Thinking About Day Trading? Read This First

More people are getting into day trading these days, but don’t believe the hype. While some get lucky, the odds are stacked against you. If you really want to give it a try, limit your risk with these three tips.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

In the midst of the pandemic, you may have noticed a rather unusual trend: More and more people are jumping into the stock market.

Despite, or perhaps even because of, extreme volatility in the market and endless speculation about what could happen next — not just with the economy but in the wider world due to the seismic shifts we’re experiencing because of COVID-19 — there’s been a recent proliferation of day trading.

While the mediums might be new — Robinhood wasn’t around 20 or even 10 years ago — the sudden spike in the popularity of day trading isn’t. We saw a similar rush of interest during the dot-com bubble.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

That might point to one of the reasons for the recent interest in this extremely speculative (and therefore exceedingly risky) way of participating in financial markets: When times are bad and things get tough, people will look for seemingly new or easier ways to make ends meet.

Unfortunately, despite what you might hear from a co-worker, neighbor or friend, day trading is rarely a good solution for most folks. So, if you’ve been considering joining in on this currently popular trend, I’d urge you to reconsider before you put your hard-earned money at risk.

Day Trading Isn’t an Easy Way to Wealth

The Wall Street Journal recently wrote a piece on the flurry of activity on day trading platforms. It’s an article that gives reason for concern on many levels.

For example, take Sharmila Viswasam, who shared some of her story with the WSJ for the article. She’s a 38-year-old real estate agent who couldn’t work due to the pandemic — and found that her unemployment checks weren’t enough to pay her bills. Her boss suggested she try day trading as a way to solve this problem and close the gap between her benefits and her expenses. Viswasam read Trading for Dummies and watched YouTube videos before she opened an ETrade account and tried her hand at day trading.

The problem here is that the very people who cannot afford to take the inherent risks associated with highly speculative investments are engaging in day trading in an attempt to hit it big.

But that’s just it: Day trading is hardly investing. It’s much more like gambling, and the odds of winning aren’t good. In fact, the same Wall Street Journal article noted that Barclays “examined trades by Robinhood customers between March and early June and concluded that the more they bought a specific stock, the worse that stock performed.”

Investing Works, But Day Trading Is More Like Gambling

To be clear, I do believe that investing in stocks and bonds is the best way to grow wealth. But you need to do so strategically, which means adjusting for risk, considering diversification, and allocating your portfolio in such a way that it is aligned with your goals and time horizon.

Day trading takes none of this into account, and again, is more akin to gambling than wise, strategic investing where you can reasonably expect to earn a moderate return over time. And in this gambling game, the odds are stacked against you.

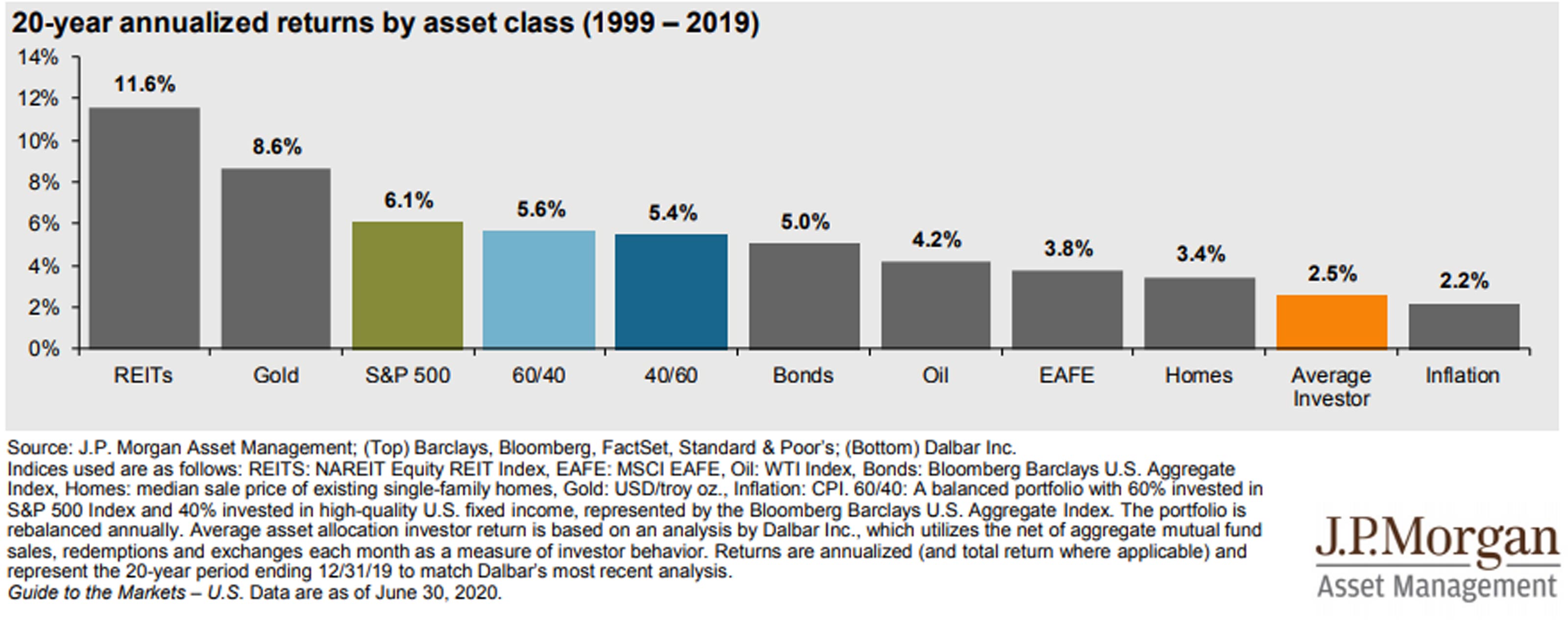

Don’t just take my word for it, though. Day traders — and even average investors who are trying to DIY their own portfolio management along the way — fall short of a variety of benchmarks in various asset classes:

Why does this happen? Because as a day trader, you are attempting to outsmart giant financial markets with millions of participants — some of which are corporate entities that exist solely to attempt to gain an edge, advantage or piece of information before anyone else knows about it in order to make money in the market, and who have entire departments of experts dedicated to these tasks.

