How to Play a Steeper Yield Curve

The first of the year was a downer for corporate bonds and real estate and utility shares. It was strong for floating-rate loan funds.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

During the tumultuous initial week of 2021, the “U.S. yield curve reached its steepest level in four years,” reported Bloomberg News.

The ostensible cause was the buzz that the unified Congress will pass a larger COVID relief and stimulus package than we’d have gotten otherwise. Bond prices quickly sank.

News-obsessed traders are known to shoot first and aim later, only to miss the target altogether. But the implication is that interest rates beyond one year’s maturity are now on an elevator. I do not buy this totally, and neither does the Federal Reserve, but markets are susceptible to mass psychology. So, what might this turn of events mean for your investments?

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

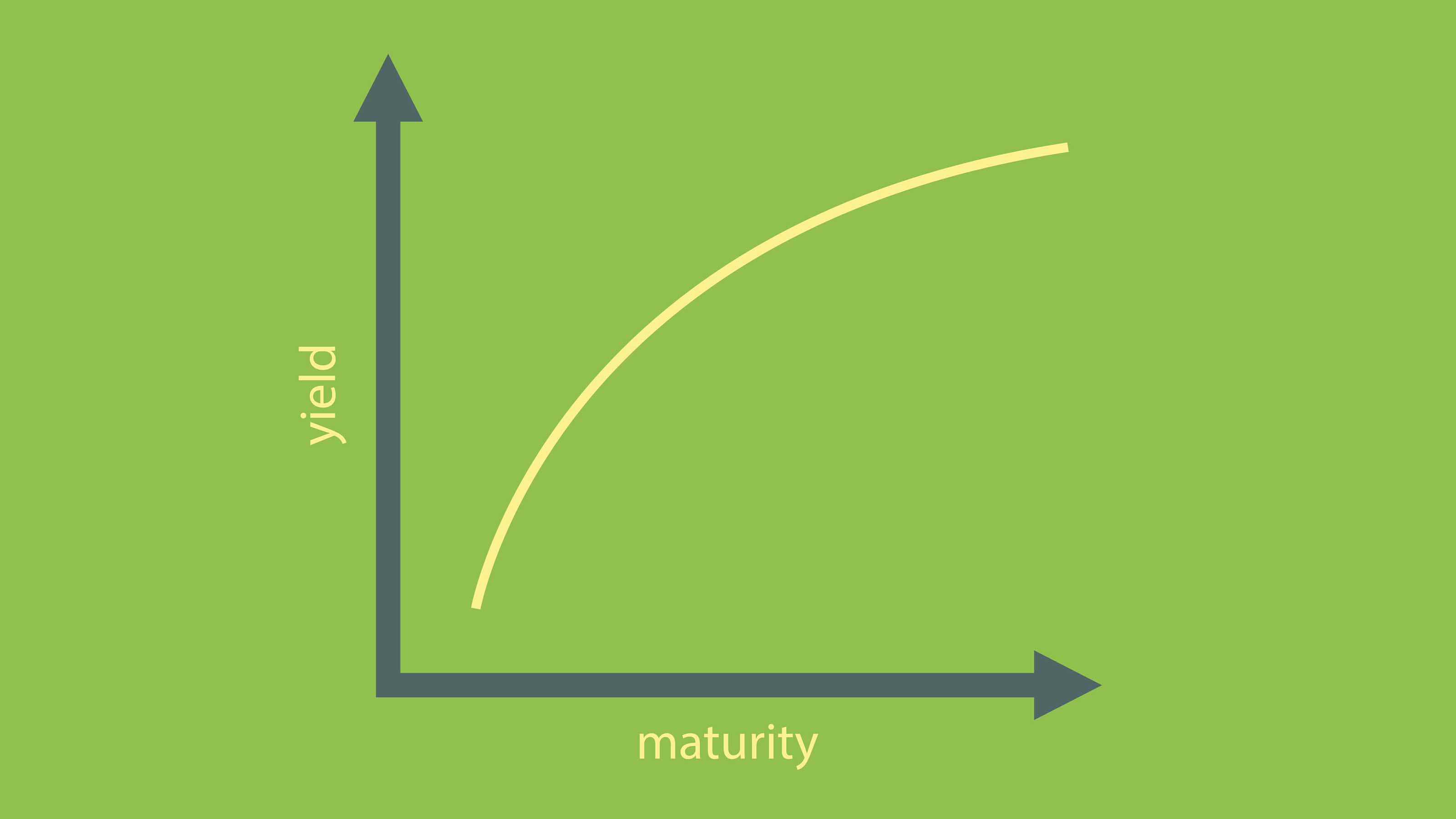

The steepness of the curve, if you need a refresher, relates to the difference between the yields on short-term credit – such as three-month Treasury bills, which influence your yield on cash and savings accounts – and a long-term benchmark such as the 10-year Treasury note. This spread closed January 8 at 1.05 percentage points, after a long spell at about half of that.

As the curve steepens, economists smell rising inflation. Savers sense a chance to earn a better return. The stock market tends to rejoice at the idea that businesses can soon raise prices and the economy will grow faster.

Indeed, the prices of most commodities, from corn to copper to crude oil, are up sharply already in 2021. And 30-year mortgage rates are creeping up. In all, the first week of the year was a downer for holders of corporate and mortgage bonds and real estate and utility shares. It was strong for floating-rate loan funds and small-cap, bank and energy stocks, paced by a spectacular 8% one-week return for master limited partnerships.

Borrow low, lend high. The steeper yield curve is favorable for any investment that profits from borrowing short-term cash cheaply and lending or investing it for higher, longer-term returns.

