25 Small Towns With Big Millionaire Populations

Large concentrations of high-net-worth households are found in surprising locales across the U.S. Check out the latest list of American small towns teeming with well-to-dos.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

A million bucks in liquid assets isn't what it used to be, but it's still really hard to amass.

Back out things such as the value of real estate (the bulk of most folks' wealth is tied up in their homes), employer-sponsored retirement plans and business partnerships, and only 6.7% of American households qualify as millionaires.

To clarify: That means they have at least $1 million in investable assets. Examples of investable assets include cash, stocks, bonds and funds, among a bunch of other types of investments and financial products.

By raw numbers, most millionaires in America can be found in and around big cities such as New York, Los Angeles and Chicago – just as you would expect. But high concentrations of millionaires can be found in some far-flung places too.

Phoenix Marketing International, a firm that tracks the affluent market, annually ranks 933 urban areas, large and small, based on the percentage of millionaire households in each location. The following list of cities is limited to "micropolitan" areas, which the Census Bureau defines as urban clusters with populations between 10,000 and 50,000, "plus adjacent territory that has a high degree of social and economic integration with the core as measured by commuting ties."

In some cases, these locations benefit from being popular recreational areas or havens for wealthy retirees. In others, a particular industry drives local wealth. Either way, these are the 25 smallest cities and towns boasting the highest concentrations of millionaire households in the U.S. And just for good measure, we're also providing some important tax and cost-of-living information.

Small cities and towns are listed by percentage of millionaire households, from lowest to highest. Estimates of millionaire households provided by Phoenix Marketing International. Investable assets include education/custodial accounts, individually owned retirement accounts, stocks, options, bonds, mutual funds, managed accounts, hedge funds, structured products, ETFs, cash accounts, annuities and cash value life insurance policies. Data on household incomes and home values come from the U.S. Census Bureau.

25. Hudson, New York

- Millionaire households: 1,810

- Total households: 25,243

- Concentration of millionaires: 7.2%

- Median income for all households: $63,032 (U.S.: $61,937)

- Median home value: $231,100 (U.S.: $229,700)

The Hudson, New York, micro area has emerged as an upstate hidey-hole for the well-heeled. Roughly 35 miles south of the state capital of Albany, the area abuts the banks of – you guessed it – the Hudson River. Water views, rolling hills and a verdant landscape (at least in the warmer months) make for many an idyllic scene.

Hudson has become popular with millionaires and non-millionaires alike thanks to its myriad restaurants, art galleries and nightlife. But the town's signature draws are antiques and architecture.

Hudson boasts scores of antiques dealers, which led the charge in making the town attractive for new residents, tourists and wealthier folks in search of second homes. At the same time, Hudson is chockablock with architectural gems. The Hudson Historic District is listed with the National Register of Historic Places.

Unfortunately for millionaires and folks of lesser means, New York State taxes take a bite. Hefty income taxes and high property taxes make the Empire State one of Kiplinger's 10 least tax-friendly states.

24. Laconia, New Hampshire

- Millionaire households: 1,840

- Total households: 24,739

- Concentration of millionaires: 7.2%

- Median income for all households: $68,368

- Median home value: $222,300

If your ideal summer retreat is a lakeside getaway, you could hardly do better than Laconia. The area sits between Lake Winnisquam and Lake Winnipesaukee in the middle of New Hampshire's famed Lakes Region.

And, unlike more rural parts of the vacation wonderland, Laconia is just a few miles off Interstate 93. That makes for easy access to the White Mountain National Forest about 30 miles to the north. More importantly, it makes Laconia a relatively easy drive from points farther south where millionaires maintain their primary residences.

It also helps that New Hampshire is a relatively tax-friendly state. As we shall see, another area near Laconia makes this list of small towns with a high percentage of millionaires.

23. Claremont-Lebanon, New Hampshire/Vermont

- Millionaire households: 6,675

- Total households: 90,652

- Concentration of millionaires: 7.3%

- Median income for all households: $61,558

- Median home value: $216,800

The Claremont-Lebanon micro area abuts Laconia and has plenty of its own attractions, as well. Perhaps best known is Hanover, N.H., which forms the northern tip of this urban agglomeration.

