Surprise! Even Conservative Investors Could Profit on Bitcoin

Risk is misunderstood. Here’s one way to use a volatile asset – and Bitcoin is about as volatile as investments get – to help your portfolio.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Money managers have two top priorities: identifying and investing in non-correlated assets, and rebalancing around volatility. With the ups and downs of the past year, it’s a perfect time to discuss the value of volatility and how a sound rebalancing process can harvest it to add value.

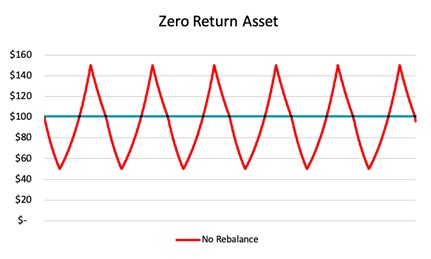

Let’s start with a hypothetical: If an asset has a return of zero percent over the long term, can it add significant value to an investor? The answer lies in its volatility.

Here is a graph of the hypothetical asset. It returns zero percent over the long term, but it experiences large swings, going down 50%, returning to even, going up 50%, and then back down to even. Over and over again.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

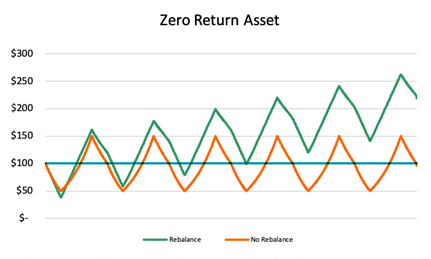

Say someone makes an initial investment of $100 in this asset, and their money manager/adviser places a rebalancing strategy around the holding. If the value of the holding drops 20%, buy it back up to $100, or buying low-ish. If the value rises 25%, sell it back to $100, or selling high-ish.

Over time, the portfolio would then look like this:

The buy-and-hold portfolio generates a total return of zero percent. The rebalanced portfolio generates a total return of 119%, or an average annual return of 14%.

Note: If, perhaps, you have a crystal ball and know that an asset will only go down, don’t buy it! If your crystal ball indicates that an asset will only go up, never sell it. But if you don’t have a crystal ball — and since historically assets experience both ups and downs — a rebalancing strategy is actually what matters.

Volatility, if used correctly, is an investor’s friend.

Bitcoin has been among the most volatile assets of all time. But the more volatile an asset, the less of it you want in a portfolio. Currently, there is only one way to purchase Bitcoin in a brokerage account, which is through the Grayscale Bitcoin Trust, ticker GBTC.

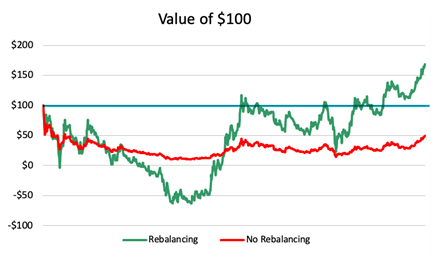

Let’s run a fictitious study… assuming you purchased GBTC at its all-time high, on Dec. 18 of 2017. This would have been the worst possible day to make the purchase. The price was $38.05 per share (the current price is around $20). Here is what would have happened to your $100 investment.

The buy-and-hold investor would have lost around half of their money. Now, let’s put a rebalancing strategy around this. If it goes down 33%, buy some. If it goes up 50%, sell some. Remember there is nothing magic about the rebalance parameters presented here … almost any reasonable parameters provide value. The parameters used here are not intended to maximize results, but are roughly based on volatility.

The rebalancing strategy took an asset that lost half of its value and turned it into a positive 70% return.

An investor does not need a positive view on Bitcoin, only an understanding of its volatility. No one knows what the future holds. In the medium-term, the volatility of Bitcoin is likely to add value to portfolios merely through a sound rebalancing process.

How much of a volatile asset should you own?

If you believe that an asset will behave in a different manner than the rest of your portfolio, the question isn’t whether you should own it. The question is how much of it you should own? Bitcoin will, of course, behave differently than the average portfolio, but by harvesting volatility, you can add value over time.

One should not go crazy here. Remember: The more volatile an asset, the less of it you should own. A 2% position won’t make or break you. Again, there’s no crystal ball. But rebalancing is key to navigating how valuable it can be.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Randy Kurtz, RIA, CFP®, is a nationally recognized expert on risk. Challenging the financial industry's status quo for over a decade, Kurtz feels the standard Wall Street portfolio comes with far more risk than clients realize. He created a method of investing that aims to lower excess risk taken in client portfolios, without reducing expected return. His goal is to transform the industry by turning the client-adviser relationship from a return-centered conversation to a risk-centered one.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AI

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AIFor financial advisers eager to embrace AI but unsure where to start, this road map will help you integrate the right tools and safeguards into your work.

-

The Referral Revolution: How to Grow Your Business With Trust

The Referral Revolution: How to Grow Your Business With TrustYou can attract ideal clients by focusing on value and leveraging your current relationships to create a referral-based practice.