A mortgage real estate investment trust is often valued on its “net interest margin,” the spread between its own cost of funds and the yield on its investments. If this were to widen out, an old standby such as Annaly Capital Management (NLY, yield 10.6%) would become more profitable, allowing it to rebuild the dividends it cut in 2019 and 2020. Fellow mortgage REITs AGNC Investment (AGNC, 9.3%) and Invesco Mortgage Capital (IVR, 9.3%) are similar.

Floating-rate bank loan funds are also powered by net-interest margins. Lenders can boost what they charge borrowers faster than the Federal Reserve or the capital markets will raise the rates the lenders pay for funding. And if the economy is indeed rescuing battered sectors such as energy and transportation, the loans’ credit quality will also improve.

No wonder our pick of this litter, mutual fund Fidelity Floating-Rate High Income (FFRHX, 3.7%), returned 0.83% in that first week of 2021 after a total 1.76% for all of 2020. Eaton Vance Floating-Rate Income Trust (EFT) is a closed-end fund (CEF) with a distribution rate (similar to yield) of 5.8%. It trades 8% below its net asset value and returned 1.4% in 2021’s first week, following 2.55% for 2020.

There are dozens of such funds; I cite these two out of familiarity. For broader-brush, although higher-risk, exposure to a variety of potential beneficiaries of yield-curve gymnastics, including MLPs and finance firms, watch Miller/Howard High Income Equity (HIE, 5.9%), another closed-end fund. Up 30% over the past three months, it still trades 11% below NAV.

I am emphatically not giving up on the lower-for-longer interest rate framework. Do not, for example, turn bearish on tax-free bonds. But for investors awaiting better results from the lagging parts of income portfolios, this burst underscores the wisdom of patience – and diversification.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kosnett is the editor of Kiplinger Investing for Income and writes the "Cash in Hand" column for Kiplinger Personal Finance. He is an income-investing expert who covers bonds, real estate investment trusts, oil and gas income deals, dividend stocks and anything else that pays interest and dividends. He joined Kiplinger in 1981 after six years in newspapers, including the Baltimore Sun. He is a 1976 journalism graduate from the Medill School at Northwestern University and completed an executive program at the Carnegie-Mellon University business school in 1978.