Located along the Connecticut River bordering Vermont, this 50-square-mile town in the Upper Valley is home to Dartmouth College, the smallest of the eight Ivy League colleges. As a result, Hanover buzzes with a diverse mix of art, culture and outdoor sporting and recreational activities year-round.

Another attractive aspect of the area is that the City of Lebanon operates Storrs Hill, a 20-acre ski area that hosts three ski trails, two ski jumps, a surface lift and ski lodge. As residents like to point out, few towns have a groomed ski area right in their downtown that is accessible to all.

22. Steamboat Springs, Colorado

- Millionaire households: 818

- Total households: 9,552

- Concentration of millionaires: 7.4%

- Median income for all households: $74,273

- Median home value: $510,600

Skiing, duh.

When folks think of Steamboat Springs, its reputation as one of the best ski resort towns in the world is likely what first comes to mind. But the area offers a wealth of outdoor fun year-round. Thanks to its location on the Yampa river, Steamboat Springs is perfect for fishing, rafting, tubing and kayaking. The rugged mountain terrain is ideal for hiking, mountain biking, camping, you name it. It also has a trio of 18-hole golf courses.

Millionaires building second homes in the Steamboat Springs area have done more to push up house prices than wages. Although median income in the micro area is roughly $12,000 above than the national level, median home value beats the U.S. median by a whopping $280,900.

21. Faribault-Northfield, Minnesota

- Millionaire households: 1,766

- Total households: 23,358

- Concentration of millionaires: 7.5%

- Median income for all households: $65,839

- Median home value: $218,100

The Faribault-Northfield area is so desirable that Kiplinger has named it a great place to retire. The Cannon River runs through town, and several parks and walking paths provide access to fishing, canoeing and kayaking.

Fitness buffs have plenty of options: In the snowy Minnesota winter, you can cross-country ski along miles of groomed trails or snowshoe through Carleton's Cowling Arboretum. Too cold outdoors? Run, swim or take exercise classes at the YMCA Community Center. No need to worry about health care, either. If you need access to specialists not available at Northfield Hospital & Clinics, the Mayo Clinic is about 60 miles away, in Rochester.

On the downside, Minnesota is not a friendly state when it comes to taxes. The North Star State hits hard with income tax and property taxes are on the high side, too.

20. Gardnerville Ranchos, Nevada

- Millionaire households: 1,562

- Total households: 20,579

- Concentration of millionaires: 7.5%

- Median income for all households: $62,503

- Median home value: $346,500

Gardnerville Ranchos is a favorite hiding place for millionaires because of its proximity to Lake Tahoe, which has long been a getaway for the rich and famous. With everything from ski resorts to beaches, the Lake Tahoe area offers year-round activities for well-heeled tourists and full-time residents alike.

Carson City, capital of the Silver State, is just 20 miles to the north of Gardnerville Ranchos, and high rollers can reach Reno's casinos in an hour.

19. Glenwood Springs, Colorado

- Millionaire households: 2,263

- Total households: 26,357

- Concentration of millionaires: 7.6%

- Median income for all households: $76,184

- Median home value: $383,300

It's easy to see why Glenwood Springs is popular with millionaires. The small resort city about 160 miles west of Denver is loaded with fun stuff to do – and not just in winter, when skiing is the main attraction in the Colorado Rockies. Hot springs, rafting, kayaking, fishing, hiking, mountain biking and golf, among many other activities, make Glenwood Springs a year-round destination.

The city's great appeal is no secret. Glenwood Springs has collected many accolades over the years. It has ranked in the top five of Outside magazine's best places to live in America, and Southern Methodist University once named it the "Most Vibrant Small Town Arts Environment in the United States."

18. Dickinson, North Dakota

- Millionaire households: 985

- Total households: 12,150

- Concentration of millionaires: 7.6%

- Median income for all households: $75,708

- Median home value: $238,100

The boom times looked to be rolling again in North Dakota until COVID-19 gutted oil demand. Indeed, benchmark U.S. crude oil is off about 35% over the past year.