The odds that you, as an individual with no such powerful tools at your disposal, would outguess everyone else are, to put it mildly, rather slim. Think about playing a game of poker with you and four friends. You might have a good chance to win some money. But what if you sat down to the table with four of the best poker players in the world? How good are your chances now?

That’s what the scenario looks like for you against the rest of the traders of the world.

If You Must Speculate, Mitigate the Risks First

While I suggest that you use a diversified, low-cost portfolio of index funds and ETFs to invest and cultivate your money in the market over time, you may be dead-set on trying day trading for yourself. If so, then first, I recommend watching this video on penny stocks from the Motley Fool. Then, try to stick to these rules whenever dipping your toe into more speculative investment waters:

- Only invest what you are prepared to lose. And by lose, I mean losing all of it. If you can’t handle the idea of losing 100% of what you put into a single stock position, then you should not be making that investment (or, more accurately, that bet). If you are buying individual names, you must be prepared — and actually able to afford — to lose your principal. Therefore, I recommend that you trade with less than 5% of your net worth to avoid racking up losses that you will struggle to recover from.

- Don’t buy on margin. Buying on margin means that you’re borrowing money to buy even more shares. It’s a bad idea for newer investors and can quickly amplify your losses.

- Avoid penny stocks. If that video wasn’t enough, let me reiterate it here: Companies are penny stocks for a reason. Stay away!

So, all this being said, I suppose it’s fair to ask … can’t you just get lucky? Isn’t it at least possible to strike it rich with something like day trading?

Sure. It is possible. But that doesn’t mean it’s likely, and in order to get lucky you might have to spend and lose a significant amount of money along the way (which clearly would have been better off in a more reliable investment vehicle, or even in cash!).

You can get lucky … but even slot machines pay out every once in awhile, and no one with any sense is claiming those are a great retirement plan.

And it isn’t spare change that most day traders are flinging into the market. It’s hard-earned dollars — dollars that could be working hard for you in turn if you only allocated them to a safer, more strategic, and more reliable way to grow wealth in the market instead.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Paul Sydlansky, founder of Lake Road Advisors LLC, has worked in the financial services industry for over 20 years. Prior to founding Lake Road Advisors, Paul worked as relationship manager for a Registered Investment Adviser. Previously, Paul worked at Morgan Stanley in New York City for 13 years. Paul is a CERTIFIED FINANCIAL PLANNER™ and a member of the National Association of Personal Financial Advisors (NAPFA) and the XY Planning Network (XYPN).

-

Look Out for These Gold Bar Scams as Prices Surge

Look Out for These Gold Bar Scams as Prices SurgeFraudsters impersonating government agents are convincing victims to convert savings into gold — and handing it over in courier scams costing Americans millions.

-

How to Turn Your 401(k) Into A Real Estate Empire

How to Turn Your 401(k) Into A Real Estate EmpireTapping your 401(k) to purchase investment properties is risky, but it could deliver valuable rental income in your golden years.

-

My First $1 Million: Retired Nuclear Plant Supervisor, 68

My First $1 Million: Retired Nuclear Plant Supervisor, 68Ever wonder how someone who's made a million dollars or more did it? Kiplinger's My First $1 Million series uncovers the answers.

-

Don't Bury Your Kids in Taxes: How to Position Your Investments to Help Create More Wealth for Them

Don't Bury Your Kids in Taxes: How to Position Your Investments to Help Create More Wealth for ThemTo minimize your heirs' tax burden, focus on aligning your investment account types and assets with your estate plan, and pay attention to the impact of RMDs.

-

Are You 'Too Old' to Benefit From an Annuity?

Are You 'Too Old' to Benefit From an Annuity?Probably not, even if you're in your 70s or 80s, but it depends on your circumstances and the kind of annuity you're considering.

-

In Your 50s and Seeing Retirement in the Distance? What You Do Now Can Make a Significant Impact

In Your 50s and Seeing Retirement in the Distance? What You Do Now Can Make a Significant ImpactThis is the perfect time to assess whether your retirement planning is on track and determine what steps you need to take if it's not.

-

Your Retirement Isn't Set in Stone, But It Can Be a Work of Art

Your Retirement Isn't Set in Stone, But It Can Be a Work of ArtSetting and forgetting your retirement plan will make it hard to cope with life's challenges. Instead, consider redrawing and refining your plan as you go.

-

The Bear Market Protocol: 3 Strategies to Consider in a Down Market

The Bear Market Protocol: 3 Strategies to Consider in a Down MarketThe Bear Market Protocol: 3 Strategies for a Down Market From buying the dip to strategic Roth conversions, there are several ways to use a bear market to your advantage — once you get over the fear factor.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.