's not clear what it will take to return the company to its glory days.

Intel still dominates the markets for central processing units (CPUs) for PCs and servers, but it's been losing share to rivals at an accelerating rate for some time. Nvidia (NVDA) and Advanced Micro Devices (AMD) are just a couple of its formidable competitors.

Where the semiconductor company really went wrong — apart from execution missteps and manufacturing delays — is the way it missed some of the biggest changes in technology. Intel famously whiffed on mobile, and now Nvidia is running away in generative AI.

It's been a curious ride for INTC investors. Thanks to its dot-com era heyday, Intel was one of the 30 best stocks in the world from 1990 to 2020.

In those three decades, INTC stock generated more than $340 billion in wealth for shareholders, or an annualized dollar-weighted return of 16%, says Hendrik Bessembinder, a finance professor at the W.P. Carey School of Business at Arizona State University.

However, the past two decades of that 30-year span have been another story.

The bottom line on Intel stock?

If you go all the way back to Intel's debut in the early 1970s as a publicly traded company, it beats the broader market handily. The chipmaker's annualized all-time total return stands at 13%. The S&P 500's annualized total return comes to 10.8% in the same span.

If you look at pretty much any other standardized period, an investment in INTC has been a major dud.

Intel stock trails the broader market by distressingly wide margins in the past three-, five-, 10- and 20-year periods. Its five-year annualized total return is negative.

What does this sort of performance look like on a brokerage statement? Nothing short of ugly.

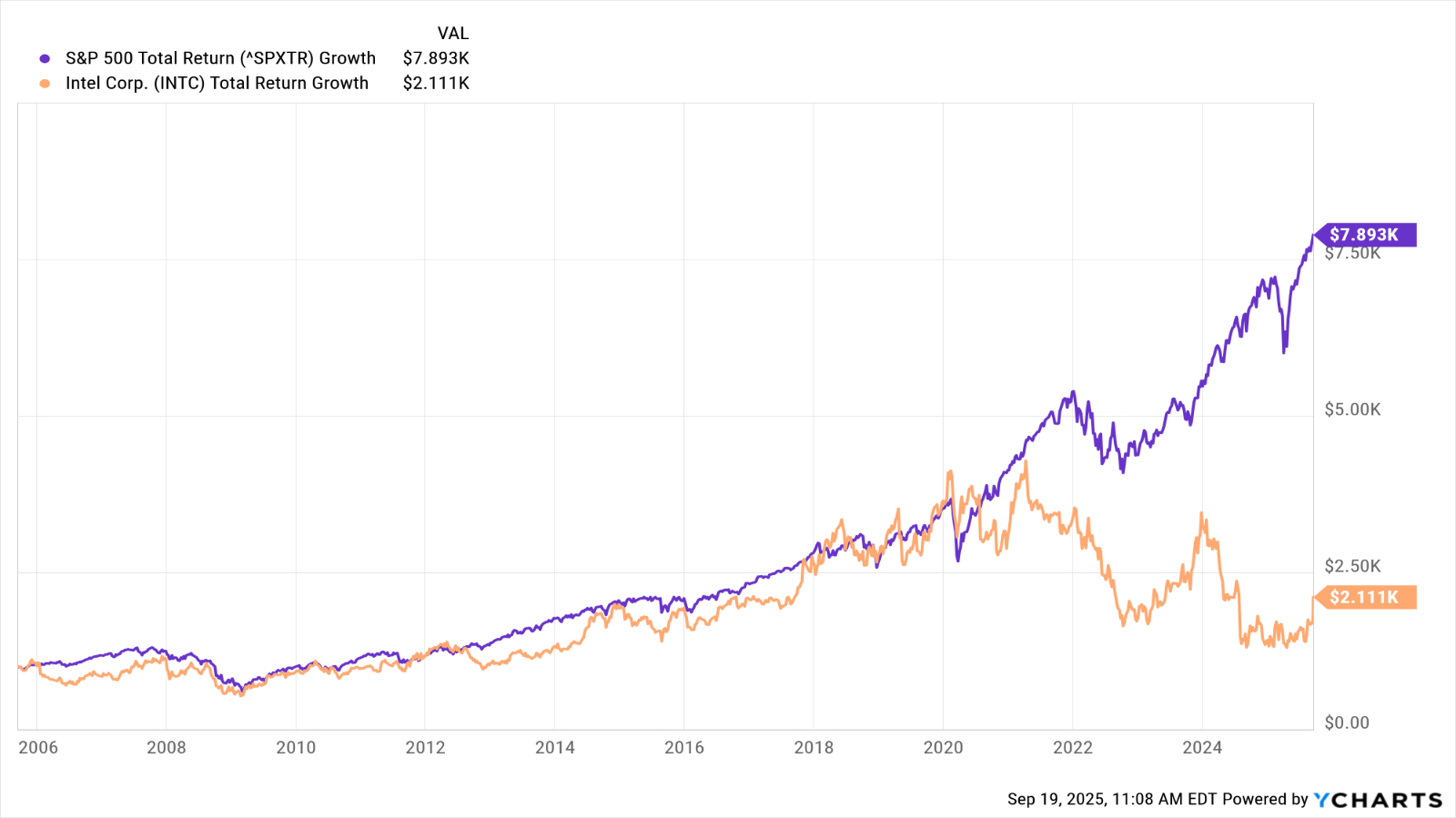

Have a look at the above chart, and you'll see that if you invested $1,000 in Intel stock 20 years ago, today your stake would be worth about $2,100 — or an annualized total return of 3.8%.

The same amount invested in the S&P 500 would theoretically be worth about $7,900 today — an annualized total return of 10.9%.

As illustrious and iconic as the Intel brand might be, Intel stock has been nothing but a sinkhole of opportunity cost for buy-and-hold investors for a very long time.

More Stocks of the Past 20 Years

- If You'd Put $1,000 Into IBM Stock 20 Years Ago, Here's What You'd Have Today

- If You'd Put $1,000 Into Microsoft Stock 20 Years Ago, Here's What You'd Have Today

- If You'd Put $1,000 Into Apple Stock 20 Years Ago, Here's What You'd Have Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.