In the first half of the 2010s, North Dakota had the fastest-growing economy in the nation, thanks to the explosion in shale oil drilling. Places like Dickinson, located in the oil-rich Bakken Formation, were mining millionaires. Then oil prices collapsed in 2014 and some folks even started pulling up stakes. By the end of the last decade, fortunes were once again looking up, but that came to a halt with the coronavirus.

Dickinson's number and percentage of millionaire households declined year-over-year.

If there's a silver lining, it's that North Dakota is one of the nation's more tax-friendly states. Indeed, it has been cutting income taxes for several years in a row – to the point that they barely exist.

17. Oak Harbor, Washington

- Millionaire households: 2,839

- Total households: 34,572

- Concentration of millionaires: 7.9%

- Median income for all households: $64,793

- Median home value: $392,500

The Oak Harbor, Washington, micro area actually encompasses all of Whidbey Island. That helps explain its inclusion on the list of small towns with high concentrations of millionaires.

"Oak Harbor is usually regarded as the poorer but more developed stepsister when compared to other Whidbey municipalities," notes the Whidbey News-Times. "Coupeville and Langley have higher incomes, swankier homes and older residents." Oak Harbor itself plays host to nearby Naval Air Station Whidbey Island.

Happily for residents, Washington is among the most friendly states for taxes. The Evergreen State makes the cut because it doesn't have an income tax. Unfortunately, some of the other state and local taxes aren't quite so taxpayer-friendly.

16. Elko, Nevada

- Millionaire households: 1,589

- Total households: 18,438

- Concentration of millionaires: 7.9%

- Median income for all households: $77,222

- Median home value: $197,700

Tiny Elko, Nevada, owes its high concentration of millionaires to its status as the capital of Nevada's gold mining industry.

Although gold mining is no longer much of a growth area, pulling the yellow metal from the ground does remain a productive endeavor. Indeed, if Nevada were a country, it would be the world's fourth-largest producer of gold behind China, Australia and Russia, according to the U.S. Geological Survey.

Elko's fortunes rise and fall with the price of gold, so one would hope that its millionaire population is properly diversified. Happily, for all of Elko's residents, Nevada is a no-income-tax haven, and one of Kiplinger's top 10 most tax-friendly states.

15. Concord, New Hampshire

- Millionaire households: 4,716

- Total households: 58,521

- Concentration of millionaires: 8.0%

- Median income for all households: $75,088

- Median home value: $239,100

The New Hampshire state capital is home to a horde of state, county, local and federal agencies – and the law firms and professional agencies that support them.

Concord also is a major distribution, industrial and transportation hub. Tourism is a key contributor to the local economy, thanks to the nearby New Hampshire International Speedway, as is the state's increasing emergence as a center of high-tech manufacturing.

Concord also benefits from being within easy reach of Laconia and the state's famed Lakes Region, as noted earlier. Residents seeking a break from quaint New England living can drive to Boston in less than 90 minutes.

14. Truckee-Grass Valley, Calif.

- Millionaire households: 3,448

- Total households: 41,447

- Concentration of millionaires: 8.0%

- Median income for all households: $66,299

- Median home value: $456,000

You'll find the Truckee-Grass Valley area on the California side of Lake Tahoe, with Truckee proper situated near the shore of the famed lake itself and Grass Valley sitting farther to the west.

Multiple bodies of water including Donner Lake, where the Donner Party met its gruesome demise, make the entire area a recreational haven for water sports. And the long, snowy winters are perfect for the numerous ski resorts in the vicinity of Truckee and Grass Valley.

Another appealing aspect of the area for millionaires: It's a straight shot down Interstate 80 to reach Sacramento, the state capital, and San Francisco.

The Golden State's reputation as a high-tax destination is built in part on how aggressively it goes after big earners, with a 13.3% tax rate that kicks in at $1 million (for single filers) of taxable income. But for more modest incomes, the impact is far milder, and property taxes are low.

13. Key West, Florida

- Millionaire households: 2,867

- Total households: 31,362

- Concentration of millionaires: 8.1%

- Median income for all households: $71,973

- Median home value: $541,900

The appeal of Key West to millionaires – and heck, everyone – is pretty self-evident. The sun-kissed island and nearby neighbors offer a tropical paradise in the good ol' U.S. of A.

The allures of the Key West area are well known. Boating, fishing, snorkeling, scuba diving and lazing on the beach are just some of Key West's draws. And don't forget the incomparable sunsets.

Like all Floridians, Key West's millionaires save a bundle on taxes. The Sunshine State is well known for its absence of a state income tax, which helps make it one of Kiplinger's 10 most tax-friendly states.

13 Best Vanguard Funds for the Next Bull Market

12. Kapaa, Hawaii

- Millionaire households: 2,118

- Total households: 22,685

- Concentration of millionaires: 8.3%

- Median income for all households: $80,921

- Median home value: $627,800

The Kapaa micropolitan area includes the entirety of Kauai, Hawaii's fourth-largest island.

Known as the Garden Island, Kauai is one of the state's less developed locales. With pristine beaches, lush forests, soaring mountains and relatively few people, Kapaa (and the surrounding area) is an ideal place for a millionaire's tropical island nest.

The downside? The Aloha State is known for its high cost of living – and a mixed picture when it comes to taxes. Be that as it may, property taxes as a percentage of home value are the lowest in the U.S.

11. Breckenridge, Colorado

- Millionaire households: 1,137

- Total households: 9,707

- Concentration of millionaires: 8.5%

- Median income for all households: $77,589

- Median home value: $563,000

By this point in our list of small towns with the highest concentrations of millionaires, it should be clear that Western ski resort towns are mighty popular with people of means. (See below for yet even more examples.) So it should come as no surprise that Breckenridge would make the cut.

Naturally, skiing is what first comes to mind when it comes to Breckenridge, but the area supports a wide range of sports and cultural activities through all four seasons. Mountain biking, hiking and fly fishing are just a few of the allures for the millionaire who likes the great outdoors.

For more sedentary folks, Breckenridge hosts the National Repertory Orchestra every summer and the Breckenridge Film Festival every autumn.

Jackson, Wyoming/Idaho

- Millionaire households: 1,236

- Total households: 12,894

- Concentration of millionaires: 8.7%

- Median income for all households: $78,452

- Median home value: $563,100

Jackson is a town in Wyoming's famed Jackson Hole valley. The greater area we're talking about here spills over into Idaho, too, and includes Grand Teton National Park, as well as parts of Yellowstone National Park and The Teton Wilderness Area.

With three major ski resorts and an abundance of other year-round recreational activities, it's easy to see the appeal for those with means.

And thanks to abundant revenue that the state collects from oil and mineral rights, Wyoming millionaires shoulder one of the lowest tax burdens in the U.S. For those living in Idaho, the tax situation is a bit more mixed.

9. Heber, Utah

- Millionaire households: 921

- Total households: 9,567

- Concentration of millionaires: 8.7%

- Median income for all households: $77,449

- Median home value: $388,900

Heber boasts world-class recreational activities for the wealthy and regular Joes alike. In winter, it's all about skiing. Five-star skiing at the Deer Valley and Sundance ski resorts is roughly a half-hour away. For year-round activities, the Heber Valley features five 18-hole championship golf courses, three state parks and a historic tourism railroad.

The micro area even holds a charming Swiss-themed village.

Fully 8.7% of Heber's 9,567 households have at least $1 million in investable assets. Median income is more than $15,000 above the national level. Median homes prices top the U.S. median by more than $159,000.

8. Easton, Maryland

- Millionaire households: 1,412

- Total households: 16,627

- Concentration of millionaires: 8.9%

- Median income for all households: $67,204

- Median home value: $331,500

Tiny Easton, on the Eastern Shore of the Chesapeake Bay, prides itself on its out-of-the-way feel, with country farms mixing with lavish waterfront estates. It has long been a retreat for the well-to-do of the Mid-Atlantic seeking antique shops and solitude. Easton's proximity to the beach, abundance of parks and good schools make for an idyllic small-town experience for residents.

At the same time, the town offers easy access to several major cities. It's less than an hour away from Annapolis, the state capital, while Washington, D.C., and Baltimore can be reached by car in about 90 minutes (traffic willing).

Maryland has the second most millionaires per capita of any state in the U.S., according to Phoenix Marketing International, but it's unfriendly when it comes to taxes.

7. Edwards, Colorado

- Millionaire households: 1,877

- Total households: 17,750

- Concentration of millionaires: 9.2%

- Median income for all households: $84,685

- Median home value: $538,600

You can sum up the appeal of Edwards in one word: skiing.

The nearby world-class resorts of Vail and Beaver Creek draw big-spending skiers hoping to see and be seen all winter long. But the area offers much more than pricey lift tickets and celebrity spotting. Fly fishing, hiking and whitewater rafting draw folks to town in the summer months. High-end restaurants, plush lodges and spas are just some of the ways that millionaires can pamper themselves.

But it's Colorado's status as a tax-friendly state for both retirees and working residents that helps make Edwards a great deal for year-round living. It's a good thing, too, considering the high price of homes in the area.

6. Vineyard Haven, Massachusetts

- Millionaire households: 736

- Total households: 6,367

- Concentration of millionaires: 9.3%

- Median income for all households: $71,224

- Median home value: $667,400

No surprise here.

Vineyard Haven is a town on Martha's Vineyard. This island off the coast of Cape Cod – the Census Bureau classifies the entire island as part of the Vineyard Haven micro area – is one of the most desirable summer vacation spots in the Northeast and has long been a favorite of the rich, the famous and the powerful. Indeed, former presidents Bill Clinton and Barack Obama have summered there, and Jacqueline Kennedy Onassis long maintained a home on the island.

Naturally, this tony locale is not easy on the wallet, as evidenced by the exorbitant real estate prices. It also can get a bit crowded. Martha's Vineyard has 17,000 or so year-round residents, but the population can swell to 200,000 during peak summer months.

On the plus side, Massachusetts' reputation as a high-tax state is overblown.

5. Williston, North Dakota

- Millionaire households: 1,312

- Total households: 13,695

- Concentration of millionaires: 9.4%

- Median income for all households: $86,575

- Median home value: $256,000

The city of Williston expanded rapidly during the first half of the 2010s, driven by the explosion in shale oil drilling that once gave North Dakota the fastest-growing economy in the nation. This city in the oil-rich Bakken Formation soon found itself home to fracking millionaires.

But as anyone who works in the oil patch knows, booms and busts are an integral part of the industry.

A steep drop in oil prices first sparked pain across the Bakken about five years ago. And when demand finally started to improve, the COVID-19 pandemic slammed the energy sector. Demand for oil is gradually coming back, but it is by no means taking off.

More than 9% of Williston's households are considered to have millionaire status, but the absolute number of millionaire households actually declined from 2019.

4. Torrington, Connecticut

- Millionaire households: 7,060

- Total households: 73,598

- Concentration of millionaires: 9.5%

- Median income for all households: $76,043

- Median home value: $256,100

Torrington is the largest town in Litchfield County, which has long been a popular retreat for Manhattan's wealthy and chic looking for a remote, mountainous retreat. (It's an in-state draw for all the millionaires from the Stamford area, too.)

As Vogue magazine has said of the area:

"There's something for everyone: art galleries, outdoor activities, shopping, great food. With its covered bridges, forests and rivers, the scenery is gorgeous. In fact, every season challenges the next for which is more beautiful."

Although Torrington might be hidden in the northwest corner of the state, millionaires can't escape Connecticut's onerous tax bite. Real estate taxes are among the highest in the country, and the state has not only a luxury tax, but the country's only gift tax.

3. Juneau, Alaska

- Millionaire households: 1,231

- Total households: 12,521

- Concentration of millionaires: 9.7%

- Median income for all households: $88,213

- Median home value: $344,000

Everything costs more in Juneau. Indeed, it's one of the more expensive cities in the U.S.

Chalk it up to the remote location of Alaska's capital, which is tucked away in the southeast corner of the state hard against the Canadian border. Groceries alone cost almost 40% more than the U.S. national average, according to the Council for Community and Economic Research's Cost of Living Index.

And while it helps to be a millionaire to live in Juneau, it's increasingly difficult to become one. Much of Alaska's wealth is tied to the energy business. The 2014 slump in energy prices touched off the state's worst recession in three decades. And just when Alaska could see an end to the downturn, COVID-19 hammered the energy sector.

On the plus side, Alaska is one of the most tax-friendly states in the union. Not only is there no state income tax, but the government actually pays residents an annual stipend.

2. Summit Park, Utah

- Millionaire households: 1,987

- Total households: 14,555

- Concentration of millionaires: 13.0%

- Median income for all households: $100,453

- Median home value: $598,900

Skiing, luxury shopping, world famous film festivals – the Summit Park, Utah, area has everything a millionaire could ask for and more.

The Summit Park micro area, which also includes Park City, is a short drive from Salt Lake City and has the second highest concentration of millionaire households of any small town in the U.S.

The aforementioned Park City, which hosts Robert Redford's Sundance Film Festival, also boasts several world-class ski resorts.

As for taxes, millionaires could do worse. The Beehive State isn't as tax-friendly as it used to be. Sure, the loss of the federal personal exemption due to the new tax law means that many Utahns, particularly those with multiple dependents, will pay higher state taxes than before. But the state has a 4.95% flat income tax system, property taxes are low and sales taxes are average.

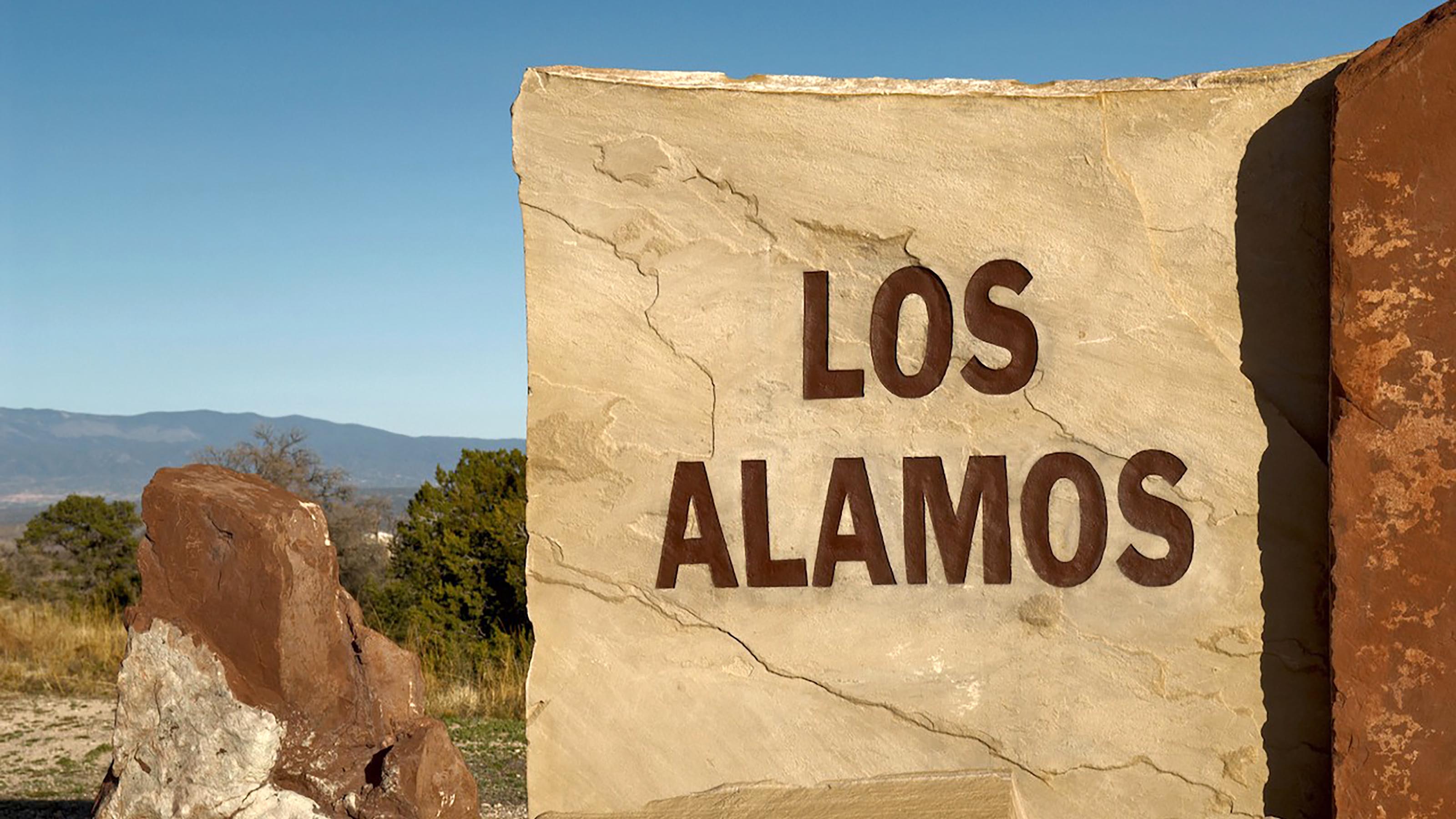

1. Los Alamos, New Mexico

- Millionaire households: 1,107

- Total households: 7,567

- Concentration of millionaires: 13.2%

- Median income for all households: $115,248

- Median home value: $292,200

Los Alamos sounds like an unlikely place to find a lot of millionaires, but we're talking about the concentration of millionaire households, not the total number of millionaires. And on that relative basis, Los Alamos really stands out.

The tiny town about 35 miles northwest of Santa Fe is home to a government nuclear weapons laboratory and a number of chemists, engineers and physicists. It's a small area with a small population but a large percentage of highly educated and highly trained engineers and scientists.

New Mexico's personal income tax rates top out at 4.9% on taxable income over $16,000 for single filers and over $24,000 for married couples filing jointly. And, hang in there until you're 100 and your income taxes are waived altogether.

Property taxes are modest, but sales taxes lean high.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

States That Tax Social Security Benefits in 2026

States That Tax Social Security Benefits in 2026Retirement Tax Not all retirees who live in states that tax Social Security benefits have to pay state income taxes. Will your benefits be taxed?

-

Could Tax Savings Make a 50-Year Mortgage Worth It?

Could Tax Savings Make a 50-Year Mortgage Worth It?Buying a Home The 50-year mortgage proposal by Trump aims to address the housing affordability crisis with lower monthly mortgage payments. But what does that mean for your taxes?

-

Four Luxury Spa Resorts for Well-Heeled Travelers

Four Luxury Spa Resorts for Well-Heeled TravelersWe hand-picked these U.S. luxury spa resorts for their serenity, amenities and dedication to the comfort of older travelers.

-

Child-Free Cruises Perfect For Your Retirement Celebration

Child-Free Cruises Perfect For Your Retirement CelebrationHow to find a bespoke ocean or river vacation for adults. Many of these options are smaller, charming river cruises, expeditions, or niche experiences.

-

Noctourism: The New Travel Trend For Your Next Trip

Noctourism: The New Travel Trend For Your Next Trip"Noctourism" is a new trend of building travel and vacations around events and plans that take place at night. Take a look at some inspiring noctourism ideas.

-

My Husband and I Retired at 67 With $3.2 Million, But He's Frugal About Travel. How Can I Convince Him to Loosen Up?

My Husband and I Retired at 67 With $3.2 Million, But He's Frugal About Travel. How Can I Convince Him to Loosen Up?We asked financial planning experts for advice.

-

What to Do With Your Tax Refund: 6 Ways to Bring Growth

What to Do With Your Tax Refund: 6 Ways to Bring GrowthUse your 2024 tax refund to boost short-term or long-term financial goals by putting it in one of these six places.

-

What Does Medicare Not Cover? Eight Things You Should Know

What Does Medicare Not Cover? Eight Things You Should KnowMedicare Part A and Part B leave gaps in your healthcare coverage. But Medicare Advantage has problems, too.